How can we combat fraud as it becomes even more pervasive and sophisticated?

Obviously, we have to think out of the box and adopt a fresh approach and strategy to shield ourselves against fraud risks more effectively.

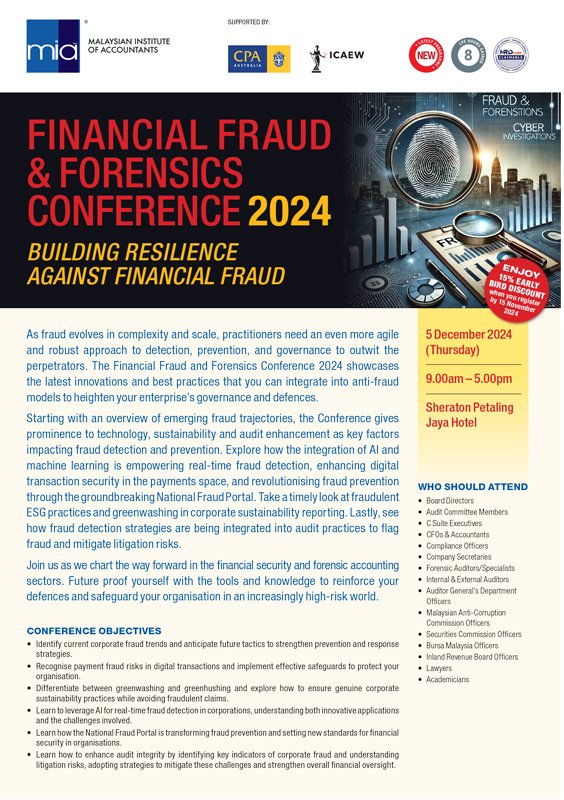

The Financial Fraud & Forensics Conference 2024 will showcase the latest solutions and best practices that can be incorporated into anti-fraud models to strengthen your organisation’s defences and governance processes.

While fraud risk cannot be completely eradicated, we can take steps to reduce the risk and safeguard our organisations. One, we could leverage strategically on AI and machine learning to boost real-time fraud detection and importantly, strengthen digital transaction security in payments, which is highly vulnerable to fraud. Interestingly, technology is also at the heart of the innovative National Fraud Portal, developed through a partnership between Bank Negara Malaysia (BNM) and PayNet, which has significantly slashed the time required to trace stolen funds.¹ Two, we can monitor fraudulent ESG practices and greenwashing in corporate sustainability reporting to protect the integrity of the sustainability agenda which is a top priority for regulators and investors. Three, as practitioners and business partners, we can proactively advise on the integration of fraud detection strategies into audit practices and processes to flag fraud and mitigate litigation risks.

These are the key matters that will be addressed at the Financial Fraud & Forensics Conference 2024 in order to help you curb rising fraud risk and address the vulnerabilities affecting every organisation in today’s digital economy. Join industry experts and senior regulators on 5December 2024 at the Sheraton Petaling Jaya as they share their insights in the following sessions:

Corporate Fraud Trends and Future Trajectories

Get up-to-date on the latest corporate fraud trends such as financial statement manipulation, procurement fraud, and misappropriation of assets, as well as emerging risks posed by synthetic identity fraud, AI-driven schemes, and the rising use of shell

companies for illicit activities. To fight back, corporate auditors and forensic accountants must urgently upskill on data analytics, predictive modelling and AI competencies to boost internal controls and shore up company defences.

Revolutionising Fraud Prevention: How the National Fraud Portal is Setting New Standards in Financial Security

BNM and financial institutions remain focused on strengthening financial security, having already blocked RM383 million worth of unauthorised transactions in 2023.² A gamechanger in the financial security landscape is the new National Fraud Portal which serves as a cutting-edge hub for real-time fraud detection powered by AI and machine learning to counter evolving scam tactics.

This panel session introduces the National Fraud Portal, highlights its innovative features and performance, and explores how the Portal works to enhance financial security and streamline regulatory compliance.

Safeguarding Digital Transactions: Navigating Payment Fraud Risks

Fraudulent payments, account takeovers, and invoice manipulation are among the key payment fraud risks that require agile multi-layered defences. This discussion will focus on payment system weaknesses and the practical measures organisations can implement to enhance transaction security, such as AI-enhanced payment verification tools and fraud detection software.

Audit Integrity in Focus: Addressing Corporate Fraud and Litigation Risks

Integrating fraud detection strategies into audit practices is crucial not only to identify fraud but also to ensure audit models and outcomes can withstand scrutiny in legal proceedings. In this session, participants will learn effective approaches to strengthen audit practices and ways to incorporate forensic audit techniques into standard audits.

Greenwashing to Greenhushing: Corporate Sustainability and Fraud

In this panel session, expert speakers will delve into the rising incidence and consequences of deceptive sustainability reporting and greenwashing practices, while discussing essential internal controls and governance measures needed to uphold integrity in sustainability reporting.

Harnessing AI for Real-time Fraud Detection in Corporations: Innovations and Challenges

AI and machine learning are undoubtedly transforming corporate strategies to manage internal fraud and external cyber threats. In this panel session, attendees will learn to utilise AI-powered risk management systems to strengthen anti-fraud measures while addressing key challenges such as minimising false positives, ensuring data integrity, and managing privacy concerns.

¹ https://fintechnews.my/46575/big-data/national-fraud-portal-trace-funds/

² https://fintechnews.my/46575/big-data/national-fraud-portal-trace-funds/

Please click here for more information on the MIA Financial Fraud & Forensics Conference 2024.