By Yu Jo Jin and Nadiah Mohammad

When an auditor takes on a new audit engagement, questions may arise relating to the kind of audit procedures to be performed at the initial audit engagement – if the financial statements for the prior period were audited by a predecessor auditor or when the prior year financial statements were not audited. The responsibilities and requirements to perform an audit of opening balances of the financial statements by a new auditor is outlined in the International Standard on Auditing (ISA) 510 Initial Audit Engagements – Opening Balances.

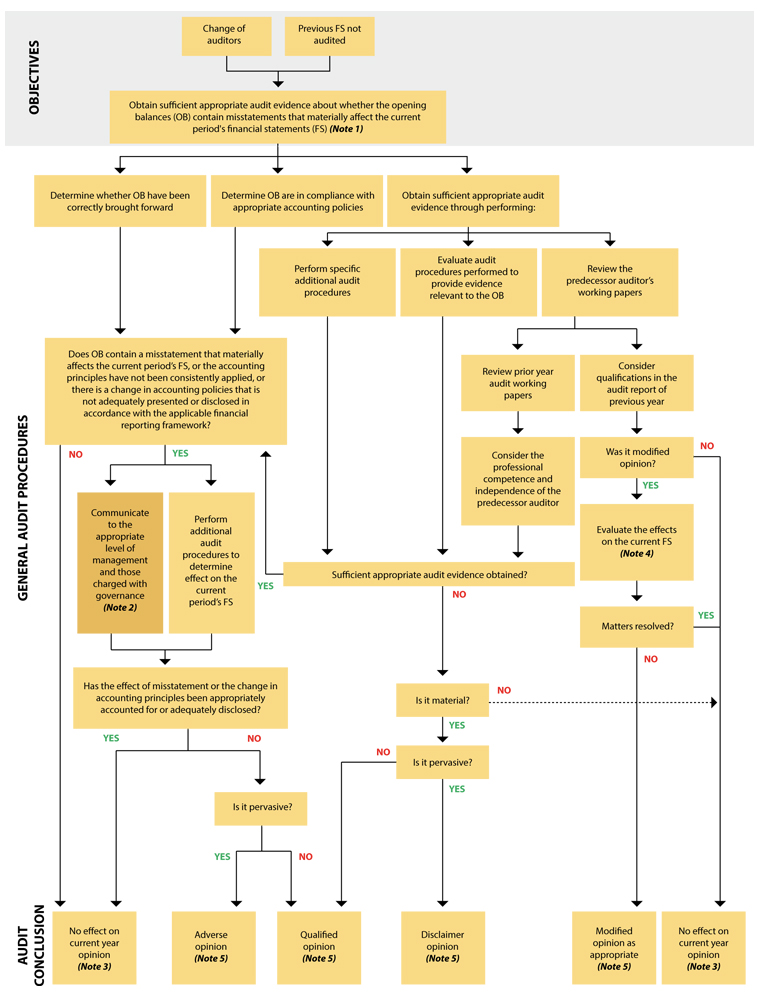

The objective of the auditor with respect to opening balances (OB) is to obtain sufficient appropriate audit evidence about whether:

- The OB contain misstatements that materially affect the current period’s financial statements; and

- Appropriate accounting policies reflected in the OB that have been consistently applied in the current period’s financial statements or changes thereto are appropriately accounted for and adequately presented and disclosed in accordance with the applicable financial reporting framework.

If the auditor obtains audit evidence that the OB contain misstatements that could materially affect the current period’s financial statements, the auditor shall perform such additional audit procedures as are appropriate in the circumstances to determine the effect on the current period’s financial statements.

If the auditor concludes that such misstatements exist in the current period’s financial statements, the auditor shall communicate the misstatements with the appropriate level of management and those charged with governance in accordance with ISA 450 Evaluation of Misstatements Identified During the Audit.

General Audit Procedures

The auditor shall read the most recent financial statements, if any, and the predecessor auditor’s report thereon, if any, for information relevant to OB, including disclosures.

The auditor shall obtain sufficient appropriate audit evidence about whether the OB contain misstatements that materially affect the current period’s financial statements by:

- Determining whether the prior period’s closing balances have been correctly brought forward to the current period or, when appropriate, have been restated;

- Determining whether the opening balances reflect the application of appropriate accounting policies; and

- Performing one or more of the following:

– Where the prior year financial statements were audited, reviewing the predecessor auditor’s working papers to obtain evidence regarding the opening balances; or

– Evaluating whether audit procedures performed in the current period provide evidence relevant to the opening balances; or

– Performing specific audit procedures to obtain evidence regarding the opening balances.

Review of the Predecessor Auditor’s Working Papers

Successor auditors can opt to review the predecessor auditor’s working papers to obtain audit evidence regarding the opening balances, if the prior year financial statements were audited. It is important to consider qualifications in the audit report of previous years.

If the prior year auditor’s report is modified, the successor auditor should evaluate the effects on the current financial statements in accordance with ISA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment.

The successor auditor should also review any material audit adjustments posted by the predecessor in the prior year, and any material management letter issued to the audit client. These should be included in the current year’s risk assessment.

However, the successor should not rely solely on the predecessors’ working papers. Instead, the successor should determine how the results of his or her review of those working papers affect the nature, timing and extent of the procedures to be performed on the opening balances and the consistency of accounting principles. The results of the successors’ review are the conclusions the successor reaches regarding the procedures performed and the evaluations made by the predecessor in the prior years’ engagement.

Ultimately, the successor must exercise professional judgement in determining the extent of procedures to be performed and the audit evidence to be obtained with respect to the opening balances.

What can be done if the predecessor auditor does not, or cannot, provide access to the audit working papers for the previous reporting period?

The predecessor may limit or deny the successor access to the working papers. The extent of access is always a matter of the predecessor’s professional judgement. How can a successor obtain audit evidence if a predecessor denies access to the prior years’ engagement working papers?

The successor auditor should evaluate whether audit procedures performed in the current period provide evidence relevant to the opening balances, or perform specific audit procedures to obtain evidence regarding the opening balances, and propose opening balance adjustments, if necessary.

For instance, auditors might want to:

- recompute the allowance for doubtful debts accounts at the end of the prior period and compare original and recomputed numbers for consistency and reasonableness; or

- review the property and equipment and its depreciation schedules for the prior year to compare them to the opening balances, as well as review the consistency of capitalisation and depreciation policies.

Again, the successor must use professional judgement in determining the nature, timing and extent of procedures to be performed with respect to the opening balances.

Audit Conclusions

If the successor auditor is unable to obtain sufficient appropriate audit evidence for the OB, the auditor shall express a qualified opinion or disclaim an opinion on the financial statements, as appropriate, in accordance with ISA 705 Modifications to the Opinion in the Independent Auditor’s Report.

If the successor auditor concludes that:

- the OB contain a misstatement that materially affects the current period’s financial statements and which has not appropriately accounted for or not adequately presented or disclosed, or

- the accounting principles have not been consistently applied, or

- there is a change in accounting policies that is not adequately presented or disclosed in accordance with the applicable financial reporting framework

- a qualified opinion or an adverse opinion should be expressed in accordance with ISA 705.

Reference: International Standard on Auditing (ISA) 510 Initial Audit Engagements – Opening Balances.

Yu Jo Jin and Nadiah Mohammad are Managers of MIA’s Small and Medium Practices Department, Professional Practices & Technical.