By the MIA Surveillance and Enforcement Team

MIA is committed to upholding the regulation and development of the accountancy profession in Malaysia in the public interest. The following article seeks to remind members that they must strictly adhere to the provisions under the Accountants Act and the Rules in carrying out public practice services, or risk running afoul of the law. Backed by our proactive enforcement approach, MIA will take stern action against members and non-members who are in non-compliance with the Accountants Act, including the imposition of penalties such as the stripping of Practice Certificates.

MIA is a statutory body established under the Accountants Act 1967 (Act 94) together with the rules in relation to members and the disciplinary rules, to provide for the registration of accountants and matters connected therewith. The more pertinent role and functions of MIA includes the power to regulate the practice of the accountancy profession in Malaysia.

To enhance professional competency of members thus upholding the profession’s reputation and to safeguard public interest, members must be cognizant of the following vital information.

Salient Provisions of the Accountants Act 1967 (the ‘Act ‘)

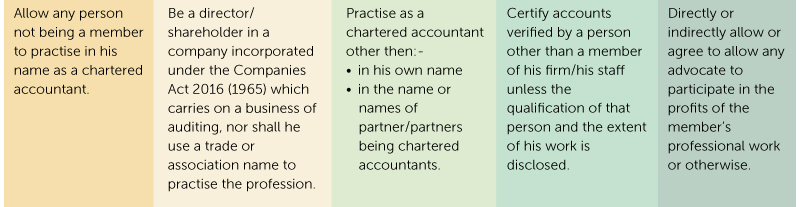

Section 18 of the Act – Prohibition

No member shall:-

Section 22 of the Act

No person shall, unless he is registered as a chartered accountant under this Act and has a principal or only place of residence in Malaysia, practise or hold himself out as a chartered accountant, auditor, tax consultant, tax adviser or any other like description or adopt, use or exhibit the term accountant or any other term of like description in such circumstances as to indicate or to be likely to lead persons to infer that he is a chartered accountant or that he is qualified by any written law to practise the profession as a chartered accountant.

MIA (Membership and Council) Rules 2001

Rule 2 MIA (Membership and Council) Rules 2001.

“Member in public practice” – means a chartered accountant who as a sole proprietor or in a partnership provides or is engaged in public practice services in return for a fee or reward for such services.

“Public Practice Services” include –

- auditing including internal auditing;

- accounting and all forms of accounting related consultancy;

- accounting related investigations or due diligence;

- forensic accounting;

- taxation, tax advice and consultancy;

- bookkeeping;

- costing and management accounting;

- insolvency, liquidation and receiverships;

- provision of management information systems and internal controls;

- provision of secretarial services under the Companies Act 2016 (1965); or

- such other services as the Council may from time to time prescribe.

Rule 9(1) MIA (Membership and Council) Rules 2001

A member shall not hold himself out as a member in public practice unless he holds a valid practising certificate issued by MIA.

Rule 2 MIA (Disciplinary) Rules 2002

Unprofessional conduct means conduct which is discreditable to the accountancy profession and includes gross carelessness, neglect and incapacity in the performance of professional duties, impropriety in professional conduct and conduct unbecoming of an accountant.

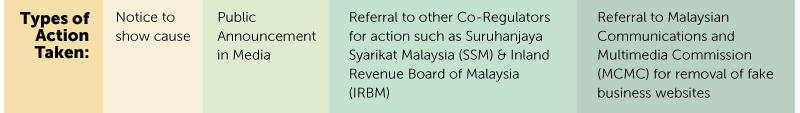

Complaints from Registrar

Proactive Enforcement

whereby complaints were lodged against 19 MIA members for the following offences:

- Engaged in public practice services without a Practice Certificate/Audit License/Tax License.

- Working in a partnership with non-members of MIA.

- Not being the controlling shareholders of the Business.

- Offering/advertising audit services through a corporate entity.

- Offering public practice services through a business registered under Registration of Businesses Act 1956.

Action Against Non-Members

- for advertising or offering public practice services without being a chartered accountant registered with MIA – 13 cases

Conclusion

Members are advised to strictly adhere to the provisions under the Accountants Act and the Rules in carrying out the public practice services enshrined under Rule 2 to uplift the reputation of the profession and to instill public confidence in the conduct of services offered.