By Bank Negara Malaysia & the Malaysian Institute of Accountants

As key players in the battle against money laundering and terrorism financing, accountants are advised to take note of the Revision to the Anti-Money Laundering, Countering Financing of Terrorism and Targeted Financial Sanctions for Designated Non-Financial Businesses Profession and Non-Bank Financial Institutions Policy Document as released by Bank Negara Malaysia (BNM).

Below is an infographic for easier understanding of the policy revisions.

What are the key changes?

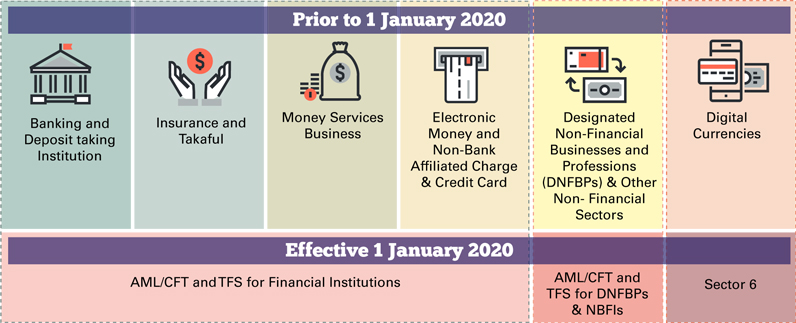

1. Reclassification of AML/CFT Policy Documents : from six sectors into three sectors

Please click here for the revised AML/CFT and TFS for DNFBPs and NBFIs Policy Document: http://amlcft.bnm.gov.my/publication/AML_CFT_TFS_PD_for_DNFBPs_and_NBFIs.pdf

2. Enhancements to AML/CFT Compliance Programme

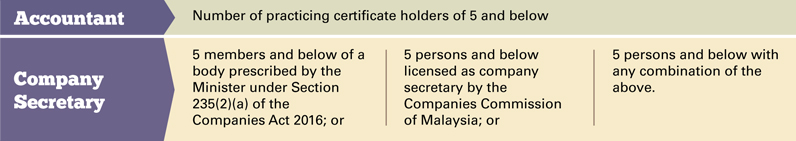

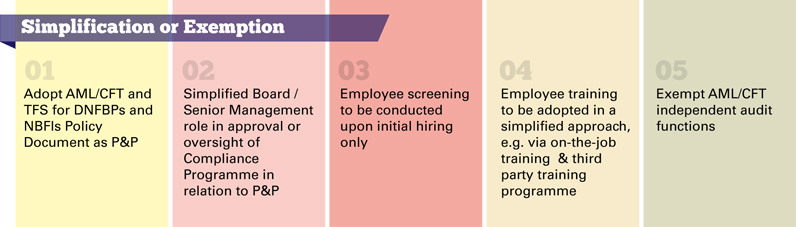

Application of Differentiated Approach for Small-sized Reporting Institutions

Small-sized reporting institutions (RIs) defined under Appendix 2 of the Policy Document are subject to some simplified or exempted AML/CFT Compliance Programme requirements, as specified under Paragraph 11.1.

Notwithstanding the above simplifications and exemption, the RIs must comply with the AML/CFT Compliance Programme requirements as and when specified by the competent authority or supervisory authority to its fullest extent.

Expansion of Fit and Proper Criteria for the Appointment of Compliance Officer (CO)

- RIs must appoint a CO at management level at the Head Office and designate a CO at management level at each branch or subsidiary, pursuant to Section 19 of the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA).

- CO acts as the reference point for AML/CFT matters, must have sufficient stature, authority, seniority and be fit and proper to carry AML/CFT responsibilities effectively.

- Fit and proper criteria is expanded to include financial integrity assessment, as specified in paragraphs 11.5.4 to 11.5.8 of Policy Document.

- RIs are required to inform the Financial Intelligence and Enforcement Department, BNM upon appointment of the CO at Head Office or any change in the appointment within ten working days, in writing or by completing the CO Nomination Form which can also be found on the AML/CFT microsite.

Please click here for CO infographic, Appendix 11 of AML/CFT & TFS for DNFBPs & NBFIs Policy Document: http://amlcft.bnm.gov.my/document/DNFBP/infographic/ii%20INFOGRAPHIC%20COMPLIANCE%20OFFICER’S%20ROLE%20&%20RESPONSIBILITIES.pdf

Exclusion of employee screening & training on several functions

RIs are given the flexibility to exclude several functions that do not have direct dealings with customers and/or not involved in the monitoring of client transactions, based on size, nature and complexity of operations and money laundering and terrorism financing (ML/TF) risks.

Elevate Board’s accountability on AML/CFT oversight

RI’s Board / Senior Partners to determine & ensure frequency and scope of independent audits conducted commensurate with its ML/TF risks and vulnerabilities. The appointed auditor must be separate from the compliance function. Please refer to paragraph 11.9 of the Policy Document.

3. Enhancements to Customer Due Diligence (CDD) Requirements

Additional CDD data points for individual customers

Paragraph 14.10.1 of the revised Policy Document requires the RIs to obtain 9 mandatory CDD data points to enable more comprehensive risk profiling, of which the additional data points are

- Occupation type:

- Name of employer or nature of self-employment or nature of business: and

- Contact number (home, office or mobile)

Tightened CDD for Government-linked companies (GLCs), state-owned corporations (SOCs) & registered persons (RP)

- Effective 1 January 2020, GLCs, SOCs and RPs are subject to standard CDD requirements.

- For existing GLC, SOC and RP customers, RIs are given a 12 months period to comply with the standard CDD requirements.

Expanded Verification Methods

Principle-based requirements for the RIs to verify customer/beneficial owner’s (BO) identity through reliable and independent documentation, electronic data or any other measures that RIs deem necessary

- Documentary data, e.g. ID issued by Malaysian government, including NRIC, driving license, etc.

- Electronic data, e.g. biometric identification, commercial or public databases, etc.

Enhanced CDD or ongoing due diligence for Higher Risk Services

Where nominee services (shareholdings, directorship, or partnership) are provided by gatekeepers (including accountants and company secretaries) to their clients, such clients shall be subjected to automatic enhanced CDD or enhanced ODD measures, where applicable as specified under paragraph 14C.2.1 of PD.

Please click here for CDD infographic, Appendix 11 of AML/CFT & TFS for DNFBPs & NBFIs Policy Document: http://amlcft.bnm.gov.my/document/DNFBP/infographic/iii%20INFOGRAPHIC%20CUSTOMER%20DUE%20DILIGENCE.pdf

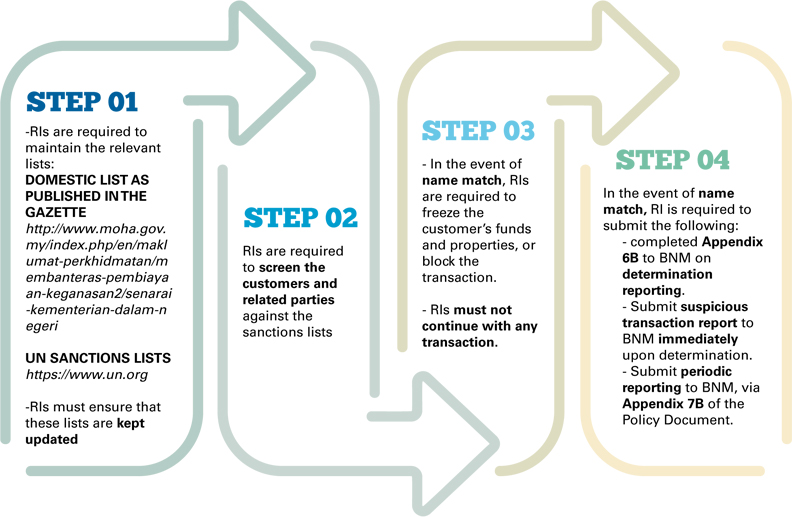

4. Targeted Financial Sanctions (TFS) on Terrorism Financing (TF), Proliferation Financing (PF) & Other UN Sanctions Regimes (OSR)

Consolidation of TFS requirements and detailed guidance

Under the revised Policy Document, the RIs are required to screen customers and related parties against Domestic List (for TF), United Nations Security Council Resolutions Lists for TF, PF and OSR.

Please refer to AML/CFT microsite for Appendices 6B and 7B. Please click here for TFS infographic, i.e. Appendix 11 of AML/CFT & TFS for DNFBPs & NBFIs Policy Document: http://amlcft.bnm.gov.my/document/DNFBP/infographic/iii%20INFOGRAPHIC%20CUSTOMER%20DUE%20DILIGENCE.pdf

5. Data and Compliance Report (DCR)

- Paragraph 25.1 of the revised Policy Document provides for the submission of the DCR.

- DCR is issued pursuant to Section 8(3)(a) of the AMLA, read together with Section 143(2) of the Financial Services Act 2013 (FSA) and operationalising paragraph 25.1 (a) of the revised Policy Document

- BNM issued the DCR on 22 May 2020, which is designed to allow self-assessment of the RI’s risks and vulnerabilities to ML/TF and identify areas of improvement needed to meet the AML/CFT requirements via generated “report card“. This is important for the firm to prepare for the possibility of being selected for onsite examination.

- The DCR is due for submission by 21 August 2020.

- BNM conducts DCR clinic to provide step-by-step guidance on how to complete the DCR. Please email to [email protected] or [email protected] if you need any assistance.

- Please follow the following steps to answer the DCR:

STEP 1: Download the DCR at this link: http://amlcft.bnm.gov.my/Docs/DCR_2020.xlsx

STEP 2: Complete the DCR

STEP 3: Submit your response to [email protected]

You may refer to the following links for more information on the DCR:

Newsletter on the DCR : http://amlcft.bnm.gov.my/NL/Newsletter_3_version_K.htm

What is the DCR?: https://youtu.be/CwDbwnBok4c

How to complete the DCR?: https://youtu.be/obe7vTRmNqw

BNM’s Circular on the DCR 2020 for DNFBPs and NBFIs: http://amlcft.bnm.gov.my/Docs/DCR_2020_Circular.pdf

For more information please click HERE