By Zulaikha Nurain

Thanks to the COVID-19 pandemic impact, remote working and virtual meetings have become a norm, with one key consequence: the need to find alternatives to signing off physical documents. As such, many organisations have turned to digital and electronic signatures as Malaysia adapts to remote working.

Despite the prevalence of digital and electronic signatures, which are not new in Malaysia, some organisations are understandably hesitant to use them due to security and validity issues. A recent webinar organised by the Malaysian Institute of Accountants (MIA) titled, “Digital Signatures: How does it work and what is the legal impact?” explored this subject in depth, covering the laws behind digital and electronic signatures, their benefits as well as their challenges.

Mohamed Ridza, the Managing Partner of Mohamed Ridza & Co. discussed the elements and laws binding electronic and online transactions, including the Electronic Commerce Act 2006, which also covers digital signatures. He stressed the importance of understanding the laws and guidelines, having the necessary firewalls, authentication and security systems in place when implementing digital and electronic signatures to mitigate risks like hacking and forgeries. “The important thing is to ensure that the person signing the document has the right to do so, and to ensure electronic channels are secure to prevent unauthorised third parties signing documents,” explained Ridza. “Another important aspect to note is what you see is what you sign, meaning each page of the document presented must be verified and confirmed by the person signing them before placing the signature.”

In his presentation on the technology behind digital and electronic signatures, Sea Chong Seak, Chief Technology Officer of Signing Cloud Sdn Bhd enumerated the challenges arising from the use of digital signatures. “This includes the lack of user expertise and knowledge and having to ensure a smooth experience for all parties involved when a digital signature is used for transactions,” he said. “Millions of transactions using digital signatures happen each day in different types of documents, so businesses must also ensure data privacy.”

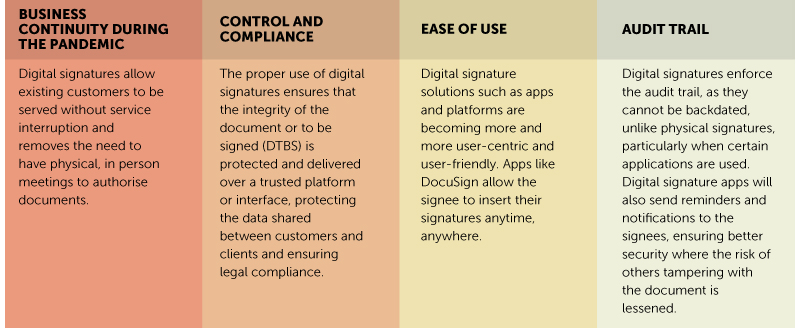

At the same time, Sea highlighted several benefits of adopting digital signatures, particularly during the COVID-19 pandemic:

The use of electronic and digital signatures was further discussed during a panel session moderated by Steven Chong, Member of the MIA Digital Technology Implementation Committee (DTIC). The panellists comprised Samantha Tai Yit Chan, Chief Executive Officer of Boardroom Corporate Services Sdn Bhd, Shamsul Izhan Abdul Majid, Chief Technology & Innovation Officer at the Malaysian Communications and Multimedia Commission (MCMC), Johnny Yong Buong Peah, Head of Capital Market & Assurance of MIA, Mohamed Ridza, and Sea Chong Seak.

The panellists discussed the practicality of digital signatures in today’s time and concurred that the agility of an organisation in adapting digital signatures into their processes is also a reflection of the landscape shifting into a digital economy.

The discussion also centred on the expectations of using digital signatures moving forward, with the following highlights:

Digital signatures will become more prevalent – Piggybacking on the government’s My Digital Aspiration, where 22% of the economic landscape will become digital, SMEs will gain more access to digital e-commerce as there will be more investments into digitisation. By the year 2022, 80% of data, which includes documents, will be shared on Cloud, allowing for a more digitised landscape for business and operational transactions. The government, through the various digital initiatives are working towards removing impediments in the various statutes that may hamper the adoption of electronic or digital signatures such as those under the Statutory Declarations Act 1969.

Businesses must adapt – Businesses must find new ways to adapt to digitalisation and to guarantee the safety of their processes, such as using secure apps to sign documents, and ensuring that all parties consent to the use of digital signatures. Organisations can also facilitate sustainable practices and expedite their processes by using digital signatures, which enable remote approvals and authorisation. This not only reduces the carbon footprint from physical transactions but was also proven to be especially critical and effective during the movement control orders and lockdowns. By adapting systems like digital signatures, businesses can increase their digital maturity and concentrate on processes that will bring efficiency, sustainability and productivity.

Building awareness is key – While electronic signatures and digital signatures are not new in some countries, there is still a sense of trepidation and resistance. Awareness needs to be built within an organisation among its employees and management, and externally with third parties and clients, to drive digital signatures. This is important especially now amidst all the disruption caused by COVID-19. In addition, the concept known as “intention to authenticate” should be encouraged across the business community as a form of best practice over time.

As part of MIA’s efforts to drive the digitalisation agenda forward, the Institute has set up a digital signature working group with the long-term goal of providing guidance to the auditing fraternity when it comes to digital and electronic signatures. These initiatives include exploring available options such as simple or advanced platforms for electronic signatures that can be used by auditors in Malaysia and the different level of security application. MIA is also pursuing this initiative with other regulatory authorities such as the Suruhanjaya Syarikat Malaysia (SSM), and the Inland Revenue Board Malaysia (IRBM), to further advocate for the adoption of digital signatures in the Malaysian ecosystem or to further expand its application into other service areas (stamp duty under IRBM, for example).

Click here for more information on the Digital Signature Act, licenses and other guidelines.

Zulaikha Nurain is Manager of the Strategic Communication & Branding, Malaysian Institute of Accountants.