By MIA Capital Market and Assurance Team

In January 2021, the International Ethics Standards Board for Accountants (IESBA) issued an exposure draft (ED) seeking to redefine public interest entities (PIE). The proposals, amongst others, sought to introduce an overarching objective for additional independence requirements for audits of PIEs, provide guidance on factors for consideration when determining the level of public interest in an entity and expand the extant definition to some categories of entities, subject to refinement by the relevant local bodies.

Titled “Proposed Revisions to the Definition of Listed Entity and Public Interest Entity in the Code” with a comment period up to 3 May 2021, the IESBA received a total of 69 comment letters from various stakeholders including the MIA’s Ethics Standards Board (ESB). The process culminated in the finalisation of the pronouncement issued on 11 April 2022 and will be effective for audits of financial statements for periods beginning on or after 15 December 2024, with earlier adoption permitted.

For Malaysia, it should be noted that there is already an expanded list of PIEs as determined by the Securities Commission under Schedule 1 of the Securities Commission Malaysia Act 1993 (SCMA). However, with the issuance of the final pronouncement, the ESB has begun the process of considering the application of the pronouncement in the local environment while working towards the same global adoption date.

Why is the new definition relevant and why now?

In recent times, the IESBA was driven by its own observations of inconsistent practices across jurisdictions and stakeholder feedback. The extant definition of PIE has limitations in its approach and furthermore, it did not provide stakeholders with clear guidance specifically on which entities should be considered as PIEs. It was then decided that it would be timely for the definition to be re-examined since it was first introduced back in the early 2000s.

By enhancing the definition of PIE, the IESBA could now provide better clarity and guidance to the concept it seeks to establish as well as align the PIE scope with the recently effective revised non-assurance services and fee-related provisions. The changes also recognise the role local authoritative bodies will need to play in refining the definition to fit their jurisdictions.

What are the salient features of the revised provisions?

An Overarching Objective

With the introduction of an overarching objective, the Code now explains the purpose of additional independence requirements for PIEs. The IESBA acknowledged that having an overarching objective to form an overall approach would then also provide a clearer principle for stakeholders to refine and determine which entities should be categorised as PIEs in the local code.

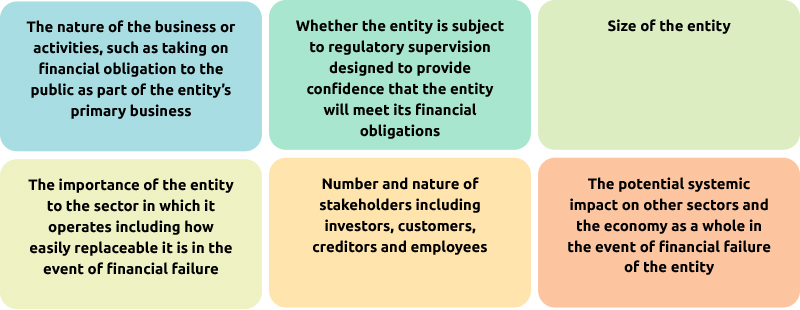

In general, the provisions drive home the notion that if there is a significantly greater public interest in an entity’s financial condition, there would be proportionate expectations of the independence of a firm performing the audit of a PIE and hence, the need for additional independence requirements. The provisions also provide greater details of the factors a professional accountant should consider in evaluating the level of public interest in the financial condition of an entity.

Redefining PIEs and establishing the role of local authoritative bodies and firms to refine the PIE categories

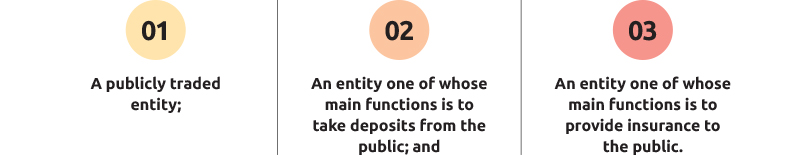

The revised provisions now take a broader approach in contrast to the extant provisions. The standard now sets out 3 mandatory PIE categories determined by the IESBA which are:

The term “publicly traded entity” is introduced as a replacement of the term “listed entities”. It is defined in the provisions as an entity that issues financial instruments that are transferrable and traded through a publicly accessible market mechanism, including through listing on a stock exchange.

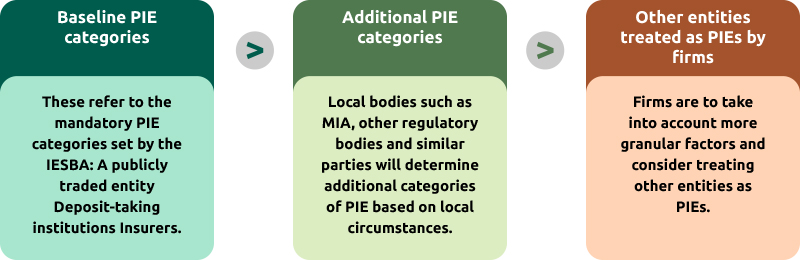

The provisions then establish that the relevant local bodies will play their part in refining the list either by adding or exempting particular categories to ensure the list of PIE categories is fit for purpose in a local setting. To refine this list, the relevant local bodies would be guided by the overarching objective, the list of factors set out above (see Figure 1) and make reference to the examples (large private companies, pension funds, public utilities and etc.) provided in the provisions. The IESBA rationalised that relying on local authoritative bodies such as local regulators, national standard setters or other relevant bodies would be the most practical approach as these bodies are best placed to assess and determine which entities fit the PIE definition.

Similarly, at the firm level, the provisions now recognise the role firms have and encourage firms to determine if any other entities should be treated as PIEs. It further sets out additional, more granular factors that may be considered in determining if other entities (apart from the mandatory categories and those determined by local authoritative bodies) should be treated as PIEs.

Recognising the importance of transparency

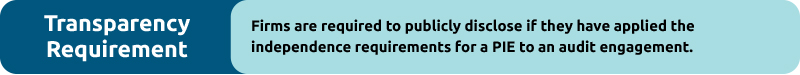

The revised provisions also clarify the requirement for firms to publicly disclose if they have applied the independence requirements for a PIE to an audit client considering the timing and availability of the information to stakeholders. This is different from the initial proposal in the ED which instead required the firm to disclose if an audit client was treated as a PIE.

The IESBA acknowledged upon receiving comments from its respondents that the initial provision would give rise to confusion among stakeholders who may interpret that there are different levels of independence and that non-PIE audits are of lower quality and provide lesser assurance.

The IESBA therefore determined to revise the objective of the transparency requirement to instead disclose if independence requirements have been applied in performing an audit of the financial statements of an entity. No examples and guidance have been provided on the mechanism of disclosure at this point in time as there is a need for the International Audit and Assurance Standards Board (IAASB) to also weigh in and conclude on this matter before appropriate examples can be given.

The provisions do, however, clarify that the disclosure should be made in “a manner deemed appropriate taking into account the timing and accessibility of information to stakeholders”. Additionally, if it would involve revealing confidential future plans of the entity (e.g. upcoming initial public offerings and etc.), the provisions allow for the disclosure to be exempted.

What are the additional independence requirements relating to audits of a PIE?

The IESBA’s Code of Ethics and by extension, the MIA By-Laws which are substantially based on the Code, contain numerous provisions which either prohibit or require necessary safeguards to be applied in the event firms are considering to enter into certain relationships or business interests with PIEs. This is due to the significant level of threats to independence that would be created as a result of these relationships. With the enhancements resulting from the revised provisions, it is important that the professional accountant re-familiarise themselves with the additional independence requirements applicable when working with PIE clients. These requirements can be summarised as follows:

Restrictions on non-assurance services

Firms may face restrictions on providing certain non-assurance services to their PIE audit clients if a self-review threat arises. This is due to the level of threats created if a firm audits its own work.

These non-assurance services can be categorised as follows:

- Permitted to provide as it does not usually create a self-review threat

- Administrative services (when clerical in nature and require little to no professional judgement)

- Tax return preparation services

- Recruitment services where the firm will not assume a management responsibility such as reviewing the professional qualifications of applicants and providing advice on their suitability for the role and interviewing candidates and advising on a candidate’s competence for financial accounting, administrative or control positions.

- Prohibited if it might create a self-review threat

- Valuation services

- Tax advisory and tax planning services

- Tax services involving valuation

- Assistance in the resolution of tax disputes

- Internal audit services

- Information technology systems services

- Litigation support services

- Legal advice

- Corporate finance services

- Prohibited

- Accounting and bookkeeping services

- Tax calculations of current and deferred tax liabilities (or assets)

- Assistance in the resolution of tax disputes if the service involves acting as an advocate

- Acting as an expert witness (unless under certain circumstances set out in the Code)

- Acting in an advocacy role in resolving a dispute or litigation before a tribunal or court

- Recruitment services which require the firm to act as a negotiator or which relate to:

- searching for or undertaking reference checks of prospective candidates;

- recommending the person to be appointed; or

- advising on the terms of employment, remuneration or related benefits of a candidate who is a director or officer or senior management who has influence over accounting records or financial statements.

In addition to this, pre-concurrence from those charged with governance on the non-assurance services (NAS) provided by the firm to a PIE is also required. This step ensures those charged with governance of the PIE audit client will carry out the necessary oversight over the independence of the firm auditing the financial statements.

Restrictions on fee dependency

As a result of self-interest and intimidation threats created by having a client represent a large proportion of the total fees of a firm, the fees earned by a firm from a PIE client should not make up more than 15% of the firm’s total fees for 2 consecutive years or the affected firm will be required to consider undertaking a pre-issuance review as a safeguard. Firms are also required to communicate to those charged with governance on whether this situation is likely to continue, the safeguards that have been applied and if there is any proposal to continue as the auditor. This is again to ensure those charged with governance are able to consider the independence of the firm.

Rotation of partners

Due to familiarity threats arising from long associations with an audit client, engagement partners, other key audit partners and engagement quality reviewers who have worked on an audit of a PIE for more than 7 cumulative years (“time-on” period) must observe a “cooling-off” period of 2 to 5 years depending on their roles. “Cooling-off” involves ceasing to act in any of the aforementioned roles or a combination of such roles for the PIE.

Concluding thoughts and further reading

Overall, the revised PIE provisions set out to bring greater clarity to the concepts of PIEs and listed entities while reflecting the latest developments in the capital markets and ensuring these concepts always remain fit for purpose. The provisions represent a significant step in maintaining public trust and underscores the vital role that audit firms and local authoritative bodies play in maintaining independence, objectivity, and integrity when working with public interest entity clients.

Members who wish to know more about the upcoming standards are able to view the “Basis for Conclusions” publication issued by the IESBA in April 2022 on their website.

The IESBA staff has also recently released a questions and answers (Q&A) publication to highlight this pronouncement on their website and is noted to be working on issuing further guidance such as infographics and a jurisdictional PIE database. The MIA’s ESB will share these upcoming resources with members as and when they are made available. As always, members are reminded to stay informed and be guided accordingly with any new developments.