By MIA Practice Review Team

The Council of the Malaysian Institute of Accountants (MIA) has introduced significant amendments to its practice review framework, aimed at enhancing the quality and accountability of audit practices. These changes, approved on September 14, 2023, involve revisions to Section B250 Quality Assurance and Practice Review and Appendix VI – Statement on Practice Review. The updated MIA By-Laws have taken effect since 1 July 2024.

For further details on the revision of the PR framework, the firm can refer to the following two (2) articles that are available from the MIA website:

1. Effective date of revised Practice Review Framework 1 July 2024;

2. Frequently Asked Questions (FAQs) on the Peer Review Process under the Practice Review Committee (PRC)’s Order for Type 3 Firms

Key Changes and Options for Audit Firms which are under transitional period

Audit firms rated Type 3 that commenced practice reviews under the previous framework and received their rating after 30 June 2024 will have the option to be reviewed under the revised Practice Review Framework or continue with the previous framework.

Option 1: Elect to transition to the revised PR framework

Audit firms that elect to the transition to the revised PR framework should note the following requirements:

1. Extended Submission Period for Remedial Action Plan (RAP)

The RAP will no longer require the PRC’s approval and the submission period for the RAP and its implementation status is extended from three (3) months to twenty-four (24) months, to be submitted annually.

The 1st RAP submission will be due twelve (12) months from 1 July 2024.

2. The need to engage a Peer Reviewer to undergo the RAP

During the transition period, the PRC implemented Order 3A mandating audit firms to appoint a peer reviewer. Firms must provide the chosen peer reviewer’s details for PRC approval within two (2) months from the date of acknowledgement of the firm’s option. The audit firm must have a minimum of three (3) audit engagements reviewed by the approved peer reviewer post signing the audited financial statements.

The peer review exercise needs to be concluded within twenty-four (24) months, with the submission of the peer review report upon completion.

3. Subsequent Review

A fresh subsequent review by the Practice Review Department (PRD) will be conducted after twenty-four (24) months.

If the subsequent review indicates that the audit firm has not rectified the issues, the Institute will lodge a complaint with the Registrar.

Option 2: Continue under the previous PR framework

Audit firms choosing to continue under the previous framework will be subject to a monitoring review conducted by the Practice Review Department. This process enables firms to continue with their existing practice review protocols without the additional requirements imposed by the revised framework.

Steps to Take Upon Receiving the Option Letter

Upon receiving the option letter from MIA, audit firms should follow these steps:

- Carefully review the details of both the revised and previous practice review frameworks to understand the implications and requirements of each option.

- Internal Discussion: Discuss internally with relevant stakeholders, including senior management and the audit team, to determine which option aligns best with the firm’s capabilities and strategic goals.

- Decision-Making: Decide whether to adopt the revised framework or to be reviewed under the previous framework. Consider the long-term benefits and challenges of each option.

- Informing Practice Review Department (PRD): Communicate your decision to PRD within the stipulated time frame. Ensure that the response is clear and adheres to any specific instructions provided in the option letter.

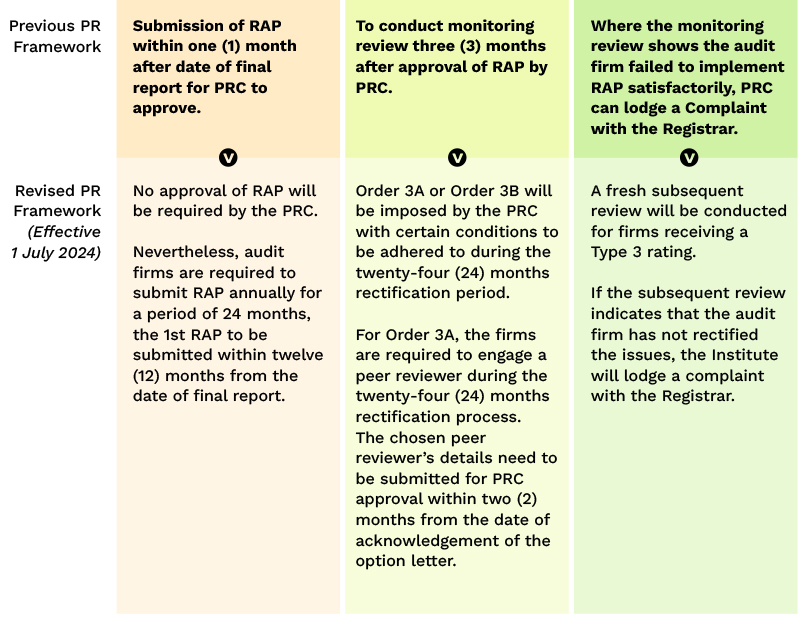

Comparison of the Previous PR Framework Vs the Revised PR Framework

Conclusion

Audit firms should thoroughly evaluate the available option that best matches their capabilities and strategic objectives. Should the firms need to gain further insights and guidance, audit firms are advised to engage with the PRD for clarification and support in navigating the new requirements effectively and/or refer to the MIA By-Laws that can be accessed from the MIA website. By staying abreast and seeking assistance where needed, audit firms can proactively align their practices with prevailing professional standards, ensuring robust compliance and operational excellence.