In its quest to develop the profession, MIA is helping to equip and upskill audit sole practitioners to become more resilient and relevant.

by the Accountants Today Editorial Team

As the primary providers of financial services to small and medium enterprises (SMEs) that are the backbone of the Malaysian economy, small and medium practitioners (SMPs) play an extremely important role in the business ecosystem. They are also a critical part of MIA’s membership body.

“Currently, there are over 1,400 audit firms in Malaysia. Approximately 70 per cent of them are small practices i.e. audit firms in sole proprietorship,” said MIA President Salihin Abang at the inaugural MIA Forum with Audit Sole Practitioners 2018.

Recognising their value in business, MIA has devoted substantial time and resources to implementing targeted initiatives to support the SMPs.

For instance, MIA recently organised seven engagement sessions with SMPs, with the theme of Members’ Dialogue with MIA President and Technical Updates. To broaden outreach and help MIA leadership put their finger on the pulse of members’ concerns, MIA held these sessions in Kuala Lumpur as well as the key regional markets of Penang, Sabah, Sarawak, Ipoh, Melaka and Terengganu. These sessions were very well received and attended by 919 members, with over 40% of participants coming from Sabah and Sarawak.

Together with MICPA, MIA organised workshops on Practical Auditing Methodology for SMPs. As of end May 2018, 38 workshops have been held – 21 in Kuala Lumpur and 17 in regional locations and these were attended by close to 1,500 participants (Please refer to the article on Enhancing SMPs: Workshops on Audit Guide for Practitioners (AGP) and Illustrative Audit Working Papers (IAWP) on pages 22-24).

MIA is also looking into ways to encourage the adoption of technology among SMPs. SMPs are encouraged to invest in suitable technologies to enhance their effectiveness and efficiency, such as audit software that can automate routine processes, improve accuracy and reduce workloads.

MIA hopes that these initiatives will help to strengthen and upskill SMPs to overcome their challenges and deliver highly valued and relevant services to their clients. Among the challenges currently facing SMEs are “higher audit concentration (meaning that their practice is not sufficiently diversified), staff retention, technology adoption, limited access to funding and lack of business opportunities overseas,” enumerated Salihin, who is himself the founder and partner of a SMP.

By developing and regulating audit sole practitioners, MIA is optimistic that SMPs in the market will be able to enhance audit quality, improve regulatory compliance and good governance, and strengthen their infrastructure and resources to become more resilient and more relevant.

Enhancing Audit Quality Through ISQC 1

Reliable structure is the key to quality audit.

“To consistently deliver high quality audits, it is of paramount importance for audit firms to have a proper structure and system in place,” said Dato’ Narendra Jasani, Vice-President and Chairman of the SMP Committee, MIA, speaking at the recent inaugural MIA Forum with Audit Sole Practitioners 2018.

Audit firms are required to comply with the International Auditing and Assurance Standards Board (IAASB)’s International Standard of Quality Control (ISQC) 1, which provides firms with a structure to raise their quality and promotes a culture that places quality at the forefront of the firms. Systems of quality control in compliance with the ISQC are required to be established by 1 January 2010 for audit firms in Malaysia

Benefits of ISQC 1

By adopting ISQC 1, SMPs stand to gain tremendous benefits, especially from the implementation of robust quality controls that can reduce their risks. “Sound firm-wide quality controls reduce the risks of inappropriate engagement reports being issued and would therefore reduce the exposure to the risk of liability,” advised Dato’ Narendra.

At the operational level, quality control policies and procedures can help firms to retain talent. People are the lever to implementing ISQC 1 successfully, he stressed. Therefore, firms considering ISQC 1 are encouraged to send their staff for the relevant training. “This would contribute to higher staff morale and motivation, and indirectly lead to improved staff retention rates.”

Implementing an effective control regime need not be sophisticated or scary. “Quality controls should be tailored to fit the operating characteristics, size and nature of the firms.”

While ISQC 1 adoption might require some investments in terms of time and costs, in the long run, the benefits of implementing ISQC 1 will far outweigh the costs. “The ISQC 1 is an effective and workable solution to improve audit quality,” said Dato’ Narendra.

Based on the results of MIA Practice Review, many practitioners believe that ISQC1 is too complicated for their small practices. Dato’ Narendra urged them to change this mindset because they risk “producing low-quality work that does not comply with professional standards. In the long run, this may jeopardise their livelihood as their professional work has to be monitored closely and their licences might be suspended or withdrawn by the Ministry of Finance,” he warned.

Collaborating for ISQC 1 Success

While there are challenges to ISQC 1 implementation, MIA stands committed to supporting audit sole practitioners on their ISQC 1 journey. MIA especially recommends that firms collaborate strategically with one another to ease ISQC 1 implementation. Firms can form industry alliances with similar firms, establish reciprocal arrangements with another firm, or even do a merger and acquisition (M&A).

By collaborating with other firms, small practitioners can beef up resources and construct an effective monitoring programme for their quality control systems. If a firm belongs to a network of firms, it could also engage practitioners from its peers within the network to inspect and review its engagements.

Another option is to enrol in the MIA-MICPA Quality Assessment Programme (QAP) to support the monitoring process. The QAP could serve as one of the monitoring controls of a firm by identifying deficiencies in the quality of audit procedures performed, documentation and the overall quality control procedures of the firm. Subsequently, the QAP can recommend action plans to improve the quality of the firm and its engagements. (Read more about the QAP and one firm’s experience on pages 26-27).

MIA strongly encourages the use of technology to help firms improve monitoring and quality. “Consider implementing a practice management system or using audit software for efficient performance of engagements. Currently there is an array of practice management software and audit software in the market to choose from,” advised Dato’ Narendra. He added that MIA is looking at ways to help smaller firms manage the costs of technology adoption, perhaps through bulk purchases of audit software or other form of collaboration.

Practice Review: An Enhanced Regime for Audit Practitioners

MIA has finetuned its Practice Review regime to improve the effectiveness of the PR process. “The Practice Review process is very important. If there are no consequences to failing Practice Review, nobody will take it seriously and the bad hats will affect the entire profession. Practice Review is not a pleasant job, but someone must do it for the good of the profession,” said Huang Shze Jiun, Chairman of the Practice Review Committee at the recent Forum with Audit Sole Practitioners, the first of an inaugural series of engagements with this important segment of the profession.

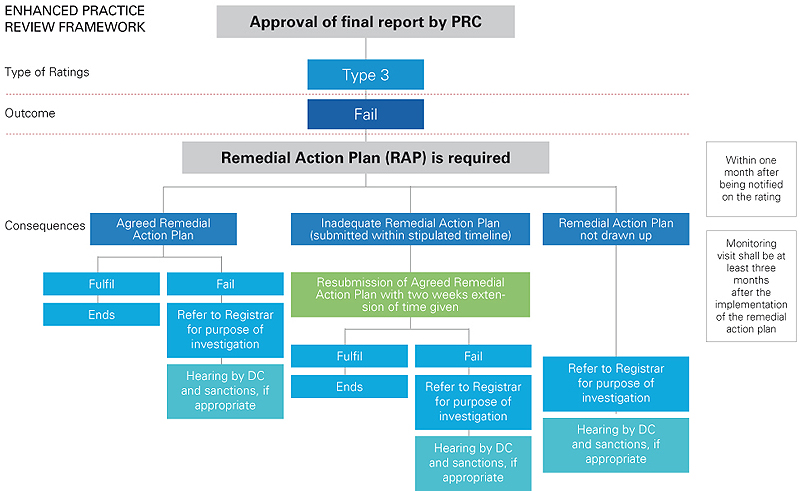

To reassure participants about the forthcoming changes, he stressed that the enhanced Practice Review is meant to be “corrective and not punitive. We are not out to punish but to regulate in order to bring up audit quality. MIA aims to make Practice Review a premier driver of audit quality for the profession in Malaysia.” Other objectives of Practice Review are to work with audit firms to enhance their compliance with professional standards and legal and regulatory requirements. Crucially, the enhanced regime aims to reduce the Practice Review failure rate (Type 3 firms) to 30% over a three-year period ending FY2019/2020 and subsequently to 10% thereafter.

Citing findings from previous Practice Review cycles, Huang pointed out some shortcomings impacting audit quality. These include the non-performance of stocktake, and the non-reconciliation of bank statements and trade debtors, much less sampling. Importantly, audit practitioners should assess and evaluate the tone at the top. They should address the relationship between firm culture and tone at the top for an effective quality control system, as internal culture shaped by strong tone at the top that focuses on audit quality is crucial. There is a tendency for partners and owners to pin blame for audit deficiencies on staff, but while practitioners “can delegate the work, they cannot delegate the responsibility,” he said.

Under the enhanced regime, firms will no longer be sampled at random for Practice Review. Firms at high risk will be prioritised for review first than those at lower risk. Eventually all firms will be reviewed.

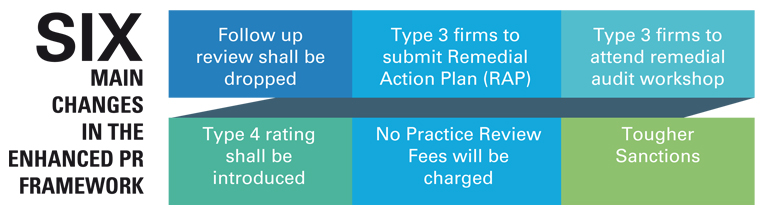

The changes to the Practice Review framework were designed to demonstrate MIA’s willingness and ability to regulate its member firms effectively and stay relevant, said Huang. There are six main changes to the framework:

- Tougher sanctions

- The abolition of fees for Practice Review i.e. no charge

- Follow-up reviews to be dropped

- Type 3 firms to submit a Remedial Action Plan

- Type 3 firms to attend a remedial audit workshop

- Introduction of a Type 4 rating

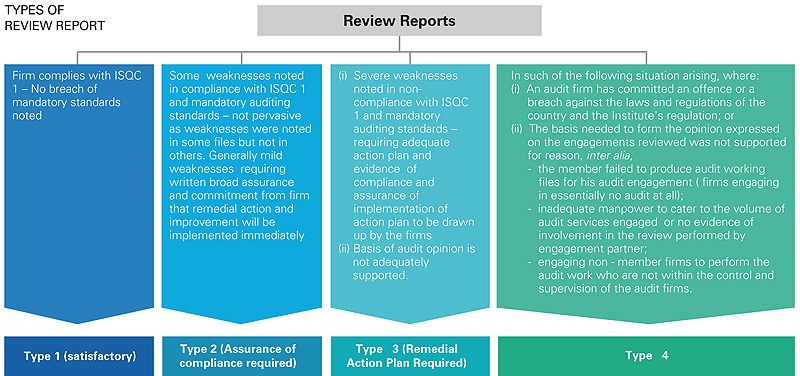

With the revisions, firms will fall into one of the four categories: Type 1 – pass, Type 2 – marginal pass, with assurance to be provided by AF, Type 3 – unsatisfactory with required follow-up, and Type 4 – failure – referred for disciplinary action.

Type 3 firms are required to submit a Remedial Action Plan because MIA wants to institute a paradigm change in audit quality and culture. “We don’t want firms to just look at their symptoms. A lot of failures are tied back to key deficiencies. The root cause analysis shows that what causes all these symptoms is a lack of tone from the top. If the culture of audit quality is in place, these symptoms will not arise.” Key areas for improvement, said Huang, are improving documentation and quality of staff, and being more selective in choosing quality clients. “If it is not documented, it is not done!” he emphasised.

Type 3 firms are advised to comply with the ISQC 1 to bring themselves up to Type 1 and Type 2 levels. “Go back to the ISQC 1 not just to address symptoms but to address fundamental issues,” said Huang. Firms are expected to draft an acceptable Remedial Action Plan or risk being referred to MIA’s Investigation and Disciplinary Committees. “We want to see firms taking the right steps so that they don’t bring down the profession.”

Type 4 firms are beyond help. These include cases of firms charging audit fees but not doing the work. “These are immediately deemed as failure cases which will be directly referred to the Investigation Committee and the Disciplinary Committee.”

To make sanctions more punitive for recalcitrant firms, MIA has proposed tougher sanctions and fees, but these are dependent on legislative amendments to the Accountants Act 1967. Tougher sanctions will add bite to Practice Review and make it more effective. “If firms feel that there are no consequences for bad behaviour, they will take it lightly,” said Huang. In the meantime, he warned that MIA will no longer support the renewal of licences for failed Type 3 and Type 4 firms and these offenders face possible suspension of membership.