By Sustainability, Digital Economy and Reporting

MIA has received various accounting queries on consolidation through our technical queries facility. In this article, we will be sharing a few more common questions received and the suggested guidance for reference. In June 2022, we issued an article titled ‘MPERS: Common Issues on Consolidation’. View the article here.

MFRS

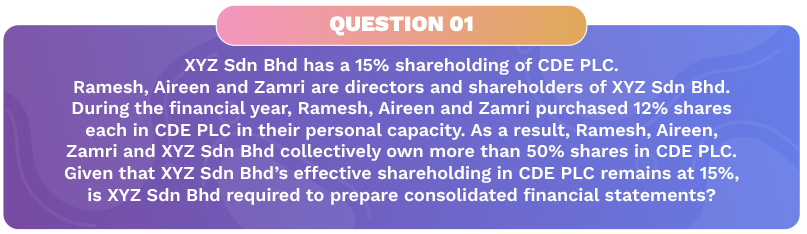

An entity that is a parent is required to present consolidated financial statements¹. As stated in Appendix A Defined Terms of MFRS 10 Consolidated Financial Statements, the term ‘parent’ is defined as an entity that controls one or more entities.

Therefore, XYZ Sdn Bhd must evaluate whether it has control over CDE PLC to determine if it is required to prepare consolidated financial statements.

An investor controls an investee if and only if the investor has all of the following²:

In addition, if facts and circumstances indicate that there are changes to one or more of the three elements of control listed above, the investor shall perform continuous assessment to determine whether it still controls the investee³.

MPERS

If the entity is using MPERS, the entity can refer to paragraphs 9.4 to 9.12 of MPERS Section 9 Consolidated and Separate Financial Statements to assess the existence of control.

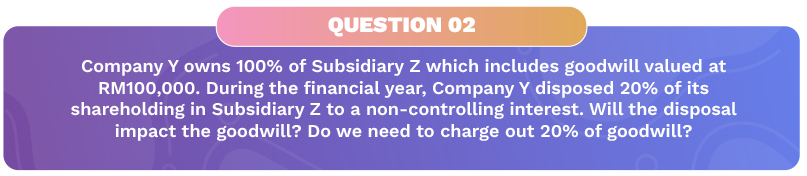

MFRS

Changes in a parent’s ownership interest in a subsidiary that do not result in the parent losing control of the subsidiary are equity transactions (i.e. transactions with owners in their capacity as owners).⁴ If control is retained, the gain or loss will be recognised in equity and no change in the carrying amounts of assets (including goodwill) or liabilities is recognised.

Therefore, Company Y must evaluate whether it loses control over subsidiary Z after the change of the ownership interest from 100% to 80%.

MPERS

If the entity is using MPERS, the entity can refer to paragraph 22.19 of MPERS Section 22 Liabilities and Equity on the non-controlling interest and transactions in shares of a consolidated subsidiary.

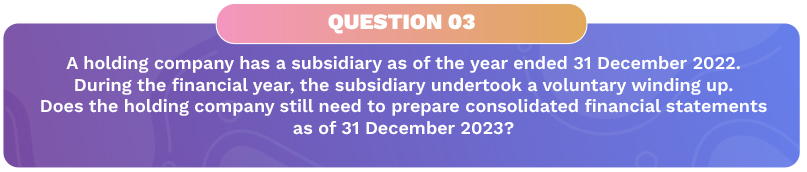

MFRS

An entity includes the income and expenses of a subsidiary in the consolidated financial statements from the date it gains control until the date when the entity ceases to control the subsidiary.⁵ Paragraph B98 and B99 of MFRS 10 outline the accounting treatment when the parent loses control of a subsidiary.

MPERS

An entity shall present consolidated financial statements in which it consolidates its investments in subsidiaries.⁶

When a parent ceases to control a subsidiary, the difference between the proceeds from the disposal of the subsidiary and its carrying amount at the date that control is lost is recognised in profit or loss in the consolidated statement of comprehensive income (or the income statement, if presented) as the gain or loss on the disposal of subsidiary.⁷

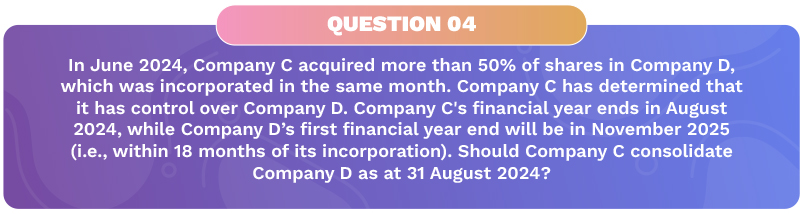

MFRS

Paragraph B92 of MFRS 10 states that “the financial statements of the parents and its subsidiaries used in the preparation of the consolidated financial statements shall have the same reporting date.” For consolidation purposes, the subsidiary is required to prepare the additional financial information as of the same date as the financial statements of the parent to enable the parent to consolidate the financial information of the subsidiary, unless it is impracticable to do so.⁸

Paragraph B93 states that “the difference between the date of the subsidiary’s financial statements and that of the consolidated financial statements shall be no more than 3 months.”

MPERS

Paragraph 9.16 states that “the financial statements of the parent and its subsidiaries used in the preparation of the consolidated financial statements shall be prepared as of the same reporting date unless it is impracticable to do so. If it is impracticable to prepare the financial statements of a subsidiary as of the same reporting date as the parent, the parent shall consolidate the financial information of the subsidiary using the most recent financial statements of the subsidiary, adjusted for the effects of significant transactions or events that occur between the date of those financial statements and the date of the consolidated financial statements.”

Therefore, Company D must prepare financial information for the year to 31 August 2024 unless it is impracticable to do so. The consolidated financial statements have a 31 August year-end because Company C is the parent.

The views expressed are not the official opinion of MIA, its Council or any of its Boards or Committees. Neither the MIA, its Council or any of its Boards or Committees nor its staff shall be responsible or liable for any claims, losses, damages, costs or expenses arising in any way out of or in connection with any persons relying upon this article.

¹ Paragraph 4 of MFRS 10 Consolidated Financial Statements

² Paragraph 7 of MFRS 10 Consolidated Financial Statements

³ Paragraph 8 of MFRS 10 Consolidated Financial Statements and Paragraphs B80 to B85 of MFRS 10 Consolidated Financial Statements

⁴ Paragraph 23 of MFRS 10 Consolidated Financial Statements

⁵ Paragraph 20 and B88 of MFRS 10 Consolidated Financial Statements

⁶ Paragraph 9.2 of MPERS Section 9 Consolidated and Separate Financial Statements

⁷ Paragraph 9.18 of MPERS Section 9 Consolidated and Separate Financial Statements

⁸ Paragraph B92 of MFRS 10 Consolidated Financial Statements