By Kunal Dutta and Yogesh Mangla

On 18 December 2020, the Organisation for Economic Cooperation and Development (OECD) issued a guidance note on the transfer pricing implications of the COVID-19 pandemic (the Guidance Note). The Guidance Note is not a departure from the general transfer pricing (TP) guidelines updated and issued by the OECD in 2017 (TPG); instead, it provides certain practical considerations based on the consensus of 137 member countries.

The Guidance Note broadly discusses four significant issues; (i) comparability analysis, (ii) losses and allocation of COVID-19 specific cost, (iii) government assistance programmes, and (iv) Advance Pricing Agreements (APA). These topics have been presented as discrete topics; however, these topics are interrelated and should be considered together in performing transfer pricing analysis. The three main concepts that string through the thirty-odd pages and are at the core of the Guidance Note are delineation, rationale and documentation. The Guidance hinges upon the arm’s length principle (ALP) or in simpler terms, common business sense.

This two-part article focuses on the application of the suggestions mentioned in the Guidance Note from a Malaysian standpoint. The article also touches upon informal/formal communiques by the Inland Revenue Board of Malaysia (IRBM) and how the Guidance Note issued by the OECD fits into it.

In this first part, we will discuss two issues, a) comparability analysis and b) APA.

a) Comparability Analysis

The ALP is at the heart of TP and can be performed by applying the most appropriate method selected out of five prescribed methods. In Malaysia, the Transactional Net Margin Method (TNMM) is the most widely used method due to the non-availability of sufficient and reliable transactional level and gross-level comparable data. However, the current pandemic has raised certain challenges in the application of TNMM to justify the ALP.

Generally, the TNMM-based analysis depends on comparable companies’ historical data, as data for the current year are not so readily available at the point of preparation of the Transfer Pricing Document (TPD). Juxtaposed with this, compliance would be difficult to achieve in the current pandemic situation as past historical data does not reflect the current economic realities and would not be a reliable basis to establish the ALP. Particularly in Malaysia, the TPD needs to be prepared by the tax return filing date, and the benchmarking needs to be dated in the TPD. In the light of new amendments proposed in the Finance Bill 2020, not having a TPD will attract a penalty of Malaysian Ringgit (RM) 20,000 to 100,000. Therefore, taxpayers should discuss various avenues available to them with their tax consultants and the group to address the information asymmetry.

The Guidance Note discusses what could be used for the purpose of comparability analysis. In case of the TNMM, the taxpayer can consider documenting the following key information:

On a microeconomic level

- Change in sales volume, use of different/other sales channels;

- Change in capacity utilisation, linking capacity utilisation of past years vis-à-vis the current year’s;

- Incremental, exceptional, non-recurring, abnormal cost with related party or as a whole (and adjustment thereof);

- Internal budget or forecasted sales and revision thereof due to COVID-19.

On a macroeconomic level

- Impact of government assistance (if any) {elaborated in part 2 of the article}

- Fluctuation in GDP, industry indicator or economic outlook from central banks, government agencies, industry or trade associations forecasts, etc.

Variance Analysis

The use of statistical methods such as regression analysis or variance analysis (budget vs actual) can be documented. A detailed profit or loss statement, pre-COVID, during COVID and post-COVID can help in this regard. The Guidance Note further champions this notion and suggests separate testing (or benchmarking) of these periods.

Taxpayers are also encouraged to account for both the negative and positive (if any) impact of COVID-19 on their businesses. The Guidance Note clearly states that widespread effects of the COVID-19 pandemic in an industry or within an MNE group do not suffice to claim that a member of an MNE group has to bear the consequences of risks materialising from the COVID-19 pandemic. Accordingly, it is critical to analyse how the economically significant risks materialised during COVID-19 have been contractually allocated to the group member.

Use of multiple year data

At the same time, the use of multiple years’ data/term test of the tested party along with comparable companies, to carve out the impact of volatility caused by COVID-19 can be a viable solution.

Compensating adjustment

The Guidance Note also suggests compensating adjustments before the filing of tax returns. In Malaysia, upward adjustments are not challenged if done in the same year; it is the downward adjustment that would need more reasoning. If the Malaysian ‘entrepreneur’ entity was the sole decision-making body for the group and had enjoyed super-profits or residual profits in the past, it ought to compensate for the limited risk-bearing entities and vice-versa. Such an adjustment may have other tax implications, which have not been discussed in the Guidance Note.

Choice of comparables and use of loss making companies

For comparability analysis, the Guidance Note advises that care should be taken in verifying that comparables have faced similar restrictions or conditions as faced (or in some cases enjoyed) by the taxpayer. In the Malaysian context, it is essential to note that mere financial updates might not be relevant as some comparable might have received government aid while some might not have. Use of a corroborative study is also encouraged. Since the IRBM prefers a Malaysian comparable, the IRBM should consider relaxing some of the comparability criteria. Lastly, use of a loss-making company should be permissible if they satisfy the comparability criteria. In case the taxpayer has been using foreign comparables, will this pandemic force them to rethink on the choice of comparables because country-specific impacts might vary?

The choice of comparables becomes pertinent for some specific industries that rely on government-led infrastructure projects. With some infrastructure projects suspended indefinitely as the funds are diverted towards healthcare, the impact of COVID-19 might last for more years as compared to others for those Malaysian entities depending on these projects and having significant related party purchases or other transaction(s). Robust documentation with a rationale and evidence is the least they can do to shield against possible TP audit.

In Malaysia, the TP audits for FY 2020 will likely commence in FY 2022. This provides time for the taxpayers and tax authorities to gather more information on the true nature of the impact. The Guidance Note also suggests that tax authorities consider and exercise judgement while auditing taxpayers for the pandemic year. However, as per the Guidance Note, the Mutual Agreement Procedure (MAP) route is always open but should be treaded carefully by all parties as it puts undue pressure on the already strained resources of the tax authorities. Transparency and exercising good judgement has been the underlying tone of the Guidance Note.

b) Advance Pricing Agreement (APA)

An APA is a mechanism by which taxpayers can proactively engage in discussion with the tax authorities to agree on the treatment of international transactions for tax certainty purposes subject to certain critical assumptions. The unprecedented crisis caused by COVID-19 has raised various uncertainties in the real business environment, and APA as a mechanism to provide tax certainties is not an exception. It might be challenging for the taxpayers to satisfy the APA’s terms, and conditions agreed based on pre COVID-19 facts and circumstances.

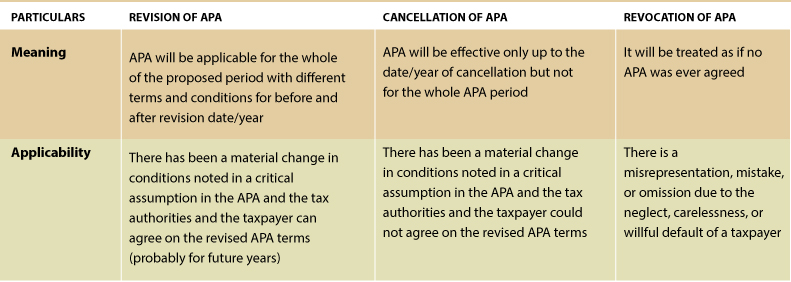

The IRBM was fast on sensing this and issued FAQs (Malaysian FAQ) on 16 June 2020 (subsequently updated on 7 October 2020) to provide clarifications to the taxpayers. The Malaysian FAQ allows the application of ‘Term Test’ on a case-by-case basis, which is quite unprecedented and uncommon keeping in view many other jurisdictions. At the same time, the Malaysian FAQ also elaborates on the procedures to be followed by taxpayers in case of any breach of critical assumptions, which are summarised as follows:

Details of the Malaysian FAQ on APA can be accessed here. The Guidance Note issued by the OECD is fairly aligned with the Malaysian FAQ and suggests a similar approach as prescribed in the table above for breach of critical assumptions. At the same time, it places emphasis on the fact that mere change in economic circumstances will not trigger review unless there is a specific breach of critical assumptions and the tax authorities should take due consideration of the terms of APA, treaty, and domestic rules in regard to APA in case taxpayers fail to meet critical assumptions.

Further, the Guidance Note provides the following additional suggestions to be considered by tax authorities and taxpayers:

- Extending the coverage of the APA period with the application of Term Test which will spread out and neutralise the impact of the extraordinary costs/losses incurred by taxpayers;

- Segregation of APA terms into the period affected and unaffected by COVID-19; and

- Aggregation and evaluation of the transactions as a whole.

Both the Malaysian FAQ and the Guidance Note mention that in case of any breach of critical assumptions, taxpayers should promptly notify and engage in discussion with the tax authorities to agree on the revised terms, thereby reducing the likelihood of cancellation of the APA. The taxpayers should provide adequate documentation or evidence, which may include, i.e. forecasted and actual results, variance analysis, nature of exceptional costs, and third party behaviour among others to defend the revision of APA terms. Simultaneously, tax authorities are recommended to increase reliance upon technology and make use of online channels of communication to minimise the delay in concluding APAs. Last but not least, taxpayers should adopt a collaborative and transparent approach by raising issues with the tax administration promptly rather than resolving them unilaterally.

Part 2 of this article will focus on losses and allocation of COVID-19 specific cost and government assistance programmes.

This article is the view of Kunal Dutta and Yogesh Mangla, both are Senior Managers in Deloitte Tax Services Sdn Bhd and have been practicing transfer pricing for over ten years.

The views expressed above are of the authors alone and does not reflect opinion of any institution or organisation to which the authors might have affiliation with, in the past, present or even in future