By Nazatul Izma Abdullah

Business today is increasingly digital, and accountants need to be tech-savvy to be more productive and useful to their organisations.

Accountants also need to adopt tech solutions fast to manage the mountains of financial and non-financial data churned out by businesses on a daily basis.

To support accountancy and finance professionals on their tech journey, the Malaysian Institute of Accountants (MIA) recently organised the MIA Accounting & Financial Technology Showcase 2025 (MIA AFT). “Our goal is to boost productivity and future-proof the profession in an era of rapid technological change. Guided by the MIA Digital Technology Blueprint, the MIA AFT is part of MIA’s ongoing commitment to champion digital transformation,” said MIA President YBhg Dato’ Seri Dr. Mohamad Zabidi Ahmad in his welcome address.

Aptly themed Be Tech Driven, Be Future Proofed, this unique one-day, one-stop event showcased innovative business productivity solutions specially geared to accountancy and finance professionals. Close to 2,000 delegates connected with over 40 leading technology companies and vendors who demonstrated their solutions that can accelerate the profession’s performance and value creation.

With access to a futuristic exhibition, live demos, and expert insights from tech experts and business leaders, delegates experienced firsthand how technologies like artificial intelligence (AI), automation, analytics, blockchain and cloud computing are revolutionising finance and accounting processes, transforming work, and shaping the future of the profession.

While showcasing many technology solutions, MIA AFT 2025 also focused on e-invoicing that is profoundly influencing tax reporting, financial systems, and compliance processes. Several technology partners participating in MIA AFT 2025 showcased practical and innovative e-invoicing solutions to help businesses and practitioners adapt to the e-invoicing framework and implementation phases, while ensuring robust compliance.

Boosting Digital Adoption

Solutions that integrate technologies such as AI, automation, analytics and cloud are expected to significantly impact the accounting industry in the future. In their sharing, many of the tech leaders present touted the benefits and advantages of embracing digital tools, especially in expediting processes and boosting value creation. These include:

Improved Efficiency, Accuracy and Reliability

Digital tools automate routine tasks, such as data entry, invoicing, and reconciliations, freeing up time for more strategic and advisory work. These solutions also reduce errors and inaccuracies, ensuring compliance with accounting standards and regulatory requirements. For example, bookkeeping is less tedious as automated tools can accurately and efficiently record financial transactions, while reducing manual errors.

Enhanced Collaboration, Communication, Mobility and Flexibility

Cloud-based digital tools enable real-time collaboration and communication with clients, colleagues, and other stakeholders, improving relationships and service delivery. Time-saving cloud solutions also allow accountants to work remotely, accessing client data and performing tasks from anywhere, at any time. Where practitioners are concerned, cloud-based accounting software can boost collaboration and efficiency as accountants and their clients can access the same data from anywhere and on any device.

Strengthened Compliance and Reporting

AI can help automate compliance reporting, such as tax returns and financial statements, supporting accountancy professionals and practitioners working in the compliance and regulatory space.

Enhanced Analysis and Insights

Harnessing the power of predictive analytics, AI-powered predictive models can analyse financial data to forecast future trends and identify potential risks. Advanced data analytics and visualisation capabilities also enable accountants to extract valuable insights, identify trends, and make informed business decisions. Financial analysis gets a boost from automated tools which can quickly analyse large datasets to provide insights on financial performance, helping accountants make informed decisions.

Staying Current, Being Future Relevant

In short, digital tools such as AI and automation are predicted to transform the accounting industry by increasing efficiency, enhancing analysis, and enabling new service offerings. However, it is essential for accountants to develop new skills and adapt to these changes to remain relevant in the future.

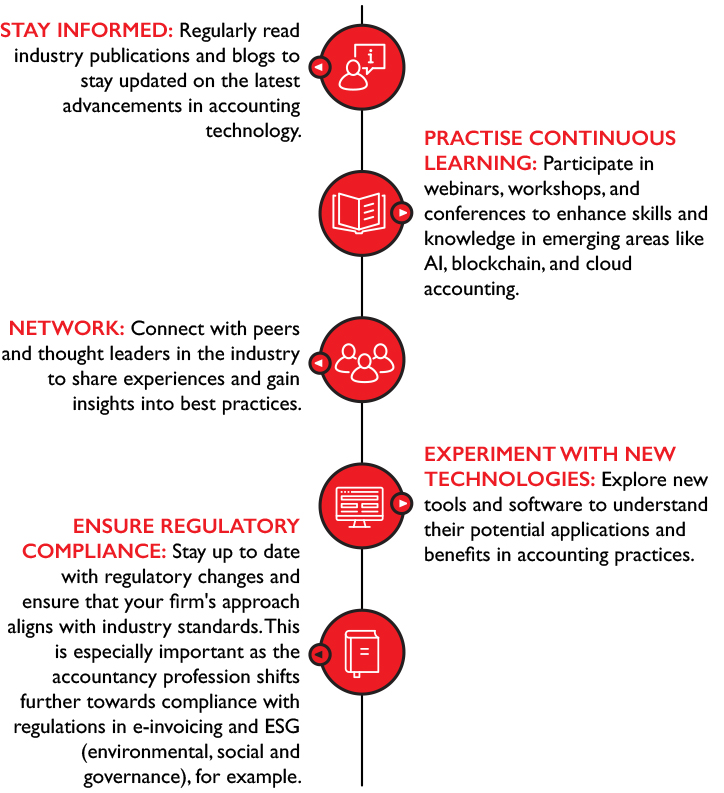

To upskill and stay current with the latest digital trends in accountancy, tech experts at MIA AFT advised accountancy and finance professionals to:

“We believe that educational and networking events that are focused on emerging technologies such as MIA AFT will help to futureproof accountancy professionals for a fast-changing tech landscape and the evolving digital economy. It is important that MIA passionately advocates for digital transformation to ensure that our more than 40,000 members are future ready and relevant to employers and business,” concluded MIA CEO Dr. Wan Ahmad Rudirman Wan Razak.

In recognition of their efforts, members attending the AFT were awarded 6 CPE (continuing professional education) hours by MIA (subject to the Terms & Conditions). This supports their CPE compliance requirements while enhancing their professional development needs.