by the MIA Financial Reporting Assurance Department

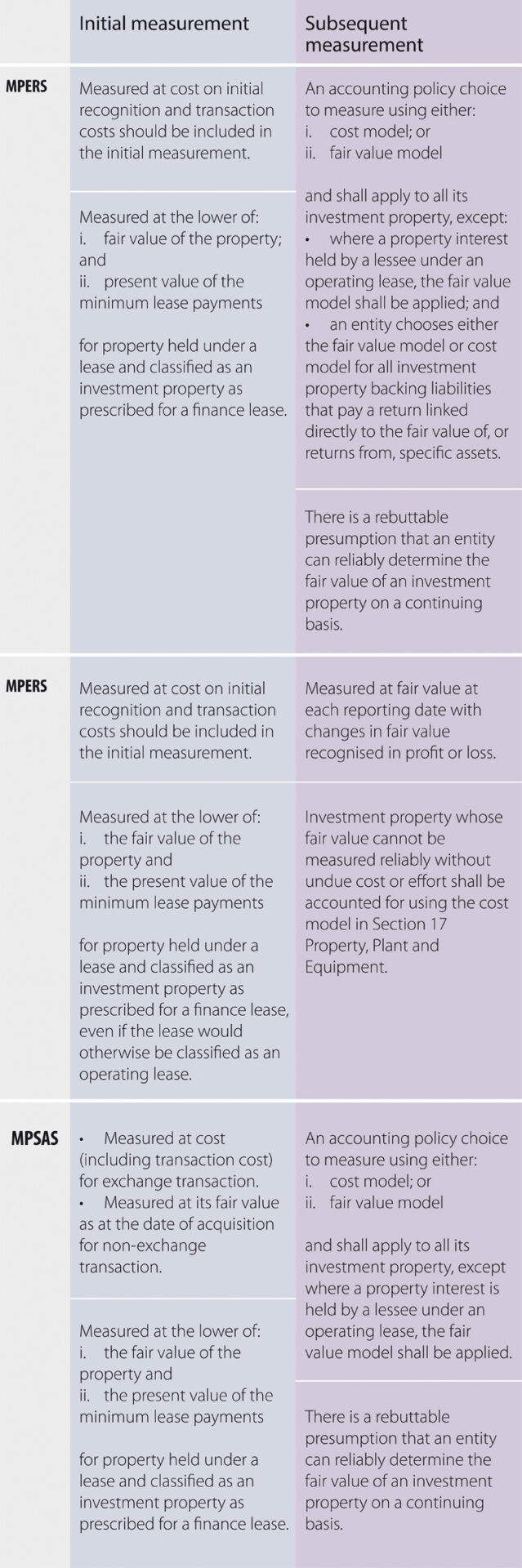

In this article, we analyse the accounting treatment for investment property under Malaysian Public Sector Accounting Standard (MPSAS) 16, Malaysian Financial Reporting Standard (MFRS) 140 and Section 16 of Malaysian Private Entities Reporting Standard (MPERS).

This analysis focuses on the significant requirements in MPSAS that are similar and different from the requirements in MFRS and MPERS in relation to (i) recognition; (ii) measurement; (iii) disclosures and (iv) first-time adoption. This comparison does not discuss the requirements in MFRS or MPERS that are not available in MPSAS.

Definition

Investment property is property (land or a building – or part of a building – or both) held by the owner or by the lessee under a finance lease to earn rentals or for capital appreciation, or both, rather than for:

- Use in the production or supply of goods or service, or for administrative purposes; or

- Sale in the ordinary course of operations.

Recognition

The following table discusses the recognition principle in the three frameworks:

MFRS, MPSAS and MPERS

Investment property shall be recognised as an asset when, and only when:

- it is probable that the future economic benefits that are associated with the investment property will flow to the entity; and

- the cost of the investment property can be measured reliably.

The three frameworks are similar in relation to the depreciation and impairment with no significant differences noted. For impairment, both MPERS and MFRS have similar requirements. However, under MPSAS, an entity has to determine whether the asset is a cash-generating1 or non-cash generating2 asset. If the asset is a cash-generating asset, the entity applies the requirements in MPSAS 26 Impairment of Cash-Generating Assets which are similar to MPERS and MFRS with no significant differences noted. While if the asset is a non-cash generating asset, the requirements in MPSAS 21 Impairment of Non-Cash-Generating Assets should be complied with. A comparison of the impairment standards will be discussed in future issues.

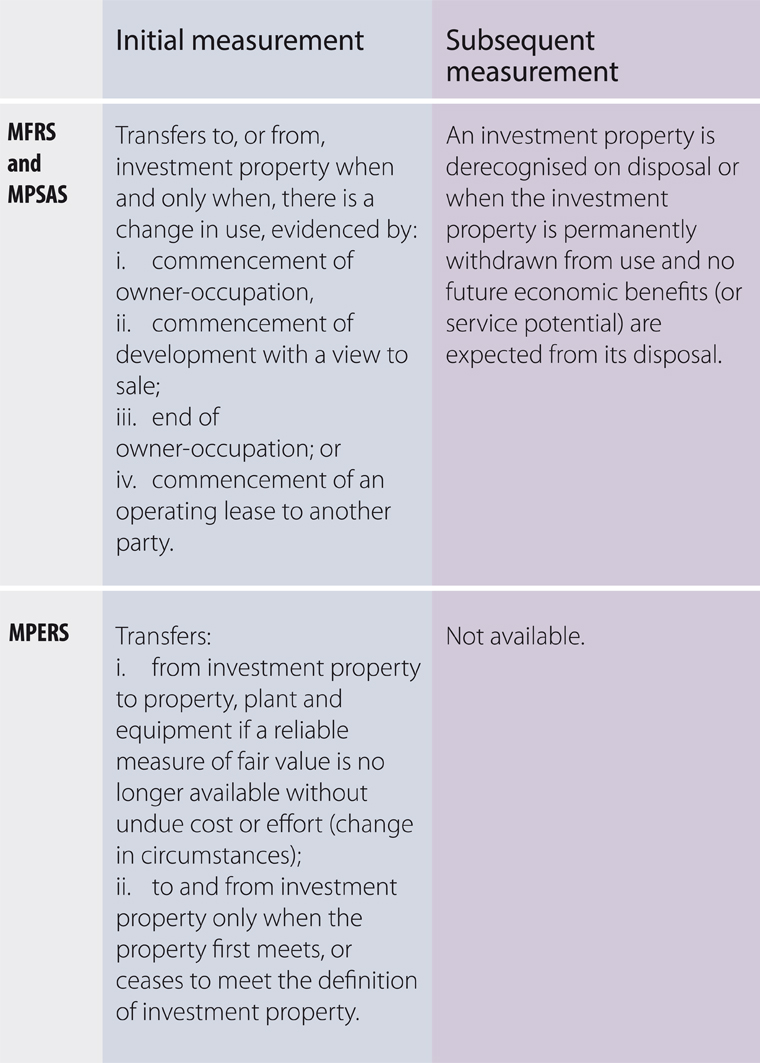

Transfers and disposal

In relation to transfers and disposal, the three frameworks stipulate the following:

Disclosure

MPSAS 16, MFRS 140 and Section 16 of MPERS have some similar requirements in relation to disclosure. Both MPSAS 16 and MFRS 140 have some additional requirements on disclosure compared to Section 16 of MPERS.

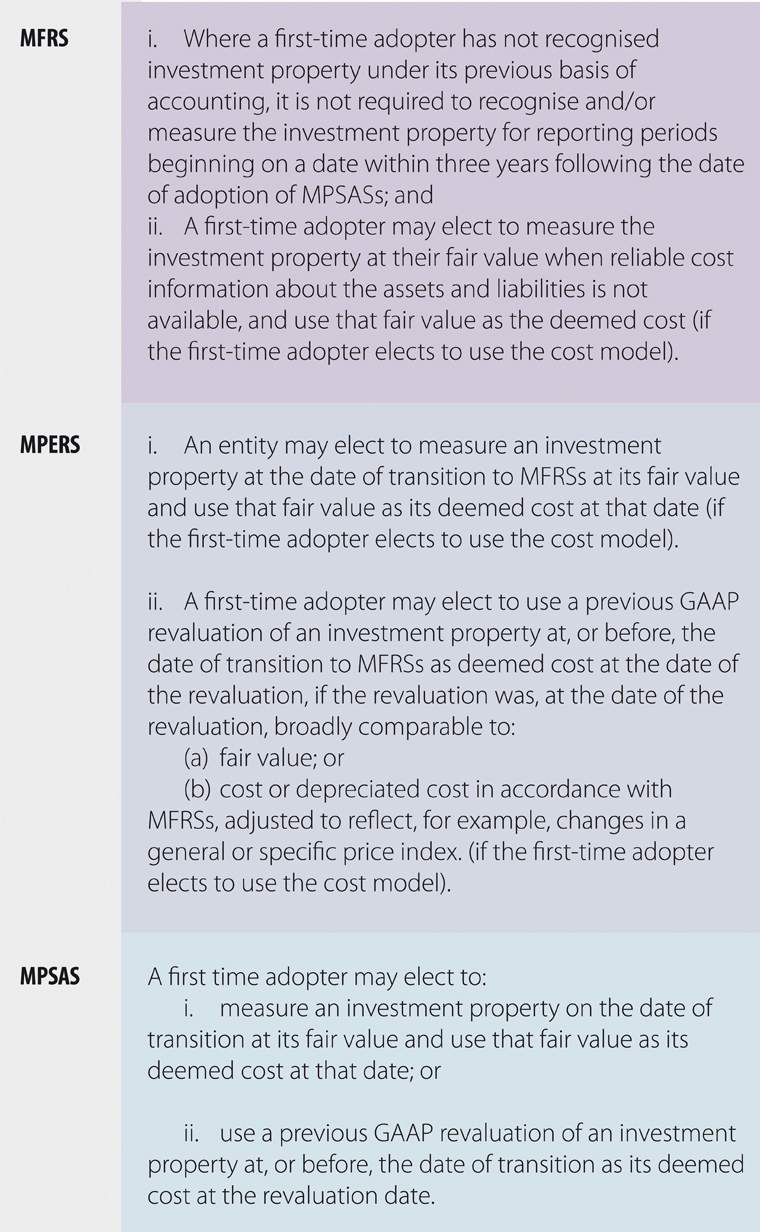

First-time adoption

General requirements in relation to first-time adoption in relation to investment property are as follows: