Tax evasion and money laundering are two interrelated financial crimes that pose significant threats to the integrity of financial systems worldwide. Understanding the intricacies of these offenses, along with the legal frameworks and penalties associated with them, is crucial for effective enforcement and compliance. In this article, we delve into what tax evasion and money laundering entail, the laws governing the involvement of accountants, and the penalties for these offenses.

What is Tax Evasion?

Tax evasion refers to the illegal act of deliberately evading tax obligations by underreporting income, overstating deductions, or concealing assets and income. It involves fraudulent practices aimed at reducing tax liability, thereby depriving the government of revenue rightfully owed. Tax evasion undermines the fairness and integrity of the tax system, affecting public services and social justice.

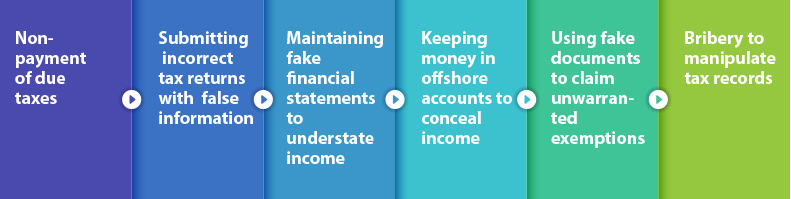

It encompasses various fraudulent practices such as:

Tax evasion not only deprives the government of essential revenue but also distorts the fairness and equity of the tax system.

What is Money Laundering?

Money laundering involves disguising the origins and ownership of illegally obtained funds, making them appear legitimate. It typically involves three stages: placement, layering, and integration. Money launderers seek to conceal the illicit source of funds, often through complex financial transactions and international transfers. Money laundering facilitates various criminal activities, including tax evasion, drug trafficking, and terrorism financing.

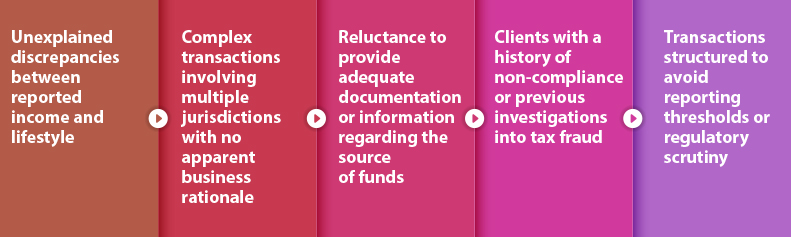

Identifying key red flags associated with tax evasion and money laundering is imperative for accountants to safeguard against unwitting involvement in illicit activities. Some common red flags include:

Laws Regarding Accountants’ Involvement in Tax Evasion and Money Laundering

Under various jurisdictions, including Malaysia, laws are in place to hold accountants accountable if they knowingly aid individuals or entities in committing tax evasion or money laundering. In Malaysia, the Inland Revenue Board (LHDN) has stringent measures to combat such financial crimes. Accountants found complicit in these offenses may face severe legal consequences, including fines and imprisonment.

Penalties for Tax Evasion and Money Laundering

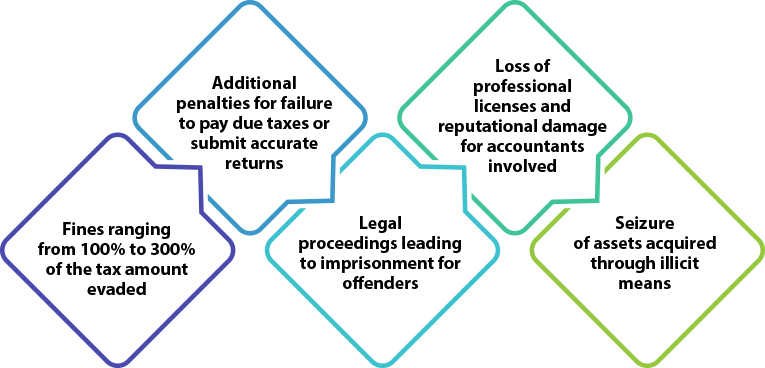

The penalties for tax evasion and money laundering can be substantial and may include:

Civil penalties such as audits, penalties for failure to maintain proper accounts, and fines for non-compliance with tax regulations

For detailed information on specific penalties for tax evasion and penalties for non-compliance related to money laundering, you can refer to:

- https://www.hasil.gov.my/en/legislation/offences-fines-and-penalties/

- https://amlcft.bnm.gov.my/penalties-for-non-compliance/

Conclusion: Intersection of Tax Evasion and Money Laundering

The intersection of tax evasion and money laundering highlights the intricate landscape of financial crime. Laundering proceeds from tax evasion fuel further illicit activities, posing significant challenges for law enforcement and regulators. Upholding legal and ethical standards is crucial for individuals, businesses, and financial professionals to combat financial crime and safeguard the integrity of the global financial system.

In essence, tax evasion and money laundering are grave offenses with profound implications. Compliance with tax laws and anti-money laundering regulations is paramount to uphold transparency, fairness, and trust in the financial realm. A comprehensive understanding of the associated laws and penalties empowers stakeholders to contribute effectively to the fight against financial crime and promote financial integrity worldwide.

This article was contributed by Ingenique, Titanium sponsor of MIAC24.