By Sukh Deve Singh Riar

Summary: The article provides an overview on the practical aspects of purchase price allocation (PPA) including how fair values of intangible assets and goodwill are ascertained on a business combination event under MFRS 3. It also discusses the reasonable test of PPA by examining the Weighted Average Return on Assets (WARA), Weighted Average Cost of Capital (WACC) & Internal Rate of Return (IRR) relationship and concludes by describing the critical informational value of PPA exercise.

Corporate mergers and acquisitions are often justified to give rise to operating and financial synergies and usually results in premium purchase price, while, in a forced sale, it is likely to result in discounts. Whatsoever may be the purchase price outcome of the acquisition that results in controlling stake in the target company, the acquirer is bound to recognise identifiable asset, assumed liabilities and any non-controlling interest in the acquiree at their fair values on the acquisition date, except if the transaction is outside the scope of MFRS 3.

It is common for the acquiree to have unrecognised inherent intangible assets embedded within its business DNA, however, on a business combination event, the combining entity shall ascertain these intangible assets at their fair values and determine goodwill or bargain purchase of the acquisition.

MFRS 138 states that intangible asset is an identifiable non-monetary asset without physical substance, while goodwill is non-identifiable as its non-separable nor that it is obtained from any contractual or legal rights though it represents future economic benefits from other assets of the acquiree. Fair value, is the price that one would receive to sell an asset and paid to transfer a liability in an orderly transaction between market participants at the measurement date and in the case of non-financial assets it shall be measured at its highest and best use (HABU) basis.

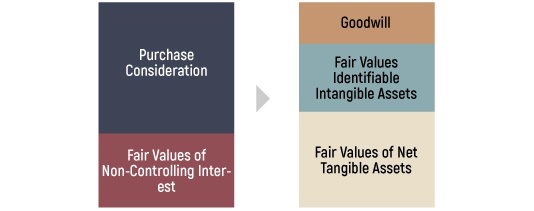

The fair values of identifiable intangible assets (IIAs) of the target company has to be ascertained and recognised on a business combination event to distinguish it from goodwill. This is done through the Purchase Price Allocation (PPA) process, that results in goodwill as the residual value after price allocation (see Figure 1). The valuation techniques that are applied to unfold the fair values of IIAs can be broadly categorised into market, cost and income approach.

Figure 1: Purchase Price Allocation

Market Approach

The market approach valuation applies the price of recent similar market transactions at the arm’s length for the IIA. This can be the case for generic software developed by the acquiree for its internal use. This method is suitable to value IIAs if there is readily available recent market data for similar assets to determine fair value with adjustments for any difference between the comparable asset and IIA. The fair values obtained through market approach are not adjusted for tax amortisation benefit factor (TAB) as it assumed the underlying market data reflect income tax effects.

Cost Approach

The cost approach is based on the cost of reproducing or replacing the IIA whilst factoring in its deterioration or obsolesces. It is less robust in comparison to the market and income approach as it ignores the future benefits to be derived from the asset that may influence the price a buyer is willing to pay.

TAB may be applicable for assets under cost approach and the following must be considered when applying TAB factor, i.e.: –

- whether the tax jurisdiction permits for the asset tax amortisation;

- the method of tax amortisation – straight line or reducing balance method;

- the use of end-year or mid-year discounting;

- the income tax rate;

- the useful tax life of the asset; and

- whether the cost to reproduce or replace the asset were obtained from observed market data as it would be safe to assume that tax effects are reflected in market estimates.

Income Approach

Under this method, the IIA fair value is determined by converting the future free cash flows over the remaining useful life of the asset to a single present value at a risk-adjusted discount rate (DCF method). Some of the common variants of DCF techniques applied for intangible asset valuation are relief from royalty method (RFRM) and multiperiod excess earnings method (MPEEM).

The RFRM derives the value of the intangible asset the from present value of royalties saved after tax for owning the assets, for example controlling brands, patents or trademarks of the target company. While the MPEEM estimates the value of an intangible asset from the residual cash flow of several periods of cash flows after excluding for contributory asset charge (CAC) and taxes.

It’s often the case for intangible assets not to produce income on its own without teaming up with other assets and CAC represent that economic charge for the use of other assets (contributory assets) to generate cash flow or income for the subject intangible asset, for e.g. net working capital, fixed assets including other intangible assets such as assembled workforce. Nevertheless, accounting standards are explicit to exclude the recognition of assembled workforce as an IIA due to its inability to meet the exit notion under the definition of identifiable and fair value and sum it into goodwill.

WACC, WARA & IRR

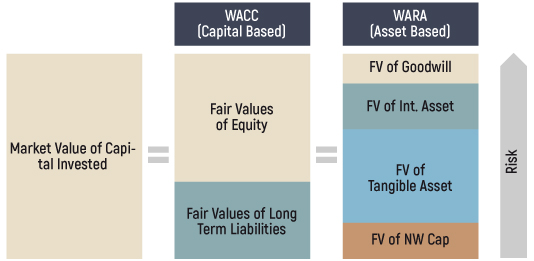

It is essential in the PPA exercise that the risk profile of the target company’s fair valued assets is estimated diligently irrespective of the valuation method adopted. The stratification of the target company’s assets rate of return should show goodwill as the riskiest and net working capital as the lowest one following the liquidity of the asset:

Figure 2: WACC -WARA Commonality (Source: Rath (2012)

The reasonableness of the target company’s assets return is tested by comparing its Weighted Average Cost of Capital (WACC) against its Weighted Average Return of Assets (WARA), where both should typically be the same. This is because WARA being the rate of return for individual assets must equal the rate of return expected by capital providers. Thus, any significant discrepancies between the two reflect fundamental errors in the underlying assumptions of the assets risk profile in deriving their fair values.

Another test that can add reasonableness to the outcome of PPA is the comparison of the acquisitions implied Internal Rate of Return (IRR) with the target company’s WACC. The IRR shall equal the WACC where purchase consideration equals to the fair value of the target company’s net assets while IRR will be less than the WACC in the event of purchase goodwill and the reverse for a bargain purchase.

Intangible Asset & Goodwill

As a general rule, all intangible assets with finite life shall be amortised over its useful economic life to the income statement or absorbed into the cost of producing other assets, whilst intangible asset with indefinite life including goodwill is not amortised but their fair values are to be tested regularly. Amortisation method and period of finite useful life intangible assets must be reviewed at each financial year end, whilst intangible assets with indefinite useful life must be reviewed annually to determine its properties to remain indefinite. In any event, an intangible asset is disposed or has lost its ability to generate future economic benefits it shall be derecognised immediately.

Intangible assets with indefinite useful life and goodwill are subjected to annual impairment testing while one with finite life shall be assessed at the end of each reporting period whether there is any indication that it may be impaired and if there is, then to test it for impairment.. Remember, goodwill does not generate income on its own but in combination with other assets and are not separately identifiable, thus any goodwill impairment testing must be done with the respective cash generating unit or group of assets annually at the same time.

On the other hand, the current COVID-19 pandemic appeared to have triggered indications that assets may have impaired for many businesses, but of course, there are exception to this, say businesses involved in toilet tissue or rubber glove production.

Conclusion

Care must be exercised in taking the meaning of fair values in PPA and financial reporting as it differs significantly from the strategic investment and financial views considered in an acquisition itself. It is an accounting perspective, wherein the case of non-financial assets it’s done on HABU basis and is not an intrinsic value of assets.

The entire exercise of PPA and fair valuation in a business combination is a laborious one. There are many accounting and corporate finance challenges posed by the exercise as many assets and liabilities do not have active market prices. The accounting standards does lend flexibility and discretion to businesses in the initial recognition and subsequent treatment of intangible asset and goodwill. The flip side of this i.e. it may leave room for managers abuse depending on how they are incentivised.

Yet it emits useful information to assess the amount, timing and risk of future earnings including the perception of the acquisition quality, for e.g. evidence of excessive goodwill may indicate overpayment and subsequent higher future impairment loss. Overall PPA serves the aim to reduce the symmetry of information between managers and capital providers and contributes towards better governance, transparency and protection of capital providers’ interest.

References

AICPA. Quick Reference Guide – Valuing Assets in Business Combinations. North Carolina: AICPA, 2016.

Black, Ervin L., and Mark L. Zyla. Accounting for Goodwill and Other Intangible Assets, 3rd ed. Hoboken: John Wiley & Sons, 2018.

Grant Thornton. Intangible Assets in a Business Combination. London: Grant Thornton, 2013.

IVSC. IVS 210 – Intangible Assets. IVSC, 2019.

MASB. MFRS 3 – Business Combinations. MASB, 2011.

MASB. MFRS 13 – Fair Value Measurement. MASB, 2011.

MASB. MFRS 136 – Impairment of Assets. MASB, 2011.

MASB. MFRS 138 – Intangible Assets. MASB, 2011.

Sukh Deve Singh Riar has a Master of Applied Finance (Macquarie University, Australia) and Master of Business Administration (University of Nottingham, UK) and is a corporate finance professional involved in real estate and infrastructure financing.