This article analyses the accounting treatment for intangible assets under Malaysian Public Sector Accounting Standard (MPSAS) 31, Malaysian Financial Reporting Standard (MFRS) 138 and Section 18 of Malaysian Private Entities Reporting Standard (MPERS).

This analysis focuses on the significant requirements in MPSAS that are similar and different from the requirements in MFRS and MPERS in relation to (i) recognition; (ii) measurement; (iii) disclosures and (iv) first-time adoption. This comparison does not discuss the requirements in MFRS or MPERS that are not available in MPSAS.

Definition

An intangible asset is an identifiable non-monetary asset without physical substance. An asset is identifiable when it:

- Is separable, i.e., is capable of being separated or divided from the entity and sold, transferred, licensed, rented, or exchanged, either individually or together with a related contract, identifiable asset or liability, regardless of whether the entity intends to do so; or

- Arises from binding arrangements (including rights from contracts or other legal rights), regardless of whether those rights are transferable or separable from the entity or from other rights and obligations.

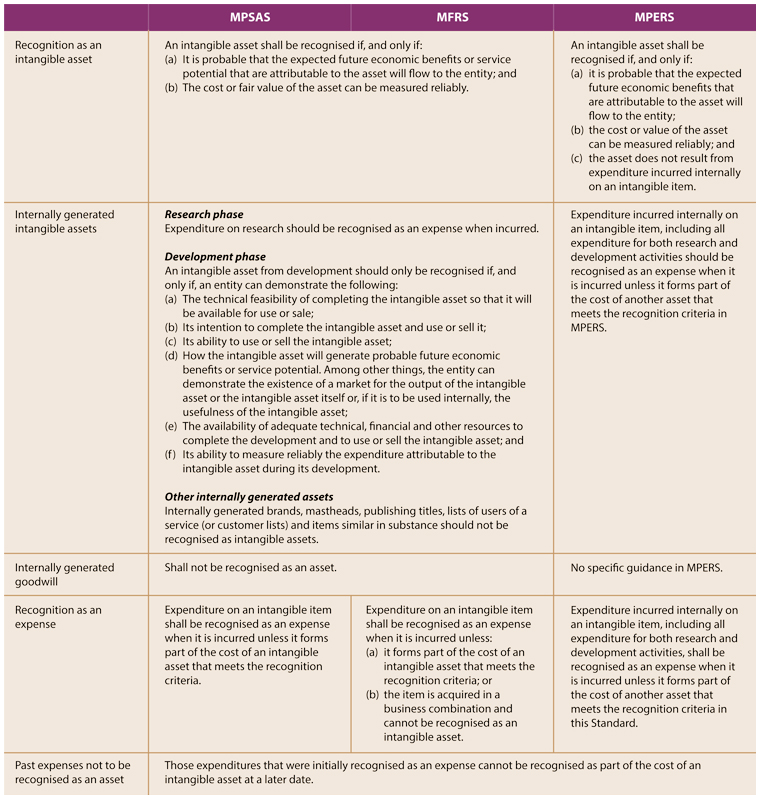

Recognition

The recognition of an item as an intangible asset requires an entity to demonstrate that the item meets:

- The definition of an intangible asset; and

- The recognition criteria.

This requirement applies to the cost measured at recognition and those incurred subsequently to add to, replace part of, or service it.

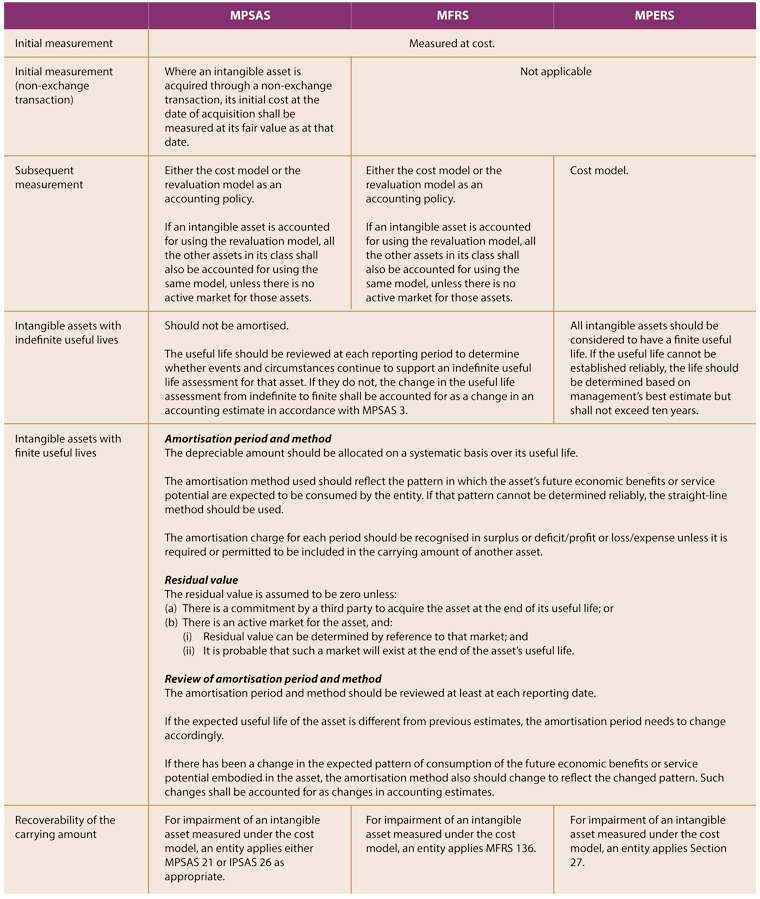

Measurement

Retirements and Disposal

The three frameworks stipulate that an intangible asset should be derecognised:

- on disposal; or

- when no future economic benefits (or service potential) are expected from its use or disposal.

The gain or loss arising from the derecognition should be recognised in profit or loss (surplus or deficit) when the asset is derecognised.

Disclosure

MPSAS 31, MFRS 138 and Section 18 of MPERS have some similar requirements in relation to disclosure. Both MPSAS 31 and MFRS 138 have some additional requirements on disclosure compared to Section 18 of MPERS.

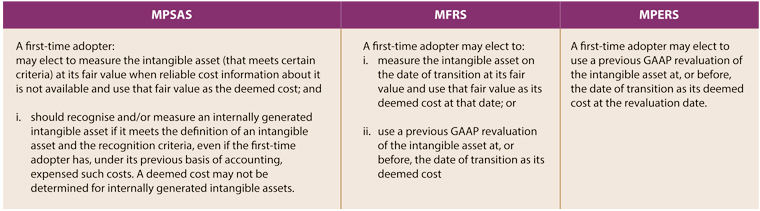

First-Time Adoption

General requirements in relation to first-time adoption in relation to intangible assets are as follow: