By MIA Financial Statements Review Department

One of the key areas commonly reviewed by the MIA Financial Statements Review Committee (FSRC) is on the application of the “going concern” assumption in the preparation of financial statements and the adequacy of the related disclosures in the financial statements.

Many businesses were affected by the challenges of the COVID-19 pandemic, which led to them facing a significant downturn in revenue, profitability and liquidity issues in the current economic scenario. This may raise concerns about an entity’s ability to continue as a going concern.

The going concern assumption is a fundamental principle in the preparation of financial statements. The assessment of an entity’s ability to continue as a going concern is the responsibility of the entity’s management. The management shall satisfy themselves that the going concern assumption used is appropriate in the preparation of the financial statements; and the appropriateness of management’s assessment is a matter for the auditor to consider on the audit of the financial statements.

Observation

Entities disclosed events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern and management’s plans to deal with these events or conditions. However, there is a lack of qualitative disclosure that enables users to understand the going concern issue. Detailed explanation/ information surrounding the events or conditions that give rise to the material uncertainties as well as the significant judgement made in concluding the material uncertainties are encouraged for better clarity.

For example, disclosures observed state that the material uncertainties related to going concern are from the net current liabilities and loss-making position, and the disclosures also indicated that Covid-19 has brought uncertainties. However, the disclosure does not explain how the Covid-19 uncertainties affect the ability of the entity/group to continue as a going concern.

FSRC’s Analysis

Paragraph 25 of MFRS 101 Presentation of Financial Statements states requires the management to make an assessment of an entity’s ability to continue as a going concern. An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading or has no realistic alternative but to do so. When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties. When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern.

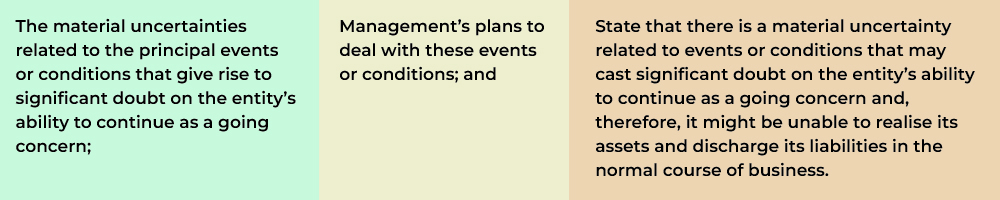

If the management concludes that the going concern basis is appropriate, but material uncertainties exist in relation to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, it should disclose:

Disclosure in the financial statements is expected when material uncertainty exists related to events or conditions that, alone or in aggregate, may cast significant doubt on the entity’s ability to continue as a going concern.

Entities should also consider the overarching disclosure requirements in MFRS101 which may include:

- Disclosure on significant judgements that the management has made in concluding there are no material uncertainties/ going concern assumption is appropriate. [MFRS101.122]

- Disclosures on the information about the assumptions it makes about the future, and other major sources of estimation uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. [MFRS101.125]

In making the disclosure, entities should give a clear explanation of the triggering events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern and the material uncertainties. Also, it is encouraged to disclose additional qualitative information in relation to how the uncertainties occur and the management’s plans to deal with these events or conditions. The disclosures should be as specific as possible about how the entity is affected. Boilerplate disclosures should be avoided.

In evaluating the adequacy of such disclosures, International Standards of Auditing (ISA) 570 (Revised) Going Concern indicates that the auditor shall consider whether the financial statements:

- Adequately describe the principal events or conditions that may cast significant doubt on the entity’s ability to continue as a going concern and management’s plans to deal with these events or conditions; and

- State clearly that there is a material uncertainty related to events or conditions which may cast significant doubt on the entity’s ability to continue as a going concern and, therefore, that it may be unable to realise its assets and discharge its liabilities in the normal course of business.

In addition to specific disclosures that may be required regarding a material uncertainty about the entity’s ability to continue as a going concern, disclosures of risks may assist users of the financial statements to better understand the entity’s financial position, financial performance and cash flows.

For those entities that are significantly affected by the current economic conditions (e.g. global economic slowdown, inflation, labour shortage and other conditions arising from the Covid-19 pandemic), management needs to consider how to address the risks arising from the current economic conditions in their financial statements (e.g. liquidity risks) and provide sufficient disclosures to enable users to understand the effects of material transactions and events on the information conveyed in the financial statements.

If management fails to make a proper assessment of the entity’s ability to continue as a going concern, or did not disclose the material uncertainties that may cast doubt upon the entity’s ability to continue as a going concern, the financial statements would not reflect the actual circumstances that are being encountered by the entity.

Illustrative / Guidance

What should management look out for in the assessment of the status of going concern of an entity?

Examples of events or conditions that, individually or collectively may cast significant doubt on the entity’s ability to continue as a going concern are set out below. This listing is not all-inclusive nor does the existence of one or more of the items always signify that a material uncertainty exists.

Financial

- Net liability or net current liability position.

- Fixed-term borrowings approaching maturity without realistic prospects of renewal or repayment; or excessive reliance on short-term borrowings to finance long-term assets.

- Indications of withdrawal of financial support by creditors.

- Negative operating cash flows indicated by historical or prospective financial statements.

- Adverse key financial ratios.

- Substantial operating losses or significant deterioration in the value of assets used to generate cash flows.

- Arrears or discontinuance of dividends.

- Inability to pay creditors on due dates.

- Inability to comply with the terms of loan agreements.

- Change from credit to cash-on-delivery transactions with suppliers.

- Inability to obtain financing for essential new product development or other essential investments.

Operating

- Management intentions to liquidate the entity or cease operations.

- Loss of key management without replacement.

- Loss of a major market, key customer(s), franchise, license, or principal supplier(s).

- Labour difficulties.

- Shortages of important supplies.

- Emergence of a highly successful competitor.

Others

- Non-compliance with capital or other statutory or regulatory requirements, such as solvency or liquidity requirements for financial institutions.

- Pending legal or regulatory proceedings against the entity that may, if successful, result in claims that are unlikely to be satisfied.

- Changes in law or regulation or government policy that are expected to adversely affect the entity.

- Uninsured or underinsured catastrophes when they occur.

The significance of such events or conditions often can be mitigated by other factors. For example, the effect of an entity being unable to make its normal debt repayments may be counter-balanced by management’s plans to maintain adequate cash flows by alternative means, such as by disposal of assets, rescheduling of loan repayments, or obtaining additional capital. Similarly, the loss of a principal supplier may be mitigated by the availability of a suitable alternative source of supply [Paragraph A3 of ISA 570 (Revised)].

It is crucial to note that what constitutes a material uncertainty that may cast significant doubt on the entity’s ability to continue as a going concern is a matter of judgement involving:

- An assessment on the magnitude of the potential impact of the unfavourable events or conditions and the likelihood of occurrence; and

- The ability of the entity to adopt realistic strategies that might mitigate that uncertainty.

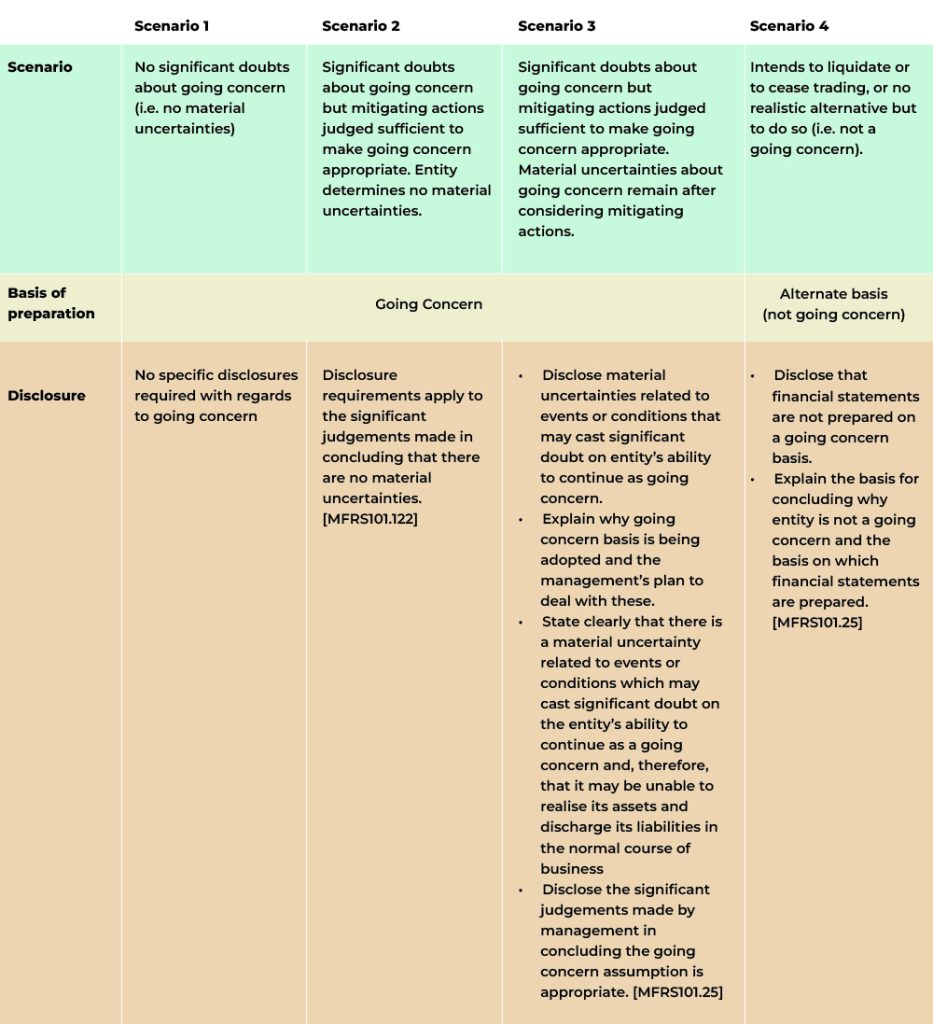

Implications on financial statements

The possible scenario from management’s assessment of going concern and the implication on the financial statements are illustrated as follows:

Management should consider the disclosures of risks and other disclosure requirements that may be relevant to the going concern assessment, including:

- Major sources of estimation uncertainty about the carrying amount of assets and liabilities [MFRS 101.125-133]

- Defaults and covenant breaches [MFRS 7.18-19]

- Risks arising from financial instruments, including liquidity risk [MFRS 7.31-42]

- Undrawn borrowing facilities and any restrictions on the use of those facilities such as covenant requirements [MFRS 107.50(a)].

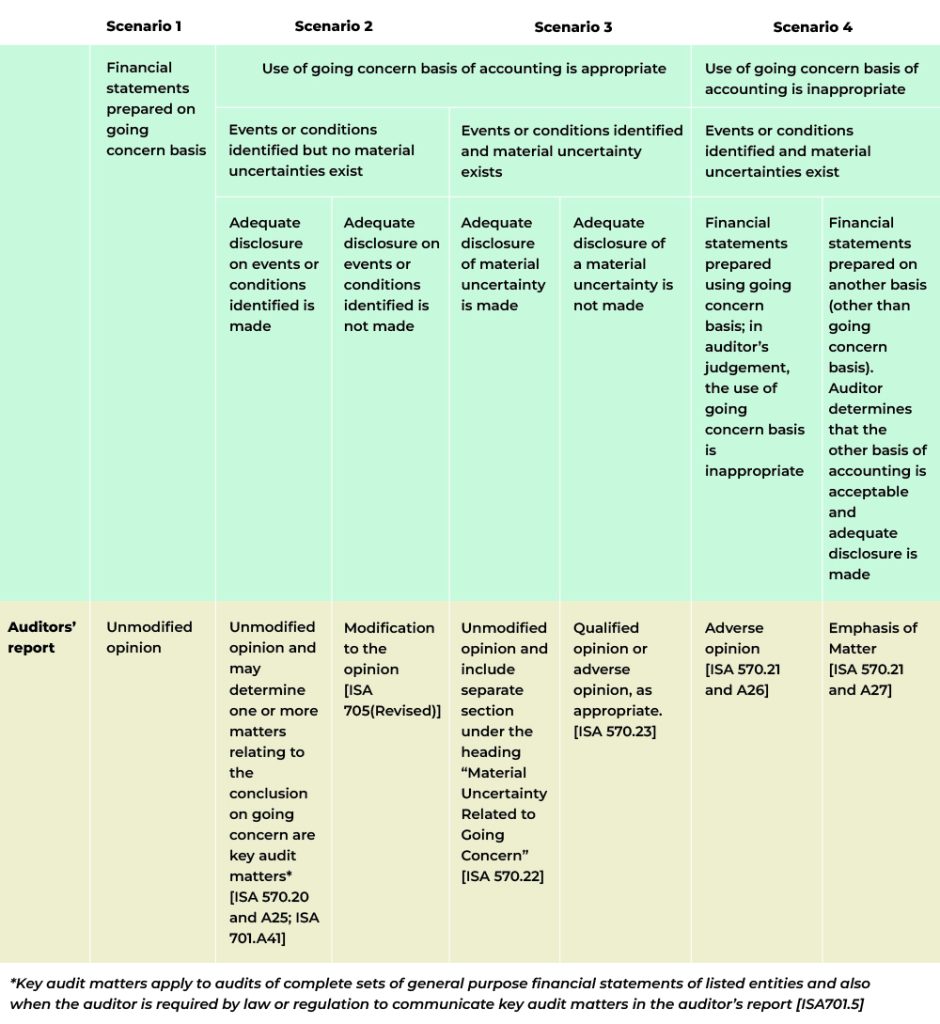

Implication on auditors’ report

The possible scenario and the implication on the auditors’ report are illustrated as follows:

Key message

- The going concern assumption is a fundamental principle in the preparation of financial statements.

- The assessment of an entity’s ability to continue as a going concern is the responsibility of the entity’s management.

- The appropriateness of the use of the going concern assumption is a matter for the auditor to consider and report accordingly on every audit engagement.

- ISA 570 (Revised) establishes the relevant requirements and guidance with regard to the auditor’s consideration of the appropriateness of management’s use of the going concern assumption and auditor reporting.

- The extent of disclosures in the financial statements is driven by management’s assessment of an entity’s ability to continue as a going concern and in accordance with the disclosure requirements of relevant MFRS.