By Ashish Kedia and Preethisha Ramachandran

Malaysia’s drive to become a global semiconductor hub under NIMP 2030 and positioning itself to move up the semiconductor value chain and attract high-tech investments. Multinational enterprises must strike a careful balance between compliance and business strategy as they navigate the complexities of TP Rules and MTPG 2024.

What is a semiconductor?

Look around – anything electrical you see contains some type of semiconductor. Semiconductors are also known as microchips or integrated circuits (ICs) which are essential components of electronic devices. They are the vital engines powering a wide range of modern technologies, powering everything from medical equipment and renewable energy systems to transportation and defense applications. These chips handle sophisticated tasks such as data storage and retrieval, signal processing, and systems control. They enhance our daily lives, boost productivity, and contribute significantly to economic development. Semiconductor technology is expected to play a key role in advancing future innovations like artificial intelligence (AI).

Global overview

The rapid rise of generative AI, the growing demand for the Internet of Things (IoT), and the increasing adoption of electric vehicles (EV) are driving a sharp uptick in the need for more advanced, powerful, and specialised semiconductors.

AI applications, ranging from autonomous vehicles to data centres, require cutting-edge chips capable of processing vast amounts of data at high speeds, resulting in greater demand for graphic processing units, tensor processing units, and other AI-specific processors. Additionally, the global shift toward EV and renewable energy is significantly influencing semiconductor demand. EVs depend on a variety of semiconductors for battery management, power electronics, and autonomous driving capabilities. The growing push for renewable energy solutions, such as solar and wind power, is further increasing the need for semiconductors that efficiently manage energy conversion and storage.

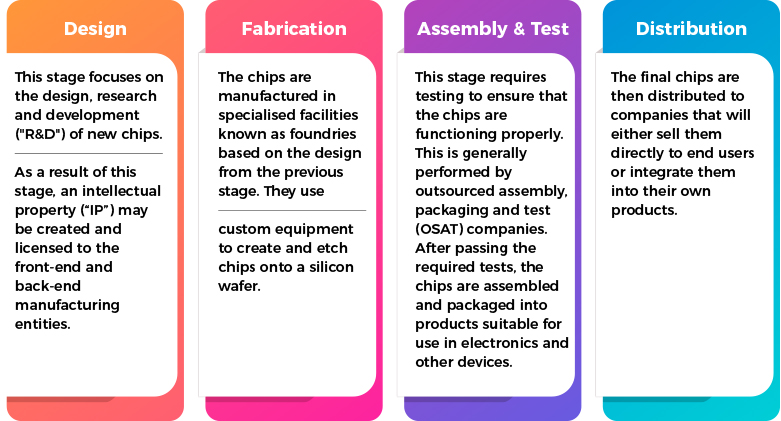

Semiconductor supply chain

Figure 1: Simplified depiction of the semiconductor supply chain

Malaysia’s semiconductor industry

Over several decades now, Malaysia’s semiconductor industry has experienced remarkable growth, establishing the country as a major manufacturing player. This industry plays a crucial role in driving Malaysia’s economic development and export earnings, benefitting from a skilled workforce, a conducive business environment, and its strategic location in Southeast Asia.

Malaysia’s semiconductor capabilities are predominantly in back-end services, such as Outsourced Semiconductor Assembly and Test (OSAT), which accounts for 13% of the global market. It ranks as the sixth-largest exporter, making it a sought-after partner in the global semiconductor supply chain.

Malaysia’s semiconductor industry is set to solidify further with various commendable initiatives outlined under Budget 2025, including the Supply Chain Resilience Initiative and the New Investment Incentive Framework. These efforts aim to bolster the country’s competitiveness in the semiconductor sector, among others, and the measures outlined in the budget lay a strong foundation for long-term growth and resilience within the industry. To enhance the electrical and electronics sector capabilities through high-value-added activities, such as IC design and advanced materials manufacturing, the government expanded the tax incentives to boost exports to also include IC design activities.

Transfer pricing in the semiconductor value chain

Why is it important?

With its strong semiconductor ecosystem, Malaysia is an attractive competitive investment destination. Multinational enterprises (MNEs) have invested significantly in their Malaysian operations, attesting to the country’s attractiveness. The semiconductor industry involves a wide range of complex cross-border transactions, including tangible and intangible properties, services and financial transactions.

Cross-border dealings inevitably raise transfer pricing (TP) considerations, particularly adherence to the arm’s length principle in intragroup transactions. As MNEs adapt to the sector’s transformation through updated business models and value chains, the nature of intercompany transactions is evolving to enhance their agility in a rapidly changing environment. Given the scale of these transactions, effective TP is crucial for MNEs to manage tax risks across operating jurisdictions.

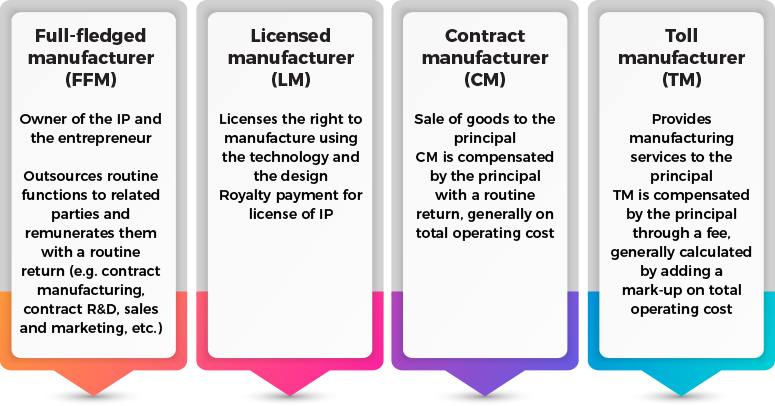

Common intercompany transactions

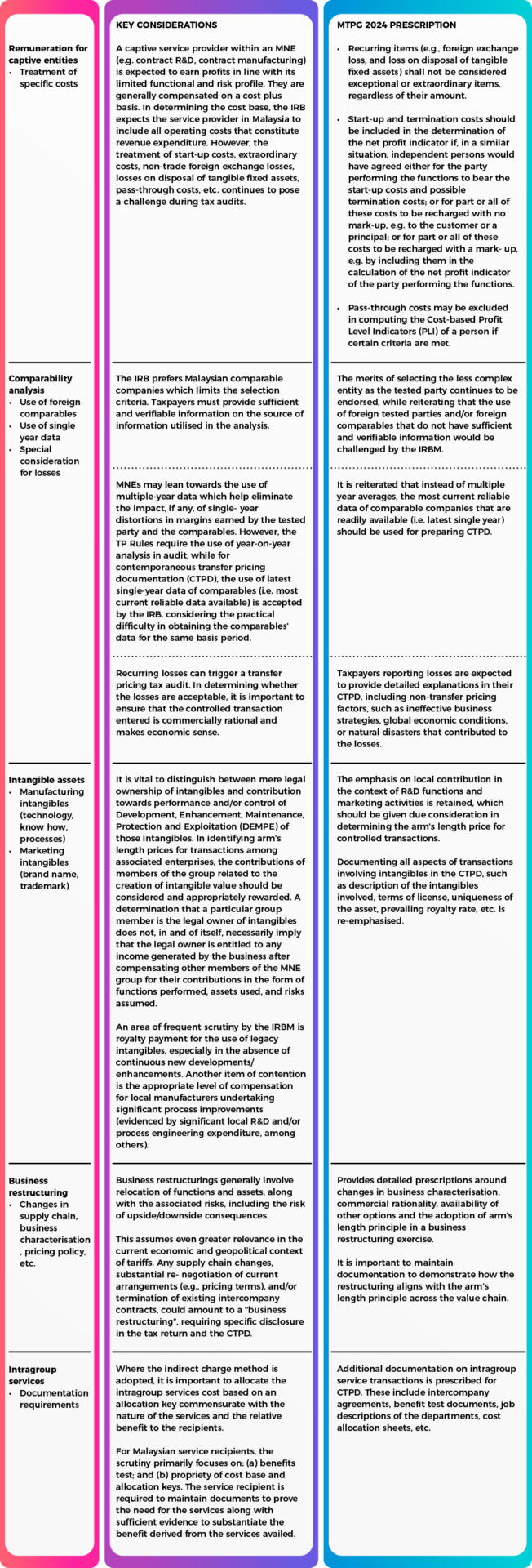

Impact of Malaysia Transfer Pricing Guidelines 2024 and Transfer Pricing Tax Audit Framework 2024

On 24 December 2024, the Inland Revenue Board of Malaysia (IRBM) released the Malaysia Transfer Pricing Guidelines 2024 (MTPG 2024) and the Transfer Pricing Tax Audit Framework (TPTAF 2024). MTPG 2024 provide several updated prescriptions for the administration of Section 140A of the Income Tax Act 1967 and the Income Tax (Transfer Pricing) Rules 2023 (TP Rules). Some of the key takeaways from MTPG 2024 that may impact the way intragroup transactions are structured and priced in the semiconductor sector are discussed below.

Conclusion

Malaysia’s semiconductor industry has been identified as a key area for growth under the New Industrial Master Plan (NIMP) 2030 and the National Semiconductor Strategy. These frameworks aim to position the country as a global hub for semiconductor manufacturing by attracting investments, adopting advanced technologies, and developing a skilled workforce. Considering the potential of the semiconductor business in Malaysia, MNEs with operations in Malaysia or looking to invest should strategically manage their TP.

TP in the semiconductor industry can be complex. The intricacies of business operations, such as highly interdependent processes spread across geographies, large capital investments, and a wide range of products, create distinct challenges in setting appropriate transfer prices. TP analyses rely heavily on the accurately delineated business characterisation, particularly for manufacturing entities.

In light of the new requirements in the TP Rules and MTPG 2024, coupled with the changing trade and geopolitical environment, it is crucial to comprehend that TP compliance is not about tax risk management alone – it is about striking a balance between strategic priorities and regulatory adherence.

Ashish Kedia is a Director and Preethisha Ramachandran is a Senior Manager, with the Transfer Pricing service line of Deloitte Tax Services Sdn Bhd.

This article represents the views of the authors only, and does not represent the views or professional advice of Deloitte Tax Services Sdn Bhd.