By MIA Financial Statements Review Department

Service concession arrangements are a key feature in the infrastructure and public service sectors, whereby private entities engage in public-private partnerships (PPPs) to participate in developing, financing, operation, and maintenance of public infrastructure.

IC Interpretation 12 Service Concession Arrangements (IC Interpretation 12) and IC Interpretation 129 Service Concession Arrangements: Disclosures (IC Interpretation 129), issued by the Malaysian Accounting Standards Board (MASB) provides comprehensive guidance on accounting treatments for public-to-private service concession arrangements as well as the disclosure requirements for service concession arrangements within the Malaysian Financial Reporting Standards (MFRS) framework.

Background

Service concession arrangements are contractual agreements whereby private sector entities (operators) participate in the development, financing, operation, and maintenance of public infrastructure. Common examples include roads, hospitals, airports, and water treatment/ distribution facilities. These arrangements are typically structured under models such as “build-operate-transfer” or “rehabilitate-operate-transfer”.

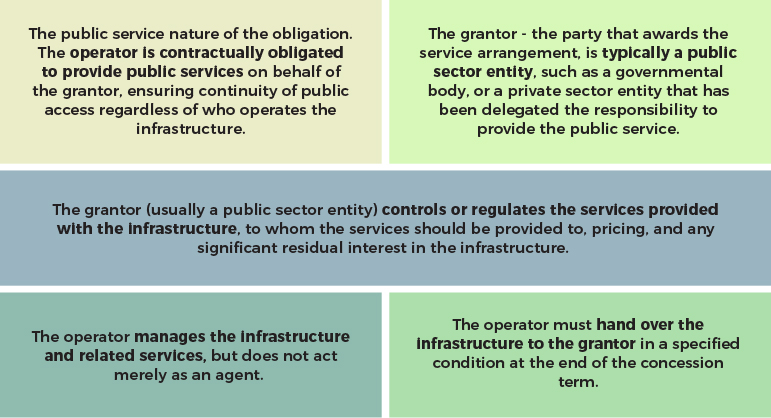

Key features of these arrangements include:

Scope

IC Interpretation 12 applies to public-to-private service concession arrangements whereby:

- The grantor controls or regulates the services provided, the recipients, and the pricing mechanisms.

- The grantor retains significant residual interest in the infrastructure at the end of the arrangement.

Infrastructure used in a public-to-private service concession arrangement for its entire useful life (whole of life assets) is within the scope of this Interpretation, if the grantor controls or regulates the services, as mentioned above.

This covers infrastructure constructed or acquired by the operator for the arrangement, as well as existing infrastructure provided by the grantor. However, it does not address accounting for infrastructure recognised as property, plant, and equipment by the operator prior to the arrangement. However, the derecognition requirements as in MFRS 116 apply to such infrastructure.

Key Accounting Principles

Operator’s Rights Over Infrastructure

Infrastructure within the scope of IC Interpretation 12 is not recognised as property, plant, and equipment by the operator as the operator does not control the asset. Instead, the operator accesses the infrastructure to provide public services on behalf of the grantor.

Revenue Recognition

Operators are considered as service providers, constructing or upgrading infrastructure and operating it over the concession period. Revenue is recognised in accordance with MFRS 15 Revenue from Contracts with Customers.

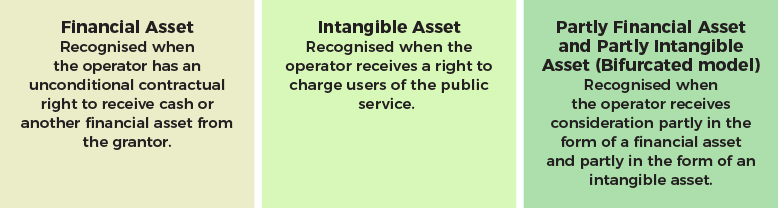

Consideration Received

The nature of the consideration received by the operator from the grantor as established from the contractual terms and applicable laws and regulations determine the accounting model that is to be used:

Operation Services

Revenue from operation, upgrade and maintenance services is recognised in accordance with MFRS 15.

Borrowing Costs

Recognised as an expense unless the operator has a contractual right to receive an intangible asset, in which case borrowing costs are capitalised during the construction phase in accordance with MFRS 123 Borrowing Costs.

Contractual Obligations

Obligations to maintain or restore infrastructure, except for any upgrade element are recognised and measured in accordance with MFRS 137 Provisions, Contingent Liabilities, and Contingent Assets.

Guidance: Accounting framework for public-to-private service arrangements

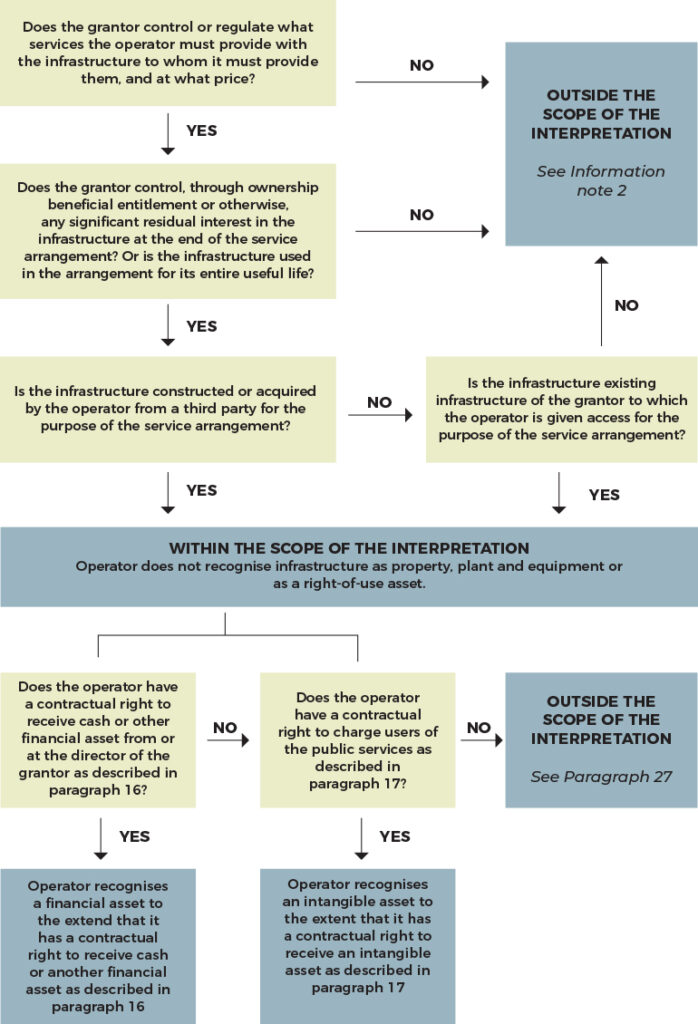

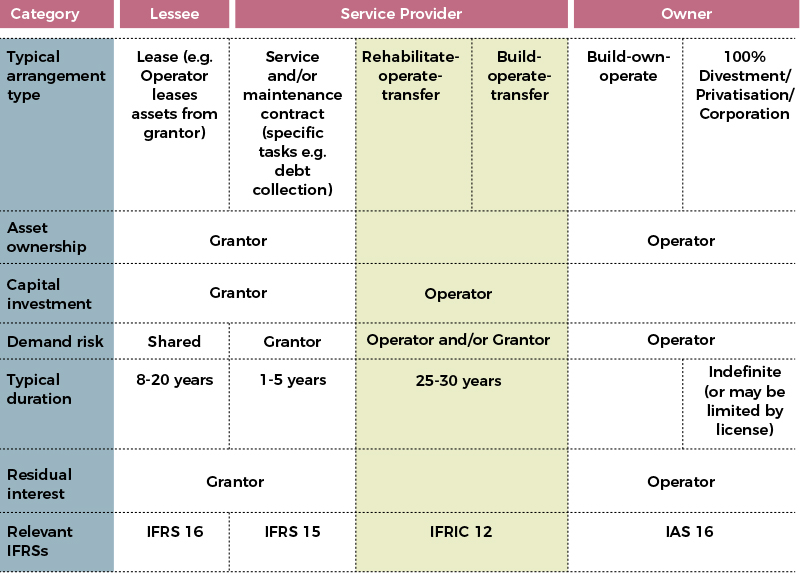

The diagram¹ below summarises the accounting for service arrangements established by International Financial Reporting Interpretations Committee (IFRIC) 12.

Information Note²

The table sets out the typical types of arrangements for private sector participation in the provision of public sector services and provides references to International Financial Reporting Standards (IFRS) that apply to those arrangements. The list of arrangement types is not exhaustive. The purpose of the table is to highlight the continuum of arrangements. It is not the IFRIC’s intention to convey the impression that bright lines exist between the accounting requirements for public-to-private arrangements.

Disclosure Requirements

Paragraph 6 and 6A of IC Interpretation 129 outline the mandatory disclosures in the financial statements for both the operator and the grantor. These disclosures include:

- a description of the arrangement;

- significant terms of the arrangement that may affect the amount, timing and certainty of future cash flows (e.g. the period of the concession, repricing dates and the basis upon which repricing or renegotiation is determined);

- the nature and extent (e.g. quantity, time period or amount as appropriate) of:

- rights to use specified assets;

- obligations to provide or rights to expect provision of services;

- obligations to acquire or build items of property, plant and equipment;

- obligations to deliver or rights to receive specified assets at the end of the concession period;

- renewal and termination options; and

- other rights and obligations (e.g. major overhauls);

- changes in the arrangement occurring during the period; and

- how the service arrangement has been classified.

- revenue and profits or losses: operator shall disclose the amount of revenue and profits or losses recognised in the period on exchanging construction services for a financial asset or an intangible asset.

Disclosures can be presented individually for each arrangement or aggregated by classes of arrangements involving similar services, such as toll operations or water treatment services.

OBSERVATIONS

This part intends to share the review findings of the Financial Statements Review Committee (“FSRC” or “the Committee”) relating to disclosures made in the financial statements and their accompanying notes to the financial statements. However, it does not delve into matters related to determining the recognition and measurement of service concession arrangements.

Comments discussed herein are intended to be applied within the context of the specific facts and circumstances associated with the identified observations. They are not intended to be exhaustive and do not address all potential issues that may arise relating to service concession arrangements.

In addition, careful consideration and judgment should be applied to individual facts and circumstances as MFRS are principles-based. Various circumstances may appear similar but are different in substance.

Review findings

Below are the observations noted by the FSRC relating to concession assets from the review of financial statements of public listed companies/entities (“PLCs”).

Observation 1

The Statement of Financial Position disclosed line items for both concession assets and intangible assets, which are related to service concession arrangements.

However, the Committee noted that the financial statements did not provide a clear explanation of the accounting policy applied by the Group in relation to concession assets. Clarification was sought on whether the arrangement falls within the scope of IC Interpretation 12 Service Concession Arrangements.

Response from PLC

The PLC clarified that their concession assets are not within the scope of IC Interpretation 12 Service Concession Arrangements, as IC Interpretation 12, Paragraph 8 excludes the accounting for assets owned by the operator before entering into a service arrangement.

Upon enquiry, the PLC clarified that the Group is the owner and operator of the concession assets and has recognised the concession assets in accordance with MFRS 116 Property, plant and equipment.

FSRC’s comments

It was noted that the PLC’s financial statements did not clearly explain the accounting policy applied by the Group in relation to concession assets included in the Statement of Financial Position.

The Committee recommends that the accounting policy be enhanced to explicitly state that concession assets are accounted for as property, plant and equipment under MFRS 116.

Observation 2

It was noted that concession assets are amortised upon the commencement of the concession period on a straight-line method over the concession period of 15 – 21 years.

Response from PLC

The PLC has recognised the concession assets as property, plant and equipment in accordance with MFRS 116.

FSRC’s comments

The financial statements inappropriately disclosed that the concession assets are amortised on a straight-line basis over the concession period of 15 to 21 years, instead of over the useful life of the concession asset which is classified as property, plant and equipment.

If the concession assets are indeed recognised as part of the Group’s property, plant and equipment under MFRS 116, the PLC should enhance its disclosures to clearly state this accounting policy. In addition, future financial statements should disclose the depreciation basis, reflecting the estimated useful lives of the concession assets where applicable.

CONCLUSION

Service concession arrangements are complex, long-term partnerships between public and private sector entities, often involving significant infrastructure investments and service delivery commitments. Under the MFRS Framework, IC Interpretation 12 and IC Interpretation 129 provide the key accounting and disclosure guidance necessary to ensure these arrangements are appropriately recognised, measured, and disclosed in the financial statements.

Proper accounting for service concession arrangements requires a robust assessment of the specific terms and conditions to ensure accurate recognition and measurement. IC Interpretation 12 addresses the accounting treatment for operators, while IC Interpretation 129 sets out the related disclosure requirements. When applied with sound judgement, these interpretations enhance consistency, transparency, and comparability in financial reporting. These interpretations ensure that entities present a clear and comprehensive view of their involvement in service concession arrangements, enabling stakeholders to better understand the financial and operational implications of such arrangements, and make informed assessments of an entity’s financial and operational performance.

¹ Extracted from IFRIC’s Implementation Guidance on implementing IFRIC 12 Service Concession Arrangements

² Extracted from IFRIC’s Implementation Guidance on implementing IFRIC 12 Service Concession Arrangements