By MIA Professional Practices and Technical

A new chapter is unfolding for small and medium-sized practices (SMPs) in Malaysia as the Suruhanjaya Syarikat Malaysia (SSM) increases audit exemption thresholds through Practice Directive (PD) 10/2024. With the directive’s progressive implementation requiring companies to assess their eligibility based on the “2-out-of-3” criteria for financial periods commencing after its effective date, SMPs now have latitude to redefine their value proposition and strengthen client relationships. This phased approach, highlighted in a recent MIA webinar titled “Navigating Rising Audit Exemption Thresholds – Challenges, Opportunities and Strategic Growth for SMPs”, creates opportunities for firms to expand their service offerings as many companies are expected to qualify for audit exemption, positioning practitioners for continuity and meaningful growth in this evolving landscape.

The initial reaction within the profession is understandably one of concern. A live poll during the webinar asked participants, “How much proportion of your fees do you expect to be affected by the audit exemptions?” The responses painted a concerning picture, with a significant number of firms anticipating a high impact on their revenue streams. This underscores that for many SMPs, statutory audits have been a reliable, recurring source of income.

Industry Readiness: A Mixed Picture

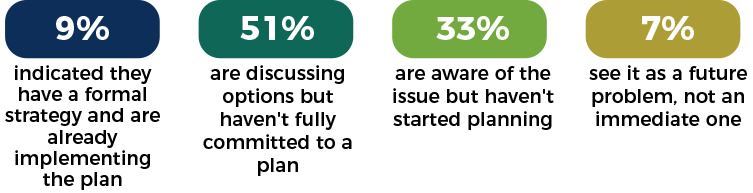

Understanding the profession’s preparedness level is crucial in contextualising this transition. When webinar participants were asked “Which best describes your firm’s current response to recent regulatory changes?”, the results revealed that SMPs are in the early stage of adaptation:

These findings highlight that while almost all firms recognise the need for change, only a small fraction have moved to concrete implementation. This gap between awareness and action represents both a challenge and an opportunity for early movers to establish competitive advantage.

However, as the webinar highlighted, “It is tough to be in public practice these days, but it isn’t easy for our clients either.” As companies grapple with economic pressures, the removal of a mandatory audit can be seen as a welcome relief, reducing their regulatory burden and costs. This shared challenge creates a unique opportunity for SMPs to reposition themselves not only as compliance enforcers but also as strategic partners.

Reframing the Challenge: Audit Exemptions Will Save Audits

In what might be considered an unpopular opinion, webinar speaker Mr Wong Wen Tak, CEO of Grant Thornton Malaysia PLT (Johor Office), proposed a compelling counter-narrative: audit exemptions will save audits. By removing compulsory audits for smaller entities, the value of a voluntary audit is heightened. When a company chooses to undergo an audit despite being exempt, it signals transparency and good governance to stakeholders, elevating the audit from routine compliance to a strategic tool for building credibility.

The key is to shift the conversation with clients from “You must have an audit” to “Here is why an audit, or another form of assurance, is in your best interest.” This requires a proactive and structured approach.

An Immediate Strategic Roadmap: From Impact Assessment to Client-Centric Innovation

The webinar outlined a clear, actionable roadmap for SMPs to navigate this new environment, built on two critical pillars – a thorough impact assessment and strategic service diversification.

Step 1: Assess the Impact with a Client Decision Framework

Before engaging clients, firms must first understand their clientele, which is the foundation of any successful strategy. The “Client Decision Framework” encourages practitioners to segment their clients by asking critical questions:

- Do they meet the “2-out-of-3” thresholds? This is the basic eligibility filter.

- What are their financing structures? Do they have lenders or external investors (not less than 5% of the total number of issued shares) that require audited statements?

- Who are their key stakeholders? Do government contracts, major suppliers, or key customers mandate audits?

- What is their future trajectory? Is the company a high-growth entity likely to exceed the thresholds soon, making an audit inevitable?

- What are their future plans? Are bank loans, mergers and acquisitions, or bringing in new investors on the horizon?

By categorising clients based on these factors, SMPs can prioritise their engagement efforts and tailor their messaging.

Step 2: Proactive Client Engagement and Communication

Waiting for clients to ask about exemption is a reactive strategy. The webinar emphasised the need for proactivity. Firms must decide: When will we start the conversation? Who will lead it? Crucially, this engagement should be framed as a strategic discussion about the client’s future, not just a notification of a regulatory change.

This is the time to discuss the potential future cost and complexity of resuming an audit, such as the need for opening balance audits if a company later loses its exempt status. Transparent communication about these implications builds long-term trust.

Strategic Growth Through Alternate Service Portfolios

The reduction in mandatory audit work creates space for SMPs to diversify into higher-value, more impactful services. The webinar presented a comprehensive spectrum of alternative services that align with the evolving needs of SMEs:

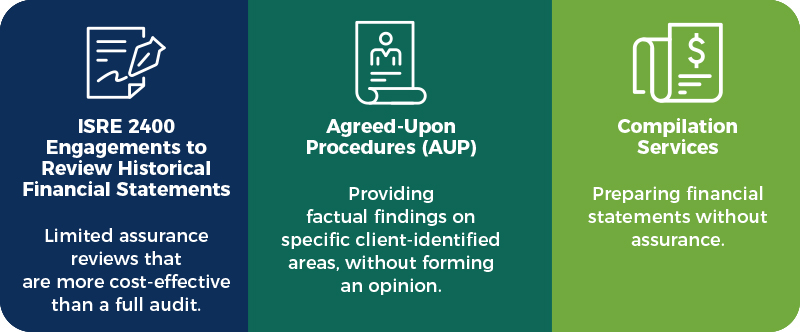

Assurance and Reporting Beyond the Traditional Audit

The market for non-financial assurance is growing. SMPs can offer:

ESG and Sustainability Assurance

Starting with readiness assessments (establishing policies, baselining metrics) and moving towards formal assurance under standards like International Standard on Sustainability Assurance (ISSA) 5000 as demand grows.

Advisory and Outsourcing as a Core Offering

This is where SMPs can become deeply embedded in their clients’ operations, by providing:

- Accounting Outsourcing & Management Reporting — Offering monthly closes, KPI dashboards, and cash flow visibility, integrated with cloud accounting technology.

- Business Advisory & Part-Time CFO Services — Assisting with budgeting, business plans, and preparing packs for investors or lenders.

- Tax Compliance and Advisory — Providing advisory services on increased transactional tax compliance obligations, such as e-Invoicing, Sales Tax, Service Tax and Stamp Duty.

- Internal Audit & Controls Design — Providing risk-based reviews for growing entities needing stronger governance.

Client-Centric Innovation Across the Business Lifecycle

The most forward-thinking SMPs will segment their services not just by client type, but by the client’s stage in the business cycle. This holistic approach allows firms to serve as trusted advisors from cradle to grave:

The rise in the audit exemption threshold is your opportunity to strategically pivot and free up valuable capacity. This shift allows you to move beyond traditional compliance and build a future-proof practice by offering the very services your clients now need most.

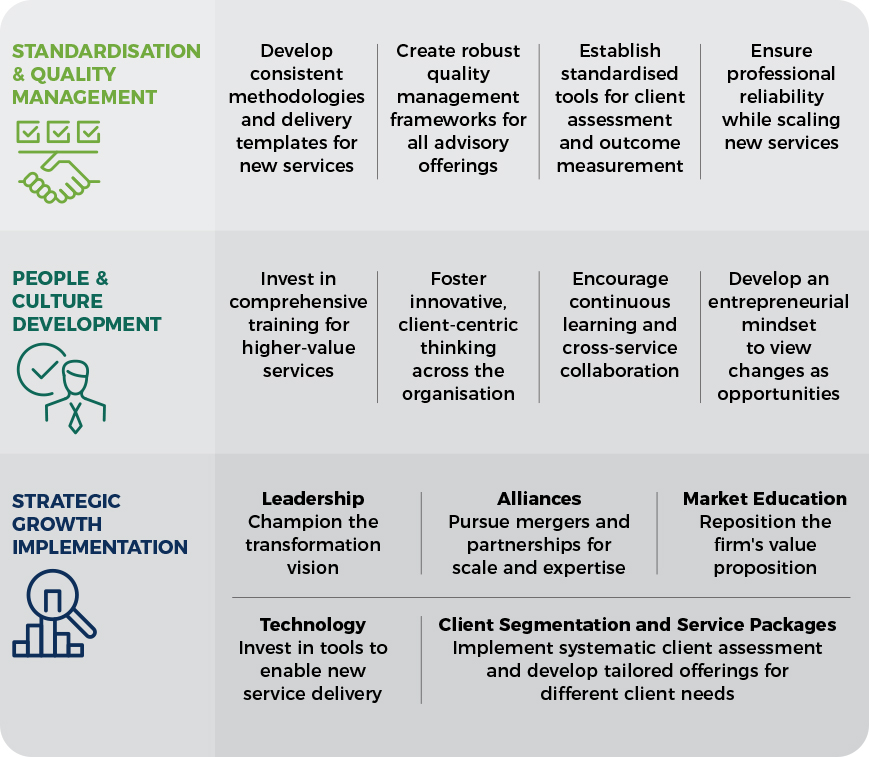

The Execution Roadmap: Building a Future-Ready Practice

To successfully transition from compliance-focused practices to strategic advisory firms, SMPs could consider following this clear execution roadmap built on three core pillars:

This structured approach enables SMPs to effectively reallocate resources from traditional compliance work to sustainable, higher-value advisory services, ensuring long-term relevance and growth in the evolving professional landscape.

Conclusion: The Rise of the Trusted Advisor

The challenge is real, but so is the opportunity. For SMPs willing to embrace this change, the future is not one of diminishment, but of strategic growth and enhanced relevance. As Wong of Grant Thornton aptly concluded during the webinar, “Audit exemption may reduce mandatory work, but it amplifies the importance of trusted advisors — that’s where SMPs can truly thrive.”

A final poll during the webinar asked, “What is your primary strategic focus in response to rising audit exemption thresholds?” The most resonant answer, and the thesis of the session, was the need to diversify into higher-value non-audit services.

This consensus confirms that the rising audit exemption threshold is not an end, but a beginning. It is the catalyst forcing a necessary evolution from a compliance-focused model to a client-centric, advisory-led practice. While the strategic roadmap is clear, the most valuable guidance comes from those who have already completed the journey. In Part 2, we will move from theory to practice, drawing actionable lessons from SMPs in Singapore and Brunei to explore how they not only adapted but emerged stronger, more resilient, and more indispensable to their clients.