By Auto Count Team

As Malaysia rolled out mandatory e-Invoicing in phases from 2024, accountancy professionals are in a pivotal position to assist small-and-medium enterprises (SMEs) in navigating the shift from fragmented, manual records to structured, compliant digital data. This isn’t a task to push onto your 2026 to-do list—it’s something to act on now. Early adoption minimises last-minute disruptions, reduces compliance risks, and positions your clients for long-term success.

The Biggest Challenge for Accountancy Professionals

The reason to act now is clear: many SMEs still rely on outdated processes such as paper receipts, Excel spreadsheets, and handwritten sales logs. Often, these transaction records are only submitted to accountants once a month, leading to delayed, reactive record keeping.

This fragmented approach lacks the timeliness and accuracy required under LHDN’s e-Invoicing framework, where data transparency and completeness are critical. For accountants, the manual consolidation of these records is not only time-consuming but also increases the risk of errors, especially during tax filings or month-end closings.

From Manual to Digital: The “How-To” of Data Transformation

Technology is the key to streamlining this transition, enabling efficient and accurate e-Invoice submission. Here’s how digitalisation transforms your workflow:

Automated Data Capture

Integrated systems like mobile Point of Sale (POS) tools automatically record transactions, including e-wallet payments, cash sales, and credit sales. This eliminates duplicate data entry and simplifies end-of-month reporting.

Data Mapping and Cleansing

Before data is submitted to the Inland Revenue Board Malaysia (LHDN), it must be mapped to specific e-Invoice fields and cleaned for consistency. Automation helps flag incomplete or inconsistent data early, reducing delays and improving accuracy.

System Integration

Many accounting software programs can integrate directly with POS systems and LHDN’s MyInvois portal via APIs, allowing data to flow seamlessly from point-of-sale to submission. This reduces manual uploads and minimises errors.

Real-Time Validation

Digital systems perform validation checks based on LHDN’s requirements before submission, catching errors like incorrect formats or missing fields. This proactive step reduces invoice rejections and ensures smoother compliance with regulations.

The Accountant’s Evolving Role: Digital Advisor

As compliance becomes more digitised, your role is transforming—into digital enablers for businesses.

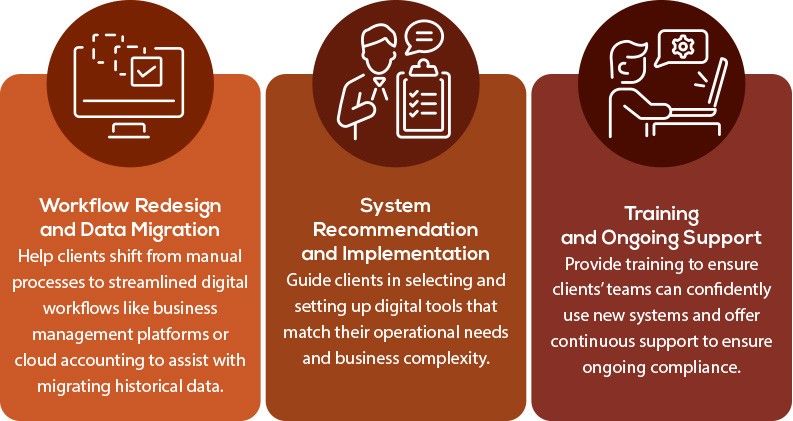

Expanding your service offering will increase your professional value and strengthen client relationships. Consider focusing on:

Elevating Your Advisory Role in the Digital Economy

Malaysia’s e-Invoicing rollout is more than a regulatory update; it’s an opportunity for accountancy professionals to take on a more strategic role.

By identifying manual data touchpoints and introducing the right digital solutions, you not only ensure compliance but also build stronger, future-ready client partnerships.

Now is the time to lead. Embrace technology like cloud accounting to guide your clients, and be the trusted advisor they need in the digital economy