By Gagan deep Nagpal and Kunal Dutta

Curacao, Gibraltar, Liechtenstein, and Panama are among the more obscure countries on the world map, yet they have effective transfer pricing regimes. This only reaffirms that Transfer Pricing (TP) is a global phenomenon and a route for many sovereign jurisdictions to put their country on the world map.

The year 2015 will go down in the history of global taxation as a cornerstone, when anti-Base Erosion and Profit Shifting (BEPS) measures were introduced on an unprecedented scale. Further, if you look deeper, all key BEPS Action Plans (especially Action Plan 1 on Digitalised Economy, Action Plan 8-10 on aligning of value creation and Action Plan 13 on three-tier documentation) have a significant underlying element of TP. Thus, it won’t be wrong to comment that in today’s world of tax, TP is an overarching fundamental, which has expansive implications on various business functions and other tax related subject matters. With all these significant amendments, the loose ends in the TP framework are being tightened in an endeavour to transform the subject into more of a science than an art.

Since Transfer Pricing Regulations are undergoing complete transformation, it is time for Multinational Enterprises (MNEs) to take TP matters all the way up to the Board and ideate a format wherein TP can be effectively converged with the other operational functions of the organisation. In fact, putting a system in place to effectively operationalise TP is gradually gaining traction across many big MNEs already.

TP: A compliance exercise or a way to conduct business?

TP in the past was looked at more as a pure tax function focusing predominantly on a year-end compliance exercise and defending TP during audits or litigation. However, one has to understand that TP is assimilated in all commercial dealings and the value chains of the businesses. Therefore, TP cannot operate in silo just as a tax function without the extensive involvement of operations and top management. The active participation of multiple stakeholders within any organisation would be required in the entire TP function as it involves a series of steps as highlighted below:

Business conceptualisation stage –

At the commencement of any new business or value chain, there are many elements of TP that need to be knitted together, especially for MNEs with an entire supply chain spread over multiple jurisdictions. The discussion at this stage generally leans towards the structuring of the entire business based on the overall business strategy and intended geographical presence. Consequentially, the identification of related party transactions arising out of proposed business structure, characterisation of the entities, and price setting formulae for various situations are put in place in the form of Group TP policy. Of course, for any later expansion or change in business, similar elements need to be considered but may be at a lesser scale. Further, the above elements may not be considered at all for one-off or related party transactions with an insignificant volume.

The involvement of the tax function in all critical decision-making relating to the structuring of a business would be the bare minimum required. The legal team will also be required to be involved to put in place intercompany agreements.

Over and above, the top management that gets extensively involved at this stage would need to have the desired level of TP awareness to implement the business strategies effectively.

Price setting stage –

Once the business is structured, proposed transactions are identified and pricing formulas are defined, there is a need to pull out the right data from various sources for computing transfer prices. The reliability of right financial data and various economic and operating assumptions to be considered at the price setting stage would be another key to successfully operationalise the TP.

The role of the Finance and Accounting team cannot be ruled out at this stage, as they would provide most of the financial information. Further, this role also extends to monitoring, compliance and defending stages. The invoicing team should also be required to be informed, once the prices are determined.

Generally, the team from commercial side viz. procurement and sales is also extensively involved at the price setting stage and it is critical that they also understand the nuances of TP. Further, the sales and marketing team also is a key source of information for market related data such as market driven prices based on competitive pricing trends, sales forecast to take assumption of capacity for price computation, and information regarding advertisement and marketing activities to determine the right pricing for transactions involving marketing intangibles etc.

Price monitoring stage –

Once the TP is up and running in the business after taking the above steps, there is a need for constant monitoring and review. Herein, again the role of Finance and Accounting teams come into play to pull out the right data required to monitor the outcome of the transactions and take further decisions in relation to the review and revision of prices to meet the arm’s length criteria.

The taxes are paid on the actual operating results at the year-end and therefore any deviations in an arm’s length outcome arising out of variances between budgeted and actual numbers need to be rectified before closure of books of accounts by way of year-end adjustments. Herein, treasury function would also have a role to play to effectively manage the cash positions at the year-end arising out of year-end adjustments.

Any commercial transaction carried out also has indirect tax impact and it requires due consideration before making any change in transfer prices. Similarly, the regulatory control angle also needs to be looked into especially during the course of repatriation of funds. Therefore, all these stakeholders have to be equally involved during the price monitoring stage.

Compliance and audit defense stage –

The last and foremost stage is to justify the transactions carried out during the year by way of year-end testing while preparing TP documentation. Further, these transactions would also need to be defended during the course of any audits and litigation by the tax authorities. Although the activities involved at this stage are in the domain of the tax function, they would need the support of other functions as well especially at the time of audit, such as pulling out the right data to satisfy the queries of Tax Authorities or during the course of conduct of functional interviews.

The contribution of the IT team will be equally critical in all the above stages. In the case of a highly automated environment, the IT team would need to build an adequate infrastructure for live feed of transfer prices into the system to ensure creation of an adequate document trail. The IT team would also need to build in adequate flexibility for any business changes and provide room for exceptions and overrides with the necessary levels of control and access.

Discussions would be required between the IT team and TP representative from the tax function during the implementation stage and during subsequent modifications arising out of business needs.

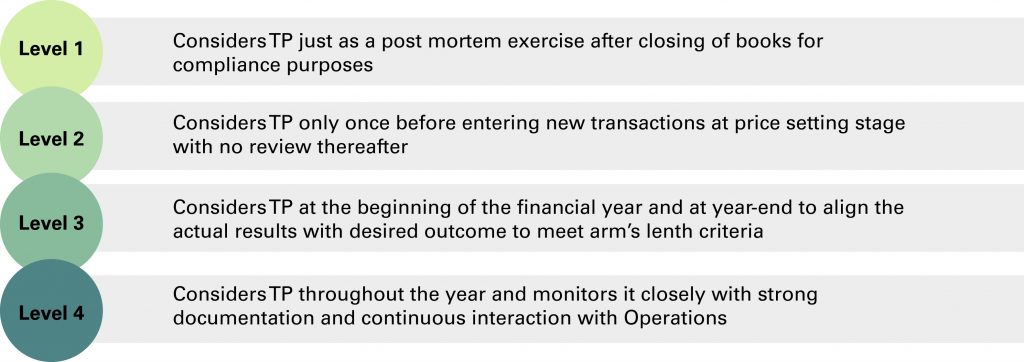

From the above, it is apparent that support from multiple stakeholders is required and TP really has to be in the genes of all relevant functions of the MNE organisation. The extent of TP embedded into business are generally found to be within the four levels below:

The obvious question is determining the appropriate level of OTP to be implemented by MNE. The challenges in determining this are discussed below.

Challenges in implementing effective OTP

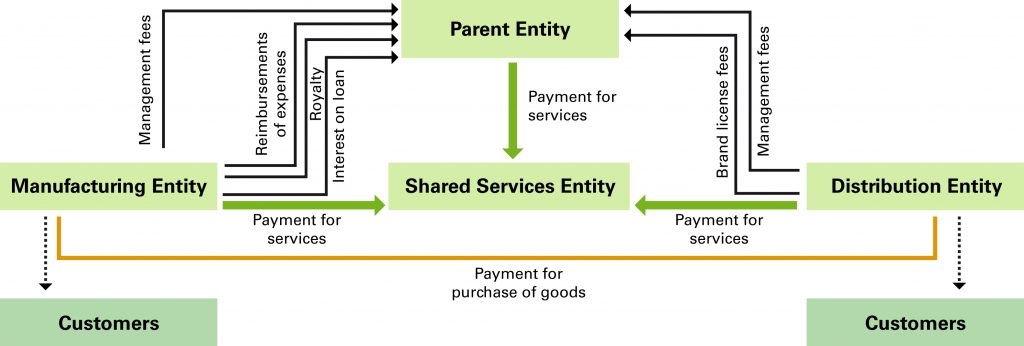

OTP implementation within an MNE group can be a tedious and resource-intensive exercise. The diagram below is an illustrative representation of an oversimplified group which gives an idea of the number of intercompany transactions within four entities. Imagine a global giant with operations in over 100 countries and over thousands of complex intercompany transactions including intangibles and financing.

In relation to various challenges to operationalise TP, the resource constraints (in terms of time, cost and efforts) would definitely top the chart. However, there are other factors which add up as well and some of these are highlighted below:

- Business is getting more agile and impacted by economic factors (such as forex, metal fluctuations, industry cycle etc.) and may therefore require frequent innovative changes in operations (e.g. business restructuring).

- Sourcing the right data and information required for implementing and defending TP (such as inability to segment the operating results).

- Aligning the priorities of various stakeholders required to be involved in the process.

- Ensuring the balanced outcome from both sides of a transaction so that TP position can be defended from both ends to avoid any double taxation.

- Catering to the unique requirements of various jurisdictions such as preference for local comparables, single year results, accounting treatment etc. to achieve consistency.

- The need to evaluate the impact arising out of other regulatory aspects such as customs, withholding taxes, incentive grants, permanent establishment exposure etc.

- Inconsistent positions arising out of any adverse rulings or mutual agreement procedures.

- Managing significant uncertainties arising out of ever-evolving TP regulations under BEPS environment especially in relation to intangibles, data and financing.

- Dealing with the expectations of managerial personnel whose KPIs are driven based on the operating results of the respective entities and may contradict the objective of effective OTP.

- Building robust and flexible IT infrastructure required for operationalising TP especially in a decentralised set-up.

In the present scenario of onerous three-tier documentation requirements on TP and increasing centralisation of TP function, most tax teams are constrained by time and resources and are simply striving to remain compliant to diverse regulations of the respective jurisdictions they operate in. However, MNEs still have to adopt various ways and means to overcome the above challenges in effectively operationalising TP and cannot afford to lose the focus on this front.

Ways to overcome the OTP challenges

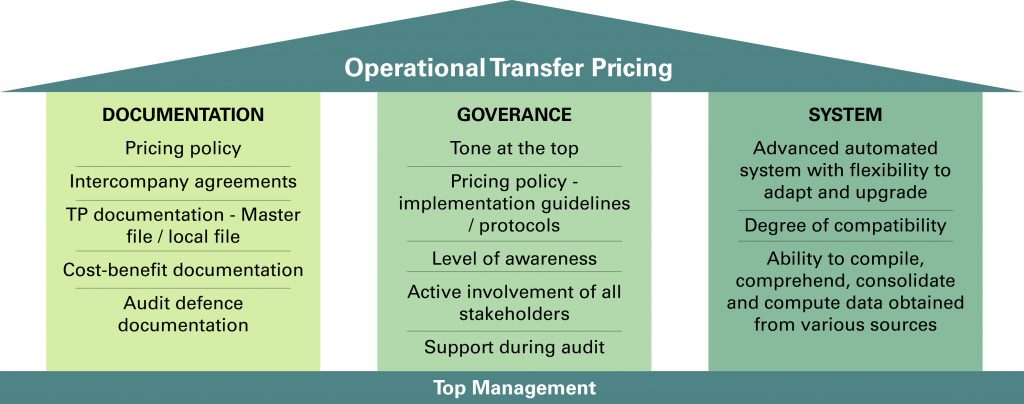

There are three key pillars for any business to be OTP savvy as portrayed below –

As can be observed above, the right tone at the top is required throughout and OTP would not be effective within an organisation unless top management is convinced to implement it.

How technology can help to operationalise TP

Trade wars, prospects of economic downturns, and implementing new forms of taxes on a unilateral basis (digital tax, GILTI, BEAT etc.) are all increasing uncertainty in the business realm. On one hand, tax authorities are getting more aggressive by introducing these measures to get their fair share of taxes to meet their economic growth targets. On the other hand, technology is evolving at a breath-taking pace and disrupting everything conventional.

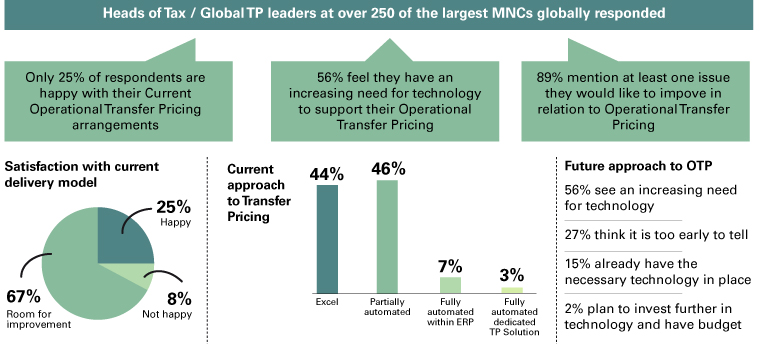

While many tax functions are recognising the importance of technology and the value it can deliver by providing real-time information, there is however a need to embrace innovative solutions rather than just leveraging on technology for reporting and compliance matters. Tax leaders are feeling the pressure arising out of onerous compliance requirements and volumes of data to be handled amidst the constant changes in the business and economic environment. They are beginning to recognise the need for disruptive technologies to properly adopt, integrate and manage the entire tax function. A summary of a recent survey done by Deloitte in this regard is shown below:

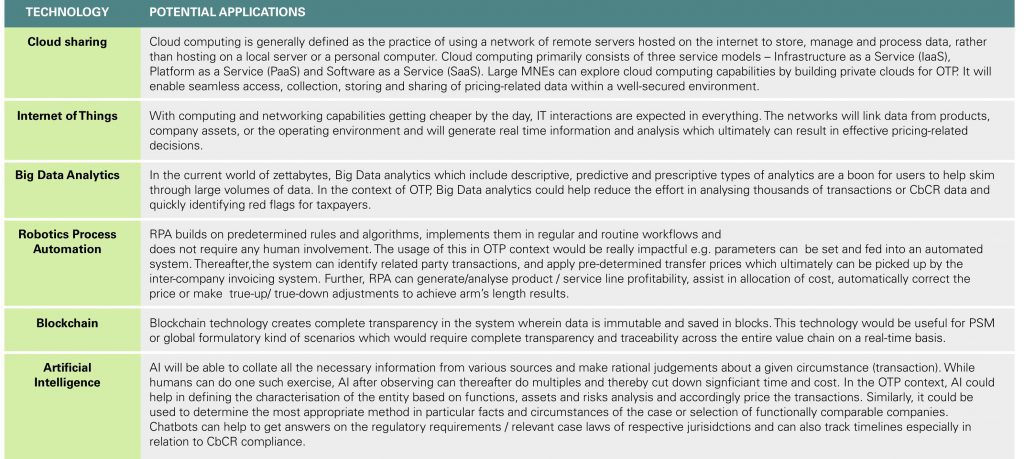

Executing transfer pricing analysis of transactions in a disruptive technological environment is another story. However, continuing with the theme of this discussion, it is timely for us to imagine how disruptive technologies could help to effectively operationalise TP.

Although it is too early to talk about the scaling up of these technologies for OTP, MNEs really have to embrace these to an extent in the current disruptive technology trend of “either adopt or fail”. In fact, many players and consultants have already rolled out OTP tools based on these disruptive technologies. Even tax authorities are not behind in this race and are already adopting big data analytics to select cases for scrutiny or analyse CbCR data.

What is the trend of OTP in Malaysia?

With nearly over a decade after an introduction of specific TP provisions, Malaysia could now be rightly called a ‘matured Transfer Pricing jurisdiction’. In an endeavour to get its fair share of taxes, Malaysia has aligned its TP regime to the OECD TP Guidelines and has recently adopted Action Plans 8 to 10 and 13 that are specifically for TP.

With new TP regulatory developments in Malaysia, the Inland Revenue Board Malaysia (IRBM) will gain more access to desired information on complete supply chains, group structure, reporting hierarchy, financial information about other entities within a group through CbCR and even more. Further, in many forums, the IRBM has highlighted their adoption of Big Data analytics, which is helping them to identify red flags much quicker than before. Importantly, based on recent audit trends, the IRBM has started looking beyond the issues of comparables and now places significant focus on pricing policy, characterisation and value chain information, leading to higher recovery per case as compared to the past. The IRBM during recent audit visits has rigorously questioned the operational teams of taxpayers on price-setting processes and related decision-making. We often see the IRBM challenging situations where the Malaysian entity is a subsidiary with limited control over business decisions and pricing but absorbing business losses. The contention is that such losses should be assumed by entities having control over the risk and with the financial capacity to assume such risks. Further, significant back-up documents are being sought in relation to the price-setting mechanism within a limited period.

With all of these developments, it has really become critical for taxpayers to effectively operationalise TP involving all stakeholders and implement proper channels to extract the relevant data in a timely manner to defend any potential audits. Many MNEs in Malaysia have already taken cognisance of these recent trends and developments and are taking active measures to effectively operationalise their TP such as by formalising proper Group Transfer Pricing Policies, which will be a good starting point to string together all these TP elements.

This article is the personal views of contributors Gagan deep Nagpal and Kunal Dutta from the Transfer Pricing Division, Deloitte Malaysia.