In providing guidance to members on good financial reporting, the Financial Statements Review Committee (FSRC or the Committee) wishes to highlight common deficiencies arising from the review of financial statements of public listed entities for the review period from July 2019 to June 2020. The financial statements under review are those with financial years ended ranging from December 2018 to December 2019.

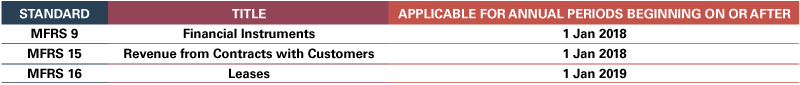

During the review period, there were new standards that came into effect, as follows:

The issues below have been identified from our reviews so far:

i. Application of new standards – MFRS 9 Financial Instruments (Disclosures)

The impairment model required by MFRS 9 is an expected loss model as compared to the incurred loss model under MFRS 139. Common issues identified during our reviews include the following:

- No disclosure of recognition and measurement of expected credit losses, including the methods, assumptions and information used to measure expected credit losses [Paragraph 35B(a) of MFRS 7 Financial Instruments: Disclosures];

- No disclosure of how an entity determines whether the credit risk of financial instruments has increased significantly since initial recognition [Paragraph 35F(a) of MFRS 7];

- No disclosure of the Group’s definitions of default, including the reasons for selecting those definitions [Paragraph 35F(b) of MFRS 7];

- No disclosure of the inputs, assumptions and estimation techniques used to apply the requirements in Section 5.5 of MFRS 9 [Paragraph 35G of MFRS 7].

ii. Application of new standards – MFRS 15 Revenue from Contracts with Customers (Disclosures)

Most of the financial statements reviewed stated that there are no material impacts resulting from the application of MFRS 15. However, common issues identified during our reviews include the following:

- No disclosure of information on the remaining performance obligations (i.e. amount of transaction price of the contract allocated to unsatisfied performance obligations) in accordance with Paragraph 120, unless applying practical expedient as in Paragraph 121 of MFRS 15;

- No disclosure of the judgements and the changes in the judgements made in applying MFRS 15 that significantly affect the determination of the amount and timing of revenue from contracts with customers in accordance with Paragraph 123 of MFRS 15;

- For performance obligations satisfied over time, no disclosure of both the methods used to recognise revenue (for example, a description of the output methods or input methods used and how those methods are applied) and an explanation of why the methods used provide a faithful depiction of the transfer of goods or services in accordance with Paragraph 124 of MFRS 15;

- For performance obligations satisfied at a point in time, no disclosure of the significant judgements made in evaluating when the customer obtains control of promised goods or services in accordance with Paragraph 125 of MFRS 15.

The FSRC will continue to monitor the application of MFRS 15 as well as the initial application of MFRS 16 in its next review cycle.

iii. Impairment of non-financial assets

From our reviews, we raised several matters concerning the disclosure requirements relating to the impairment of non-financial assets in accordance with Paragraph 130 of MFRS 136 Impairment of Assets.

The following disclosures were often omitted:

- The events and circumstances that led to the recognition or reversal of the impairment loss [Paragraph 130(a) of MFRS 136].

- Whether the recoverable amount of the asset is its fair value less cost to sell or its value in use [Paragraph 130(e) of MFRS 136].

- If the recoverable amount is fair value less costs to sell, the basis used to determine fair value less costs to sell (such as whether fair value was determined by reference to an active market for an identical asset) [Paragraph 130(f) of MFRS 136].

- If the recoverable amount is value in use, the discount rate(s) used in the current estimate and previous estimate (if any) of value in use [Paragraph 130(g) of MFRS 136].

Upon reviewing the replies relating to the above disclosure requirements, another issue commonly identified relates to the discount rate applied on the cash flow projections (if recoverable amount is the value in use) for impairment assessments. For example, there was a case whereby the Group is financed by equity and borrowings. However, the discount rate used in its value in use (VIU) computation was much lower than the Group’s average borrowings rate and clearly below the industry average.

Paragraph 55 of MFRS 136 Impairment of Assets states that the discount rate shall be a pre-tax rate that reflects the current market assessments of the time value of money and the risks specific to the assets. Appendix A of MFRS 136 Impairment of Assets provides additional guidance on estimating the discount rate for VIU computation.

We also noted the adoption of key assumptions that were related to financing activities and therefore should not be incorporated in the VIU computation for impairment testing on property, plant and equipment. Paragraph 50(a) of MFRS 136 Impairment of Assets states that estimates of future cash flows shall not include cash inflows or outflows from financing activities.

iv. Financial Guarantee Contracts (Disclosures)

A parent company may issue corporate guarantees to financial institutions to secure credit facilities extended to its subsidiary companies. These corporate guarantees are financial guarantee contracts (FGCs) that meet the definition of financial liabilities and shall be recognised and measured in accordance with MFRS 9 Financial Instruments.

Most of the reviewed financial statements have classified FGCs as financial liabilities, although there are still some that disclosed FGCs as contingent liabilities. Where it had been assessed that an outflow of cash is not probable, these FGCs were disclosed as contingent liabilities. MFRS 137 Provisions, Contingent Liabilities and Contingent Assets does not apply to financial instruments (including guarantees) that are within the scope of MFRS 9 Financial Instruments [Paragraph 2 of MFRS 137].

However, in cases where FGCs have been classified as financial liabilities, the following weaknesses were noted:

- No disclosures were noted in respect of FGCs that were not recognised in the Statement of Financial Position. As a good practice, in instances where FGCs have not been recognised due to the immateriality of their fair values, a disclosure reflecting this should be made in the financial statements.

- Weak or non-existent disclosures on the nature and extent of risks arising from FGCs. Typical risks arising from FGSs include liquidity risk and credit risk [MFRS 7.31-42]. Entities fail to provide the necessary disclosures citing that the risk of default is low. The Committee wishes to highlight that the entity is exposed to these risks, notwithstanding the low risk of default. Specifically, in addressing liquidity risk disclosures, the maximum amount of the guarantee is allocated to the earliest period in which it could be called [MFRS7.B11(c)].

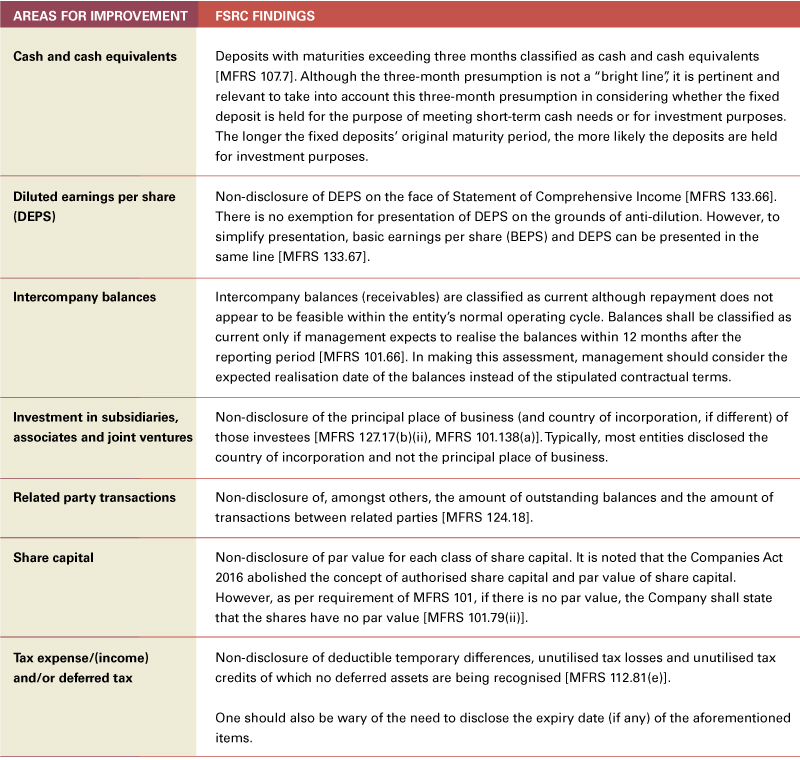

COMMON FINDINGS

The following common findings on non–compliances with the applicable accounting standards were compiled from the reviews of the financial statements conducted by the FSRC from July 2019 to June 2020.

CONCLUSION

These are challenging times for those involved in the financial reporting process considering the ever-changing economic conditions, particularly the impacts of the unprecedented COVID-19 pandemic either direct or indirect. From a financial reporting standpoint, there are expectations that the financial statements should state clearly whether and how the entity’s operations are being affected by the COVID-19 pandemic. In line with their respective responsibilities, those involved in the financial reporting process should work hand in hand to improve the quality of financial reporting and to provide users with balanced and useful information on the financials of an entity.

The FSRC wishes to reiterate that the responsibility for the preparation of financial statements under the Companies Act, 2016 lies with the entity’s management and Board of Directors. Financial statements are to be accompanied by a statutory declaration made by the person primarily responsible for the financial management of the entity setting forth their opinion as to the correctness of the accompanying financial statements. [S251(b), Companies Act 2016].

Whilst auditors play an important role in enhancing the credibility of the financial statements, this role would be further enhanced with the entity’s management and Board of Directors engaging with the auditors throughout the financial reporting process.

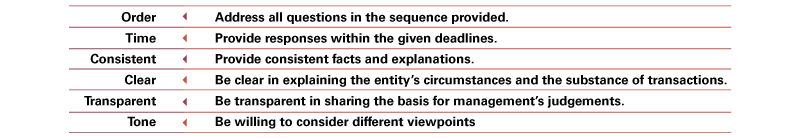

In responding to the FSRC’s enquiries, parties concerned are encouraged to consider the following:

Whilst the FSRC continues to inform and educate members on good presentation and disclosure practices, its actions will be guided by its penalty tariff that depends on the severity of non-compliances. This comes back to its primary objective to monitor compliance in financial reporting, in supporting the Institute to regulate the practice and strengthen the credibility of the accountancy profession in Malaysia. This in turn protects the public interest and supports the Institute’s overarching purpose of nation building.

The Financial Statements Review Committee (FSRC or the Committee) of the Institute was set up with the aim of upholding the quality of financial reporting of entities listed on Bursa Malaysia.

The Committee reviews audited financial statements and audit reports that are prepared by or are within the responsibility of members of MIA, for the purpose of determining compliance with statutory and other requirements, approved accounting standards and approved auditing standards in Malaysia.