Prime Minister Tan Sri Muhyiddin Yassin has announced a supplementary stimulus package that is specially targeted to support small and medium-sized enterprises (SMEs).

The supplementary stimulus is critical to ensure the survival of SMEs who are the backbone of the Malaysian economy. SMEs currently account for over two-thirds of the country’s total jobs and nearly 40% of the economy.

This SME package is in addition to the RM250 billion economic stimulus announced on 27 March 2020, which included direct cash transfers to qualified households and individuals, wage subsidies, moratoriums on bank loans and delays to income tax submissions, among other measures.

Although the earlier rescue plan had allocated RM3 billion in funding for SMEs under the Special Relief Fund for SMEs, with a reduced interest rate from 3.75% to 3.5%, SMEs and businesses gave feedback that they preferred wage subsidies and other direct measures to urgently protect businesses.

As the regulator of the profession, MIA submitted key proposals to the Government to support SMEs, including small and medium practitioners (SMPs) who are the business partners and advisors to SMEs.

We are pleased to see that some of these proposals have been taken up by the Government. The following are the highlights of the Supplementary Stimulus Package for SMEs, along with MIA’s recommendations where relevant:

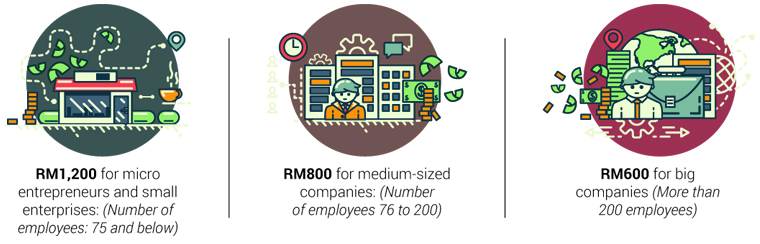

- Additional allocation of RM7.9 billion for the 3-month wage subsidy programme introduced under ESP PRIHATIN for SMEs to all micro entrepreneurs and small enterprises, medium companies and big companies, based on the said entities’ number of employees. The qualifying wage threshold remains the same i.e. RM4,000 and below. The subsidy amounts are as follow:

- An additional condition is that companies must be registered with Suruhanjaya Syarikat Malaysia (SSM) or local authorities before 1 January 2020 and also registered with PERKESO. The companies must also retain the employees for 6 months i.e. during the 3 months when the subsidy is in effect followed by the next 3 months. The Institute is also currently seeking clarification with the Ministry of Finance (MOF) whether SMPs are included in the wage subsidy programme.

- The Government has agreed to encourage negotiations between employers and employees on employment terms, including pay cuts, unpaid leave, etc. during the Movement Control Order (MCO). Employees and employers can refer to Jabatan Tenaga Kerja for advice on any unresolved disputes. All discussions and negotiations must be in accordance to laws and regulations.

- The Government has granted an automatic moratorium of 30 days from the last date of the MCO to facilitate the filing of statutory documents per SSM’s requirements. The deadline to submit financial statements also has been extended for 3 months from the last date of the MCO. This extension applies to companies with financial year-ends of 30 September to 31 December 2019. Companies must submit their applications for the moratorium and/or extension to SSM, and no late charges will be imposed on these companies.

- Previously, MIA had requested that companies with year-ends falling between 30 September 2019 to 31 December 2019 be granted a minimum extension of two months to prepare for AGM and extension to the subsequent deadline for submission of financial statements, in view of the extended MCO and possible bottlenecks in the finalisation of financial statements/audits and preparation for AGM after the lifting of the MCO.

- Additional tax deduction effective from April to June 2020 will be given to private business premise owners that provide reduction or waiver of rental to SMEs during MCO and the following 3 months after MCO. The stipulated condition of at least 30% reduction in rental must be fulfilled to be eligible for this additional tax deduction.

- Interest on the RM500 million Micro Credit Scheme under Bank Simpanan Nasional is waived, reduced from 2% previously to 0%. The micro loan scheme for micro companies is also extended to TEKUN Nasional with a maximum loan limit of RM10,000 per company at 0% interest. For this purpose, a sum of RM200 million will be provided. Applicants are allowed to choose either one of these schemes in order to benefit more micropreneurs.

- 25% reduction in foreign workers’ levy payments for all companies with work permits expiring from 1 April to 31 December 2020. This reduction does not apply to domestic workers.

Please click HERE for the detailed Speech.

The Institute hopes that the Supplementary Stimulus Package will support the business continuity and economic sustainability of our SME members.

During this time of crisis, the Institute urges SMPs to take on the role of “economic frontliners”, providing the advisory and guidance so desperately needed by SMEs to manage cashflows and ensure business continuity in this unprecedented crisis.

The Institute will continue to closely monitor the situation, maintain close communication with the Government, regulators and our stakeholders, and will notify members of any future developments.

In the interim, MIA hopes that everyone will stay safe and comply with the extended MCO and all rules and regulations for our mutual benefit.

#STAYHOME #STAYSAFE #ACCOUNTABILITY #INTEGRITY

Thank you.

Dr Nurmazilah Dato’ Mahzan

Chief Executive Officer