By MIA Valuation Team

In an era where financial transparency and security are paramount, ensuring compliance with protocols established by regulatory bodies is not just a necessity but a fundamental obligation for maintaining the stability, credibility, and integrity of an institution. On 15 October 2024, Bank Negara Malaysia (BNM) and MIA co-issued the requirements for the submission of the Data and Compliance Report (DCR) 2024 for Accountants, which are issued pursuant to:

- Sections 8(3)(a), 16(6) and 25(2) of The Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA);

- Section 143(2) of the Financial Services Act 2013 (FSA); and

- Section 155(2) of the Islamic Financial Services Act 2013 (IFSA).

Understanding the Data and Compliance Report (DCR)

DCR is a mandatory submission to BNM by Designated Non-Financial Businesses and Professions (DNFBPs) Reporting Institutions (RIs). DCR is a form of supervisory engagement by BNM and includes questions on how RIs have met the Anti-Money Laundering, Countering Financing of Terrorism, Countering Proliferation Financing (AML/CFT/CPF) requirements and exposure to money laundering, terrorism financing and proliferation financing (ML/TF/PF) risks that RIs might have. (Source: Home DNFBP Portal)

The DCR is more than just a routine submission – it is an essential compliance document that gives BNM insights into how RIs are performing in terms of adherence to regulatory obligations and risk management. This report is part of the broader framework that supports BNM’s efforts to safeguard Malaysia’s financial system against money laundering and terrorism financing.

The report serves multiple purposes:

- Assessment of Risk Exposure: Through the DCR, BNM can evaluate the level of vulnerabilities of the RIs to Money Laundering / Terrorism Financing / Proliferation Financing (ML/TF/ PF) compliance and assess the risk profile of the sector.

- Regulatory Monitoring: Response from the DCR is vital for gauging RIs’ understanding and application of the AML/CFT programme. It acts as an assessment tool, providing BNM with the ability to identify which areas require more improvements and guidance.

- Guidance for Improvement: Response from the DCR serves as a “report card,” identifying areas for improvement within a firm. This process benefits both BNM and RIs: for BNM, it highlights areas where RIs require additional support; for RIs, this “report card” helps them recognise gaps in their internal control systems and compliance frameworks. It empowers them to develop targeted strategies and focus on strengthening areas that require the most attention, ultimately enhancing their AML/CFT compliance and operational effectiveness.

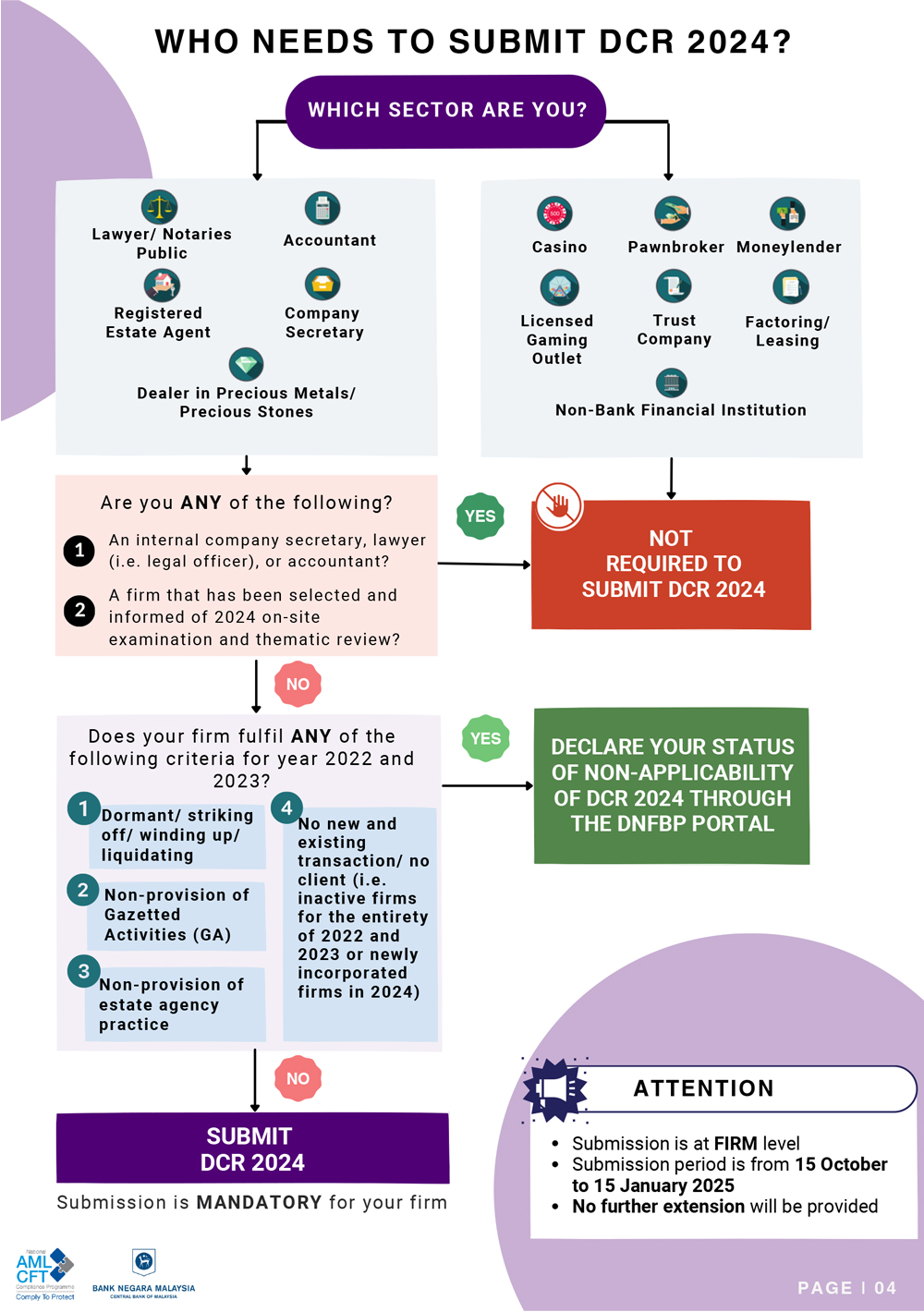

Who needs to submit DCR 2024?

Source: DCR2024 InfoKit (1 November 2024)

Note: Accountants who only provide auditing services, which do not fall within any of the five GAs, are not RIs under the AMLA. As such, your firm is only required to make a declaration of non-applicability of DCR 2024.

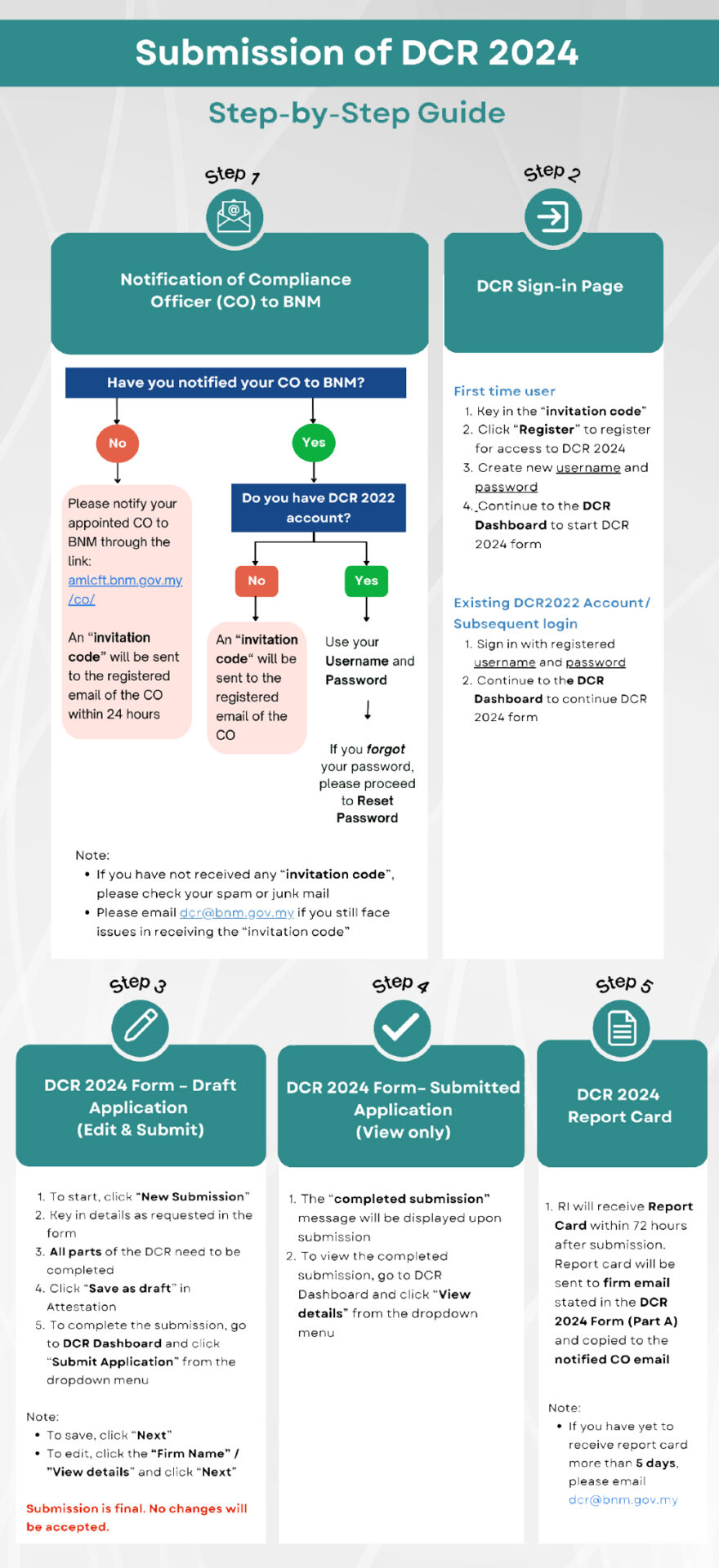

How to Submit DCR 2024 – Step by Step Guide

Source: User Guide for Data and Compliance Report 2024

Applicability of the DCR 2024

DCR 2024 is only applicable for RIs that are still operating and have new and existing clients for the entirety of 2022, 2023 and 2024.

However, the following firms are only required to declare their status in the Declaration on Non-Applicability of DCR 2024 section:

- Dormant / process of striking off / winding up / liquidating

- Non-provision of Gazetted Activities by firm

- No new and existing transaction or client, i.e. inactive firms for the entirety of 2022 and 2023 or newly incorporated firms in 2024.

- A firm that has been selected and informed of 2024 on-site examination and thematic review

Firms should ensure that they have fully understood the GAs before making the declaration.

Key Deadlines and the Compliance Window for 2024

For DCR 2024, the submission period is from 15 October 2024 to 15 January 2025. Only completed DCRs will be accepted and processed by BNM for the subsequent issuance of report cards to the RIs. BNM only accepts submissions made through the portal and no other methods (e.g. PDF file) will be accepted.

The information submitted by RIs in the DCR 2024 is confidential and will be utilised by BNM for supervisory purposes and risk assessments. Upon completion of the DCR 2024, RIs must attest that all provided information is complete and accurate to the best of their knowledge.

It is crucial to adhere strictly to this timeframe as BNM has emphasised that no extensions will be granted. Early preparation is essential to ensure that all data are accurate, comprehensive, and compliant with BNM’s reporting format.

While no enforcement action will be taken for gaps identified in the DCR, RIs may still face enforcement action under the AMLA, FSA, or IFSA for failing to submit their DCR within the specified timeframe.

Furthermore, failure by RIs to submit the DCR 2024 constitutes non-compliance with the professional ethics requirements outlined in paragraphs 260.5 A1 and A2, R115.1, and B150.1 of the MIA By-Laws (on Professional Ethics, Conduct, and Practice).

Steps to Ensure a Successful DCR Submission

- Designate a Compliance Officer: It is essential for DNFBPs to appoint a compliance officer who is thoroughly familiar with BNM’s reporting requirements. This officer will oversee the compilation and timely submission of the report. If any firm has yet to do so, please appoint the firm’s CO and notify Bank Negara Malaysia (BNM) by filling in an online form included in the portal or click here.

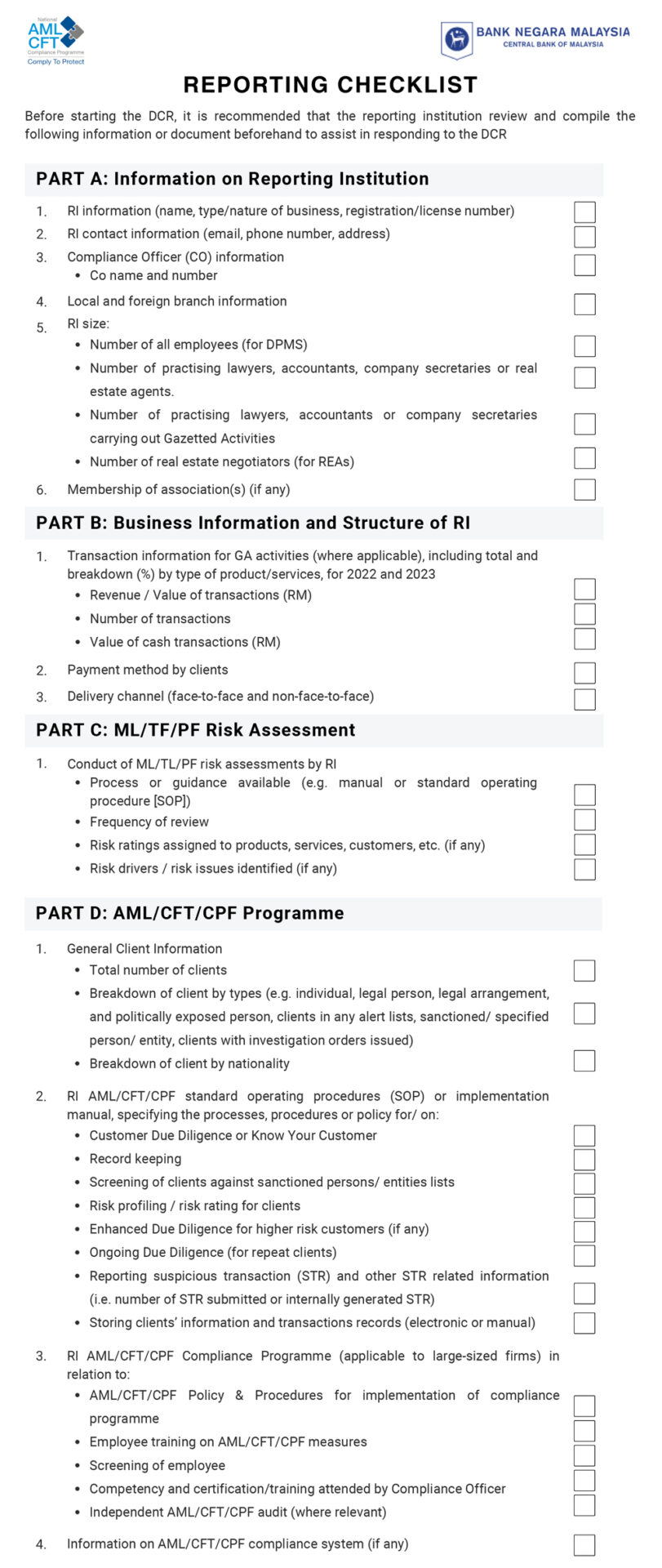

- Review the Reporting Checklist – Before starting the DCR, it is recommended that the reporting institution review and compile the following information or documents beforehand to assist in responding to the DCR which can also be retrieved from the DCR Information Kit.

Source: DCR2024 InfoKit (1 November 2024) – page 16

- Review Internal Policies: Ensuring that RI’s internal policies align with BNM’s expectations can prevent errors and omissions in the report.

- Data Integrity Checks: Prior to DCR 2024’s submission, double-check that the data provided is accurate, consistent, and in line with prior submissions or declarations to avoid discrepancies.

What should I do after submitting DCR 2024?

Upon submission of DCR, you will receive a report card with the assessment of compliance of your firm. You are required to take note, especially on the areas that are rated as “Weak” or “Marginal”, and ensure improvements are made to enable your firm to become fully compliant with the requirements. You may refer to the appendix in the report card as guidance.

The Role of BNM in Upholding Compliance

Bank Negara Malaysia has consistently prioritised the importance of anti-money laundering and counter-terrorism financing measures. The DCR 2024 is one of the many tools employed to ensure that both DNFBPs and RIs actively contribute to maintaining a clean and transparent financial ecosystem. BNM’s approach reflects a balance between regulatory strictness and guidance, helping RIs understand their responsibilities while also holding them accountable.

BNM also provides resources through its DNFBP Portal, where RIs can access the latest compliance guides, submission instructions, and necessary forms. This portal serves as a vital touchpoint for RIs needing assistance or seeking clarifications regarding their reporting duties.

Conclusion

Submitting the DCR 2024 is not just about regulatory adherence; it is an affirmation of a DNFBPs’ and RIs’ dedication to operating within the law, protecting its reputation, and contributing to a safer financial environment. With stringent deadlines and significant implications for non-compliance, DNFBPs and RIs should prioritise early preparation, appoint experienced compliance officers, and take full advantage of resources provided by BNM.

By meeting these expectations, DNFBPs and RIs can enhance their resilience against financial crimes, maintain a positive industry standing, and build a foundation of trust and reliability with clients and partners alike.

RIs are highly encouraged to refer to the online portal for further information regarding DCR 2024, including the DCR 2024 Information Kit to prepare for submission and schedule for DCR 2024 clinics, etc.

For any enquiries on DCR 2024 which could not be found within the materials or resources provided in the online portal, please submit any query via the following link: DCRQuery. For more information on the AML/CFT requirements, please visit AML/CFT website at Home DNFBP Portal.