By Ahmad Syahazan Yaacob

The accountancy profession stands at an inflection point. As Malaysia advances toward its net-zero commitment by 2050 and implements the National Sustainability Reporting Framework (NSRF) from 2025, accountancy professionals must evolve from traditional financial gatekeepers to strategic enablers of sustainable value creation. This transformation demands not merely new technical competencies, but a fundamental reimagining of our professional identity and societal role.

As sustainability-related engagements continue to expand across the profession, they present both opportunities and practical challenges for Malaysian public practice firms. While 87% of Malaysian accountants recognise sustainability’s importance to our profession, only 14% report high involvement in sustainability activities, according to the Malaysian Institute of Accountants’ (MIA) Member Survey 2024. This disconnect between awareness and action is particularly pronounced among Small and Medium Practices (SMPs), which are the backbone of the public practice sector yet face unique constraints in developing ESG capabilities.

This article provides a practical roadmap for bridging the theory-practice divide, drawing from real-world implementation experiences and the roadmap established by MIA. The path forward requires acknowledging our challenges while leveraging our unique strengths as accountancy professionals to become trusted advisors in Malaysia’s sustainability transformation.

What Businesses Now Expect from Accountancy Professionals

The implementation of mandatory NSRF requirements is reshaping stakeholder expectations of accountancy professionals. Main Market listed companies with market capitalisation exceeding RM2 billion began reporting under IFRS S1 and S2 in January 2025, with phased expansion to cover all listed entities and approximately 260 large non-listed companies by 2027 (The Edge Malaysia). This regulatory shift creates immediate demand for accountancy professionals who can operate confidently at the intersection of financial and sustainability reporting.

Beyond compliance, businesses increasingly seek accountancy professionals who can translate sustainability data into strategic insights. Today, organisations are no longer asking merely how to report emissions; they are seeking guidance on integrating carbon pricing into capital allocation decisions, quantifying climate risks in financial projections, and demonstrating how sustainability initiatives contribute to enterprise value. The recent case of PETRONAS, which achieved USD1.3 billion in sustainability perception value through systematic ESG integration, illustrates how robust sustainability accounting drives both stakeholder trust and financial performance (Brand Finance 2025).

Malaysian SMEs, which make up 98.5% of all business establishments (SME Corp), are experiencing rising pressure as global supply chains demand ESG compliance. For instance, a manufacturer supplying to European markets was recently required to establish a Scope 3 emissions tracking system to meet evolving EU regulatory expectations. This example reflects a broader trend: sustainability-related competencies are now essential for SMEs and their advisors to maintain business relationships and continued access to international markets.

The shift extends beyond technical reporting and now includes strategic advisory capabilities. Boards and management increasingly expect accountants to conduct scenario analysis for climate transitions, develop internal carbon pricing mechanisms, and design sustainability-linked KPIs that are tied to executive compensation. Meeting these expectations requires accountants to synthesise environmental science, risk management, and financial analysis into coherent strategic recommendations.

Challenges Facing Small and Medium-sized Practices

Despite growing demand, SMPs continue to face substantial barriers in building credible sustainability/ESG service offerings. Feedback gathered from engagements with practices across Malaysia indicates three recurring categories of challenges.

Technical capacity constraints remain the most immediate obstacle. Unlike large firms that can establish dedicated sustainability departments, SMPs must build capabilities within existing resource constraints. A recent MIA Survey on Understanding Sustainability in the Accountancy Profession revealed that 69% of practitioners cite inadequate ESG knowledge as their primary barrier. The complexity of carbon accounting, which requires understanding of chemistry, engineering, and environmental science alongside traditional accounting principles, can be overwhelming for practitioners trained exclusively in accounting and financial reporting. Furthermore, the proliferation of frameworks (GRI, SASB, TCFD, ISSB), each with distinct methodologies and disclosure requirements, creates confusion and makes it difficult for SMPs to prioritise their limited training efforts.

Data quality challenges further compound technical difficulties. Unlike financial information, ESG data often lacks standardisation and robust internal controls. In many early-stage sustainability reporting exercises, organisations often discover inconsistencies, such as energy consumption data from different sites using inconsistent units, emission factors varying by source, and social metrics lacking clear definitions. The challenge intensifies with Scope 3 emissions, mandatory from 2027, which require data from suppliers who may be unwilling or unable to provide reliable information. Manual data collection processes, still common among Malaysian SMEs, introduce additional errors and inconsistencies that undermine the credibility of sustainability reporting.

Ambiguities within the assurance framework add another layer of complexity. Although the International Standard on Sustainability Assurance (ISSA) 5000 provides comprehensive standards for sustainability assurance, its principles-based approach requires substantial interpretation and professional judgement. SMPs commonly grapple with issues such as maintaining independence when they provide both advisory and assurance services to the same client, determining the appropriate procedures for limited versus reasonable assurance, and competing with non-accounting firms that offer sustainability services without comparable professional standards. The absence of clear precedents and limited guidance on proportionate application for smaller engagements further contributes to uncertainty about the expected level of service quality.

These challenges are not insurmountable, but addressing them effectively requires systematic approaches and institutional support.

MIA’s Strategic Response

MIA has developed a comprehensive infrastructure to support members on their sustainability journey. The MIA Sustainability Blueprint for the Accountancy Profession launched in June 2024, followed by the MIA Sustainability Roadmap in January 2025, provides a structured pathway for capability development across 169 specific initiatives.

Through its collaboration with the Business Council for Sustainable Development (BCSD) Malaysia, MIA offers a structured seven-module training programme covering sustainability fundamentals, carbon accounting, materiality assessment, and assurance standards. These programmes, eligible for RM7,000 tax relief under Budget 2025, support practitioners in enhancing sustainability competencies in line with national reporting requirements.

MIA also recently launched the MIA Certificate of Sustainability for Accountants. This is a structured three-day learning pathway designed to equip accountancy professionals, finance leaders, and sustainability practitioners with essential technical and practical competencies required for ESG and sustainability reporting, climate-related disclosures, assurance, and strategic advisory.

The Certificate of Sustainability was launched at yet another key platform for developing sustainability competencies – the inaugural MIA Sustainability Showcase 2025 which connected close to 600 accountancy professionals and experts under one roof, and focused on Sustainability Frameworks, Regulations, and Reporting and Sustainability in Practice. The inaugural Sustainability Showcase was offered on a complimentary basis, supported by MIA’s RM1.1 million allocation for FY2025/2026 to enhance members’ development, skills and future-readiness.

To enhance ethics as the foundation of the profession, MIA issued ISSA 5000 and International Ethics Standards for Sustainability Assurance (IESSA) in March and June 2025 respectively. These standards, effective for assurance engagements for periods beginning on or after 15 December 2026, position Malaysian practitioners ahead of many global counterparts. This proactive stance provides over one year for practices to develop methodologies and build capabilities before mandatory application. The standards explicitly include proportionality provisions that support SMPs by addressing concerns about scalability and resource requirements.

Beyond training, MIA provides practical technical support through tools and guidance. The Interactive Small Business Sustainability Checklist helps practices assess readiness and identify capability gaps. MIA also produces media content clarifying emerging issues, as well as provides consultation responses to ISSB and other standard-setters, to ensure that Malaysian perspectives are reflected in global developments. The strong emphasis on sustainability at the MIA International Accountants Conference 2024 and 2025, which attracted over 3,500 participants per year, further underscores the profession’s commitment to collective capability building.

A Practical Roadmap

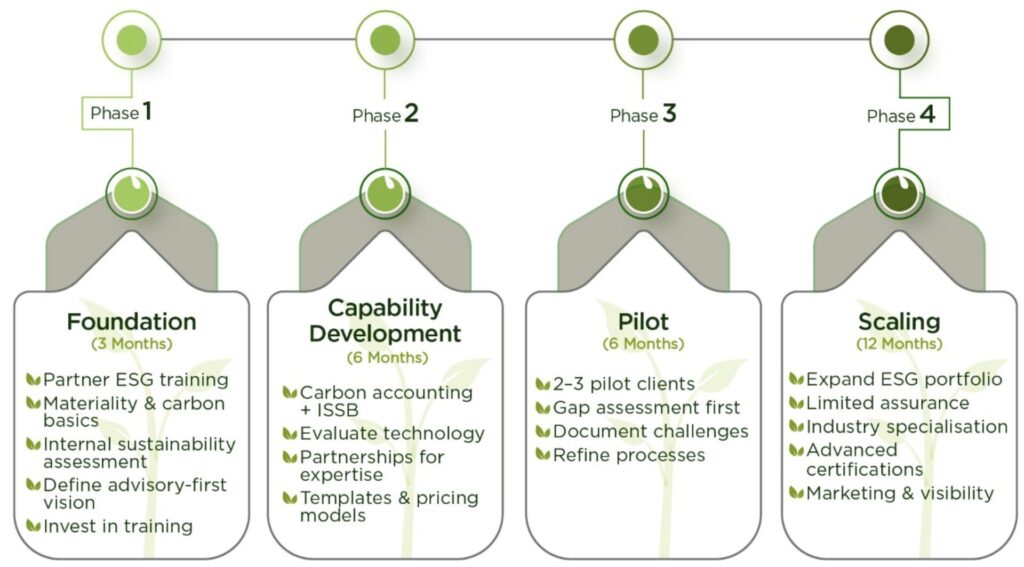

Experience from successful implementations across multiple practices shows that a phased approach covering foundation, capability development, pilot implementation and scaling, supports systematic capability development while effectively managing resource constraints.

The foundation phase, typically lasting three months, establishes the baseline understanding and builds organisational commitment. Partners begin with fundamental ESG training to grasp core concepts including materiality, carbon accounting principles and regulatory requirements. Conducting sustainability assessments within the practice provides practical experience while signalling commitment to clients. Initial investment should focus on essential training rather than expensive software systems.

The capability development phase, typically spanning six months, focuses on building technical expertise and service infrastructure. Invest in comprehensive training on carbon accounting methodologies and ISSB standards relevant to your client base. Evaluate technology solutions appropriate for your practice size; spreadsheet-based tools may suffice initially before progressing to specialised platforms. Establish partnerships with environmental consultants or larger firms to access specialised expertise when needed. Develop standardised engagement letters, pricing models, and quality control procedures leveraging adaptation from existing financial audit methodologies.

The pilot implementation phase, typically lasting six months, focuses on testing service delivery with selected clients. Identify two to three clients facing immediate ESG requirements, ideally from different industries to maximise learning. Begin with gap assessments and advisory services before progressing to assurance engagements. Carefully document challenges, solutions and lessons learned to refine your service delivery approach. Implement internal review procedures to ensure service quality and compliance with professional standards.

The scaling phase, typically spanning twelve months, focuses on expanding the client base and enhancing service sophistication. Gradually progress from advisory to limited assurance services as capabilities strengthen. Develop industry specialisations by leveraging existing client relationships and sector expertise. Invest in advanced training for key staff including international sustainability certifications where relevant. Implement marketing strategies that showcase ESG capabilities and successful client engagements.

The above phases are summarised in the following diagram.

ESG Practice Development Roadmap for SMPs

Transforming Challenges into Competitive Advantages

SMPs possess inherent advantages in sustainability service delivery but these advantages are often overshadowed when focusing on resource constraints. Deep client relationships built over years of service create trust essential for navigating sensitive sustainability transformations. Intimate knowledge of client operations, gained through recurring engagements, provides context for identifying material ESG issues and improvement opportunities. Additionally, their agility enables rapid service adaptation without the bureaucratic constraints faced by larger firms.

The key lies in leveraging existing competencies while systematically building new capabilities. Financial analysis skills transfer directly to sustainability reporting, particularly in quantifying ESG impacts on enterprise value. Audit methodologies provide frameworks for ESG data verification and control assessment. Risk management expertise applies to climate scenario analysis and transition planning. Tax knowledge becomes valuable as carbon pricing mechanisms and green incentives proliferate.

Success requires embracing collaborative approaches that complement individual practice limitations. Partnering with environmental consultants provides technical expertise while maintaining client relationships. Joining practice networks enables resource sharing and peer learning. Engaging with MIA programmes provides continuous professional development and technical support.

The Path Forward

The transformation from compliance-focused reporting to strategic sustainability stewardship represents both professional imperative and market opportunity. As Malaysia progresses toward developed nation status and net-zero ambitions, accountants must lead rather than follow this transition.

This evolution demands commitment to continuous learning, courage to venture beyond traditional boundaries, and conviction that our profession’s core values (integrity, objectivity, and professional competence) remain relevant in addressing humanity’s greatest challenges. The roadmap presented provides structure for this journey, but success ultimately depends on individual and collective willingness to embrace change.

The gap between sustainability theory and practice will not close automatically. It requires deliberate action by practitioners, sustained support from professional bodies, and recognition that our traditional skills, properly evolved, position us uniquely to help organisations create sustainable value. By embracing this transformation, Malaysian accountants can strengthen their relevance, elevate the profession, and contribute meaningfully to the nation’s sustainable development agenda.

This article reflects the views of Ahmad Syahazan Yaacob, MIA Vice-President, Member of the MIA Small and Medium Practices Committee, and the Managing Partner of Aljafree Salihin Kuzaimi PLT.