By Peter Spence

Technology is revolutionising our industry, but if you want to make the most of the possibilities it offers you have to make sure your team have the skills they need. AICPA & CIMA’s Peter Spence explains more.

Organisations around the world are taking bold steps towards finance transformation, but too many fail to bring their people along for the journey.

According to KPMG International’s 2019 Future Ready Finance survey, many top organisations have embraced a range of technologies to increase efficiency and improve performance, yet only 28% reported those initiatives to be a ‘great success’.

Part of the reason so many finance transformations fail might be an underinvestment in talent.

According to Finance transformation: the human perspective, joint research from the Association of International Certified Professional Accountants® and KPMG International, less than 3% of respondents said their finance function had the skills it needed. Despite this awareness of a skills gap, less than 10% of respondents said their transformation programmes focus on developing employee skills.

A lack of funding also implies employee training is a low priority, with over half of respondents allocating less than 10% of their finance transformation budget for training new staff, and 41% spending at similar levels for existing employees.

Companies can adopt all the latest technologies, but if their people don’t know how to effectively leverage these tools, their transformations are likely to fall flat.

Organisations that want to take a human-centric approach to finance transformation can start by following these best practices:

Involve employees in each step of finance transformation

Involving employees at all levels during the planning and implementation of finance transformation initiatives will help ensure everyone is on the same page.

Gather insights from employees who will use new tools or processes to understand their pain points and communicate how new technologies will change their day-to-day work.

Transformation initiatives will likely shift the goals of some employees, so it’s important for managers to provide clarity on how their roles could evolve. For example, new data analytics and visualisation tools might allow employees to spend more time generating insights and applying those insights to the business.

Keep lines of communication open indefinitely so employees can alert leadership to any issues they might have as they integrate new tools.

Invest in employee training to fill gaps

Finance professionals should play a central role in the digital transformation of operating models because of their ability to connect the dots between operations and value creation. However, most finance teams lack the range of skills necessary to support digital transformation.

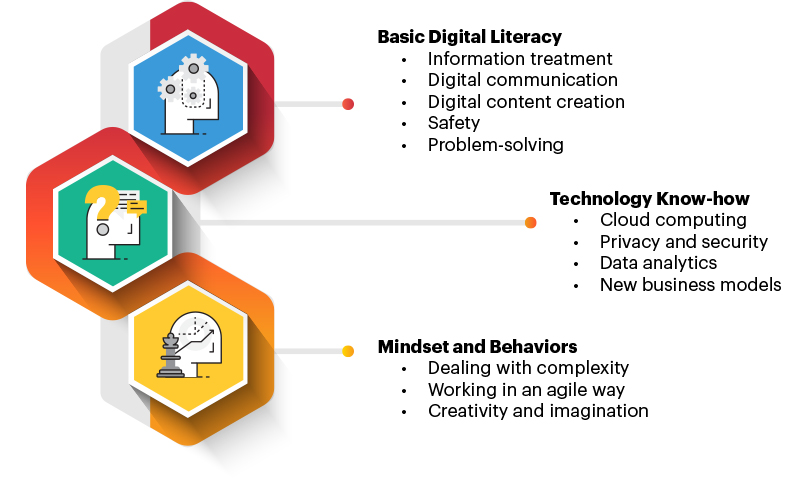

The CGMA Re-inventing finance for a digital world report listed the following skills, mindsets and behaviors finance professionals should develop to effectively work with emerging technologies:

Leaders should determine which of these skills and mindsets their finance team is lacking and invest in employee training and development to fill those gaps.

Many organisations interviewed for Finance transformation: the human perspective reported using a 70:20:10 learning and development model. Under this model, employees learn 70% of their knowledge on the job (with workplace and leadership support), 20% through interactions with others (including mentoring and team collaboration) and 10% through formal learning (such as courses and conferences).

Providing a range of employee development initiatives can help ensure your finance team attains well-rounded knowledge and experience.

Be sure to designate a sufficient portion of the budget for training and development to give your transformation initiatives the best chance at success.

Plan for continuous transformation

Transformation shouldn’t have an end date. Business ecosystems are constantly changing, and organisations must adapt in tandem or risk falling behind.

Create a transformation plan and continuously review it to make sure you’re still on the right track. Regularly re-evaluate employee learning and development to accommodate emerging critical skills.

Leaders should adopt a growth mindset and inspire their teams to do the same.

According to Finance transformation: the human perspective, employee motivation to embrace change and get behind transformation initiatives was the most critical factor for finance transformation success.

Leaders and employees need to be willing to leave behind legacy mindsets and get to work shaping a better future for the finance function. Those with a growth mindset have no need to fear the unknown because they know they can adapt to meet any challenge that arises.

Peter Spence is the Associate Technical Director—Management Accounting, AICPA & CIMA