By Mohd Ilham Mat Rabi

In March 2019, the IFRS Interpretations Committee (IFRIC) issued an Agenda Decision on IAS 23 Borrowing Costs relating to capitalisation of borrowing costs in relation to the construction of a residential multi-unit real estate development (building). MFRS 123 Borrowing Costs is identical to IAS 23 in all respects other than the nomenclature.

The IFRIC issues Agenda Decision on a submission received when it did not recommend standard-setting to address the matter in the submission. Agenda decisions often include information to help companies applying IFRS where it explains how the applicable principles and requirements in IFRS apply to the submission with the objective to improve consistency in the application of IFRS.

Agenda decisions do not have the authority of IFRS Standards and therefore, they are not mandatory requirements but should be seen as helpful, informative and persuasive. The International Accounting Standards Board (IASB) does not ratify Agenda Decisions. Similar to the IASB, the Malaysian Accounting Standards Board (MASB) does not ratify IFRIC Agenda Decisions.

Fact pattern

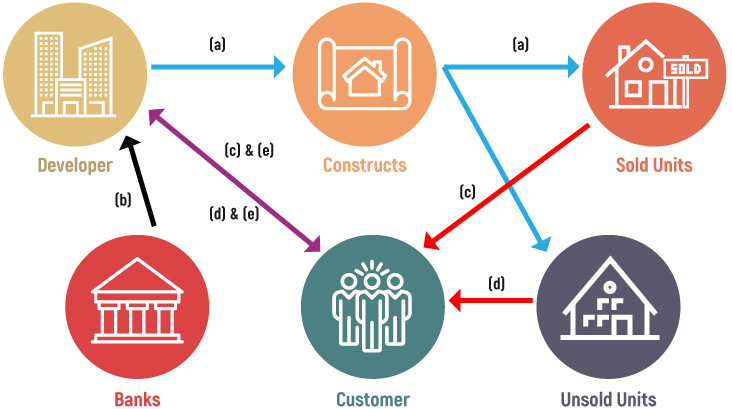

The fact pattern described in the Agenda Decision is as follows:

(a) a real estate developer (entity) constructs the building and sells the individual units in the building to customers.

(b) the entity borrows funds specifically for the purpose of constructing the building and incurs borrowing costs in connection with that borrowing.

(c) before construction begins, the entity signs contracts with customers for the sale of some of the units in the building (sold units).

(d) the entity intends to enter into contracts with customers for the remaining part-constructed units (unsold units) as soon as it finds suitable customers.

(e) the terms of, and relevant facts and circumstances relating to, the entity’s contracts with customers (for both the sold and unsold units) are such that, applying paragraph 35(c) of IFRS 15 Revenue from Contracts with Customers, the entity transfers control of each unit over time and, therefore, recognises revenue over time. The consideration promised by the customer in the contract is in the form of cash or another financial asset.

The fact pattern is illustrated below.

Issue raised

The requestor asked whether the entity has a qualifying asset as defined in IAS 23 and, therefore, capitalises any directly attributable borrowing costs.

IFRIC’s conclusion

Paragraph 8 of IAS 23 states that “an entity shall capitalise borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset. An entity shall recognise other borrowing costs as an expense in the period in which it incurs them” while paragraph 5 of IAS 23 defines a qualifying asset as ‘an asset that necessarily takes a substantial period of time to get ready for its intended use or sale’.

Accordingly, an entity should assess whether, in the fact pattern described above, it recognises an asset that necessarily takes a substantial period of time to get ready for its intended use or sale. Depending on the particular facts and circumstances, the entity might recognise a receivable, a contract asset and/or inventory.

IFRIC concluded that:

- a receivable that the entity recognises is not a qualifying asset. Paragraph 7 of IAS 23 specifies that financial assets are not qualifying assets.

- a contract asset that the entity recognises is not a qualifying asset. The contract asset (as defined in Appendix A to IFRS 15 Revenue from Contracts with Customers) would represent the entity’s right to consideration that is conditioned on something other than the passage of time in exchange for transferring control of a unit. The intended use of the contract asset – to collect cash or another financial asset – is not a use for which it necessarily takes a substantial period of time to get ready.

- inventory (work-in-progress) for unsold units under construction that the entity recognises is not a qualifying asset. In the fact pattern described in the request, this asset is ready for its intended sale in its current condition – i.e. the entity intends to sell the part-constructed units as soon as it finds suitable customers and, on signing a contract with a customer, will transfer control of any work-in-progress relating to that unit to the customer.

The principles and requirements in IAS 23 provide an adequate basis for an entity to determine whether to capitalise borrowing costs in the fact pattern described in the request.

Application of the Agenda Decision in Malaysia

The MASB observed that non-private entities in the real estate industry might need to change their accounting policy as a result of the Agenda Decision on IAS 23.

In ensuring consistent application of the Malaysian Financial Reporting Standards, which are word-for-word IFRS Standards, the MASB has decided that an entity shall apply the change in accounting policy as a result of the Agenda Decision to financial statements of annual periods beginning on or after 1 July 2020.

Conclusion

As the Agenda Decision may entail changes in an entity’s accounting policy, entities should consider the impact of applying the Agenda Decision in its financial statements both before and after 1 July 2020 and apply the requirements on accounting policy change in MFRS 108 Accounting Policies, Changes in Accounting Estimates and Errors.

References

http://eifrs.ifrs.org/eifrs/bnstandards/en/IAS23.pdf

http://www.masb.org.my/pdf.php?pdf=BV2018_MFRS%20123.pdf&file_path=pdf_file

http://www.masb.org.my/press_list.php?id=305

Mohd Ilham Mat Rabi is Manager of Financial Reporting and Capital Market, Malaysian Institute of Accountants