By MIA CPE Compliance Team

Continuing Professional Education (CPE) is an essential aspect of the accounting profession, ensuring professional accountants stay up-to-date with the evolving industry standards, practices and regulations pertinent to their roles in the accountancy fields. The CPE requirements set by the Institute are structured to ensure that all professional accountants maintain the highest standards of professionalism and competency. However, there are instances where members may encounter circumstances that hinder their ability to fulfil the CPE requirements. CPE Exemption was established to offer temporary flexibility by allowing professional accountants to be exempted from fulfilling CPE requirements. This article aims to demystify the concept of CPE Exemption, stating the criteria, application process, members’ eligibility and implications of seeking an exemption.

Understanding Continuing Professional Education Requirements

CPE is an ongoing process that enables accountants to maintain and enhance their professional competence. This is essential given the ever-evolving landscape of the accounting profession. CPE ensures the competency level of professional accountants, enables lifelong learning, safeguards public interest and upholds the credibility of the profession. For professional accountants, CPE is not just a requirement for maintaining licenses or certifications; it is a commitment to delivering high-quality services and upholding the integrity of the profession.

As the regulatory body responsible for overseeing the accounting profession, the Institute mandates CPE requirements for its members. All members are required to fulfil a minimum of 20 structured CPE credit hours per annum, as stipulated in the Institute’s By-Laws on Section B110.4. This is to ensure members are well-equipped to handle the complexities of their roles and remain competent.

In addition, members are required to participate in CPE learning that is related to members’ scope of work and professional responsibilities [By-Laws Section B110.2].

CPE Exemption Criteria

While CPE is mandatory, there are circumstances where professional accountants may be eligible for exemption. As stipulated in Section B110.9 of the Institute’s By-Laws, the Council of the Institute may at its absolute discretion, grant a temporary or partial exemption from the CPE requirements for the following reasons:

- prolonged illness or disability; and/or

- any other reason as may be determined by the Council.

The criteria for CPE Exemption determined by the Council include:

Senior Members

Senior members who have retired from full-time employment and are not providing professional services have the option to apply for an exemption as Senior Members, enabling them to uphold their membership with the Institute without the obligations of meeting the CPE requirements.

Exemption Criteria for Senior Members:

- Members aged 60 years and above; and

- have retired from full-time employment and / or practice.

Members who hold practicing certificates will not be eligible for CPE Exemption.

Homemakers

Members taking temporary leave from the workplace, for example, female members who temporarily leave workplace and take care of their families, may find it challenging to meet CPE requirements during that period. Exemption during such leave allows for a balanced approach to personal and professional commitments.

Exemption Criteria for Homemakers:

- A homemaker; and

- Not in full-time employment and / or practice.

Caregiving Duties

Members may face personal challenges, such as family emergencies, that make it difficult to dedicate time to CPE activities. CPE exemption can provide relief during times of exceptional personal hardship. For example, members who have a caregiving duty for an ill family member.

Exemption Criteria for Caregiving Duties:

- Caregiving duties for a close family member over a long period of time (exceeding 12 months) and not in full-time employment and / or practice.

Unemployment

Unemployment may lead to financial constraints, posing challenges for members in covering the costs associated with CPE activities. Members may seek exemption during a period of unemployment to alleviate their financial burden.

Exemption Criteria for Unemployment:

- Unemployment over a long period of time (exceeding 12 months).

Health Issues

Members facing serious health issues (prolonged illness) or medical emergencies may encounter difficulties in allocating time and effort to engage in CPE activities. In such cases, seeking an exemption allows them to prioritise their well-being without jeopardizing their professional standing. The application is required to be supported by a medical report from a licensed physician or hospital.

It is crucial for members to review and understand the eligibility criteria set by the Institute and ensure compliance with the established guidelines to avoid their application for CPE Exemption being rejected by the Institute.

Members Who Are Not Eligible for CPE Exemption

Although members may apply for CPE Exemption based on the criteria determined by the Institute, members are NOT eligible if they are:

- Practicing certificate holders and audit license holders,

- Serving on the board of any public listed companies/ public interest entities; and/ or

- Providing any professional services to any organisations (with or without reward); and/ or

- Acting in any other capacity which carries equivalent responsibility as a professional accountant.

These restrictions are in place to ensure that members in key corporate governance roles and in practice maintain a high level of professional competence and stay abreast of industry developments, thereby fulfilling their responsibilities to stakeholders and contributing to the effective governance of their organisations.

Application Process

The CPE Exemption application process entails several key steps to ensure that members seeking relief from CPE requirements are granted exemption appropriately. Typically, members are required to submit a formal request to the Institute via the Member Portal.

The application should be accompanied by supporting documentation that validates the grounds for seeking an exemption. The documentation might include medical certificates, letters of termination from the past employer, Employees Provident Fund statements for current and preceding year or any other documents that are deemed relevant. Supporting documentation is to be emailed to [email protected].

The application undergoes thorough review and evaluation by the Institute, considering factors such as the severity of the individual’s circumstances and adherence to the eligibility criteria. Upon review and approval, the applicant is notified of the status of the exemption application.

Approved exemptions may be granted for a specified period, subject to periodic reviews. Members who have been granted CPE exemptions will maintain their exemption status if they meet the specified criteria. If members fail to fulfil the criteria, the Institute reserves the right to revoke the exemption. Upon the lapse of the reason for which the exemption was granted, the members are required to fulfil the CPE requirements pursuant to Section B110 of the By-Laws. Members are responsible for notifying the Institute in writing of any changes in their status.

Consequences of Falsifying Information: The Risks of Dishonest Application

Members who participate in dishonest practices, such as falsifying information or submitting misleading documents, are subject to disciplinary action, including the possibility of a complaint being filed against them. This could lead to disciplinary proceedings overseen by the Disciplinary Committee (DC). If found to be in violation, members may face sanctions in accordance with the MIA Disciplinary Rules.

Throughout the application process, transparency, fairness, and adherence to guidelines are paramount to uphold the integrity and credibility of the exemption process.

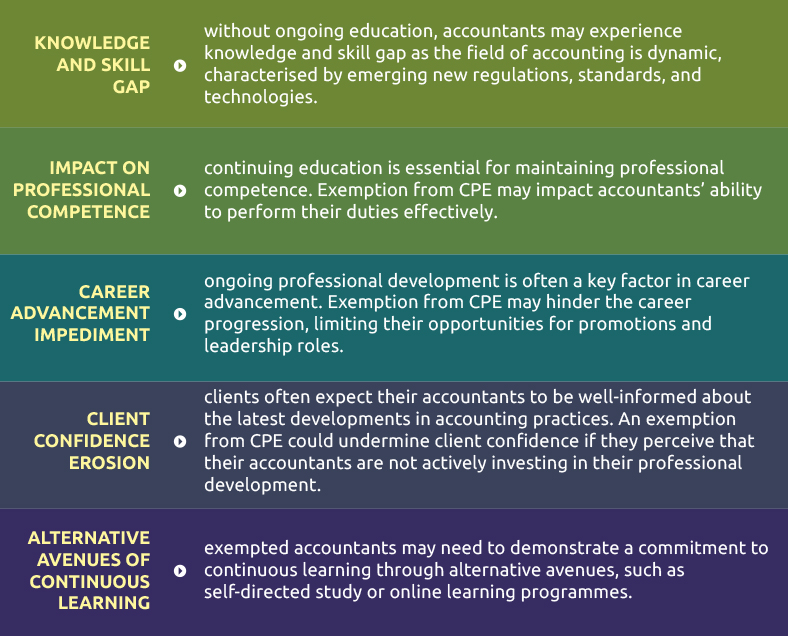

Implications of CPE Exemption

While exemptions provide a necessary degree of flexibility for professional accountants facing genuine challenges, it is crucial to understand the potential implications. Professional accountants granted exemption must carefully assess the impact on their professional standing, as exemption may affect their credibility and competence with their professional standing. The impacts are assessed as follows:

In conclusion, CPE Exemption serves as a mechanism for providing relief to professional accountants facing exceptional circumstances that hinder their ability to fulfil CPE requirements. While exemption offers temporary flexibility, it is essential for accountants to approach exemptions responsibly, ensuring that they maintain their competence and uphold the integrity of the accounting profession. Striking a balance between accommodating genuine hardships and upholding professional standards is key to fostering a resilient and adaptable accounting workforce.