Malaysia’s e-Invoicing mandate, set to take effect on 1 July 2026, marks a pivotal step in broadening the tax base, fostering sustainability, and driving digital economic growth. All businesses, unless specifically exempted, will be required to adopt e-Invoicing, making preparedness critical to avoid compliance pitfalls.

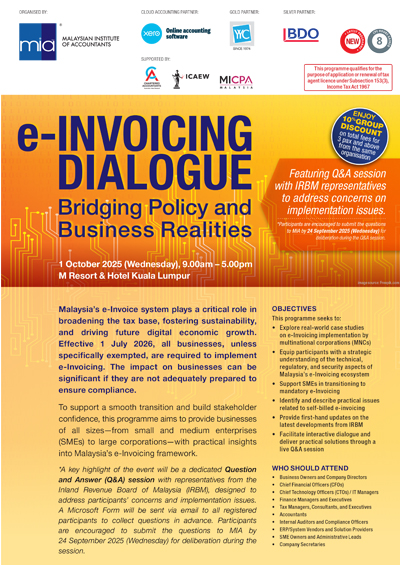

To support the business community through this transition, the Malaysian Institute of Accountants (MIA) is organising the E-Invoicing Dialogue: Bridging Policy and Business Realities on 1 October 2025 at the M Resort & Hotel, Kuala Lumpur. This full-day event is designed to equip participants with strategic insights and practical solutions to navigate Malaysia’s evolving e-Invoicing framework.

Addressing Policy, Practice, and Pain Points

The Dialogue will open with a panel on Post-Implementation of E-Invoicing for Multinational Corporations (MNCs), highlighting operational realities, cross-border compliance challenges, and best practices. This will be followed by a session on Securing the Future of E-Invoicing, focusing on regulatory compliance, cybersecurity, and trust.

A dedicated session tailored for SMEs will guide smaller businesses through the readiness-to-resilience journey, helping them adapt to the mandate while leveraging digital tools for long-term sustainability. The programme will also spotlight complex scenarios such as self-billing, consignment sales, and third-party transactions, providing practical guidance from the Inland Revenue Board of Malaysia (IRBM).

Direct Engagement with IRBM

A highlight of the Dialogue is the live Q&A session with IRBM representatives, who will address participants’ concerns and implementation challenges. Registered participants are encouraged to submit their questions by 24 September 2025 via a Microsoft Form, ensuring that key issues are discussed in detail during the session.

Why Attend

The Dialogue offers a unique platform for business owners, directors, CFOs, finance and tax professionals, IT managers, ERP vendors, and SMEs to gain clarity on regulatory expectations, learn from real-world case studies, and build confidence in managing e-Invoicing adoption. Beyond technical knowledge, it fosters open dialogue between businesses and regulators, bridging the gap between policy and practice.

Click here for registration and more information.