By Jenny Chua and Billy Kang

Running an assurance and compliance practice offers plenty of satisfaction and rewards, while at the same time, poses certain challenges. There are many difficult questions that you have to contemplate: Are you doing better than other accounting firms? Are the results you are achieving through long hours greater than those being achieved by your peers? Or are other firms doing better simply by working smarter, such as through achieving cost-structure efficiency, employing better talent management strategy and investing in technology?

Publicly available survey results are often not so relevant to your firm or provide narrow insights. Perhaps it is easier to find answers for those questions when you know how your peers are handling similar concerns. Benchmarking allows you to measure your business performance against your peers in your profession across key performance indicators (KPIs).

The Malaysian Accounting Profession’s Benchmarking Exercise

Working together with the Professional Services Productivity Nexus (PSPN) of the Malaysian Productivity Corporation (MPC), the Malaysian Institute of Accountants (MIA) conducted a benchmarking exercise with the aim to assist Small and Medium-Sized Practitioners (SMPs) to better understand their place in this very competitive landscape.

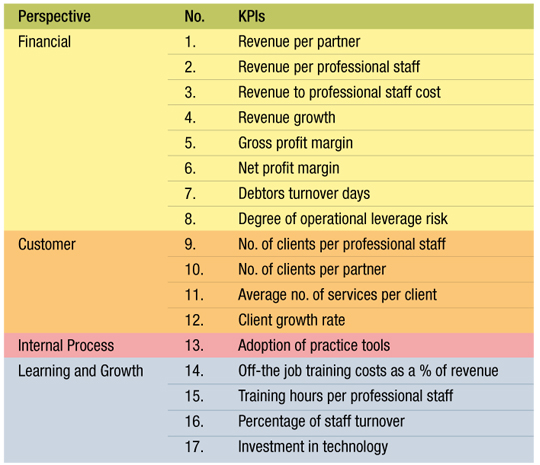

From a clear set of 17 KPIs, the benchmarking provides participating firms with measurements across the four pillars of running a successful accounting practice: financial, customer, internal process, and learning and growth. Excelling in each of these 17 areas under the four (4) overarching pillars is how firms can achieve a higher level of practice excellence. Participating firms first provided their data which was collated into the MPC’s e-benchmarking system. Based on this data, the participating firms were ranked across these KPIs, indicating where they stand in comparison to the other participants.

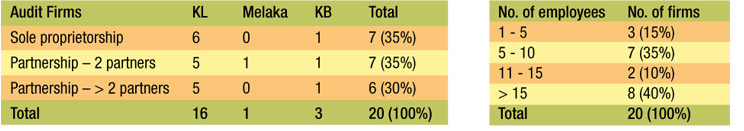

MIA has collaborated with the MPC since 2007 on this project and the last benchmarking exercise was in 2010. In 2019, this exercise was revived and about 20 participating firms successfully completed this exercise.

Why is Benchmarking so important?

Finding out how other firms are performing and gaining insights

It is not good enough for the firm just to know how well it is performing. The firm can gain much insight if it can compare its KPIs with its peers and take corrective measures to improve. Whether the firm wants to drive performance to the next level or identify new approaches and efficiencies that can improve current profitability, the benchmarking data can help inform the firm to achieve its goals. When analysing the results, firms should ask themselves, “What actions do we need to take to improve performance across specific KPIs in our firm?”

Deciding the type of practice and setting the right strategy

Starting an accounting firm is no different from starting any other small business. You start by figuring out your purpose, goal, and market. This will then influence many other decisions, including the type of services you provide. Generally, practising firms have several revenue streams (see Table 1) that they can rely on.

Table 1: Types of services

How a firm allocates its resources to capture that part of the business will depend on the strategic stance of the firm. It is common for an SMP to focus on traditional compliance services such as audit, taxation and accounting. Although these services are easier to capture, they are also very competitive and crowded. It is a ‘red ocean’ market. Operationally, the firm must strategise for growth and operational efficiency.

Table 2 shows the many façets of managing an SMP.

Table 2: Practice Management

Source: IFAC Guide to Practice Management for SMPs

The majority of SMPs in Malaysia adopt low operating cost and low pricing as their business strategy. Under this scenario, it is important that the firm knows its cost structure and that of competing firms. Only with this knowledge can the firm allocate its resources and build a cost-effective and efficient structure.

Knowing where the firm stands will point it to the right path of setting the right strategy.

Benchmarking Exercise in 2019

In 2019, MIA and the PSPN MPC revived the benchmarking exercise with 20 participating firms. The details of participating firms and benchmarking KPIs are as follows:

Table 3: Profile of participating firms

Table 4: 17 KPIs

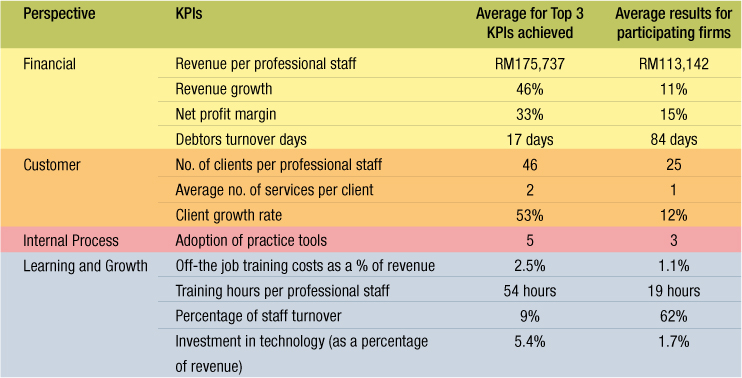

Table 5: The results of some key KPIs (based on data in 2018)

Seven firms which placed within the top three for at least three KPIs were invited to share their best practices in January 2019. Below are some insights gained from their sharing:

Insights from high-performing firms

- Retaining the “right” staff for your firm and taking the time to develop loyal relationships with those staff should be a high priority. It is significantly more expensive to attract new staff to an accounting firm than to invest in staff retention. In addition, without cultivating relationships with the “right” staff, accounting firms are apt to face high staff turnover. The firm that scored highest in this KPI only experienced 8% of staff turnover rate (out of the total number of professional staff).

Takeaways: Initiatives that are well-received are flexible working arrangements in terms of working hours, where to work and what to wear; long service awards in multiple tiers based on years of service; sponsorships for further study and study leave; as well as recreational activities such as family day, annual dinner, staff-clients event, etc. It is also important to cultivate an open and consultative culture at the firm – allow staff to come forward and surface issues relating to their job satisfaction and well-being. As communication is often at the heart of the problem, keep the channels open.

- There is a need to strike a balance between profitability and other KPIs. Your firm may not achieve the financial KPIs in the short-term due to investment in staff, clients and technologies. The top three firms that generated the highest net profit margin on average trained their staff for 30 hours per annum, spent 1% of their revenue in off-the-job training programmes for staff and invested 1% to 8% of their revenue in technologies. This resulted in staff turnover rates ranging from 9 to 20%.

- Many high performing firms are embracing technologies and change for the betterment of both firm and clients. Among firms that have invested heavily in technologies over the past few years (ranging from 4 to 8% of total revenue), some did not fully utilise tools (i.e. used on a very limited basis) that could drastically reduce the costs of compliance and improve client service. This lag is typically caused by a combination of factors within a firm, some of which can be summarised as the lack of appropriate reviews on harmonising existing processes with the new technology and users’ denial of the urgency for change at all levels in the firm.

Tips: Based on some existing research, the inclusion of an integrated IT support team to assist auditors in understanding and adjusting the tools, helps at the time of adoption and facilitates usability. The accounting knowledge of the supporting IT consulting team facilitates adoption because of better understanding of auditors’ needs. It seems that the complexity of current audits requires this integration.

- Small firms are not always worse off. While big firms have the advantage of a global network, an extensive portfolio, and a large number of employees at their disposal, smaller is not always worse off, especially when it comes to a service-based industry such as the accountancy profession. Make the most of your status as a smaller firm and create the best work environment possible. This helps you to attract talent who perhaps want to travel less and seek to experience pleasant working conditions and better work life balance. A firm that treats its employees well and delivers good job satisfaction is also attractive to prospective clients, hence resulting in a ‘win-win’ situation for everyone.

Takeaways: Smaller in size also means easier to manage as shared by some participating firms. Some smaller firms with 1-2 partners actually have low debtors’ turnover days, which can be as low as 6 days, and high net profit margin (as high as 34%).

Appreciation

MIA would like to express its appreciation to the MPC for sponsoring and facilitating this exercise. Special thanks go to the dedicated 20 participating firms as well. Our ultimate aim is to conduct an industry-wide national benchmarking survey, with cross-states’ data for firms of all sizes ranging from sole practitioners to large multi-partner firms. Begin your journey to practice excellence today by contacting the SMP Department at [email protected] to express your interest to participate in future benchmarking exercises. By participating, you can compare your firm to your peers and pinpoint your key strengths, weaknesses and opportunities for improvement.

Billy Kang, sole proprietor of Billy Kang & Co PLT, is the immediate past member of the MIA Public Practice Committee. Jenny Chua is the Head of Small and Medium Practices at MIA.