By Sukh Deve Singh Riar

Since the inception of the London Interbank Offered Rate (LIBOR) in the 1980s, the benchmark rate has widened from being basically a London-only money market rate into a global reference rate to price financial derivatives, bilateral and syndicated loans, repos and many other financial products.

Initially, the British Bankers Association (BBA) was tasked to publish LIBOR term rates for a set of currencies but as unethical behaviour affected its compiling mechanism, change was then suggested by the Wheatley Recommendations in 2012. Now, LIBOR is compiled and distributed by the Intercontinental Exchange in five currencies and seven maturities under the watchful eyes of the UK’s Financial Conduct Authority (FCA).

Nevertheless, LIBOR’s reputational damage was never fully restored, which then led FCA to announce the retirement of LIBOR by end-2021. After this, the panel of banks is no longer obliged to submit its borrowing cost following LIBOR set of rules.

A soup of new benchmark rates has emerged now, and banks are scrambling to ensure their borrowings and lending tied to LIBOR correspond with these benchmark rates. Any mismatch can cause loss of income and set forth bad fits between assets and liabilities. This is a serious matter for banks and the overall business community exposed to LIBOR.

The Relevance of LIBOR

LIBOR is widely used as a benchmark rate by banks all over the globe, with the Economist calling it the world’s most important number as hundreds of trillions of dollars in financial contracts are tied to it. It also represents the unsecured borrowing rate between banks. The spread between Risk Free Rates (RFRs) and LIBOR reflects credit risk and is frequently used as a proxy to measure financial stress in the markets. In our Malaysian scenario, this spread can be measured by the difference between MYR 3-Month KLIBOR and 3-Month Malaysian Treasury Bills (MTB), similar to the Treasury Eurodollar (TED) spread. Financial managers frequently benchmark financial instruments to Interbank Offered Rates (IBOR) since it is a forward-looking rate and delivers certainty of interest pay-out at the end of the setting period. In the case of floating rate notes, it is common for interest pay-out calculations to be benchmarked against relevant IBOR term rates at the beginning of the coupon period.

However, it must be pointed out that this important number is not obtained from actual trades but estimates of borrowing cost submitted by a handful of panel banks. This is because the unsecured wholesale term lending between banks is not sufficiently active especially in the case of longer tenors. This means that it is an inferred number instead of one observed from transactions in the interbank lending market.

What comes after LIBOR?

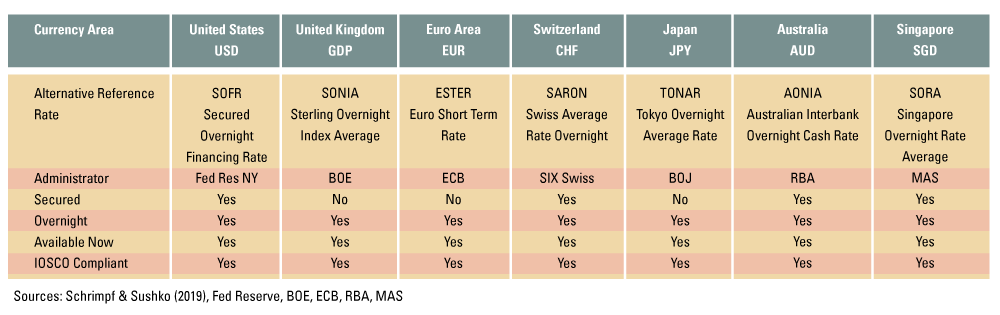

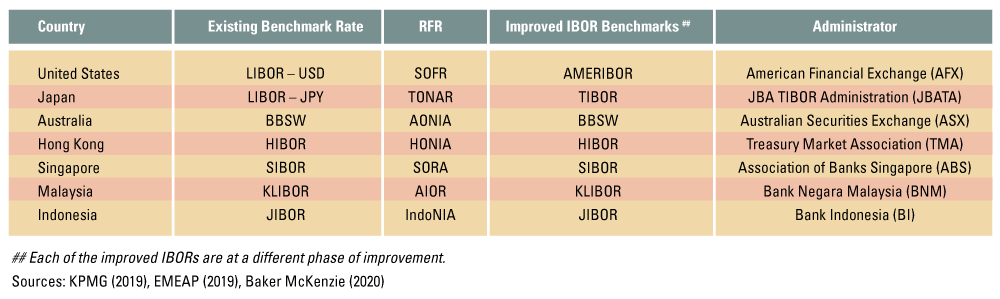

Thus far there is a lack of definitive direction in the long run. However, there is a barrage of benchmark rates available depending on the term currency used for the financial contracts (see Table 1 and Table 2). While the tussle continues between regulators who prefer RFRs based on overnight rates and banks with their deep love for forward-looking unsecured borrowing rates like IBOR, the adoption of benchmark rates must meet the International Organisation of Securities Commission’s (IOSCO) principles for financial benchmarks.

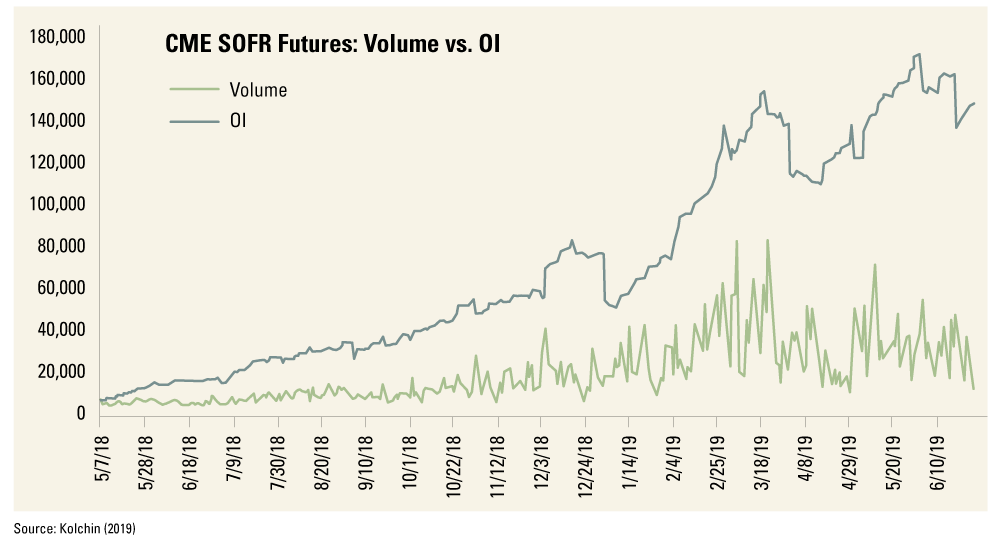

Steady albeit time-consuming improvements are being made to develop forward-looking RFR rates aimed to meet IOSCO’s principles. Nevertheless, the major issue with such RFR futures at present is its low liquidity. In addition, a robust transaction-based forward-looking RFR benchmark must be anchored to an active liquid market (see Figure 1 which shows the relative low volume of Secured Overnight Financing Rate (SOFR) futures traded on the Chicago Mercantile Exchange (CME)#). Perhaps this will improve as we get closer to 2022 with more banks adopting alternative benchmarks.

# CME has one and three-month SOFR futures contracts with each having an underlying value of US$2500. A daily total trade volume amounting to 100,000 contracts will represent US$250 million of debt – which is relatively miniscule to the SOFR daily transaction value of approximately US$1 trillion.

Considering RFRs are devoid of credit risk and the given importance of credit-sensitive benchmarks, regulators have adopted a two-benchmark approach where an improved local IBOR-type rate will coexist alongside as a forward term rate. This is the case with Australia, where the Reserve Bank of Australia (RBA) has taken this route with Australian Interbank Overnight Cash Rate (AONIA) and Bank Bill Swap Rate (BBSW) complementing one another. Both AONIA and BBSW are supported by liquid markets to produce robust benchmarks consistent with IOSCO’s requirements.

In cases where there is a lack of liquidity in the IBOR market as is the case with KLIBOR in Malaysia, administrators can resort to the observed best bid and offer rates to compute the benchmark reference rate. A list of RFRs and IBORs (each at a different stage of readiness) that will coexist side by side post-2021 in the Asia-Pacific region is shown in Table 2 below.

LIBOR Transition Challenges

The ramifications of LIBOR discontinuance can be chaotic and extremely challenging if not managed diligently. In Malaysia, the exposure to LIBOR risk amounts to roughly US$200 billion. Some of the common issues and challenges that financial or business institutions will face in managing the LIBOR transition are:

- to address the sufficiency of fallback language in legacy contracts on LIBOR dissolution, where cases may arise for floating rate instruments deemed as fixed post 2021;

- to deal with timing problems as the fallback provision may trigger a new benchmark rate at different times for different contracts with consequences to asset liability management (ALM);

- the fallback provisions or proposed variations are viewed by one party as neither lawful nor fair for being worse off than one would have been under LIBOR and this could skew into a legal minefield;

- to agree on the acceptable spread adjustment on adopting RFR as the benchmark rate to account for credit risk, as credit spreads are dynamic and will vary according to prevailing market conditions;

- the selection of a suitable replacement benchmark rate, whether should it be a RFR + spread or IBOR-like benchmark rate and matching it to ALM to fit within the balance sheet;

- to address conduct risk in engaging with customers to curtail erosion of trust in dealing with legacy contracts;

- to complete the readiness of corporate infrastructure and resources to facilitate the transition and to accelerate suitable corrective actions where weaknesses are identified;

- the vulnerability to regulatory and compliance risk that may arise as a result of new rules of engagement for legacy contracts that could trigger additional disclosures or compel the use of new benchmark rates;

- to deal with hedge accounting matters as a change of reference rate will affect the valuation of financial instruments / products and have aftereffects on the income statement and balance sheet; and

- subject to the nature of business and jurisdiction, it may give rise to tax implications that need to be accounted and well-planned for.

It is obvious that there will be deep and wide ripple effects as a result of LIBOR’s cessation. Hence, awareness must be widened so that the affected parties can plan and critically examine the consequences of the inevitable disruptive change of reference rates. A recent survey by the EMEAP### Working Group on Financial Markets revealed that the awareness and readiness in the East Asia region is poor among institutional investors, corporates and retail investors. This needs to be reversed and engagement must commence forthwith so parties have plenty of time to develop amicable solutions.

Conclusion

Though LIBOR’s end is certain, it will not go without rumpus and there will be tears. Regulators globally are coordinating closely to contain systemic risk with the transition and firms must take diligent actions without delay to ensure this uncertain trajectory does not slip off course. Doing nothing or not enough is not an option and would be a sure bet for financial tragedy, whilst the current coronavirus pandemic is not helping the financial markets with the transition.

In addition, over-reliance on fallback language in managing the LIBOR transition can be disastrous without connecting the dots to the ALM ecosystem. Both qualitative and quantitative issues must be addressed holistically. There will be no “one size fits all” solution and the solution itself must be flexible, robust and resilient. Much desired progress on LIBOR’s transition has been made to date but more is required to hop over the remaining hurdles.

The reality is that businesses with substantial LIBOR exposure will be subjected to significant financial risk, and this may present as a material risk if an orderly transition to a suitable benchmark rate is not undertaken in an orderly and timely manner.

### Executives’ Meeting of East Asia Pacific Central Banks

Sukh Deve Singh Riar has a Master of Applied Finance (Macquarie University, Australia) and Master of Business Administration (University of Nottingham, UK) and is a corporate finance professional involved in real estate and infrastructure financing.