By Nurul Hidayah Zailani

The Malaysian Business Reporting System (MBRS) is a submission platform introduced by the Companies Commission of Malaysia (SSM) for companies incorporated in Malaysia to submit: annual return, financial statements and exemption application as required under the Companies Act 2016. The MBRS submission platform is based on the eXtensible Business Reporting Language (XBRL) format.

The Malaysian Business Reporting System (MBRS) is a submission platform introduced by the Companies Commission of Malaysia (SSM) for companies incorporated in Malaysia to submit: annual return, financial statements and exemption application as required under the Companies Act 2016. The MBRS submission platform is based on the eXtensible Business Reporting Language (XBRL) format.

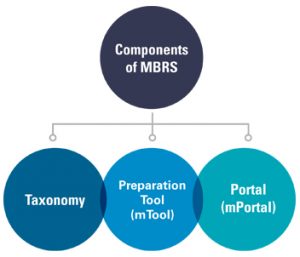

The MBRS submission platform consists of three main components: (1) the XBRL taxonomy; (2) the preparation tool (known as mTool); and (3) the portal (known as mPortal).

Here are some FAQs to familiarise accountants with the MBRS:

Why is the XBRL important for businesses and other stakeholders (e.g. regulators, investors, banks)? How would they benefit from the XBRL?

The XBRL increases the usability of financial statement information whereby businesses, investors, regulators, policy makers and other stakeholders can utilise financial and non-financial information in a timely, systematic and efficient way for policy and economic decisions.

In Malaysia, other regulators such as Bank Negara Malaysia and Securities Commission have already leveraged on the XBRL to collect certain data relating to financial institutions as well as capital market. In other jurisdictions, the XBRL is used not only for submission of information but also for enforcement and surveillance.

What are the practices in other jurisdictions with regard to the XBRL?

The XBRL is used by more than 100 regulators, governments, data providers, analysts, investors and accountants in over 60 countries worldwide. For example:

- The Securities and Exchange Commission of the United States (US SEC) uses the XBRL to analyse listed companies and securities’ compliance with disclosure obligations as well as to identify outliers that may indicate accounting fraud.

- The Emirates Securities and Commodities Authority (ESCA) uses the XBRL for listed companies to submit quarterly XBRL-based financial statements to enhance transparency for the UAE market, particularly to allow foreign investors to view the financial statements in a range of languages.

- The UK Companies House, the UK company registry, uses the XBRL for UK companies to file their financial statements.

- The Spanish Business Register uses the XBRL for corporations to submit their annual financial statements.

What are the differences between current submissions as compared to submissions via the MBRS platform?

There are two significant differences:

- The MBRS allows companies to submit documents online, hence eliminating over-the-counter hard copy or paper-based submissions.

- There is no need to submit the paper-based financial statements, annual return and exemption application. Instead, companies need to prepare these documents using the mTool for online submission.

However, similar to the previous practice, company secretaries are required to do the submission of these documents.

What are the expected challenges from the implementation of the MBRS?

There are three main challenges:

Preparation of dual financial statements

The MBRS financial statements are different from the audited financial statements, although the preparation tool itself is constructed based on the IFRS taxonomy and most of the information required for the MBRS financial statements are derived from the audited financial statements. This means that companies are required to prepare two sets of reports – financial statements for the purpose of statutory audit as required under the Companies Act 2016 and the MBRS financial statements for the purpose of submission to the SSM. However, this is only applicable for the first year of implementation as the MBRS allows pre-population of prior year data, which reduces the effort to key-in prior year data into the mTool.

Judgement surrounding the process of tagging to prepare the MBRS financial statements

The SSM XBRL taxonomy consists of approximately 5,500 elements for the MFRS financial statements and 2,364 elements for the MPERS financial statements, which is built from the analysis of various industries based on National Key Economic Areas (NKEAs). Judgement is required on how best to tag items in the audited financial statements into the MBRS financial statements. Preparers are expected to be familiar with financial reporting and have adequate accounting technical knowledge to be able to prepare the MBRS financial statements.

Increase in cost of compliance

The expected increase in cost of compliance from the implementation of the MBRS is mainly derived from: one, cost of providing the XBRL tagging service and two, cost of assurance service.

As the process of tagging information from the audited financial statements into the mTool generally needs to be done manually, companies without in-house financial expertise may resort to outsourcing the work and incurring additional cost to prepare the MBRS financial statements.

Company directors, who have the ultimate responsibility for the financial statements, require comfort or assurance that information in the audited financial statements have been properly tagged and entered into the MBRS financial statements. The assurance service is also expected to increase the cost of compliance for businesses.

How can the MBRS benefit small and medium practitioners (SMPs)?

SMPs may be approached to provide the MBRS-related compliance and assurance services to small and medium enterprises (SMEs), which are generally without in-house financial expertise. SMEs would likely turn to SMPs for support in areas such as preparing the MBRS financial report or providing assurance on whether the financial data has been filled up accurately for regulatory submission.

As such, it may be worthwhile for SMPs to invest time and effort to gain competency in the MBRS.

Why is MIA organising the MBRS courses for businesses and preparers? What is MIA’s role with regard to the MBRS?

We believe accountants play an important role in this MBRS journey. Accountants, as trusted partners to businesses, are expected to play a significant role either in assisting their organisations/clients to prepare the MBRS reports or as a subject matter expert in this area.

As part of our commitment to the accountancy profession in Malaysia, MIA has been appointed as an MBRS approved training partner by the SSM to conduct the MBRS training programmes. From June to September 2018, MIA conducted 31 training programmes throughout Malaysia and trained approximately 1,200 participants. MIA has also scheduled another 21 training programmes until the end of the year. MIA will continue to educate and create awareness among our accountants on the MBRS.

Nurul Hidayah Zailani is Head, Financial Reporting & Capital Market, MIA.