MIA Sustainability, Digital Economy & Services Team

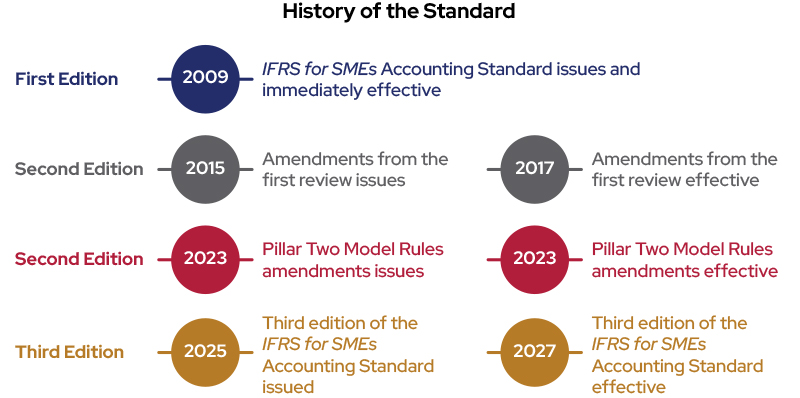

On 27 February 2025, the International Accounting Standards Board (IASB) issued the third edition of the IFRS for SMEs Accounting Standard (the Standard) following its second comprehensive review of the Standard (the Review). The IASB updated the Standard to reflect improvements that have been made to the full IFRS Accounting Standard while keeping the Standard suitable for small and medium-sized entities (SMEs)¹.

On 27 February 2025, the International Accounting Standards Board (IASB) issued the third edition of the IFRS for SMEs Accounting Standard (the Standard) following its second comprehensive review of the Standard (the Review). The IASB updated the Standard to reflect improvements that have been made to the full IFRS Accounting Standard while keeping the Standard suitable for small and medium-sized entities (SMEs)¹.

About the IFRS for SMEs Accounting Standard

The Standard was developed by the IASB in response to global calls for a dedicated set of financial reporting standards for SMEs. The Standard provides a set of high-quality accounting principles specifically designed to meet the needs of SMEs and the users of their financial statements. For purposes of the Standard, SMEs are entities without public accountability. An entity has public accountability if its equity or debt instruments are listed in a public market or it holds assets in a fiduciary capacity.²

Malaysian Private Entities Reporting Standard (MPERS)

The Malaysian Private Entities Reporting Standard (MPERS) was first issued by the Malaysian Accounting Standards Board (MASB) in February 2014, as a framework developed for private entities. The accounting requirements of the MPERS are word-for-word the same as the IFRS for SMEs Accounting Standard issued by the IASB.

In May 2015, the IASB issued a second edition of the IFRS for SMEs Accounting Standard following its first comprehensive review of the Standard. The MASB issued limited amendments to the MPERS to maintain alignment with the updated Standard in October 2015.³

In 2025, the MASB issued MASB Exposure Draft 80 Malaysian Private Entities Reporting Standard (MPERS), proposing to revise MPERS to be fully aligned with the third edition of the Standard.

Second Comprehensive Review

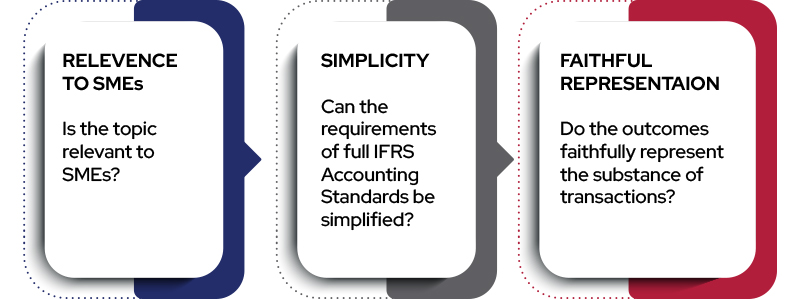

As part of the Review, the IASB established a set of alignment principles to guide how alignment with the full IFRS Accounting Standard should be applied to the Standard. These principles help the Board determine whether alignment is appropriate and, if so, how it should be implemented. The key principles are as follows:

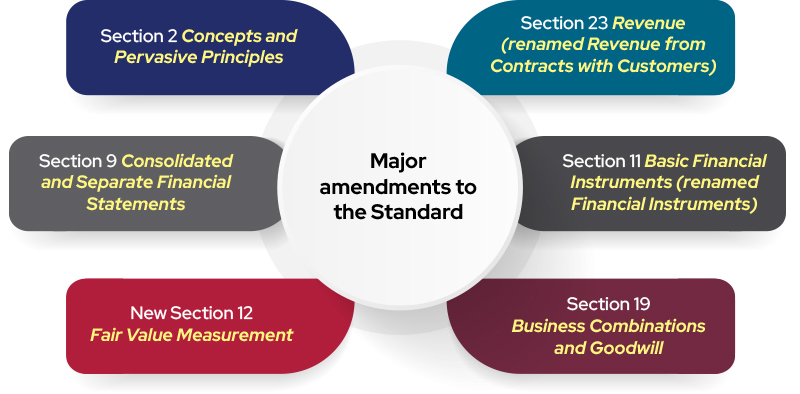

In the final scope of the Review, the IASB included 2018 Conceptual Framework for Financial Reporting (the Framework), nine IFRS Accounting Standards (see diagram below) and forty-two amendments to the IFRS Accounting Standard and IFRIC Interpretations⁴.

Amendments to the IFRS for SMEs Accounting Standard

Following the Review, significant updates have been made to the following sections:

This article aims to provide a high-level view of these updates.

Section 2 Concepts and Pervasive Principles

Section 2 outlines the objective of financial statements for SMEs and establishes the fundamental concepts and principles that underpin their preparation. Previously, this section was based on the 1989 Framework for the Preparation and Presentation of Financial Statements, which has since been replaced by the 2018 Framework. The updated section now reflects the concepts introduced in the updated Framework.

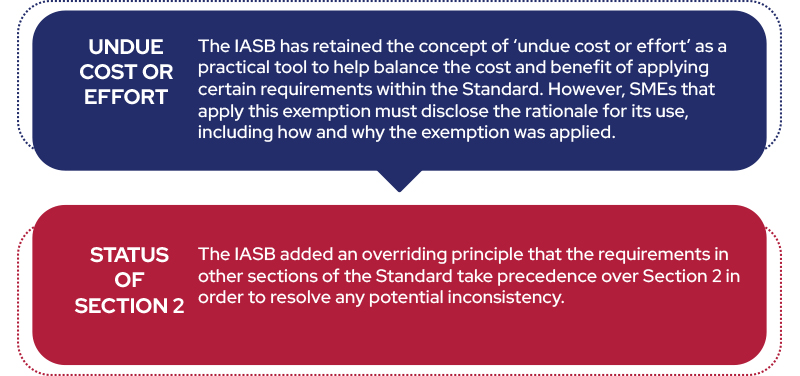

Among the requirements in other sections that take precedence over Section 2 are the new concepts on measurement, presentation and disclosure as well as guidance on derecognition.⁵

Section 9 Consolidated and Separate Financial Statements

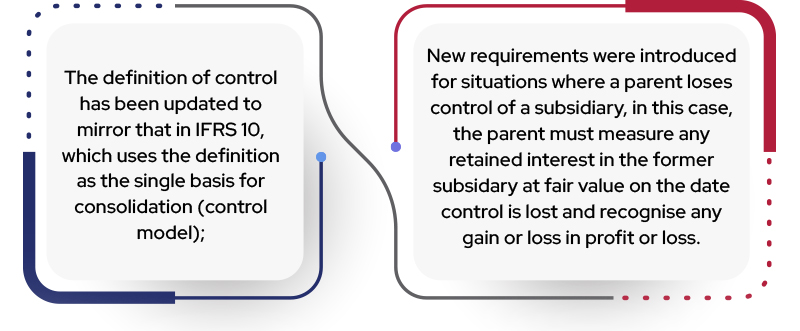

The IASB has revised Section 9 of the Standard to align its requirements with those in IFRS 10. Among the updates are⁶:

The IASB has retained the rebuttable presumption that control exists when an investor holds a majority of the voting rights in an investee, which helps simplify the application of the control model.⁷

Section 11 Basic Financial Instruments (renamed Financial Instruments)

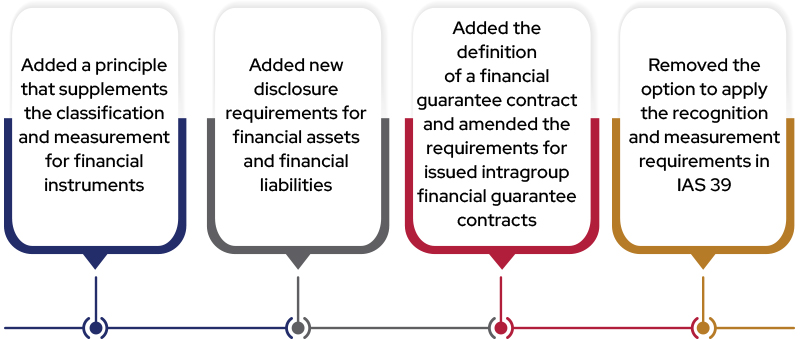

Section 11 Basic Financial Instruments and Section 12 Other Financial Instruments have been merged into a single section which is Section 11. This revised section incorporates selected alignments with IFRS 9 and removes the option given to SMEs to apply the recognition and measurement requirements of IAS 39 Financial Instruments: Recognition and Measurement.

Among the alignments with IFRS 9 are as follows:

Section 11 retains the incurred loss model from the second edition for the impairment of financial assets measured at amortised cost, as well as the hedge accounting and derecognition requirements.⁸ Section 11 also includes a requirement for SMEs to disclose a maturity analysis for financial liabilities, which aligns with IFRS 7 Financial Instruments: Disclosures.

Section 12 Fair Value Measurement

Section 12 is a newly introduced section that consolidates the fair value measurement requirements previously spread across various sections of the second edition of the Standard. This section provides a definition of fair value consistent with IFRS 13 and is broadly aligned with the principles of fair value measurement and disclosure set out therein. Fair value is defined as the price that would be received to sell an asset, or paid to transfer a liability, in an orderly transaction between market participants at the measurement date.⁹

Section 19 Business Combinations and Goodwill

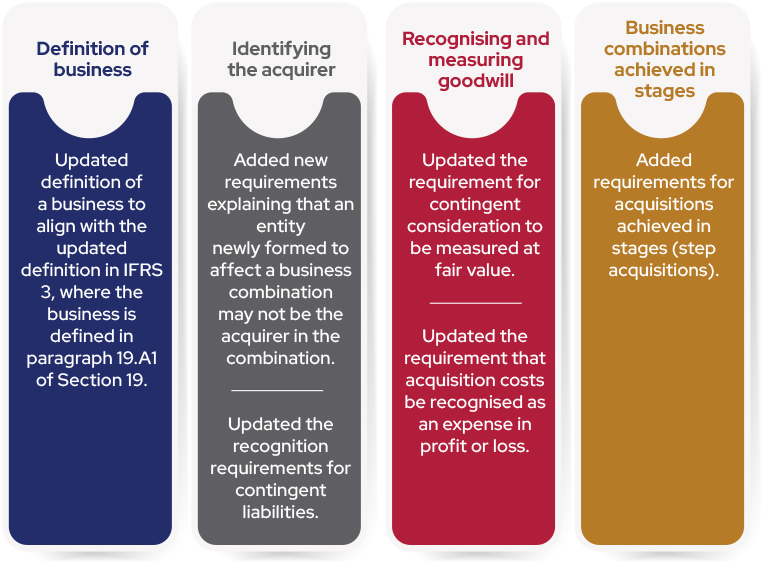

Applying the alignment approach, the IASB revised Section 19 for the following topics:

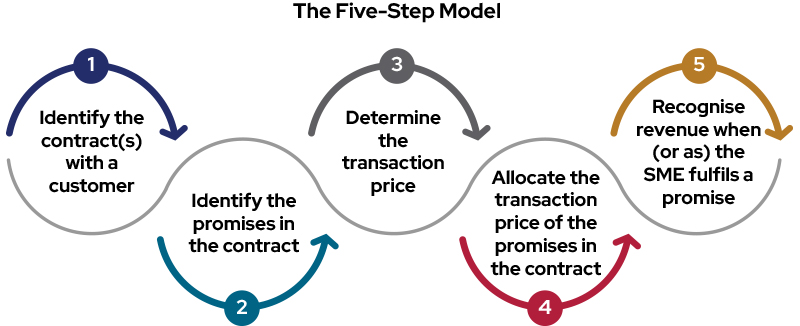

Section 23 Revenue from Contracts with Customers

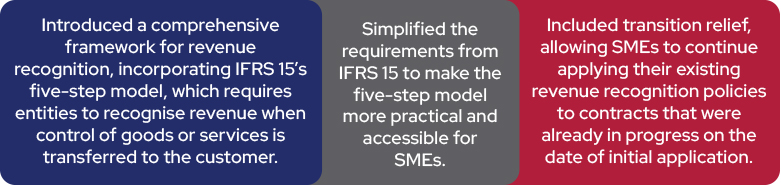

The IASB has revised and renamed Section 23 to bring it into alignment with IFRS 15. As part of this update, the IASB:

Transition

The third edition of the Standard will take effect for reporting periods beginning on or after 1 January 2027. Earlier application is permitted but must be disclosed.

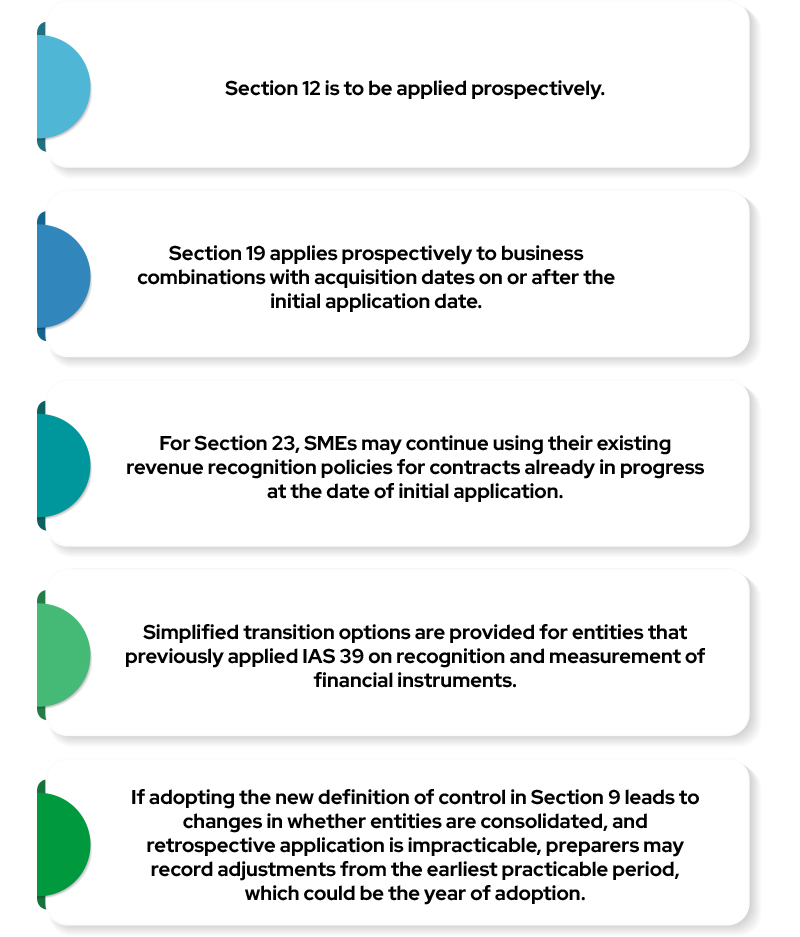

SMEs are required to apply the new and revised requirements retrospectively. However, several transitional relief measures are available, including:

¹ IFRS Foundation, 8 September 2022, IASB Publishes Proposals to update its Accounting Standard for Small and Medium-sized Entities, https://www.ifrs.org/news-and-events/news/2022/09/iasb-publishes-proposals-to-update-its-accounting-standard-for-small-and-medium-sized-entities/

² IFRS Foundation, February 2025, Project Summary, https://www.ifrs.org/content/dam/ifrs/project/2019-comprehensive-review-of-the-ifrs-for-smes-standard/ifrs-standard/project-summary.pdf

³ MASB, 26 May 2025, MASB ED 80 Malaysian Private Entities Reporting Standard (MPERS), https://www.masb.org.my/press.php?id=479

⁴ IFRS Foundation, February 2025, Project Summary, https://www.ifrs.org/content/dam/ifrs/project/2019-comprehensive-review-of-the-ifrs-for-smes-standard/ifrs-standard/project-summary.pdf

⁵ Paragraph 2.2 of Section 2 Concepts and Pervasive Principles of the IFRS for SMEs Accounting Standard, https://www.ifrs.org/content/dam/ifrs/publications/ifrs-for-smes/english/2025/ifrs-for-smes.pdf?bypass=on

⁶ IFRS Foundation, February 2025, Project Summary, https://www.ifrs.org/content/dam/ifrs/project/2019-comprehensive-review-of-the-ifrs-for-smes-standard/ifrs-standard/project-summary.pdf

⁷ Paragraph 9.5 of Section 9 Consolidated and Separate Financial Statements of the IFRS for SMEs Accounting Standard, https://www.ifrs.org/content/dam/ifrs/publications/ifrs-for-smes/english/2025/ifrs-for-smes.pdf?bypass=on

⁸ Paragraph 11.25 of Section 11 Financial Instruments of the IFRS for SMEs Accounting Standard, https://www.ifrs.org/content/dam/ifrs/publications/ifrs-for-smes/english/2025/ifrs-for-smes.pdf?bypass=on

⁹ Paragraph 2.89 of Section 2 Concepts and Pervasive Principles of the IFRS for SMEs Accounting Standard, https://www.ifrs.org/content/dam/ifrs/publications/ifrs-for-smes/english/2025/ifrs-for-smes.pdf?bypass=on

The views expressed are not the official opinion of MIA, its Council or any of its Boards or Committees. Neither the MIA, its Council or any of its Boards or Committees nor its staff shall be responsible or liable for any claims, losses, damages, costs or expenses arising in any way out of or in connection with any persons relying upon this article.