By Ng Boon Hui, Kerk Su Ngee and Grace Ng

As industrialisation advances, e-commerce has become a pivotal force driving economic vibrancy. In the 21st century, the internet revolutionised business operations, giving rise to e-commerce as a prominent online marketplace. With high internet penetration and the support of free trade, e-commerce in Southeast Asia has achieved a market size of approximately US$137 billion in 2023 and is expected to increase to US$380 billion in 2030¹.

E-commerce has evolved significantly from its early days. Initially, it was a simple platform where merchants listed products for sale, with commission fees ranging from 0% to 10% of the transaction price. Over time, the industry diversified, introducing subscription models that offered benefits like discounts and expedited delivery. More recently, social commerce (a branch of e-commerce that utilises social media platforms to promote and sell products) and livestream shopping have emerged. With the help of user-generated content such as photos, videos and reviews, businesses take their relationship with consumers to a deeper level.

Studies show that 65% of Southeast Asian consumers are inclined to make purchases based on the recommendations of their favourite influencers. This evolution reflects the growing sophistication of e-commerce as it adapts to technological advancements and changing consumer preferences.

As we consider the valuation of e-commerce entities, it is essential to recognise the multifaceted nature of the industry. The rapid growth and innovation in e-commerce have not only transformed consumer shopping habits but also the investment landscape. Venture capital, private equity and public markets have shown a keen interest in the sector, with valuations often reflecting the promise of disruptive business models and the potential for scale.

However, as companies progress from their nascent stages to more mature phases, the valuation focus shifts. Investors begin to scrutinise the sustainability of growth, the efficiency of operations and the path to profitability. These factors play a critical role in shaping the methodologies used to value e-commerce businesses.

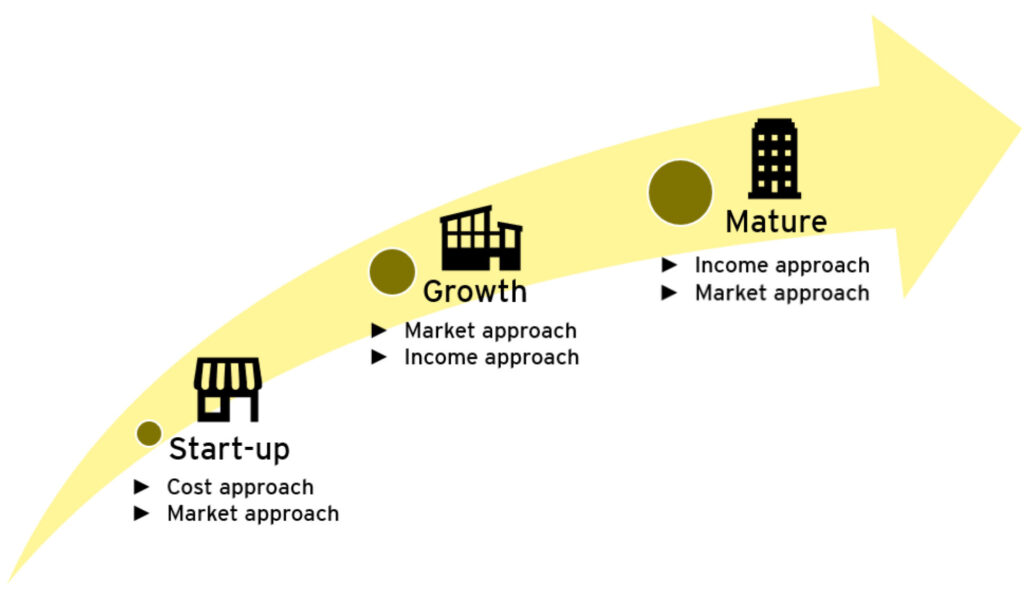

With this context in mind, we will now explore the various valuation methodologies that are applied to e-commerce companies. These methodologies must be flexible enough to account for the unique challenges and opportunities presented at different stages of a company’s lifecycle, from the early days of rapid user acquisition to the later stages of operational optimisation and market leadership.

Valuation methodologies

Typically, the income approach, market approach or cost approach is being adopted as the valuation methodology of a business. The valuation methodology for e-commerce business will not be significantly different for other businesses, though e-commerce stands out as there are e-commerce businesses across the globe that are at different stages of development. Hence, the valuation methodology adopted will be performed on a case-by-case basis.

Startup stage:

- Cost approach: At the startup stage, the cost approach provides a baseline valuation based on the investment required to build the e-commerce business. This method focuses on the costs incurred in developing core assets, such as IT infrastructure and technology platforms and requires the capturing of all relevant development costs, including both capital expenditures and operating expenses incurred before revenue generation.

The useful life of technology assets plays a crucial role in this approach, as it affects how quickly these assets depreciate or amortise. Shorter useful lives lead to higher annual amortisation expenses, reducing the assets’ book values more rapidly. This necessitates using amortisation schedules that reflect the rapid pace of technological obsolescence. Furthermore, the valuation should also consider the value of intellectual property, such as patents, trademarks and proprietary algorithms, which can constitute critical assets for e-commerce startups. - Market approach: At the startup stage, the market approach can still provide valuable insights, although it is less common at this very early phase. This approach involves comparing the startup to similar e-commerce businesses that have recently been valued or sold. The process begins with selecting comparable companies, emphasising the importance of industry relevance, business model similarity and stage of development.

Key multiples used in this approach include Price/Sales or Price/GMV (Gross Merchandise Volume). Given that truly comparable transactions for early-stage startups are scarce, it may be necessary to broaden the set of guideline companies to include similar companies with recent funding rounds or valuations. Adjustments to these multiples are crucial to account for differences in growth rates, profit margins and market potential between the startup and the guideline companies, ensuring a more accurate valuation estimate.

Growth stage:

- Market approach: During the growth phase, the market approach gains prominence due to the availability of more data on revenue and user metrics. This stage sees e-commerce businesses using market-based valuation methods more effectively. Key multiples such as Price/Sales, Price/GMV and Price/User become central to the valuation process. The selection of appropriate multiples is critical and should reflect the company’s specific business model – whether it is a marketplace, direct-to-consumer or subscription-based model.

Understanding the lifecycle of e-commerce companies is also important, as multiples can vary significantly based on growth prospects and market saturation. Additionally, comparisons with recent transactions of similar companies may help gauge the company’s market position and growth potential. - Income approach: As e-commerce businesses enter the growth phase, the income approach starts to play a significant role. This method involves projecting future cash flows and discounting them to present value. Key factors in this approach include the company’s revenue growth, profitability and operational efficiency to assess the company’s potential to generate sustainable cash flows based on its growth trajectory.

The selection of an appropriate discount rate is also essential and should reflect the specific risks associated with the e-commerce sector. Hence, for growth-stage companies, a venture capital rate of return might be used to reflect the higher risk and potential return. Scenario analysis and sensitivity testing can also be conducted to evaluate how variations in key assumptions impact the overall valuation outcome. This comprehensive approach provides a clearer picture of the company’s financial prospects and risk profile.

Mature stage:

- Income approach: For mature e-commerce businesses, the income approach is the primary method used. This approach focuses on the company’s ability to generate consistent cash flows and achieve profitability. It involves detailed financial projections and the application of a discount rate that reflects the company’s risk profile.

In mature stages, the Weighted Average Cost of Capital (WACC) is commonly used as it accounts for the company’s capital structure and market risk. Additionally, estimating terminal value is crucial, considering the long-term sustainable growth rate and the competitive moat of the business. Integrating working capital management and capital expenditure planning into the cash flow projections is also important, as these factors significantly impact the company’s financial health and future performance. - Market approach: For mature e-commerce businesses, the market approach, while secondary to the income approach, plays a critical role as a cross-check in valuation. This method involves benchmarking the company against industry peers using valuation multiples such as Price/Earnings (P/E), Price/Sales or Price/EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation).

The relevance of different multiples can vary based on the e-commerce business model – whether it is marketplace, direct-to-consumer or subscription-based – making it important to use a range of multiples to capture diverse aspects of the company’s performance. Hence, careful consideration should be given on the selection and application of multiples to ensure that the valuation provides a well-rounded assessment of the company’s worth and is reflective of current market dynamics.

Challenges and risks in valuing e-commerce businesses

Scalability

Scalability is a vital valuation driver, especially for startups. The ability to grow and handle increased GMV is essential in a landscape dominated by established players. The scalability of an e-commerce business is influenced by its geographical market as well. While e-commerce has the potential for global reach, trade tensions such as the US-China trade dispute can restrict access to certain regions.

On the other hand, companies positioned in regions with high consumer growth and internet penetration tend to achieve better valuations. Furthermore, the shift from a low-interest rate environment to higher rates may complicate access to capital for marketing and growth. In this context, businesses may leverage innovation to reduce cash burn rates and lower customer acquisition costs, enabling them to achieve the desired scalability and growth.

Consumer behaviour

Shifts in consumer preferences and purchasing habits are critical factors influencing e-commerce valuations. E-commerce businesses must continuously adapt to evolving consumer expectations, such as preferences for faster delivery, personalised shopping experiences and various payment options. Changes in consumer behaviour can significantly impact revenue and profitability. For example, if consumers shift their spending towards more sustainable or ethically sourced products, e-commerce companies that do not align with these trends may see a decline in their customer base and sales.

Additionally, trade wars can alter consumer sentiment and spending patterns by affecting product availability and pricing. Valuation must consider how well a company can adapt to these changing preferences and the potential impact on its financial performance.

Competition and market saturation

Intense competition and market saturation present significant challenges for e-commerce businesses, impacting their ability to maintain growth and profitability. As the e-commerce landscape becomes increasingly crowded, companies face pressure to differentiate themselves and capture market share. This competitive environment can lead to price wars, increased marketing expenditure and reduced profit margins. Additionally, market saturation can limit growth potential as the number of new customers and opportunities dwindles.

The introduction of new digital payment systems can also intensify competition, as consumers expect diverse payment options and seamless transactions. Valuers must account for these competitive pressures and market dynamics to provide a realistic assessment of future performance and sustainability.

Technological disruption

Technological disruption is a critical factor in e-commerce valuations, as the industry is highly dependent on continuous innovation and technological advancements. Companies must consistently update their platforms, integrate new technologies, and enhance user experiences to remain competitive. Rapid advancements in technology, such as AI, machine learning and automation, can create new opportunities while rendering existing technologies obsolete.² E-commerce businesses that fail to adapt to these technological changes risk falling behind, which can negatively affect their valuation. Therefore, valuers must consider a company’s ability to innovate and adapt when assessing its value.

Customer retention and trust

As e-commerce businesses mature, maintaining profitability and cash flow becomes paramount. A significant focus shifts toward customer retention, as repeat purchases are critical to sustaining revenue. Challenges such as counterfeit products and fake reviews can undermine trust, necessitating investments in technology and processes to ensure a reliable shopping experience. Valuators must consider how well a business can retain customers and whether ongoing investments in technology and customer service are sufficient to uphold customer loyalty.

Founding members and key-man risks

In many early-stage e-commerce ventures, the founders or a small group of executives are often the driving force behind the company’s vision, culture and operations. If these key individuals leave or their performance declines, it can result in a loss of momentum, diminished investor confidence or even operational instability. As such, understanding the succession plan and the broader management team’s ability to step up and lead is crucial to mitigating this risk and ensuring the business can continue to thrive in their absence.

Complexity of capital structures

Capital structure is the combination of debt and equity used by a company to finance its overall operations and growth. For startups, the capital structure can be complex due to the variety of funding sources and instruments they may use, especially as they progress through different stages of growth, such as a mix of equity, convertible debt, preference shares and other hybrid instruments to raise capital, each with its own set of terms and potential dilution effects. Hence, it is important to carefully analyze these financial instruments to understand their potential conversions and dilution impacts, ensuring a clear picture of the company’s value.

Business plan / future cash flow

Projecting future cash flow can be particularly challenging for e-commerce businesses due to the dynamic and rapidly evolving nature of the industry as well as the factors mentioned above. Given these uncertainties, e-commerce businesses must adopt flexible and adaptive forecasting techniques that account for a wide range of variables. This may include scenario planning, sensitivity analysis and regularly updating projections based on real-time data. By acknowledging and addressing these challenges, businesses can improve their financial planning and enhance their ability to navigate the complexities of the e-commerce environment.

Conclusion

Valuing e-commerce businesses involves a complex interplay of investor expectations, company performance and market conditions. From startups to mature entities, the valuation methodologies – cost approach, market approach and income approach – must be adapted to reflect each stage of development. The sector’s rapid growth, technological innovations and competitive landscape present both opportunities and challenges for valuation.

Understanding these dynamics and addressing associated risks or challenges are crucial for investors, business owners and stakeholders. By staying informed about emerging trends and adapting valuation practices, stakeholders can make strategic decisions that capitalise on the evolving e-commerce landscape. As e-commerce continues to innovate and grow, ongoing assessment and flexibility in valuation approaches will be key to harnessing the sector’s full potential in the digital economy.

¹ “Booming Social Commerce Opens New Opportunities for ASEAN Retailers,” EMIS Insights Industry Report, September 2024

² EY Global: AI Trends in Internet and Social Commerce, July 2024

Note: The views reflected in this article are the views of the authors and do not necessarily reflect the views of the global EY organisation or its member firms.

Ng Boon Hui is a Partner with Strategy and Transaction, Ernst & Young PLT and the Chairman of the Malaysian Institute of Accountants (MIA) Valuation Committee. Kerk Su Ngee is a Partner with Strategy and Transaction, Ernst & Young PLT. Grace Ng is a Director with Strategy and Transaction, Ernst & Young PLT.