By Sustainability, Digital Economy and Reporting Team

“IFRS 18 represents the most significant change to companies’ presentation of financial performance since IFRS Accounting Standards were introduced more than 20 years ago. It will give investors better information about companies’ financial performance and consistent anchor points for their analysis.”

Andreas Barckow, IASB Chair¹

In April 2024, the International Accounting Standards Board (IASB) published a new IFRS Accounting Standard aimed at enhancing the reporting of companies’ financial performance enabling better investment decisions by investors. IFRS 18 Presentation and Disclosure in Financial Statements will replace IAS 1 Presentation of Financial Statements.

The Malaysian Accounting Standards Board (MASB) issued MFRS 18 Presentation and Disclosure in Financial Statements in June 2024. MFRS 18 is word-for-word IFRS 18 and it will replace MFRS 101 Presentation of Financial Statements. MFRS 18 will become effective for annual reporting periods beginning on or after 1 January 2027, with earlier application permitted. MFRS 101 shall be withdrawn on the application of MFRS 18².

This article provides an overview of this new standard.

Benefits of IFRS 18

This standard aims to enhance the quality of financial reporting by³:

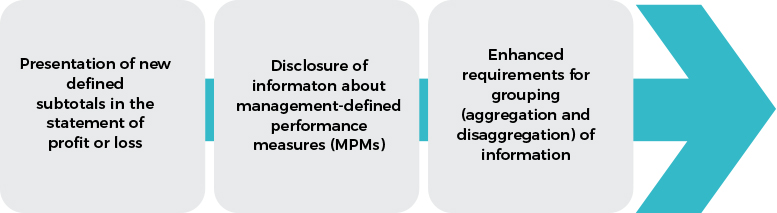

Key Changes of IFRS 18²

The main changes introduced by IFRS 18 relate to these areas:

Presentation of new defined subtotals in the statement of profit or loss

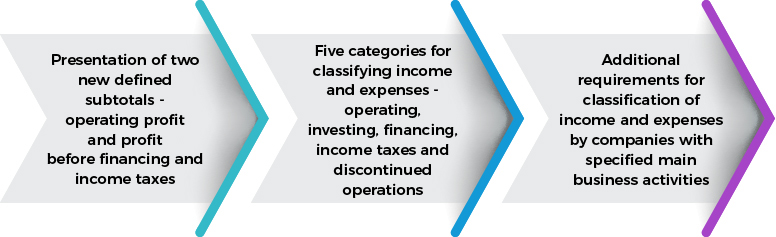

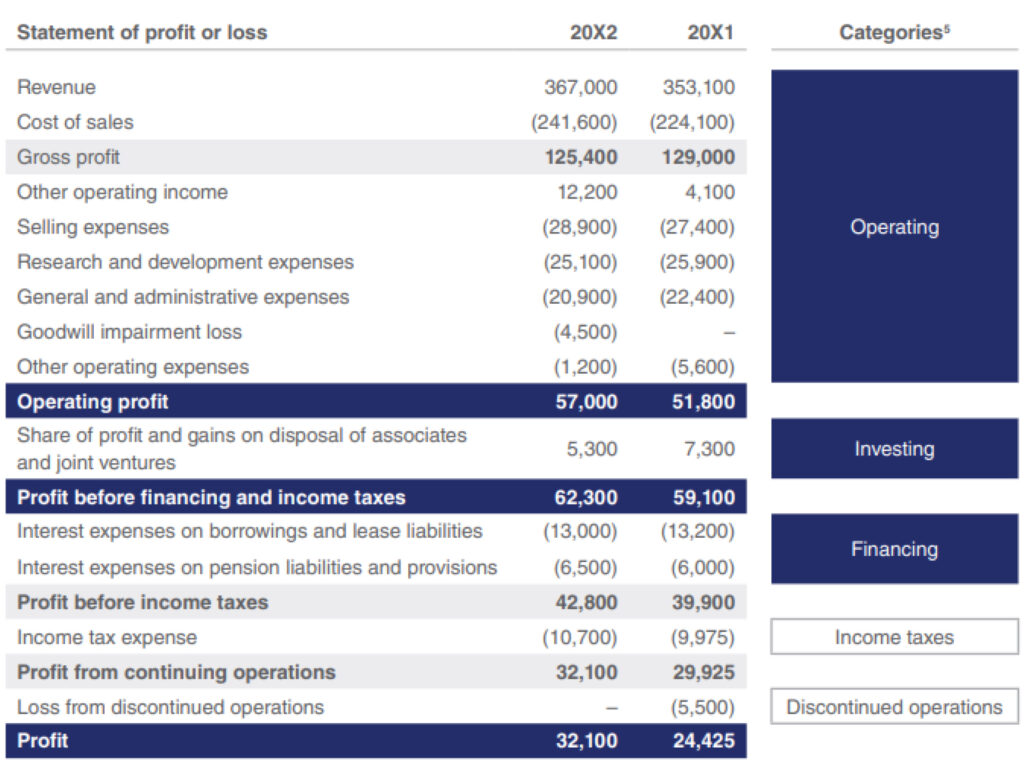

The following are the key changes regarding subtotals and categories:

Paragraph 69 of IFRS 18 requires an entity to present totals and subtotals in the statement of profit or loss for:

- Operating profit (or loss) – comprises all income and expenses classified in the operating category

- Profit (or loss) before financing and income taxes

- comprises of operating profit or loss; and

- all income and expenses classified in the investing category

- Profit (or loss)

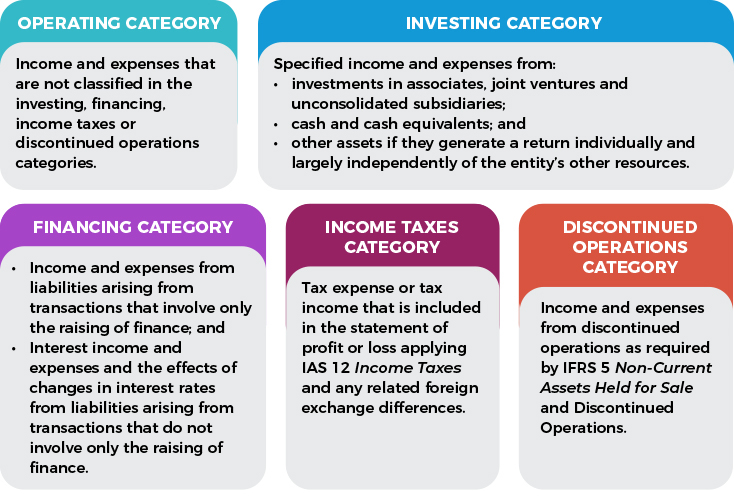

Paragraph 47 of IFRS 18 requires an entity to classify income and expenses included in the statement of profit or loss in one of five categories:

- the operating category

- the investing category

- the financing category

- the income taxes category

- the discontinued operations category

For the purposes of classifying its income and expenses into the operating, investing and financing categories as required by IFRS 18, an entity will need to assess whether it has a specified main business activity⁴. Determining whether an entity has such a specified main business activity is a matter of fact and circumstances which requires judgement⁵.

Disclosure of Information about management-defined performance measures (MPMs)

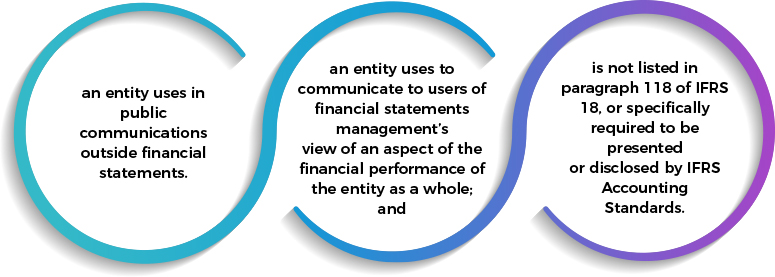

IFRS 18 introduces the concept of a management-defined performance measure (MPM) which is a subtotal of income and expenses that³:

The objective of such disclosures is for an entity to provide information to help users of financial statements understand the following:

- The aspect of financial performance that, in management’s view, is communicated by a management-defined performance measure; and

- How the management-defined performance measure compares with the measures defined by IFRS Accounting Standards⁶.

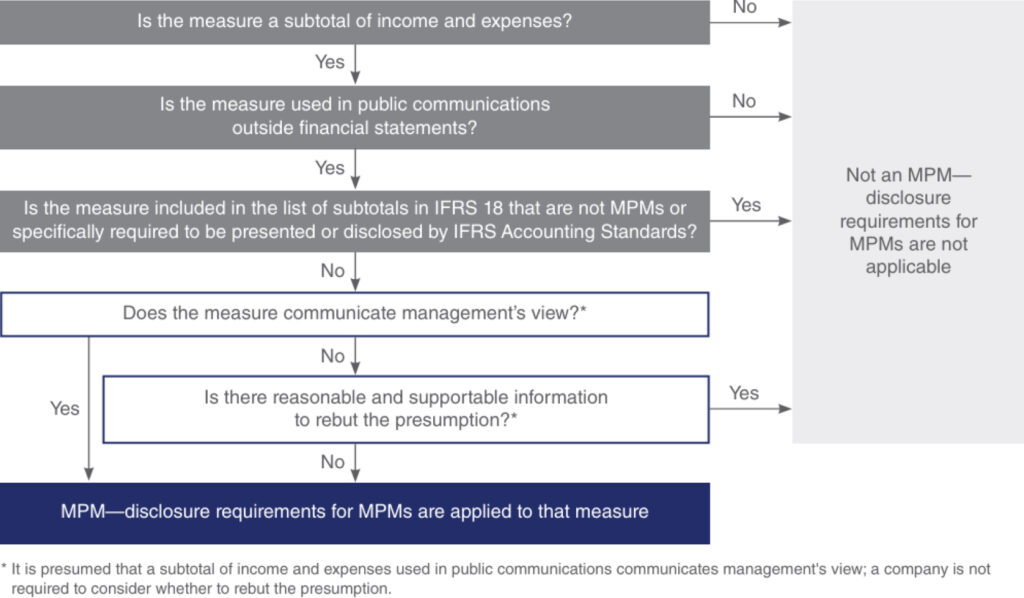

Based on paragraph 119 of IFRS 18, an entity shall presume that a subtotal of income and expenses used in public communications outside financial statements represents management’s view of financial performance. However, as stated in paragraph 120, a company is permitted to rebut this presumption if it has reasonable and supportable information demonstrating that such a subtotal does not communicate management’s view.

The figure below explains how to identify an MPM⁷:

Referring to paragraph 122 of IFRS 18, an entity shall disclose information about all measures that meet the definition of management-defined measures in paragraph 117 of IFRS 18 in a single note. This note shall include a statement that the management-defined performance measures provide management’s view of an aspect of the financial performance of the entity as a whole and are not necessarily comparable with measures sharing similar labels or descriptions provided by other entities.

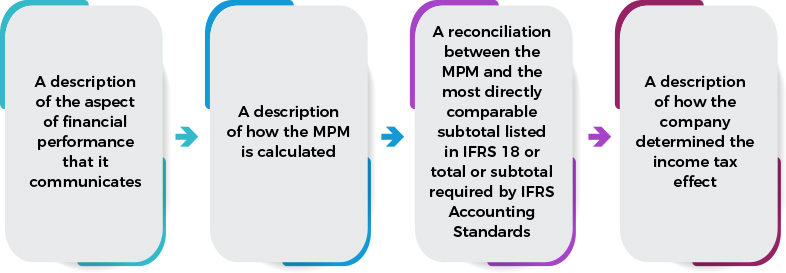

For each MPM, the note will include the following:

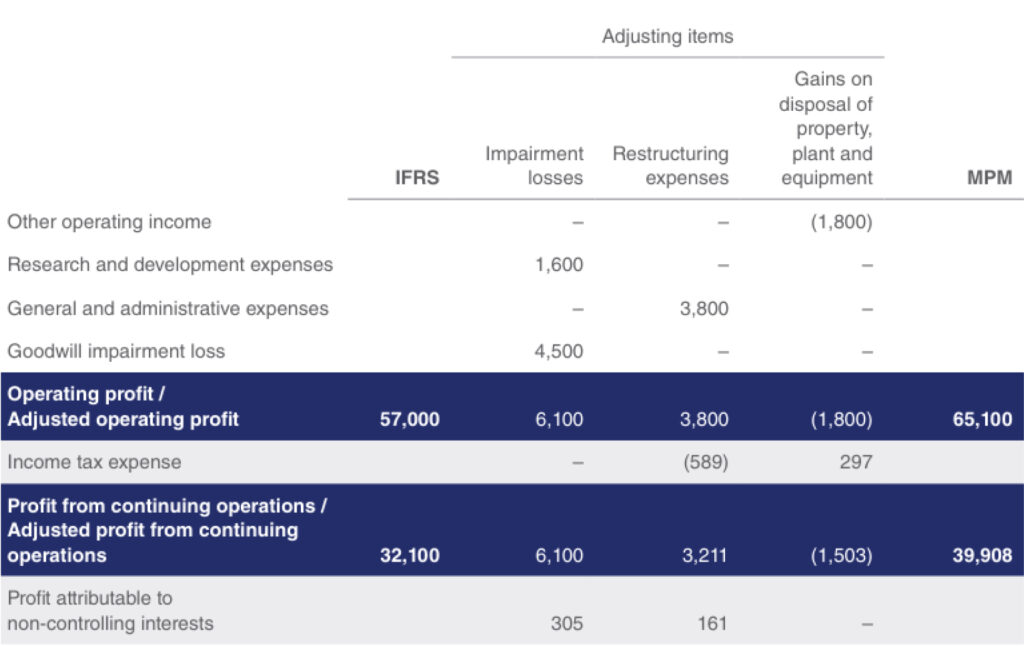

Below is the extract from the Illustrative Examples in IFRS 18 that shows an MPM reconciliation:

Enhanced requirements for grouping (aggregation and disaggregation) of information

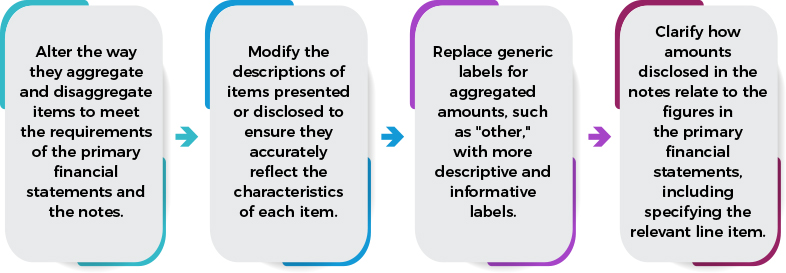

The role of the primary financial statements is to provide structured summaries of a reporting entity’s recognised assets, liabilities, equity, income, expenses and cash flows, that are useful to users of financial statements⁸. The principles for grouping of information as extracted below will require companies to⁹:

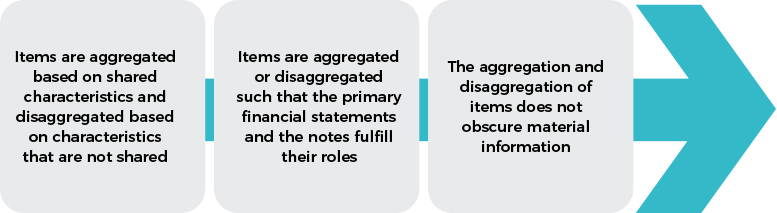

Accordingly, IFRS 18 requires companies to ensure that:

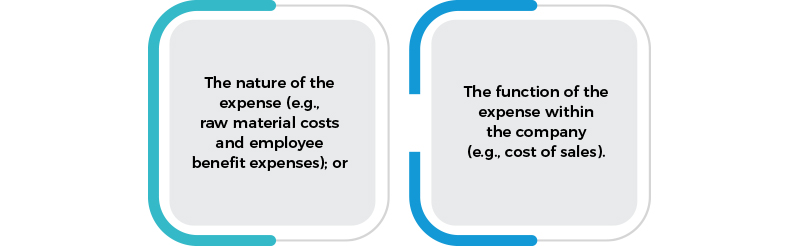

IFRS 18 also requires companies to classify and present operating expenses in a manner that provides the most useful structured summary, based on the following characteristics:

A company may classify some operating expenses by function and others by nature if it results in the most informative summary of its expenses.

Below is the extract from the Illustrative Examples on IFRS 18 to illustrate the structure of the statement of profit or loss:

Other changes

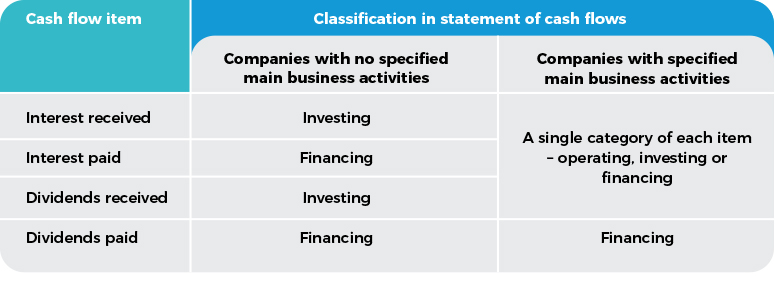

IFRS 18 also introduced some other limited changes to presentation and disclosure in the financial statements. For example, IAS 7 Statement of Cash Flows, is amended to¹⁰:

- specify ‘operating profit or loss’ as the starting point for reconciling cash flows from operating activities; and

- specify interest and dividends paid and received should be disclosed in the operating, investing and financing categories as follows:

Entities should also comply with the requirements in IFRS 18 to determine the structure of a primary financial statement in order to provide a useful structured summary in the statement¹¹.

Effective date

All companies that prepare financial statements that comply with IFRS Accounting Standards are required to apply IFRS 18 retrospectively from 1 January 2027. Earlier application is permitted¹². The application should be applied retrospectively, including to interim financial statements. In the first year of adoption, IFRS 18 mandates a reconciliation between the presentation of the statement of profit or loss for the comparative period under MFRS 101 and its presentation in the current year under IFRS 18. Interim financial statements in the first year of adoption must also include similar reconciliation requirements¹³.

The views expressed are not the official opinion of MIA, its Council or any of its Boards or Committees. Neither the MIA, its Council or any of its Boards or Committees nor its staff shall be responsible or liable for any claims, losses, damages, costs or expenses arising in any way out of or in connection with any persons relying upon this article.

¹ “New IFRS Accounting Standard will aid investor analysis of companies’ financial performance”; 9 April 2024; https://www.ifrs.org/news-and-events/news/2024/04/new-ifrs-accounting-standard-will-aid-investor-

analysis-of-companies-financial-performance/

² “MASB issues new presentation and disclosure Standard to improve companies’ reporting of financial performance”, June 2024; https://www.masb.org.my/press_list.php?id=455

³ “Effects Analysis”, April 2024; https://www.ifrs.org/content/dam/ifrs/publications/amendments/english/2024/effect-analysis-ifrs18-april2024.pdf

⁴ A main business activity of:

a) investing in particular types of assets, referred to hereafter as investing in assets; or

b) providing financing to customers [paragraph 49 of IFRS 18]

⁵ “IASB Issues IFRS 18 Presentation and Disclosure in Financial Statements”; 10 April 2024; https://www.ey.com/en_gl/ifrs-technical-resources/iasb-issues-ifrs-18-presentation-and-disclosure-in-financial-statements

⁶ Paragraph 121 of IFRS 18

⁷ “Effects Analysis”, April 2024; https://www.ifrs.org/content/dam/ifrs/publications/amendments/english/2024/effect-analysis-ifrs18-april2024.pdf

⁸ Paragraph 16 of IFRS 18

⁹ “Effects Analysis”, April 2024; https://www.ifrs.org/content/dam/ifrs/publications/amendments/english/2024/effect-analysis-ifrs18-april2024.pdf

¹⁰ “MFRS is Here: Redefining Financial Performance Reporting’, June 2024; https://www.pwc.com/my/en/assets/publications/2024/pwc-my-mrfs-18-redefining-financial-performance-reporting.pdf

¹¹ Paragraph 22 of IFRS 18

¹² “Primary Financial Statements”, April 2024; https://www.ifrs.org/projects/completed-projects/2024/primary-financial-statements/

¹³ “MFRS is Here: Redefining Financial Performance Reporting’, June 2024; https://www.pwc.com/my/en/assets/publications/2024/pwc-my-mrfs-18-redefining-financial-performance-reporting.pdf