By Small and Medium Practices Department

Interested in applying to become an approved liquidator under the Companies Act 2016? Then this article is for you.

On 21 January 2020, the Accountant General (AG) issued the Guidelines for Approval as a Liquidator under the Companies Act (CA) 2016 (The Guidelines). These allow for qualified persons to apply for approval as a liquidator under the CA 2016, in order to take on appointments as liquidator, receiver or receiver and manager, judicial manager and nominee in a corporate voluntary arrangement.

Following this, Suruhanjaya Syarikat Malaysia (SSM) also issued the Circular No.1/2020 Guidance Notes on the Registration of Firms of Liquidators and Notification on the Approval as an Approved Liquidator (The Circular) on 24 January 2020.

New Qualification Regime for Approved Liquidators

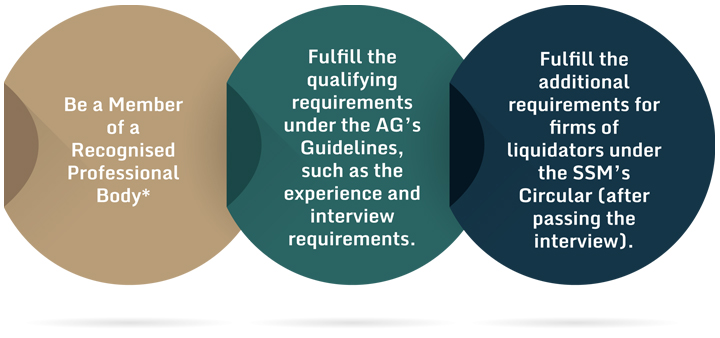

The new qualification regime for a liquidator will involve meeting the following criteria:

*On 13 March 2018, the Malaysian Institute of Accountants (MIA) and the Malaysian Institute of Certified Public Accountants (MICPA) were gazetted as recognised professional bodies under Section 433(5) of the CA 2016.

Passing the Interview

A member of MIA and / or MICPA that fulfils the qualifying requirements must pass an interview before one can become an approved liquidator.

Candidates must pass the interview which will be conducted by the Jawatankuasa Kelulusan Penyelesai Syarikat (Jawatankuasa). The Secretariat of the Jawatankuasa is Unit Kawal Selia Juruaudit Syarikat dan Penyelesai, Bahagian Pembangunan Perakaunan dan Pengurusan (BPPP) from the Accountant General’s office.

The Jawatankuasa was established by the Accountant General’s Department (AG) to assess the competency and character of the candidates applying to become an approved liquidator. The Jawatankuasa comprises the following members:

- Accountant General’s Department (AG) or AG’s representative (Chairman)

- Representative from the Malaysian Institute of Accountants (MIA)

- Representative from the Malaysian Department of Insolvency (MDI)

- Representative from the Securities Commission (SC)

- Representative from the Suruhanjaya Syarikat Malaysia (SSM)

The interview will be conducted 1-2 times in a month at the Jabatan Akauntan Negara Malaysia (JANM), Presint 2, 62599 Putrajaya. It is estimated that an interview session will last for approximately one hour per applicant, with each panel interviewer spending approximately 15 minutes questioning the applicant on their respective areas of authority.

Scope of interview for Approved Liquidators

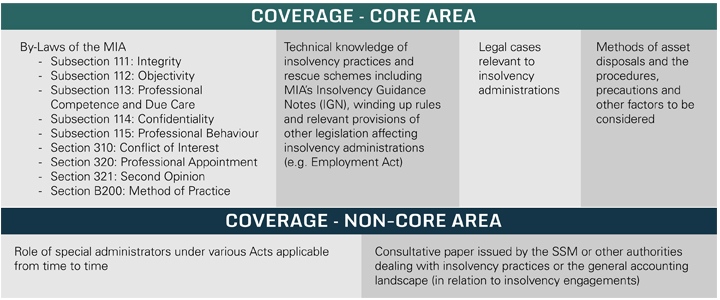

What questions can an applicant expect from each Jawatankuasa representative during the interview? Below, we have compiled information on the scope of the interview and expected knowledge for approved liquidators which will benefit applicants preparing for the interview:

Malaysian Institute of Accountants (MIA)

Note:

- The scope was last updated in March 2020. It is expected that these areas will evolve over time.

- It is not expected that an interviewer has to cover all the above areas in each interview session.

- The same standard should apply for all interviewees without regard to their experience profile

Malaysian Department of Insolvency (MDI)

- Part IV of the Companies Act 2016 (Winding-Up by Court)

- Companies (Winding-Up) Rules 1972

- Relevant laws

- Liquidation administration

- Powers and functions of approved liquidator; and

- Dos and Don’ts

- Documents lodged to Official Receiver

- Importance of the documents;

- Contents of documents; and

- Purpose of lodgement.

- Supervision on approved liquidator

- Supervision by Official Receiver;

- Supervision by Court; and

- Duties of approved liquidator towards the supervision.

Securities Commission (SC)

- Various Acts and guidelines administered by the Securities Commission Malaysia and the Malaysian Code on Corporate Governance.

- Roles and responsibilities of the Securities Commission Malaysia, Audit Oversight Board and Bursa Malaysia Berhad.

- Liquidation:

- Criteria and obligations of PN17 issuers under Main Market listing requirements of Bursa Malaysia Berhad.

- Criteria and obligations of GN3 issuers under ACE Market listing requirements of Bursa Malaysia Berhad.

- Contents of announcement in relation to appointment of a liquidator by a public-listed company.

Suruhanjaya Syarikat Malaysia (SSM)

- Division 8 of Part III of the Companies Act 2016 – Corporate Rescue Mechanism

- Part IV of the Companies Act 2016 – Cessation of Companies

- Division 2 – Provisions Applicable to Every Winding Up

- Division 3 – Winding Up of Unregistered Companies

Interview Passing mark

A candidate must pass all modules (i.e. MIA, SSM, SC and MDI) in order to obtain an overall pass to become an approved liquidator. The passing mark is 60% for each module. Candidates would have to go through the entire application process again and be interviewed by the same panel consisting of MIA, SSM, SC and MDI, regardless of how many modules he or she failed.

However, for a candidate who failed marginally (50%-59%) in only one module, the candidate is allowed to re-attempt the failed module only, within three months from the date of the letter of results. Should the candidate fail the interview again, such a candidate will have to go through a fresh interview process if he or she is determined to become an approved liquidator.

Submission of application

The AG accepts manual applications as an interim measure, until the Business Licensing Electronic Support System (BLESS) is ready to cater for electronic applications to become approved liquidators. For further information, please visit the AG’s website at http://www.anm.gov.my/index.php/khidmat/kelulusan-juruaudit-dan-penyelesai-syarikat.

For further enquiries, please contact the AG’s Unit Kawal Selia Juruaudit Syarikat dan Penyelesai at 03-8882 1000 or email at [email protected] .