By Johnny Yong

What does the SMP landscape look like in Malaysia? Drawing on the 2018 IFAC Global Survey of SMPs, these are some of the key highlights from the Malaysian data that both SMPs and MIA as the developer and regulator of the profession can use to build capacity and competency.

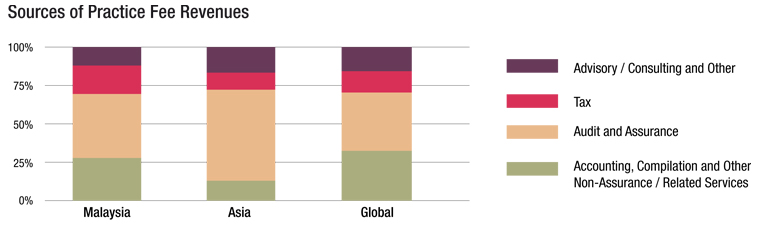

Practice Fee Revenues

The biggest proportion of revenues for 2018 was still generated by auditing and assurance services in Malaysia at 42%, which is higher than the global average at 38% but lower than the Asian region (59% sourced from audit and assurance), the latter of which is skewed due to the responses from China.

Next biggest was the provision of accounting, compilation and other non-assurance services (NAS) at 28%. Although higher than Asia as a region (13%), Malaysian SMP revenues from NAS were lower than the global average (32%). The percentage of fees from advisory services at 12% was also relatively low when benchmarked against Asia (17%) as well as globally (16%).

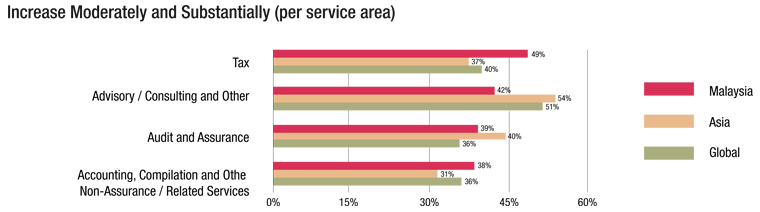

This indicates that there is room for Malaysian SMPs to diversify further into NAS, and strengthen revenues. For 2019, Malaysian SMPs project a moderate to substantial increase in fees for tax and advisory. This is the reverse of global projections, where advisory/ consulting is forecast to experience the fastest growth among the four service lines at 51%, followed by tax at 40%.

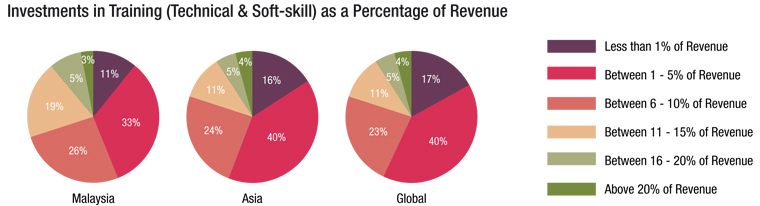

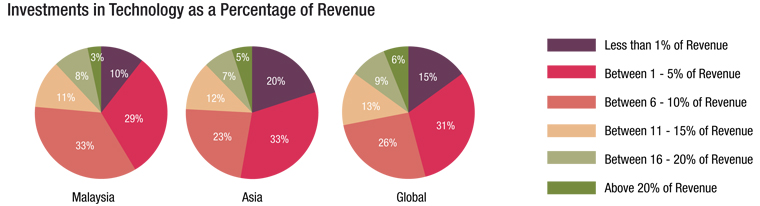

Investment in Training and Technology

Malaysian SMPs surveyed expect to invest the following percentages of revenue in training and technology in the next 12 months, as compared to Asian and global SMPs surveyed.

How much would be a recommended ratio for revenue investment in technology? A recent article in the Economist noted that the Big Four firms are investing north of 10% of their annual multi-billion dollar revenues in technology. This is certainly food for thought for Malaysian SMPs when planning their technology investment strategy, as the way forward lies in digital and tech adoption.

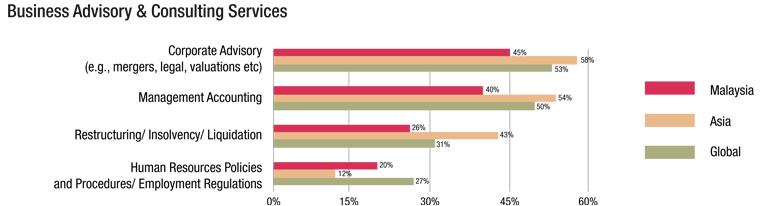

Business Advisory and Consulting Services

Globally, corporate advisory and management accounting, excluding tax planning, is still the main form of business advisory and consultancy that SMPs provide. Tax planning is categorised under the broader banner of Tax Services.

Globally, 86% of SMPs offered some form of business advisory and consulting services as compared to 84% of Malaysian SMPs and 85% of Asian SMPs.

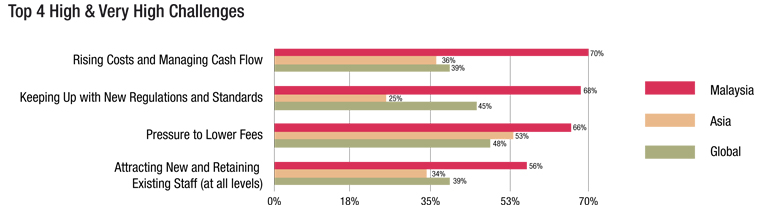

Most Critical Challenges

In Asia, the top four challenges for 2018 were pressure to lower fees (53%), competition (47%), rising costs and managing cash flows (36%) and attracting new and retaining existing staff at 34%. Globally, the top challenges were pressure to lower fees (48%), attracting new and retaining existing clients (46%), competition (46%) and keeping up with new regulations and standards at 45%.

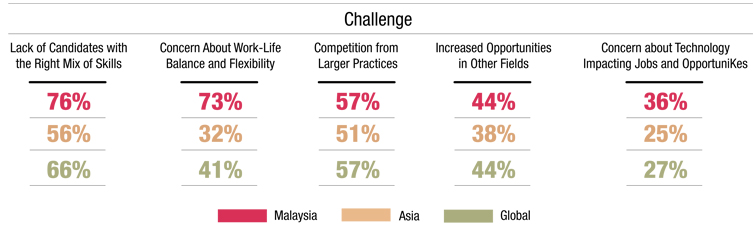

Over 70% of SMPs in Malaysia raised the difficulty of attracting next-generation talent, compared to Asia (61%) as a region and globally (54%). Asked, they cited the shortage of talent with the right skills as well as talent’s expectations of flexible working arrangements and improved work-life balance.

IFAC understands that MIA is engaging proactively with all stakeholders within the talent ecosystem, including employers and institutions of higher learning as well as aspiring accountants, to help equip next generation accountants with the requisite skills to meet employers’ demands.

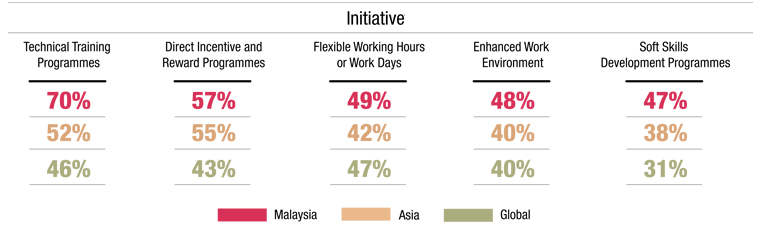

Commendably, Malaysian SMPs are planning to initiate these strategies over the next 12 months to manage these talent challenges:

Apart from technical training and direct incentive and rewards, nearly half of the Malaysia respondents are contemplating the implementation of flexible working hours to retain staff over the next 12 months. This should assuage demand for flexibility from talent and improve the talent shortage conundrum.

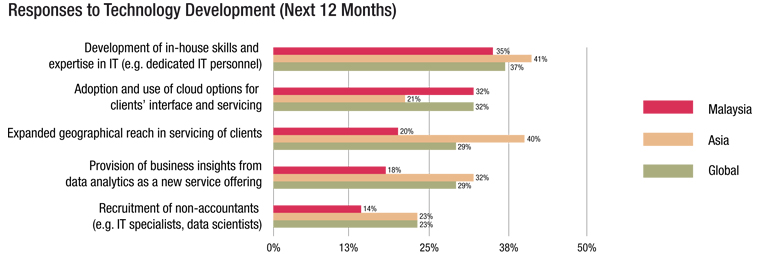

In term of technology development, Malaysian SMPs are planning these initiatives over the next 12 months:

However, it is worrying that more than one-third (36%) of the SMPs in Malaysia reported zero technology development. This number is higher than that of Asia as a region (25%) and globally (26%), and could affect Malaysia’s competitiveness especially as the digital economy and IR4.0 gain momentum. IFAC welcomes MIA’s advocacy in helping SMPs embrace technology through initiatives such as the MIA Digital Technology Blueprint, the MIA SMP Roadmap and the MIA RoboCFO Pilot Programme that leverages analytics for better financial insights.

About the Survey

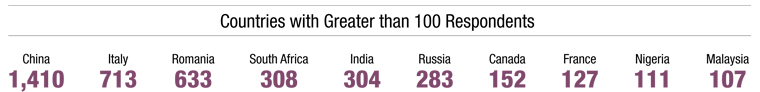

This Malaysian perspective is drawn from IFAC’s 2018 research into SMPs. Between mid-March to mid- May of 2018, IFAC ran a global survey of SMPs, attracting 6,258 respondents from 150 countries, including 107 Malaysian SMPs.

The most highly represented regions in the survey were Europe (39%) and Asia (36%) with each comprising over one-third of the respondents. The lowest was from Australasia and Oceania at 1% only. The countries with the highest number of respondents were as follows:

Consistent with the prior IFAC Survey, a majority of the respondents were from smaller practices i.e. sole proprietors (30%) and practices with two to five partners and staff (34%). For Malaysia, out of the 107 respondents, two-thirds were either partner, owner or sole-proprietor. Hence, these respondents were highly knowledgeable of their own practice performance as well as challenges.

Consistent with many regions, most of the respondents from Malaysia were male (64%) and the average age groups that responded were between 25 to 35 (29%) and between 36 to 45 (36%).

The IFAC 2018 Global SMP Survey results can be found at https://www.ifac.org/publications-resources/new-global-smp-survey-reveals-keys-growth-small-accounting-firms.

Johnny Yong is the Technical Manager, Global Accountancy Profession Support, International Federation of Accountants