By Cleartax Team

Malaysia’s e-invoicing mandate, introduced under the Income Tax Act 1967, has entered its second phase since 1 January 2025, targeting businesses with an annual turnover or revenue between RM25 million and RM100 million. As part of the Inland Revenue Board of Malaysia’s (IRBM) digital transformation roadmap, this phase aims to streamline tax administration, reduce errors, and enhance transparency.

Here’s what affected businesses need to know to ensure compliance.

Who Falls Under Phase 2 of Malaysia e-Invoicing?

Phase 2 applies to taxpayers whose 2022 audited financial statements or tax returns reflect annual turnover/revenue within the RM25–100 million threshold. This includes entities such as corporations, partnerships, cooperatives, and trusts. New businesses established post-2023 must comply by Phase 3 (1 July 2025).

Key Requirements for e-Invoicing Phase 2 Compliance

- Choose one of IRBM’s e-Invoicing Mechanisms: Businesses can submit e-invoices via the MyInvois Portal (for manual or batch uploads) or API integration (for automated, high-volume transactions). API integration requires aligning systems with IRBM’s Universal Business Language (UBL2.1) standards in XML/JSON formats.

- Mandatory Data Fields: E-invoices must include 55 mandatory fields, such as supplier/buyer details, transaction descriptions, tax breakdowns, and a digital signature. Specific scenarios (e.g. cross-border transactions) may require annexures.

- Timely Submission and Validation: E-invoices must be submitted to IRBM for real-time validation. Post-validation, suppliers can share the e-invoice (with a QR code) or its visual representation (PDF) with buyers.

- Adjustments and Cancellations: Buyers can request invoice rejections, and suppliers can cancel invoices within 72 hours of validation. Post-deadline adjustments require issuing credit/debit/refund notes.

Interim Relaxation Period: What Businesses Should Know

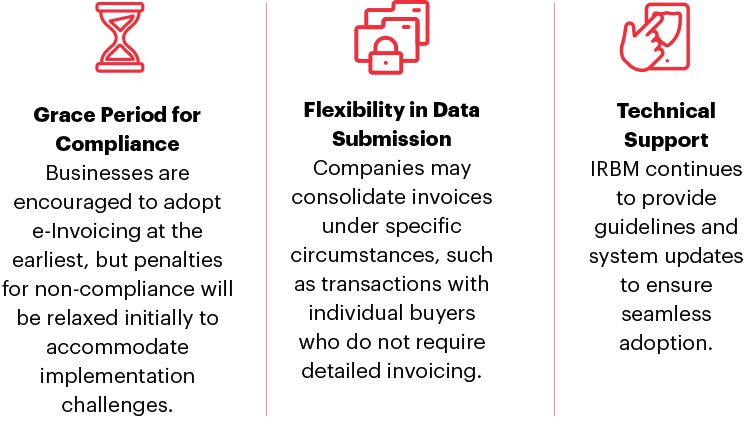

While e-Invoicing is now in effect for Phase 2 businesses, IRBM has provided an interim relaxation period to ease the transition. This relaxation allows businesses to make necessary adjustments to their invoicing processes and IT infrastructure. Key aspects of this relaxation include:

Preparing for Phase 2

- System Readiness: Businesses should assess whether their current accounting or ERP systems are compatible with MyInvois API integration or require upgrades to ensure compliance.

- Training and Awareness: Employees handling invoicing processes must be well-informed about e-Invoicing requirements and the use of MyInvois.

- Record-Keeping and Audit Compliance: Since e-Invoices serve as primary proof of transactions, maintaining accurate and validated records will be crucial for audits and tax filings.

- Transaction Handling with Exempted Parties: Certain transactions, such as those with individuals not conducting business, may be exempt from e-Invoicing. Businesses should verify exemption criteria to avoid unnecessary compliance efforts.

Looking Ahead

Since Phase 2 is already in effect, businesses must prioritise compliance to avoid disruptions. For detailed guidelines, refer to IRBM’s e-Invoice Guideline. Click here for more information.