Article prepared by the MIA Financial Statements Review Committee

Financial statements are intended to provide financial information about an entity that is useful to various stakeholders in making economic decisions. Disclosure of accurate, adequate and timely information is critical in order to achieve effective communication of quality financial information. While the industry is leaning towards transparency in financial reporting, some entities still strive to comply only with the minimum disclosure requirements in accordance with the applicable approved financial reporting requirements. The quality of disclosures is compromised as the entities are providing incomplete and/or irrelevant disclosures and in some cases, omissions of mandatory disclosure items.

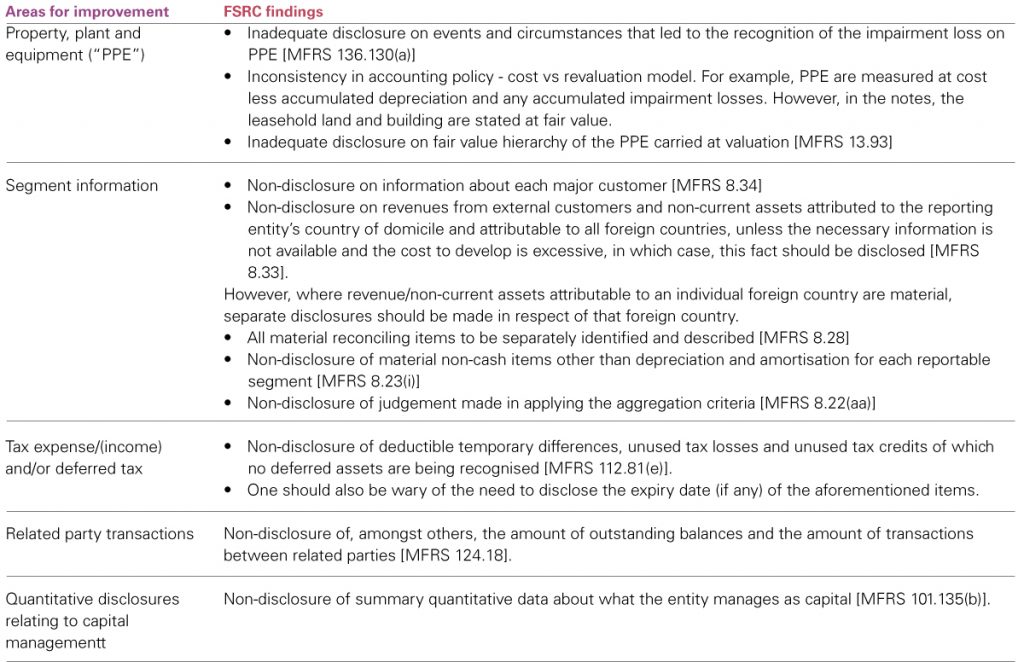

In providing guidance to members on good financial reporting, the Financial Statements Review Committee (“FSRC” or “the Committee”) wishes to highlight common deficiencies arising from the review of financial statements of public-listed entities for the period from July 2017 to June 2018, as shown in Table below:

The FSRC draws particular attention to the following, which continue to be the areas of deficiencies found in the financial statements since the past reviews:

Fair value measurement

There have been improvements in term of disclosures relating to MFRS 13 Fair Value Measurement following its application for financial statements with annual periods beginning on or after 1 January 2013.

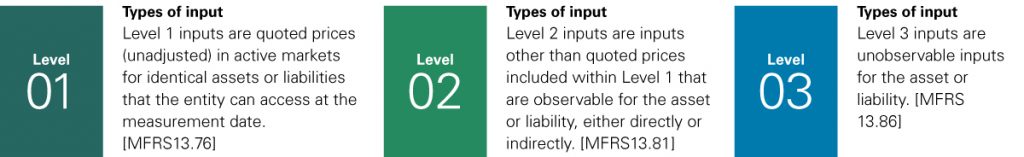

MFRS 13 requires an entity to disclose the level of the fair value hierarchy within which the fair value measurements are categorised in their entirety. The fair value hierarchy consists of the following three levels:

The Committee noted that most entities have complied with the requirement of disclosing the fair value hierarchy.

However, the classification of fair value measurements into the above three levels is often challenging and judgemental. For example, the Committee noted differences in classifying fair value hierarchy for investment properties, which typically (based on the reviews) were classified as Level 2 and/or Level 3.

The Committee wishes to highlight that Paragraph 84 of MFRS 13 states that an adjustment to a Level 2 input that is significant to the entire measurement might result in a fair value measurement categorised within Level 3 of the fair value hierarchy if the adjustment uses significant unobservable inputs.

In addition, the Committee has come across instances whereby there were transfers between Level 1 and Level 2 of certain assets during the financial year but there were no disclosures on the information as required by Paragraph 93(c) and Paragraph 95 of MFRS 13.

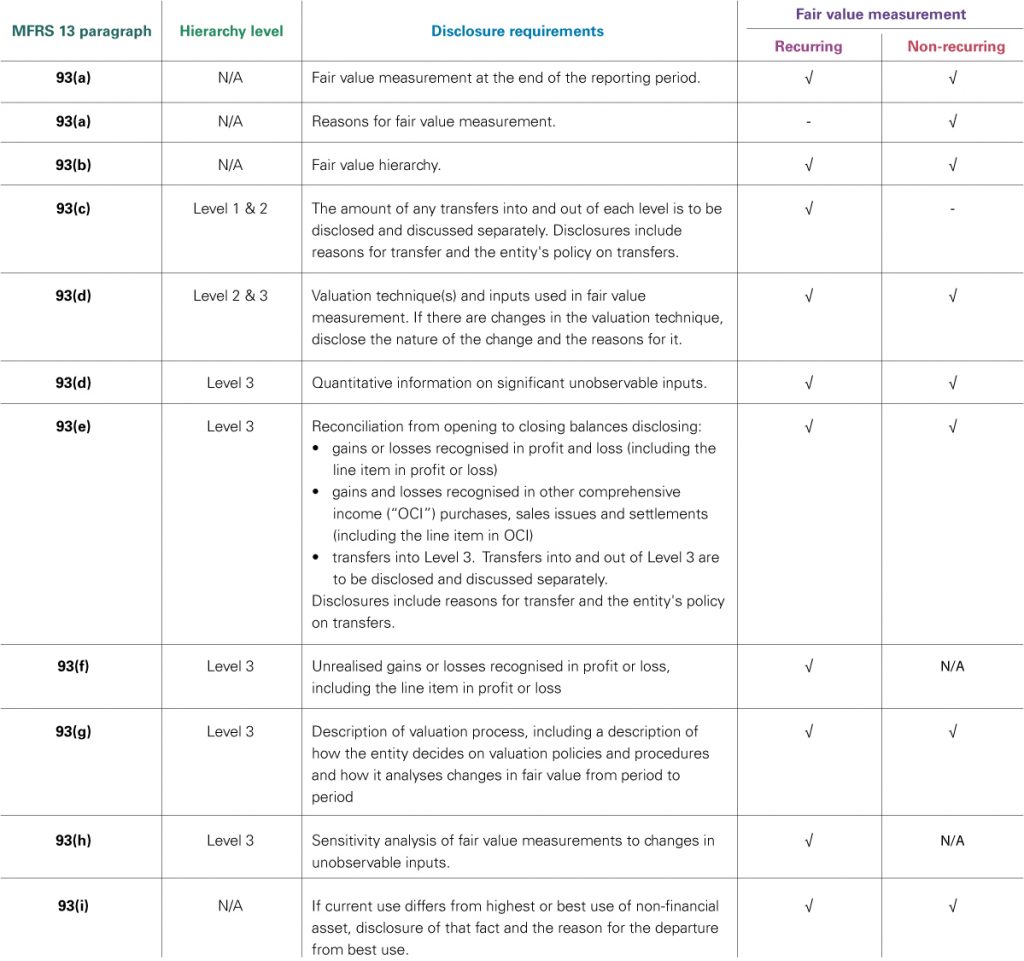

MFRS 13 also requires extensive disclosures in relation to assets and liabilities included in Level 3. The review of some of the financial statements revealed that insufficient information was disclosed and often included no discussion of unobservable inputs and/or benchmarks used.

Our earlier article on Complying with MFRS 13 (Accountants Today, Mar/Apr 2016) showed a chart listing down the (minimum) disclosure requirements of MFRS 13. The chart* is re-produced below for your easy reference:

* The chart above does not include the disclosure requirements for those items within the scope of MFRS 13 whereby the fair value is required to be disclosed in the notes only.

Financial Guarantee Contracts (FGCs)

Typically, a parent company issues corporate guarantees to financial institutions to secure credit facilities extended to its subsidiary companies. These corporate guarantees are FGCs that meet the definition of financial liabilities and shall be recognised and measured in accordance with MFRS 139 Financial Instruments: Recognition and Measurement or MFRS 9 Financial Instruments (effective from 1 January 2018).

It is good to note that most of the reviewed financial statements have classified FGCs as financial liabilities, although there are still some that disclosed FGCs as contingent liabilities.

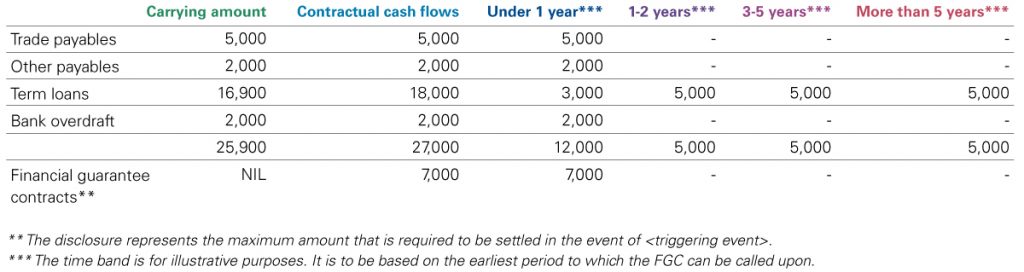

However, where the FGCs were classified as financial liabilities, there were no disclosures noted on the nature and extent of risks arising from FGCs, which typically includes credit risk and liquidity risk [MFRS 7.31-42], specifically on the disclosure of maturity analysis [MFRS 7.39]. Commonly, the reviewed financial statements were lacking in the necessary disclosures, citing that the risk of default is low. The Committee wishes to highlight that the entity is always exposed to these risks, notwithstanding the low risk of default.

Illustrated below is an example of how the relevant disclosures should be made:

Credit risk

The maximum exposure to credit risk in relation to the financial corporate guarantees given amounts to RM XXX (201Y: RMXXX) as at the end of the reporting period.

Liquidity risk

** The disclosure represents the maximum amount that is required to be settled in the event of <triggering event>.

*** The time band is for illustrative purposes. It is to be based on the earliest period to which the FGC can be called upon.

In addition, we also wish to highlight that MFRS 9 introduces new requirements relating to the subsequent measurement of FGCs [MFRS 9.4.2.1c and MFRS 7.B8E].

Conclusion

In communicating their story, preparers of financial statements are encouraged to critically consider what information is useful to the users of financial statements. In addition to complying with the applicable approved financial reporting requirements, the disclosure of adequate, meaningful and useful information is important to help the users to understand the financial statements better.

Above all, the FSRC wishes to reiterate that the responsibility for the preparation of financial statements under the Companies Act 2016 lies with the entity’s management and Board of Directors. Financial statements are to be accompanied by a statutory declaration made by the person primarily responsible for the financial management of the entity setting forth their opinion as to the correctness of the accompanying financial statements. [S251(b), Companies Act 2016].

Whilst auditors play an important role in enhancing the credibility of the financial statements, this role would be further enhanced with the entity’s management and Board of Directors engaging with the auditors throughout the financial reporting process.

The Financial Statements Review Committee (“FSRC” or “the Committee”) of the Institute was set up with the aim of upholding the quality of financial reporting of entities listed on Bursa Malaysia.

The Committee reviews audited financial statements and audit reports that are prepared by or are the responsibility of members of MIA, for the purpose of determining compliance with statutory and other requirements, approved accounting standards and approved auditing standards in Malaysia.