By Gagandeep Nagpal and Thomas Chan Yeu Wai

The risk-reward theory in economics states that higher the risk, higher the return. This principle of economics is also used in transfer pricing (TP) to determine the arm’s length compensation of the transacting parties. It means the transacting entity who takes relatively more risk in any business arrangement vis-à-vis its counterparty would be expected to have relatively higher returns (actual/expected) under TP principles. Therefore, it is critical to define the precise risk profile of the transacting parties, as TP compensation for any transaction would be determined accordingly. In TP jargon, the risk profile of the entity is reflected through a few commonly used phrases, which we generally refer to as TP characterisation.

In this context, it is worth discussing certain latest amendments to the Year of Assessment (YA) 2022 Form C, which requires significant additional TP disclosures (as per Item F8). One of the main TP disclosures in this updated Form relates to TP characterisation, which hints at an increasing reliance by the Inland Revenue Board of Malaysia (IRBM) upon information about TP characterisation to perform risk-based selection of audit cases. As such, we will examine the important aspects of TP characterisation in the subsequent paragraphs.

TP characterisation is the foundation of arm’s length analysis

One of the building blocks of any TP analysis is the functions, assets, and risks (FAR) analysis, wherein the functions performed, assets deployed, and risks assumed by the transacting parties are analysed. TP characterisation is basically an outcome of FAR analysis which sums up the entire functions, assets, and risk analysis in a defined short phrase. It further lays the foundation of economic analysis viz. selection of the most appropriate TP method, profit level indicator, selection of tested party and comparable companies.

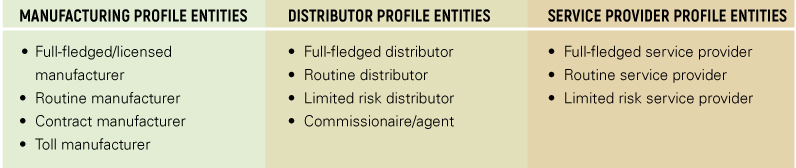

Malaysia TP Guidelines (the Guidelines) have also recognised the TP characterisation as an important step towards determination of arm’s length price of the controlled transaction. The Guidelines also talk about characterisation based on the nature of activity and complexity of the operations. The most commonly used transfer pricing characterisation based on the nature of the business activities is listed below:

Kindly note that there could be a situation wherein the profile of the transacting parties may not fit exactly into any of the above water-tight compartments of TP characterisation – i.e. hybrid situations.

Approach to determine the right TP characterisation

After discussing the relevance of TP characterisation, the next obvious question is how to determine the right TP characterisation in relation to the business activities carried out by the transacting parties. As a matter of caution, it would be a risky proposition to determine TP characterisation without conducting a FAR analysis. FAR analysis not only indicates which transacting party is assuming economically significant risks arising from the transaction, but also functions performed and assets deployed by transacting parties to manage and control those economically significant risks. To illustrate the relevance of FAR analysis in determination of TP characterisation, the following case study would be useful.

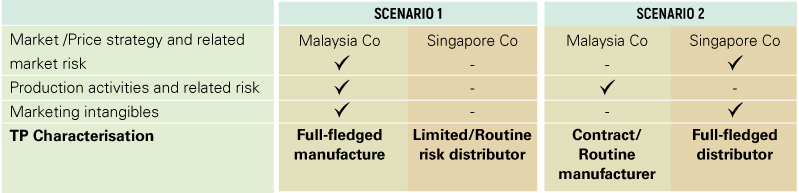

Case study - A Malaysian entity manufactures and sells goods entirely to its related party in Singapore. The Singapore entity is the marketing arm that facilitates onward sales of the goods supplied by the Malaysian entity. In this kind of supply chain, we have tabulated below two scenarios to appreciate how FAR analysis impacts the characterisation of the transacting entities.

The above FAR analysis (although not comprehensive for the sake of brevity) reflects how this analysis could have an impact on TP characterisation of both Malaysia and Singapore entities.

Common disputes around TP Characterisation

Based on recent TP audit trends, some common disputes by the IRBM around TP characterisation were:

Determination of arm’s length compensation

As mentioned above, TP characterisation lays the foundation of economic analysis. Therefore, any incorrect declaration about TP characterisation could give a wrong impression to the tax authorities about the risk profile and accordingly could lead to a situation wherein the IRBM may expect particular type of compensation for the taxpayer. In order to illustrate it better, we have laid out below two illustrative scenarios (not exhaustive) –

- In the first scenario, a Malaysian taxpayer declares that it is a full-fledged manufacturer (selling to a related party limited risk foreign trading arm). In such a case, the IRBM would expect that the transaction pricing should be such that the trading arm only gets a routine return, and the residual profit should be attributed to the Malaysian taxpayer.

- In the second scenario, a Malaysian taxpayer characterises its business as a limited risk distributor (buying from a risk-bearing foreign related party manufacturer). In such a case, the IRBM would expect that the local taxpayer should be entitled to an assured routine return, generally irrespective of market situations. During the pandemic, it was a moot question debated by many limited risk entities.

Further, TP characterisation could have a bearing on the selection of TP method. For instance, the IRBM may expect a taxpayer with the characterisation of a full-fledged manufacturer to apply the profit split method instead of the transactional net margin method, if the foreign counterparty is sharing certain economically significant risks with said manufacturer. In other cases, the dispute could also be on the selection of the tested party or the profit level indicator, and most commonly the selection of comparable companies.

Performance of economic adjustments

A taxpayer may perform certain economic adjustments in case its financial performance in any particular year was impacted by abnormal business factors. However, the IRBM considers such economic adjustments on a case-by-case basis after evaluating the TP characterisation of the entity. For example, in case the taxpayer is a limited risk entity, then the IRBM may not recognise any economic adjustments to improve the operating results and may expect that limited risk entity to get an assured routine compensation from the risk-bearing counterparty.

Business restructuring

If there is any change in TP characterisation, it may be viewed as a case of business restructuring and any business restructuring would come with its own set of consequential TP issues. In particular, if a change in business characterisation has an impact on the profit potential, then it attracts attention from the IRBM and could be challenged if there is no change in the functions performed, the assets deployed, or the risks assumed, pre and post restructuring, based on the conduct of the parties.

In fact, information about business restructuring is another set of particulars sought by the IRBM in the updated Form C that applies to YA 2022. Therefore, these particulars need to be filled in carefully.

Significant advertisement, marketing and promotion expenses

The IRBM also tends to challenge the TP characterisation of limited risk and routine distributors, if the IRBM determines that the local entity is involved in significant local advertisement, marketing, and promotion activities, usually reflected through high local expenditure on these activities. As a consequence, the IRBM may expect additional compensation in the form of reduced royalty (or discount on purchase price) or cost-plus compensation treating it as a separate service over and above routine distribution activities or consider only comparable companies having a similar level of advertisement, marketing and promotion expenses. In certain cases, the IRBM may go into the realms of profit split method as well.

The above examples are not exhaustive in terms of the potential areas of dispute relating to TP characterisation, but these at least provide a sense of how critical the issue of TP characterisation is.

Way forward

With the introduction of the updated YA 2022 Form C on TP disclosures involving business characterisation, it is important that the taxpayer is characterised accurately, with reference to the FAR analysis. Taxpayers eligible to prepare minimum transfer pricing documentation (without FAR analysis) especially should exercise care in providing the declaration about TP characterisation. An incorrect declaration regarding TP characterisation could have significant implications during an audit.

Gagandeep Nagpal is Executive Director of Transfer Pricing, Deloitte Malaysia.

Thomas Chan Yeu Wai is Director of Transfer Pricing, Deloitte Malaysia.

The content in this article are personal views of the authors and does not purport to reflect the views of Deloitte Malaysia.