By Thenesh Kannaa

1 January 2019 didn’t just mark the first day of 2019, but also the requirement for Malaysian businesses to self-account for 6% service tax upon procuring certain services from foreign service providers. This requirement applies even to Malaysian businesses that are not service tax registered.

Why this new requirement?

2018 was a year of unprecedented changes for Malaysia vis-à-vis the political front as well as taxation, particularly indirect taxation. Goods and Services Tax (GST) was reduced to zero per cent effective 1 June 2018 and formally repealed effective 1 September 2018.

Following the three-month tax holiday period, Sales Tax and Service Tax (SST) was implemented effective 1 September 2018.

One of the key differences between GST and SST is that SST is a single-stage taxation, which means that businesses that incur SST on their acquisition are generally not eligible for a credit of the SST incurred on their costs/acquisitions.

As a result, businesses would prefer to acquire goods and services without SST to keep the costs low (there’s no compelling reason for such preference in the GST regime given that businesses are generally granted an input tax credit in respect of any GST incurred on acquisition).

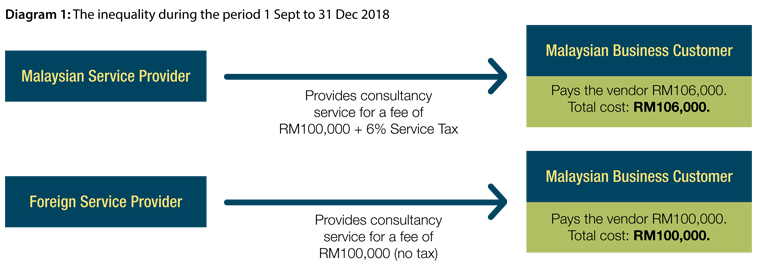

Hence, during the period 1 September 2018 to 31 December 2018, Malaysian service providers were arguably at a disadvantage as they had to charge 6% service tax to their customers on provision of taxable services. However, these customers would not incur any service tax if they had purchased the same service from a foreign provider. This inequality is illustrated in Diagram 1 below.

As illustrated in Diagram 1, the Malaysian service provider is required to charge 6% service tax but the foreign service provider, which does not have any establishment in Malaysia, is not required to charge service tax.

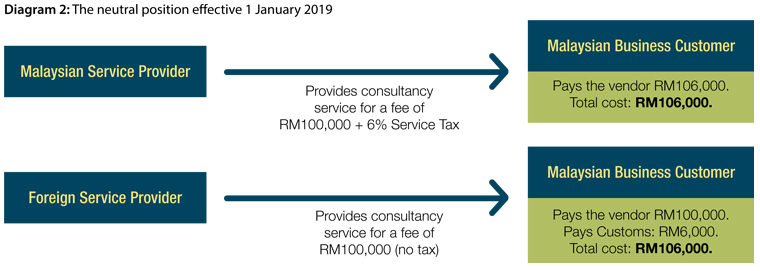

Given that no input tax credit is available under the SST regime, the Malaysian business customer would prefer to acquire the services from a foreign service provider. To avoid such bias and any potential serious consequences in the long run, the imported services tax was introduced effective 1 January 2019.

The concept of imported services tax

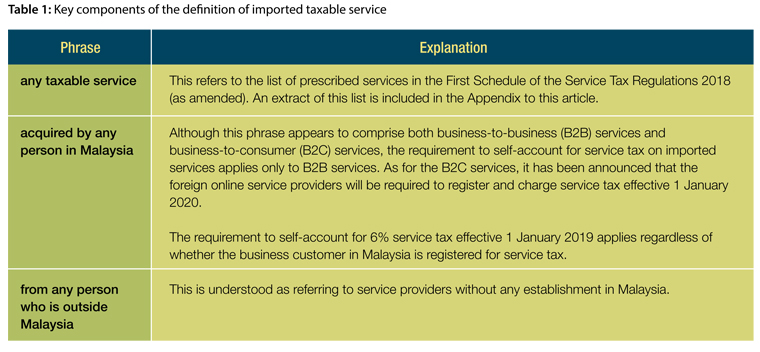

Imported taxable service is defined in the Service Tax Act 2018 (as amended) as any taxable service acquired by any person in Malaysia from any person who is outside Malaysia. The three key phrases in the definition are further explained in Table 1 below.

The reverse charge mechanism during the GST era were limited to situations where the services are consumed in Malaysia. There’s no express provision that limits application of imported service tax based on place of consumption. However, Customs has recently expressed its interpretation that accommodation in a hotel overseas is not an imported service, and hence not subject to imported service tax. No detailed reasoning was offered to support the interpretation and hence the criteria used by Customs to determine whether or not a service is being “imported” is yet to be known.

Compliance mechanism

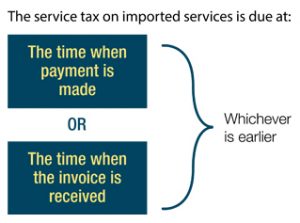

The service tax on imported services is due at:

Where the customer is service tax registered, the service tax on imported services is to be accounted in the bimonthly service tax return.

Where the customer is not service tax registered, the service tax on imported services is to be accounted for in a declaration which is required to be submitted by the end of the month which follows the month in which the service tax is due.

Here’s an example to illustrate the mechanism.

XYZ Sdn Bhd, a company with a 31 December year-end, acquires consultancy services from a foreign company. On 10 March 2019, XYZ Sdn Bhd receives an invoice from the foreign company for RM100,000 in respect of the services rendered in February 2019. The invoice would be paid in full in July 2019.

The service tax of RM6,000 (being 6% of RM100,000) is due on 10 March 2019 (being the earlier of date of payment and receipt of invoice).

If XYZ Sdn Bhd is service tax registered, the service tax of RM6,000 must be included in the service tax return for the taxable period March to April 2019, which is due by 31 May 2019. Service tax must be paid to Customs by 31 May 2019 as well.

If XYZ Sdn Bhd is not service tax registered, a special declaration must be submitted by 30 April 2019 (being the end of the month that follows 10 March). Service tax must be paid to Customs by 30 April 2019 as well.

From a broader perspective, it is important to note that the imported service tax requirement avoids the bias towards foreign service providers which was prevalent prior to 1 January 2019, as illustrated in Diagram 1 above. The present neutral position is illustrated in Diagram 2 below.

Exemption for services within a group of companies

It is common for companies to acquire services from their parent company or other companies within the group. The Service Tax Regulation 2018 (as amended) provides for intragroup exemption for services acquired domestically, but not imported services.

Fortunately, Customs has expressed that the Minister provides intra-group exemption for imported services. This exemption would not be published in gazette but is pursuant to the Minister’s power to make exemptions in particular cases. It is anticipated that a blanket approval letter for the exemption would be published in the public domain soon. Readers are advised to watch out for this letter, and to observe any conditions attached thereto.

At this juncture, Customs makes reference to paragraphs 4 to 8 of the First Schedule of the Service Tax Regulations 2018 for the definition of control and group which, in loose terms, requires:

- more than 50% shareholding; or

- shareholding between 20% to 50% with exercisable power to appoint or remove all or majority of the board of directors.

In any case, it is important to note the intragroup exemption applies only to the following services:

- Advocate / solicitor

- Syarie lawyer

- Public accountant

- Licensed / registered surveyors

- Professional engineer

- Architect

- Any person providing consultancy services

- Any person who provides information technology services

- Any person who provides management services.

This list is notably shorter than the list of taxable services in the Appendix. Hence, it is important to ensure that intragroup exemption is not unintendedly applied on procurement of taxable services other than those listed above.

So, what about withholding tax?

The new imported service tax effective 1 January 2019 is a separate and distinct requirement from the decades-old withholding tax requirement.

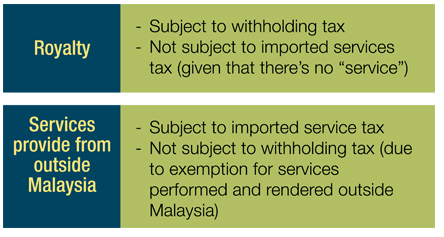

As such, it is possible that services etc. procured from a foreign entity may:

- Be subject to imported service tax but not withholding tax (for example, consultancy services performed and rendered entirely outside Malaysia);

- Be subject to withholding tax but not imported service tax (for example, royalty payments or services performed in Malaysia by a company within the same group); or

- Be subject to both imported services and withholding tax (for example, services performed in Malaysia by a third-party foreign service provider).

Combination 3 above does not tantamount to double taxation as withholding tax is, in principle, a tax imposed on the income of the non-resident provider while service tax is a tax on consumption by the Malaysian customer.

The practical dilemma for the IT industry etc.

Following an exemption given effective September 2017, payments to foreign entities for services are subject to withholding tax only if services are performed in Malaysia. Payment of royalty (as defined in the Income Tax Act 1967 (as amended), however, is subject to withholding tax regardless of any physical location.

On the other hand, the imported service tax should, as the name imply, apply only to services.

Hence, conceptually one arrives at the position that, where the foreign entity does not perform any work in Malaysia, the payment is for either of the following:

While this position appears to be conceptually appropriate, it may not be always true given that there’s no formal confirmation from the tax authorities confirming that a particular payment can be only either royalty or service fee. Instead, the two tax administrators have their own interpretation. As an example, the Income Tax Act 1967 (as amended) defines royalty to include payments for the use of software while Customs regards provision of software as an IT service.

Hence, it appears that both the tax authorities in Malaysia do not take the position that they are bound by each other’s interpretation of technical matters, as well as interpretation of facts. Hence, the dilemma of the same transaction being regarded as royalty for the purposes of Income Tax Act 1967 and as service fee for the purposes of Service Tax Act 2018 may arise in practice. While such issues may be more prevalent in the IT industry, these may also apply well beyond the IT industry.

Concluding remarks: what should businesses do immediately?

Businesses (including those that are not service tax registered) should ensure that their systems, including standard operating procedures (SOPs), are updated to ensure:

- The 6% service tax on imported services is taken into account as part of the budget as well as the procurement procedures.

- The compliance mechanism is put in place (Note: unlike withholding tax, service tax is due at the earlier of the date of receipt of invoice and date of payment. Given that in most practical scenarios the invoice date will be earlier, imported service tax requires a separate compliance mechanism in addition to withholding tax, which is based on the date of payment).

The imported service tax applies only on taxable services, and not all services. Hence, it is important for businesses to appoint tax professionals to review the common transactions and advise on the applicability of the imported service tax.

It is important to ensure that contracts and business documents accurately reflect the commercial nature of transactions. Such convergence helps to prevent disputes over the classification of transactions for both imported service tax as well as withholding tax purposes.

Thenesh Kannaa is a partner at TraTax, a firm of independent tax advisors rated within the Top 10 in Malaysia for Transactional Taxation. He is also the author of several books on Malaysian taxation and a frequent speaker at seminars organised by MIA. He can be contacted at [email protected]. Views expressed are his own.

Appendix: List of prescribed taxable services:

- Operating accommodation (e.g. hotel, inns, lodging house, service apartment, homestay etc.)

- F&B – Restaurant, bar, canteen etc., catering & food court.

- Night club etc., health or wellness centre, massage parlour etc.

- Private Club

- Golf club and golf driving range

- Betting & gaming

- Professionals:

– Advocate / solicitor*

– Syarie lawyer*

– Public accountant*

– Licensed / registered surveyors*

– Professional engineer*

– Architect*

– Any person providing consultancy services (including training & coaching)*

– Any person who provides information technology services*

– Any person who provides management services*

– Any person who provides employment services (excluding secondment)

– Private agency (security services). - Credit card and charge card (fixed service tax of RM25 per annum or part thereof)

- Other service providers:

– Insurance (excluding life and medical insurance to individual consumers)

– Telecommunication services and paid television broadcasting services

– Customs agent (only on goods clearing services)

– Parking operators

– Motor vehicle service or repair centre

– Courier services.

– Hire-and-drive passenger motor vehicle

– Any person who provides advertising services

– Any person who provides transmission or distribution of electricity

– Airline operator (domestic flights only)

– Amusement park

– Services in relation to brokerage or underwriting

– Cleaning services

Items marked with * qualify for intragroup exemption.

Important Note: This list is merely an extract and has been deliberately simplified due to space constraints. Kindly refer to the Service Tax Regulations 2018 (as amended) for full details and kindly seek case-specific consultation for actual cases.