By the MIA Sustainability, Digital Economy and Reporting Team

The MIA Sustainability, Digital Economy and Reporting Insights provide quarterly updates on the areas of sustainability, digital economy, tax, reporting and research. The Insights highlight contents and initiatives that are of high value to MIA members.

Sustainability Reporting in Malaysia

Since 2015, listed issuers on Bursa Malaysia (Bursa) have been required to provide sustainability disclosures through the inclusion of a Sustainability Statement in their annual report. Bursa enhanced its sustainability reporting requirements in September 2022 to better align with global reporting expectations, including recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). Click here to find out more about the current state of play in the sustainability reporting space worldwide and in Malaysia as well as the roles that accountants can play in expediting adoption of sustainability reporting.

Digital Advocacy

Digital Transformation Programme for SMPs

In its continuous effort to facilitate digital adoption by the accounting profession, MIA in collaboration with the Malaysia Digital Economy Corporation (MDEC) organised a workshop focusing on digital transformation for small and medium practitioners (SMPs) on 27 September 2023. As SMPs in Malaysia support thousands of small and medium enterprises (SMEs) and sole proprietors in Malaysia, it is vital for them to acquire digital competencies to realise the full potential of digital technologies in creating value.

The programme was attended by 56 practitioners and included sharing by expert speakers from the accounting industry. Mr Jeremy Chia, Managing Partner and Co-founder Chia, Ka & Partners PLT and Mr Steven Chong, Founder Global Analytics Alliance and member of the Digital Technology Implementation Committee, MIA spoke on various topics including recognising technology as an enabler of SMPs’ value creation, determining the right digital tool to adopt and discovering grants available to finance digital transformation. Participants were equipped with valuable insights to progress and advance in their digital transformation journey by the end of the workshop. Stay tuned for the insights from the programme in our next issue!

Unlocking Business Efficiency Through Digitalisation with e-Invoicing

In today’s fast-paced business climate, embracing digital technology is critical for competitiveness and growth. E-invoicing is a revolutionary tool for streamlining financial operations and increasing corporate efficiency. Embracing e-invoicing is a strategic step towards digital transformation and keeping ahead in today’s competitive business world.

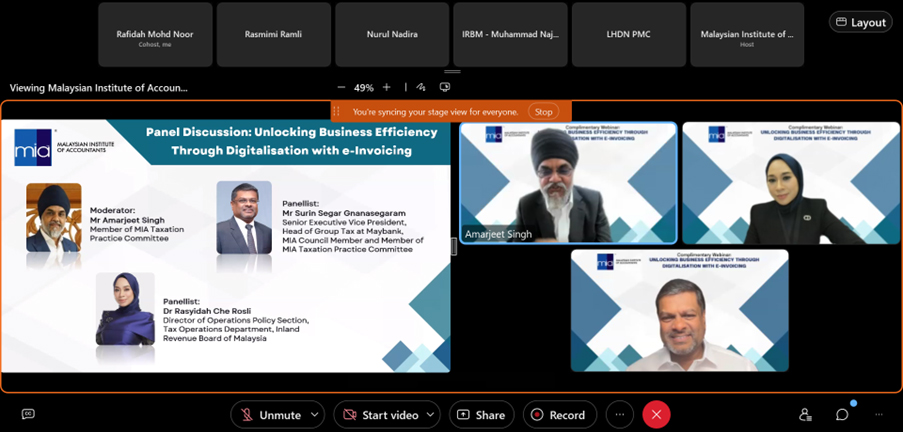

The Institute organised a complimentary webinar entitled ‘Unlocking Business Efficiency Through Digitalisation with e-Invoicing’ on 14 September 2023. Mr Amarjeet Singh, Member, MIA Taxation Practice Committee (TPC), moderated a panel session with expert panellists Dr Rasyidah Che Rosli of Lembaga Hasil Dalam Negeri Malaysia and Mr Surin Segar of Maybank and a TPC Member.

The webinar aimed to equip participants with knowledge and insights on starting the e-invoicing journey to maximise the potential of their organisations. 311 members participated in the webinar.

Advocacy on taxation

2024 Budget Consultation

The Institute submitted a Joint Memorandum for 2024 Budget Consultation to the Ministry of Finance (MOF) on 13 July 2023. The Memorandum comprises 76 proposals covering various measures to revitalise the economy, enhance equitabilityand broaden the revenue base towards economic development in addition to pursuingcontinuous tax improvement and efficiency.

Among others, the Memorandum applauded the government for reviewing the definition of plant in a timely manner by deleting “an intangible asset” from the definition of “plant” with effect from Year of Assessment 2023. It also includes policy changes regarding the tax treatment of income received from outside Malaysia such as review of underlying tax for the purpose of Income Tax Exemption.

In addition, the Memorandum reiterates the timely implementation of carbon tax in order for Malaysian producers and exporters to remain globally competitive. The tax revenue to be collected from the implementation of carbon tax requires transparency on its utilisation for the benefit of society and businesses.

Capital Gains Tax

Following the Institute’s participation in a workshop on the proposed implementation of capital gains tax (CGT) organised by the Ministry of Finance (MOF) in August 2023, a joint comment letter on the Proposal Paper on Implementation of Capital Gains Tax was submitted to the MOF in September 2023. Among others, the joint comment letter proposed to limit the imposition of CGT to only gains arising from disposal of foreign assets in line with the requirements of the European Union to allow more time for Malaysia to evaluate the merits and mechanism for imposition of CGT on gains arising from disposal of domestic unlisted shares.

Other proposals include tax certainty, clarity on the foreign source income exemption regime, choice of rate and proposed implementation date.

Luxury Goods Tax

The Institute submitted joint feedback on the Proposal Paper on Implementation of Luxury Goods Tax (LGT) to the MOF. The feedback includes comments and suggestions on determination of type of tax (legislation and scope of charge), category of chargeable good, rate and threshold as well as other policy matters.

Common Accounting Issues on Investment Property and Property, Plant and Equipment

The Institute received various accounting queries on investment property (IP) and property, plant and equipment (PPE) through our technical queries facility. We have produced an article to share the common questions received on these areas and the suggested guidance for reference. Click here to view the article.

Advancing the Accountancy Profession through Research: The Role of MAREF

Enabling accountancy-related research and education is vital to ensuring the future relevance of the accountancy profession. Find out more about the role of MAREF in advancing the accountancy profession in Malaysia here.