By Nurul Hidayah Zailani

Despite its legacy as an economic stimulus, Waqf today is under-utilised in modern Islamic economies. Might reintroducing the Waqf concept into takaful products be able to drive the takaful industry in Malaysia to a higher level?

Waqf Takaful in Malaysia: Where Are We Today?

Earlier on, Malaysia had been introduced to Waqf takaful through Syarikat Takaful Malaysia’s Takaful Waqf Plan under the Mudarabah-Waqf model. In existence from 2002 until 2009, the plan received strong support throughout that period, attracting approximately 5,000 participants from 2002 to 2004 with a total contribution of RM7.5 million. The plan allowed people from all walks of life to participate and optimise their contribution to charity while managing their other financial commitments.

Waqf Takaful: Practices in Other Jurisdictions

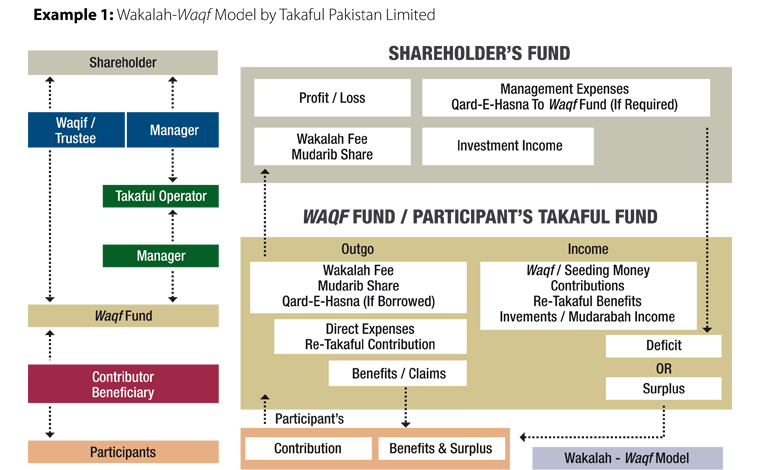

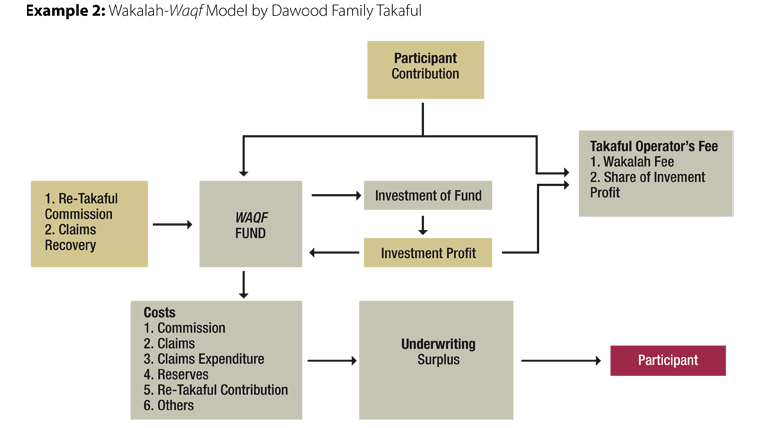

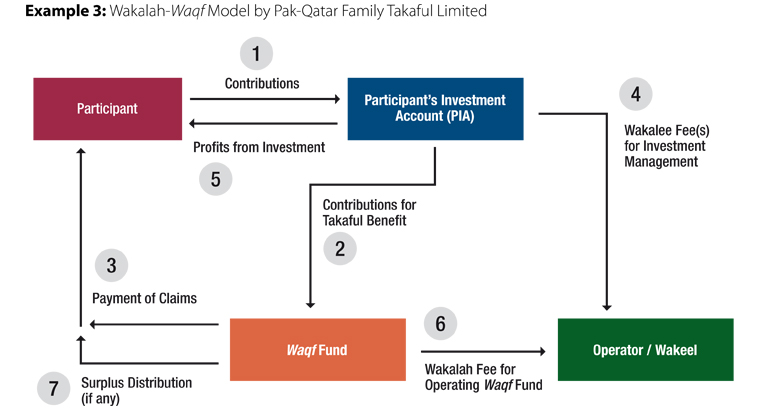

Waqf takaful products are commonly used in Pakistan and South Africa, whereby the Waqf takaful products offered in these jurisdictions are mainly based on Wakalah-Waqf model. Under this model, takaful operators (being the shareholders) will first create the Waqf fund through a Waqf donation. Participants who participate in this Waqf takaful policy would then contribute to the Waqf fund based on a tabarru’ concept. The Waqf fund is then used to help and assist participants who are in need whereby all claims are paid through the Waqf fund. Takaful operators play two roles in the Wakalah-Waqf model which are (i) takaful operators are appointed as wakil or agent to manage and operate the Waqf fund and receive a Wakalah fee which will be paid from the Waqf fund itself; and (ii) takaful operators receive a Wakalah fee upfront for the investment service of the Waqf fund. Any investment profit from the Waqf fund would normally be kept or channelled back to the Waqf fund to cover future losses and deficits, distributed among the participants or donated to charitable organisations.

The main challenge of the Wakalah-Waqf fund adopted by other jurisdictions mainly arises from the risk of ensuring sufficient Waqf funds to cover takaful claims from participants. As the fundamental set up of a Wakalah-Waqf in other jurisdiction is to help and assist participants who are in need, huge takaful claims may jeopardise the Waqf fund from continuing in perpetuity.

Waqf Takaful: What’s Next for Malaysia?

Going forward, the Wakalah-Waqf model could potentially be applied by takaful operators in Malaysia for their products with some improvements as follows:

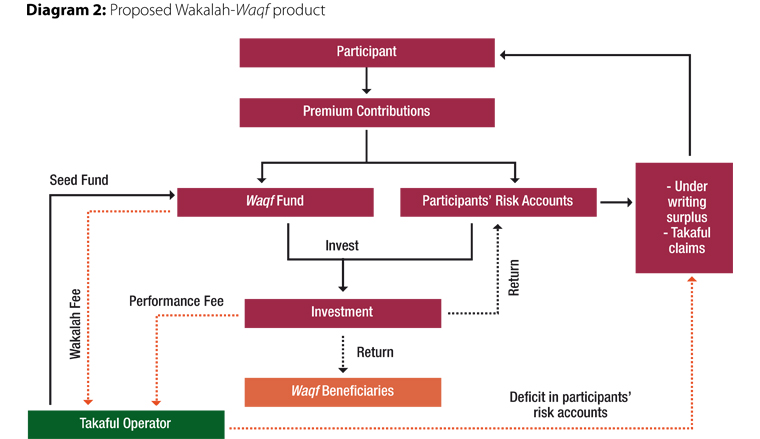

Under this proposed Wakalah-Waqf product,

- Takaful operator donates a seed fund to establish a Waqf fund for the product/policy.

- On a monthly basis, premium contributions made by participants are split into two portions – a portion for tabarru’ contribution to Waqf fund and a portion to participants’ risk account. The appropriation (based on percentage of premium contributed) shall be decided and agreed upfront between the takaful operator and participants.

- Any takaful claims will only be paid/deducted from the participants’ risk account while any surpluses will be credited back into the same account.

- Both Waqf fund and participants’ risk account will be invested in Shariah compliant instruments to generate returns where the return from the participants’ risk accounts will be credited back to the account. Returns from the waqf fund however, will be channelled to the waqf beneficiaries as approved by the takaful operator’s Shariah Committee.

- In the event of death, the deceased’s beneficiaries will be compensated with the takaful benefit from the participants’ risk account. No further amount is paid on behalf of the deceased to the Waqf fund (hence, the contribution to waqf fund is limited to the amount contributed while the participant is alive).

Of course, the proposed Wakalah-Waqf model above does come with some practical challenges including:

• Taking into consideration the current laws and legislation in Malaysia, Waqf is still under the purview of the state religious councils (SRCs) – be it for public Waqf, family Waqf or a combination of the two as provided by the Ninth Schedule of the Malaysian Federal Constitution. SRCs however, are allowed to appoint any organisation as their mutawalli/nazir to manage and administer the Waqf asset/fund as well as to execute what is intended by the donor (waqif).

The creation of Waqf is rather straightforward, whereby it is created by way of sighah between two witnesses according to Hukum Syarak and such Waqf to be registered as soon as practicable with the SRCs. However, takaful operators in Malaysia would need to address whether the SRCs would allow takaful operators to be their mutawwali to manage and administer the Waqf fund embedded in the takaful product, particularly in the absence of specific laws and regulations to govern the rights and duties of mutawalli in Waqf matters.

This could probably be one of the concerns to appointing mutawalli as there are some irresponsible parties who misuse Waqf fund/properties, ignoring the ultimate intention of donors. Unless such permission is given/granted by SRCs, takaful operators may not be able to maximise the concept of Waqf in their takaful products.

• In Malaysia, takaful products are normally distributed through direct or indirect channels. Direct distribution channels refer to distribution of takaful products through either their head office and branch premises or an online platform while indirect distribution channels refer to other types of distribution channels including agency distribution and bancassurance. Takaful operators need to consider the pricing structure of the Wakalah-Waqf product to balance the cost of takaful risk and takaful premium pricing, in order to ensure an acceptable profit margin that protects shareholders in the long run.

• Takaful operators need to analyse the selection of participants for such products e.g. participants with low risk and within certain age groups. Takaful operators may also need to consider whether the premium contribution of such products should be increased to cater to the takaful risk and ensure the perpetuity of the programme in the long run.

• Note that the Waqf fund itself does not belong to neither the participants nor the takaful operator. The waqf fund should be carefully managed by the takaful operator as the agent appointed by participants and shareholders. The takaful operator as the agent shall demonstrate full transparency and adhere to a high governance standard to ensure that the Waqf fund is properly managed and utilised as intended.

This is the executive summary of a case study written by Nurul Hidayah Zailani, as a requirement for the MIA Islamic Finance Mini Pupillage Programme.

You might also be interested in these articles on Waqf: Waqaf Saham Larkin Sentral: Pioneering Initial Public Offering of Waqf Shares by Rasmimi Ramli and Mohd Lukman Mahmud and Professionalising Waqf in Malaysia – Issues and Challenges by Zharif Agil.