The MIA Sustainability, Digital Economy and Reporting Insights provides quarterly updates on the areas of sustainability, digital economy, tax, reporting and research. The Insight highlights contents and initiatives that are of high value to MIA members.

MIA Sustainability Roadmap

In June 2024, the MIA Sustainability Blueprint for the Accountancy profession was launched at the MIA Conference 2024. The Blueprint sets out the sustainability aspirations of the profession as well as the guiding principles to facilitate accountancy professionals in navigating their sustainability journey.

In effort to operationalise the Blueprint, the MIA Sustainability Roadmap was developed and approved by the MIA Council in January 2025. It is an ambitious, long-term plan that encompasses 169 initiatives that will be carried out by sixteen MIA Committees in three phases, from 2025 to 2029. The Roadmap is designed to ensure that MIA remains at the forefront of sustainability efforts by focusing on three themes as follows:

The capacity-building initiatives will focus on equipping professionals with the necessary expertise and training to navigate sustainability. Meanwhile, the tools and guidance will support the profession by providing relevant resources for implementing sustainability. Finally, advocacy efforts will aim to promote sustainability within the profession as well as stakeholders on the role of accountants in sustainability.

Digital Technology Adoption Awards (DTAA) Winners in Action Series

At the inaugural DTAA Presentation Dinner in May 2024, fourteen exceptional winners were celebrated for their remarkable accomplishments representing a diverse array of digital innovation within the profession. To inspire ongoing digital transformation across the accountancy profession, MIA has launched an exciting new interview series titled ‘DTAA Winners in Action’. This ongoing series highlights the journey of the winners in adopting technology. Each article in the series explores their unique stories, showcasing the challenges they overcame, strategies they deployed and best practices adopted in embracing digital technology. Through their narratives, the series seeks to motivate others to embark on their own digitalisation journey and harness the power of technology to drive their own success.

Read their digital transformation journey here.

Global Minimum Tax: Latest Developments and Implications for Businesses

In February 2025, the Institute organised a complimentary tax webinar – Global Minimum Tax: Latest Developments and Implications for Businesses. Key insights from this webinar are as follows:

- The Global Minimum Tax (GMT) ensures multinational enterprises (MNEs) with revenues over EUR750 million pay at least 15% tax worldwide. If a company’s effective tax rate (ETR) is below 15%, a top-up tax applies.

- Many countries including UK (2024) and Malaysia (2025) are implementing GMT. Businesses must comply with new reporting obligations, including GloBE Information Returns, Top-Up Tax Returns, and local registration.

- Traditional tax incentives like tax holidays may be less effective. Companies should explore alternative tax strategies such as Qualified Refundable Tax Credits (QRTC) and selective use of deductions to optimise tax liabilities.

- Key challenges include complex tax calculations, country-specific deviations, and compliance costs. Businesses have to decide whether to upskill internally or outsource tax expertise to manage the new requirements. Coordination between global headquarters and local teams is essential.

- To prepare, companies should assess the impact of GMT, restructure tax incentives, monitor global tax changes, and ensure compliance. Staying proactive will help businesses navigate GMT efficiently and minimise risks.

Strengthening Tax Governance for Compliance & Risk Management

Tax governance has become a crucial corporate priority as global tax regulations tightened. Businesses must now manage tax risks proactively, ensuring compliance with evolving laws and avoiding reputational damage. The OECD’s Base Erosion Profit Shifting (BEPS) framework and high-profile tax cases, such as Apple’s ˆ13bn dispute with Ireland, highlight the increasing scrutiny on corporate tax practices. The Institute organised a complimentary webinar on tax governance in March 2025 to continue its advocacy on the matter.

In Malaysia, the Tax Corporate Governance Framework (TCGF) and the MIA-MICPA Tax Governance Guide encourage listed companies to adopt structured tax management and transparent reporting. Effective tax governance, aligned with ESG considerations, enhances investor trust and corporate accountability. Boards and audit committees must take an active role in tax strategy, ensuring robust risk management and clear disclosures. By integrating tax governance into corporate frameworks, businesses can strengthen compliance, reduce financial risks, and build long-term stakeholder confidence.

Public Sector Sustainability Reporting: Where do We Stand?

A webinar on Public Sector Sustainability Reporting: Where do We Stand? was successfully held on 26 February 2025. Moderated by Encik Mohamad Hamim, Executive Director, Project Management Kuala Lumpur City Hall and a member of MIA Public Sector Accounting Committee, the webinar featured valuable insights from Puan Nor Yati binti Ahmad, Accountant General of Malaysia, Datu Hajah Elean Masa’at, Sarawak Accountant General, and Puan Rasmimi Ramli, Executive Director, Sustainability, Digital Economy and Reporting, MIA.

Nearly 500 MIA members attended the session. The webinar kicked off with a presentation on the global updates of public sector sustainability reporting, followed by a panel discussion that highlighted the significance of transparency and accountability in public sector sustainability efforts. The panellists also discussed the impact of reporting on decision-making, policy development and public trust as well as the necessary steps to improve reporting practices in the future.

Advocacy in Global Public Sector Reporting

MIA has submitted comments to the International Public Sector Accounting Standards Board (IPSASB) for the following consultation documents on 28 February 2025:

| ED 92, Tangible Natural Resources | ED 92 is the primary component of the IPSASB’s broader Natural Resources project. The ED proposes a definition of tangible natural resources, as well as guidance on their recognition, measurement, display and disclosure in the general-purpose financial statements. | Comment Letter Submission on ED 92 |

| IPSASB SRS ED 1, Climate-related Disclosures | The objective of this ED is to provide principles for public sector entities to disclose information in its general-purpose financial reports that is useful to primary users for accountability and decision-making purposes about: Climate-related risks and opportunities to its own operations; and Climate-related public policy programmes and their outcomes. | Comment Letter Submission on IPSASB SRS ED 1 |

Advocacy in Direct and Indirect Taxes

Meeting with the Secretary-General of Treasury of the MoF

In March 2025, the Institute participated in a consultation session with YBhg Datuk Johan Mahmood Merican, the Secretary-General of the Ministry of Finance (MoF) to deliberate on draft policies and guides pertaining to the expansion of scope of sales and service tax (SST).

The Institute applauds the MoF in drafting policies and guides as well as engaging with industry through various dialogues. This collaborative approach will lead to a well-calibrated policy framework. It is anticipated that the finalised tax provisions, which took effect on May 1, 2025, would be made public soon.

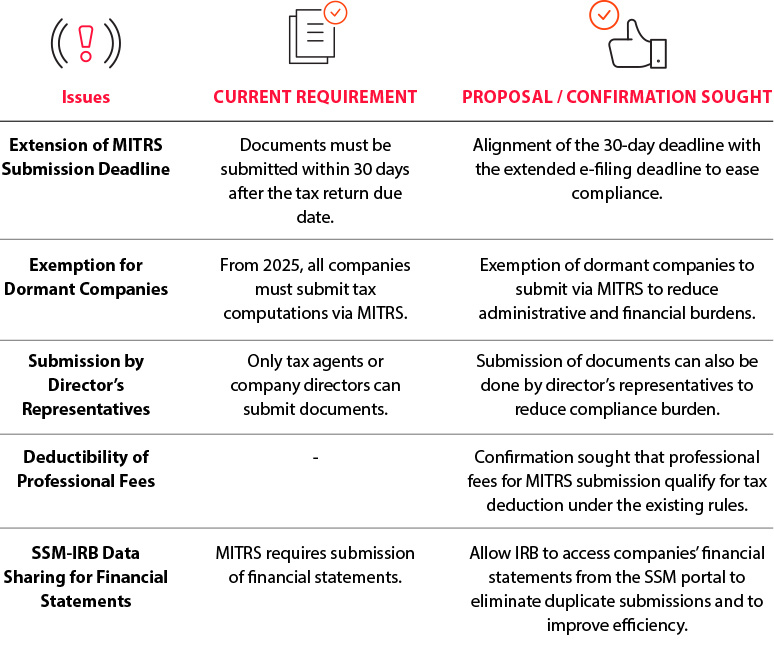

Joint (MIA-MICPA) Letter on Issues Arising from the Implementation of MIRTS

In March 2025, the Institute and The Malaysian Institute of Certified Public Accountants (MICPA) submitted a joint letter on the implementation issues of the filing programme for documents indicated in Section 82B of the Income Tax Act 1967 via the Malaysian Income Tax Reporting System (MITRS). Summary of key issues and proposals in MITRS submitted are as follows:

Continuous Engagements with Stakeholders

Between January and March 2025, the Institute, represented by its Taxation Practice Committee and staff, has participated in four engagements with various stakeholders. These engagements are mainly for advocating and providing constructive inputs on direct and indirect tax policy making. The Institute will continue to support the tax authorities on these initiatives.