By Anil Gupta and Yogesh Mangla

Transfer Pricing (TP) risk has never been as high for MNEs as it is today due to additional reporting requirements and exchange of information emanating from Base Erosion and Profit Shifting (BEPS) action plans issued by the Organisation for Economic Co-operation and Development (OECD). This is evident from the inventory of tax dispute cases (primarily TP cases) between treaty partners which over a decade has increased from 2,897 in FY 2008 to 6,605 cases in FY 2018. Further, the unprecedented crisis caused by COVID-19 (C-19) has caused uncertainties in different economies and taxation systems, including TP, across the world.

In this scenario, APA may provide a potential solution for multinationals to proactively engage in discussion with tax authorities and mitigate the transfer pricing risk. An APA is an agreement entered into by taxpayers with tax authorities to determine TP methodology pertaining to intercompany transactions in advance, subject to certain terms and conditions (called ‘critical assumptions’). The APA programme in Malaysia is applicable for corporate taxpayers satisfying the following conditions:

- Assessable and chargeable to tax

- Turnover exceeding RM100 Million

- The value of the proposed covered transaction exceeds:

- For sales – 50 per cent of total turnover

- For purchases – 50 per cent of total purchases

- For other transactions – RM25 Million

- For financial assistance – RM50 Million

- The covered transaction must relate to chargeable income, i.e. not tax-exempt.

An APA can be unilateral, bilateral, or multilateral.

- Unilateral APA: An APA between a taxpayer and the tax authority of the same jurisdiction;

- Bilateral APA: An APA between taxpayers and tax authorities of two different jurisdictions; and

- Multilateral APA: An APA between taxpayers and tax authorities of more than two jurisdictions.

The key benefits of entering into an APA are to get TP certainty, avoid the risk of double taxation, alleviate the compliance burden, and resolve TP issues in advance without any litigation. However, taxpayers subject to an APA based on pre C-19 facts and circumstances might be sceptical about the final outcome. An APA may also pose challenges to manage TP risks, specifically if there is a static pricing arrangement without any mechanism to adjust it for unforeseen circumstances. Though there can be an argument that an APA is for a long-term period, i.e. generally for 5-8 years (including roll-back) and business disruption is only for a few months, i.e., 2-3 months, nevertheless, C-19 may have a dire and long-lasting impact on different industries that cannot be envisaged at the moment. For example:

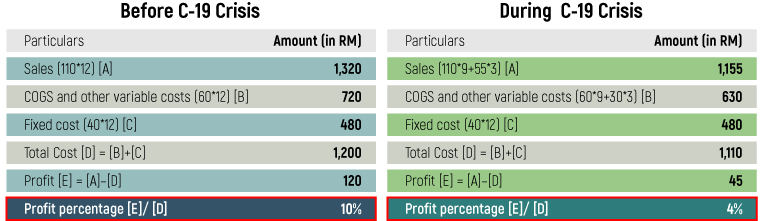

Company A is engaged in the manufacturing business in Malaysia and agreed on an APA with an arm’s length range of mark-up on costs of 8-10 per cent. The cost of Company A comprises 60 per cent variable cost and 40 per cent fixed cost. Due to C-19 and the lockdown situation, Company A has operated at 50 per cent capacity for three months and resumes normal business post lockdown. The annual profitability of Company A, before and during the C-19 crisis is as follows:

It can be observed from the above that due to the lockdown situation for a mere three months, the profit margin of Company A dropped from 10 per cent to 4 per cent, which is outside the agreed arm’s length range with the tax authority. Besides, taxpayers might not be able to attain their normal sales even after lockdown due to fragile market demand. In such scenarios, an APA agreement entered by the taxpayer based on the pre C-19 facts might not be very fruitful.

FAQs from the IRBM

To avoid ambiguities arising in the APA domain due to the C-19 pandemic, the Inland Revenue Board of Malaysia (IRBM) issued FAQs on 16 June 2020 and further updated them on 7 October 2020. The salient points are as below:

A. New APA application: The IRBM will accept a new APA application only from taxpayers whose businesses are not significantly impacted by C-19.

B. Ongoing APA:

- Negotiation for ongoing APAs will be based on the pre C-19 situation;

- IRBM does not allow any amendment to an ongoing APA application as the full impact of C-19 is highly unpredictable;

- The application of the “Term Test” will be on a case-to-case basis depending on the facts and circumstances surroundings the covered transaction. Further, any compensating adjustment pursuant to the Term Test shall be made at the end of the APA covered period; and

- A taxpayer can either continue an ongoing APA or consider withdrawing if the business is significantly impacted by C-19.

C. Concluded APA:

- Needs to comply with all critical assumptions agreed previously with the IRBM with no exceptions; and

- A taxpayer can revise an APA or apply for cancellation.

D. Renewal of APA: Taxpayers will not qualify for the renewal of an APA if they are not able to fulfill the critical assumptions of existing APAs

Analysis of FAQs issued by the IRBM

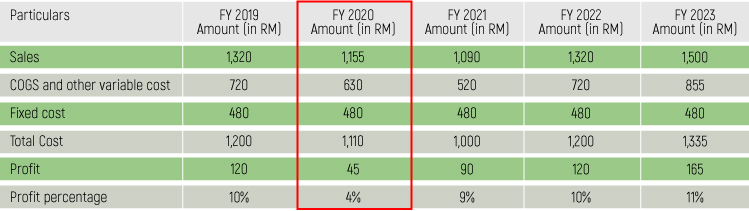

A. Term Test: The Term Test refers to the testing of a transaction over a period of time rather than on a year-on-year (“y-o-y”) basis. Considering the current pandemic situation, the reference to the Term Test by the IRBM is a welcome move. The Term Test may help to spread non-recurring or extraordinary cost/losses incurred by a taxpayer during the pandemic over a period of time (e.g. the covered period of the APA). For instance, if we apply the Term Test by assuming an APA period of five years in the abovementioned example, the outcome could be as follows:

As can be observed from the above, if the IRBM applies y-o-y testing, Company A will not be able to meet the agreed arm’s length range of 8-10 per cent for the C-19 impacted year. Conversely, by application of the Term Test, C-19’s impact has been spread across the overall period covered in the APA and no TP adjustment may be warranted.

It is important to note that competent authorities of some of Malaysia’s key trading partners, e.g. China and Japan, accept the Term Test for APA proceedings, and this would assist in providing TP certainty to MNEs operating in Malaysia. Nevertheless, it will be interesting to see the actual application of the Term Test by the IRBM, e.g., whether it will be applicable for rollback periods pertaining to pre C-19, and whether the taxpayer would be required to maintain profitability within a particular range to satisfy the Term Test criteria, etc.

B. Negotiation/renegotiation for ongoing APAs/concluded APAs

In the FAQs, the IRBM has mentioned that the full impact of C-19 is highly uncertain and the negotiation / review process of ongoing APA will be based on the pre C-19 situation.

Due to C-19 (or similar future event), the taxpayer might incur various extraordinary costs, e.g., additional employee benefits cost, expenditure on sanitisation and additional operational costs due to disruption in the supply chain, etc. and might be exposed to different risks that are not envisaged at the time of negotiating the APA. Accordingly, the taxpayer should take into consideration relevant current and potential circumstances in negotiating critical assumptions with the tax authority. Additional critical assumptions pertaining to an extraordinary decline in revenue or increase in costs due to extraneous factors would be of particular relevance in today’s circumstances.

In case of a concluded APA, the taxpayer should inform the tax authority about the impact of C-19 on its business through the Annual Compliance Report, including information on unanticipated costs incurred, additional risks borne, etc. Proactive initiation of discussion with the tax authority on the above is recommended, and required, especially if there is a probability of breach of a critical assumption or any other terms of the APA.

C. Revision/cancellation of an APA

In the FAQs, the IRBM has mentioned that if the taxpayer is not able to fulfill the critical assumptions due to C-19, then it can apply for revision or cancellation of the APA. Accordingly, if the taxpayer anticipates that due to the economic and business impacts of C-19, it will not be able to meet critical assumptions stipulated in the APA, then it must notify the IRBM within 30 days of becoming aware of such a situation. The revision of an APA, depending on its type, i.e., unilateral, bilateral, or multilateral, requires the concurrence of the taxpayer, the IRBM, and/or the competent authority of the treaty partner(s). If all the parties together are not able to reach an agreement pertaining to the revision of the APA, then the IRBM may cancel the APA. The effective date of the cancellation of an APA will be from the beginning of the year of assessment wherein the taxpayer fails to meet the critical assumptions, as per the APA Rules 2012 and the APA Guidelines 2012.

Conclusion

We all are aware that the world is going through an unprecedented crisis, and there is no legal precedent / international guidance available to deal with TP in the current volatile environment. Accordingly, in such an uncertain environment, the taxpayer should:

- Assess – Taxpayers who have signed an APA or are in the process of negotiating an APA should assess the impact of C-19 on their business and prepare FAR (Function, Asset, and Risk) analysis based on the pre and post C-19 situation and y-o-y variance analysis of profit and loss statements to demonstrate the actual financial impact.

- Engage – After assessing the impact of C-19, taxpayers are encouraged to engage in proactive discussion with the tax authority, present all the relevant facts pertaining to their business, and impact on the overall industry.

- Respond – Based on discussion with the tax authority and forecasted business impact, taxpayers should make informed decisions taking into account the cost and resources employed by them in an APA proceeding.

The introduction of the Term Test by the IRBM is an encouraging move to tackle the C-19 situation. The Term Test would yield more utility value in an APA covering a longer period of time (i.e. 5 future years instead of 3 years), as any extraordinary costs/losses incurred by taxpayers would be spread out over the covered period of the APA. In conclusion, both taxpayers and the tax authorities should keep an open line of communication for an amicable conclusion on ongoing APA negotiations as well as adherence to concluded APAs.

Anil Gupta, Director and Yogesh Mangla, Senior Manager are from Deloitte Tax Services Sdn Bhd. Anil Gupta is also a member of MIA

The views/ opinions expressed above are of the authors alone and have no bearing on any organisation with which the authors were, are, or will be associated. The authors reserve the right to change or delete in part or in full any section of this article.