By Small and Medium Practices Department

As part of the initiative to facilitate the increase in the number of skilled workforces in Malaysia under the 11th Malaysia Plan, the Human Resources Development Corporation (HRD Corporation) broadened access to the Human Resources Development Fund (HRDF) by expanding the coverage of the PSMB Act 2001, with the exception of Federal Government, State Government, local council, and statutory body, effective from 1 March 2021. Please refer to the PSMB (Amendment of First Schedule) Order 2021 (PSMB Order 2021) which was gazetted on 26 February 2021 for the list of industries after the expansion of coverage.

It is significant to note that the professional services industry (including the accountancy industry) is one of the new industries identified following the expansion of the coverage of the PSMB Act 2001.

The History of Expansion of PSMB Act

In the past, there were two attempts in 2005 and 2010, to expand the scope of coverage of the PSMB Act, to include the accounting profession. However, the Government eventually reversed that decision after MIA submitted a memorandum. The points raised in the memorandum were that training is an integral part of the accounting and auditing profession, and hence, there is no necessity to expand the coverage of the PSMB Act to the profession. Furthermore, based on recent statistics, only 21% of total member firms have 10 or more staff, to be liable for registration with HRDF.

Efforts of MIA in getting the accounting and auditing profession exempted from the expansion of scope under PSMB Act 2001 since 2019 include the following:

- Submission of the “Memorandum Pertaining to the Proposed Expansion Scope of the Pembangunan Sumber Manusia Berhad (PSMB) Act, 2001 (Act 612) to the Accounting and Auditing Industries” to HRDF, MOF and Ministry of Human Resources (MOHR);

- Several engagement sessions with HRDF/MOF/MOHR to convey MIA’s stance and also to lobby for exclusion of accounting and auditing from the First schedule;

- Submission of a letter to Ministry of Human Resources after the PSMB (Amendment of First Schedule) Order 2021 was gazetted on 26 February 2021, requesting to delay the effective date for expansion of scope to 1 July 2022;

- Submission of a Joint Letter by the Bar Council, MIA, The Malaysian Institute of Certified Public Accountants (MICPA), the Chartered Tax Institute of Malaysia (CTIM), the Institute of Engineers, the Association of Consulting Engineers Malaysia and Pertubuhan Akitek Malaysia to the MOHR. The letter was also sent to the Prime Minister’s Office.

As there was no response from the MOHR after the submission of the Joint Letter in December 2021 and after checking with HRD Corp staff that no further levy exemption will be granted, MIA issued Circular MF2/2022 in early February 2022 to clarify that there will be no further extension of levy exemption and MIA member firms that met the requirement for registration and levy contribution were required to register with HRD Corp and start contributing levy since January 2022.

For the legal profession, the Bar Council initiated action by filing an application at the High Court of Malaya, Kuala Lumpur to seek declaratory relief that the PSMB (Amendment of First Schedule) Order 2021 is not applicable to those regulated by the Legal Profession Act 1976 (“LPA 1976”) as well other reliefs relating directly to the LPA. A stay of the application of the PSMB Act, including its enforcement, vis-à-vis the legal profession, pending the disposal of their application, is also being sought.

If the decision from the Court is favourable to the Bar Council, MIA may be able to apply the same legal precedent in that decision. On 16 October 2022, the attempt to seek a judicial review by the Bar Council was rejected and on 18 October 2022, an interim stay was granted until the next court date. The Institute will continue to monitor the progress and update member firms accordingly.

Requirement for registrations and levy contribution

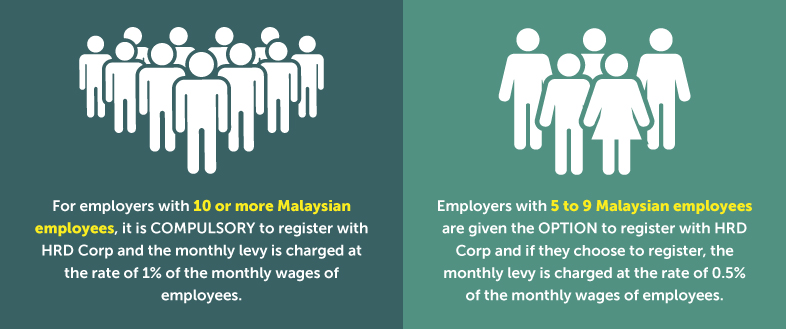

For employers that fall under the expansion of coverage, following are terms and conditions for new registration:

Currently, HRD Corp still accepts registration with no penalty except for the cases that had been referred for further action.

Payment of levy

The deadline for levy payment is by every 15th of the following month. Previously, employers that are required to be registered as employers with HRD Corp (i.e., those with 10 or more employees), are given an exemption from paying the HRDF levy for three (3) months from 1 March to 31 May 2021 under the PSMB (Exemption of Levy) Order 2021 (PSMB Exemption Order 2021) gazetted on 26 February 2021.

Subsequently, the Minister of Human Resources extended the period for exemption of levy payment until 31 December 2021 for employers covered under the Pembangunan Sumber Manusia Berhad (Amendment of First Schedule) Order 2021, PSMB Act, 2001 (P.U. (A) 84/2021) commencing 1 March 2021 and registered with HRD Corp before 1 July 2021. The levy exemption period was from 1 June 2021 to 31 December 2021.

No further extension was granted for exemption of levy payment. All member firms with 10 or more employees and registered with HRD Corp are subject to levy payment effective 1 January 2022, and the first levy payment shall be made to HRD Corp by the 15th of the following month.

FAQs on HRD Corp Claimable Courses

MIA’s courses have been granted the Approved Training Programme (ATP) status under the PSMB Act 2001.

Based on the HRD Corp’s Training Providers’ Circular No. 3/2021, HRD Corp has imposed a requirement that training providers need to register their training programmes under the HRD Corp Claimable Course Scheme to become eligible to offer trainings to registered employers.

Here are some frequently asked questions on claimable courses:

What are HRD Corp Claimable Courses?

HRD Corp Claimable Courses, formerly known as SBL Khas, are collectively a scheme to assist registered employers, especially those with limited resources to train and upskill their employees in line with their operational and business requirements.

Under this scheme, HRD Corp will pay the course fee (subject to a 4% service fee from 1 April 2021) directly to the training providers by deducting the amount from the employers’ levy account. HRD Corp will also pay other claimable allowances to the employer.

What is the submission process for HRD Corp Claimable Courses?

- Firstly, MIA will submit its courses registration via the HRD Corp e-TRiS system. Once the course is approved as a Claimable Course, it will appear in the e-TRiS system.

- Employers will need to access the e-TRiS system to select the course and submit to HRD Corp for grant approval. The total claimable amount is subject to the approval of each Employer’s individual grant application.

- Once HRD Corp has approved the Employer grant, the e-TRiS system will generate and send the approval letter to the training provider.

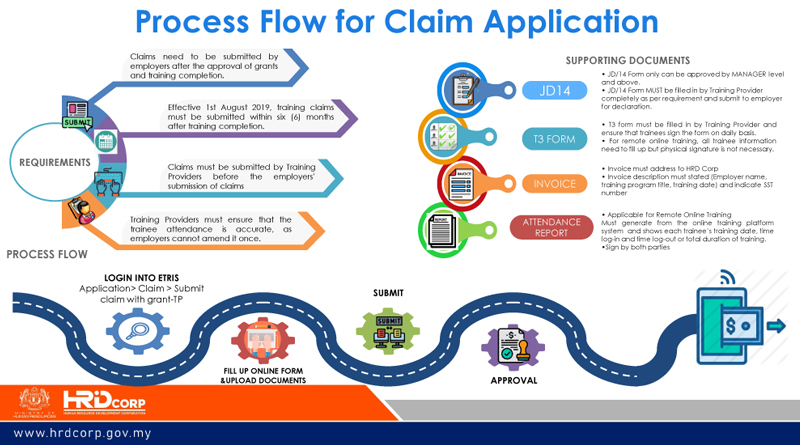

- After the training is completed, Employers are required to verify the JD 14 Form, Attendance Form (T3) and Attendance Report filled in by the Training Provider. The Employers need to sign (Manager and above) and insert their company stamp on required documents. The signed and stamped documents are to be forwarded back to the Training Provider.

- MIA will then submit all completed documents to HRD Corp e.g., JD 14 Form, Attendance Form (T3), invoice and system-generated report (for Remote Online Training only).

In the event that HRD Corp rejects the Employer-approved grant submitted by MIA, due to any unresolved queries or lack of documentation on the training (including shortage of attendance, change of participant details or unqualified participants), MIA reserves the right to issue their invoice directly to the company/member firm. The company/member firm is obligated to settle the payment to MIA directly for all training conducted and services provided to the company/member firm.

What is required in the submission of a training grant application (for Employer)?

Employers can view the details here https://hrdcorp.gov.my/wp-content/uploads/2022/03/Claimable-Courses-HRDCorp-Grant-Helper.pdf

What are the procedures to submit a complete claim application for a training conducted?

There are two (2) types of claims for HRD Corp Claimable Courses.

Training Providers will have to submit claims for the course fees while employers will submit the claims for their allowances.

Please click on the following link for more information on training claim application by employers: https://hrdcorp.gov.my/wp-content/uploads/2021/10/Claim-Submission_SBLKHAS_EMPLOYER_HRDCORP-Claim-Helper-3.pdf

The submission of claims by training providers is explained in previous question above. Please click on the following link for the process flow for claim application by training providers:

Note: For more information and updates on HRD Corp, please visit www.hrdcorp.gov.my.

Should you have any problem accessing your e-TRiS account, kindly forward the issue to HRD Corp Support Centre via supportcentre.hrdcorp.gov.my.