By SMP Department, Professional Practices & Technical

Building on the global perspective, this part of the article delves into Malaysia’s specific initiatives on AQIs for Audit Oversight Board (AOB)-registered audit firms and proposed AQIs for non-registrants of AOB. By implementing these initiatives, Malaysia seeks to align with global best practices while addressing the need for the improvement of audit quality across firms of various sizes and clientele.

AQIs Initiative for audit firms of PIEs in Malaysia

Since 2015, the AOB has embarked on an annual data gathering exercise involving the major audit firms in Malaysia. This data gathering exercise, which was subsequently expanded to include the other audit firms in 2020, has enabled the AOB to compile statistics relating to Audit Quality Indicators (AQIs) for both the major audit firms and the other audit firms.

In Malaysia, an audit firm that meets the following reporting criteria for two consecutive years is required to produce an Annual Transparency Report commencing from 2021:

- Audit firms with more than 50 PIE audit clients; and

- The total market capitalisation of the audit firm’s PIE clients is above RM10 billion.

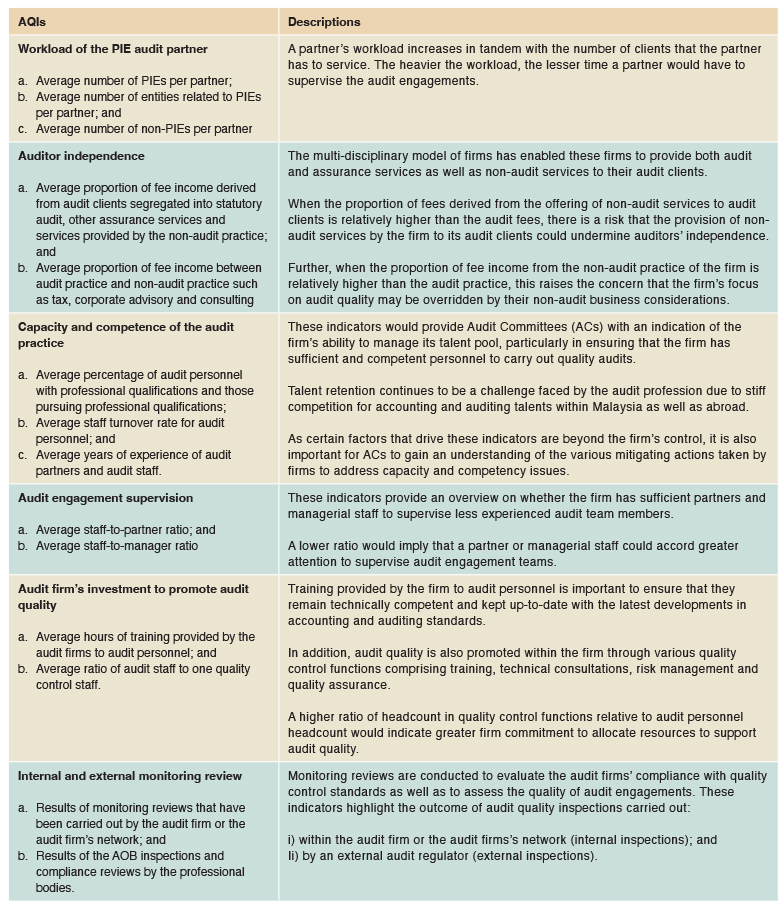

Audit firms are required to mandatorily disclose a set of common AQIs in their Annual Transparency Reports to facilitate comparisons between the audit firms.

Source: AOB Annual Inspection Report 2021 and AOB Annual Inspection Report 2022, Securities Commission

In 2021, a total of eight audit firms in Malaysia were required to produce the Annual Transparency Reports as they had met the reporting criteria stipulated above. The average data of the above AQIs was also published by the AOB in their yearly annual report.

Audit Committees (ACs) are encouraged to compare the AQI information disclosed in the audit firm’s Annual Transparency Reports with those average data disclosed in the AOB Annual Inspection Report to drive continued focus and improvements on audit quality.

The AOB also continues to monitor the audit firms’ key AQIs as part of the risk assessments’ process. Some of the key AQI trends include but are not limited to the following:

- Audit partner workload;

- Capacity and competence of the audit practice; and

- Level of audit engagement supervision.

AQIs for non-PIE audit firms in Malaysia

Unlike the audit firms of PIEs, there is no requirement to report a common set of AQIs for audit firms of non-PIEs. Under the PPC’s Strategic Paper to Strengthen the Public Practice Sector and SMPs, it is proposed that average data of AQIs be developed to provide insights into factors that may influence audit quality of non-PIEs auditors.

The proposed AQIs will serve as a benchmark, facilitating audit firms of non-PIEs to monitor their performance against industry standards. By analysing these indicators, firms can identify specific areas where audit quality measured data have previously fallen short and recognise ongoing factors that could compromise the quality of current or future audits. This proactive approach allows firms to pinpoint weaknesses in their audit processes and take timely, corrective actions to enhance their practices.

Moreover, the implementation of AQIs can foster a culture of continuous improvement within audit firms. Regular monitoring and evaluation of these indicators can help firms maintain high standards of audit quality, ultimately leading to increased client confidence and satisfaction. The data derived from AQIs can also provide firms with insights into industry trends and emerging risks, enabling them to adapt their audit strategies accordingly.

Consultation Process

The proposed AQIs will be developed in consultation with audit firms and other stakeholders in Malaysia:

- A focus group will be established to finalise the AQIs for non-AOB registered audit firms in Malaysia with the following composition: Representatives from MIA Public Practice Committee (PPC), Small and Medium Practices Committee (SMPC), Practice Review Committee (PRC), Investigation Committee (IC) and Disciplinary Committee (DC).

- A consultation session with representatives from AOB and professional accountancy bodies.

- MIA Council’s approval.

The first Focus Group discussion was conducted in November 2023 and the concept paper was amended based on the discussion outcomes.

Guiding principles

The guiding principles for developing non-PIE AQIs are discussed, covering aspects such as scope, type of AQIs, nature of reporting, reporting period, comparators, averages, and trends, responsibility for publication, and data gathering methods:

- Scope: Non-PIEs audit firm that have 3 partners and above, excluding auditors registered with AOB, as these firms are already under rigorous inspection and required to submit the AQIs to the AOB.

- Type of AQIs: Adopted all AOB’s current AQIs (firm-level).

- Nature of reporting: Mandatory reporting.

- Reporting period: To cover the same 12 months across all firms, and to publish the average data on the same date, e.g., cover the period from 1 April of one year to 31 March of the following year for each year.

- Reporting comparators, averages and trends: From the second year of implementation, the prior year comparative will be disclosed for each AQI. Subsequently can consider if a number of years’ prior data should be averaged.

- Responsibility for publication: The average information needed to be made available on MIA’s website.

- Data gathering method: Annual return to MIA.

As part of the consultation process, the Institute would like to invite perspectives from audit partners, specifically those from 3-partner audit firms, on the proposed AQIs and their implementation through an online survey.

To participate in this survey, please click here and submit your views by 13 September 2024.

Audit partners are also encouraged to email their views to [email protected].

Efforts to enhance audit quality in Malaysia through the setting of Audit Quality Indicators (AQIs) reflect a strong commitment to aligning with global best practices. With the disclosure of AQIs and encouraging their continuous monitoring and evaluation, a culture of continuous improvement in audit quality can be fostered amongst firms.