By MIA Financial Statements Review Team

A financial guarantee contract is a contract that requires the issuer to make specified payments to reimburse the holder for a loss it incurs because a specified debtor fails to make payment when due in accordance with the original or modified terms of a debt instrument.

SCOPE: FINANCIAL GUARANTEE CONTRACTS

Financial guarantee contracts (FGC) can be in various forms, for example, a guarantee, some types of letter of credit, a credit default contract or insurance contract. The accounting treatment does not depend on their legal form.

It is common that a parent company issues corporate guarantees to financial institutions to secure credit facilities extended to its subsidiary companies. These corporate guarantees are financial guarantee contracts that meet the definition of financial liabilities and shall be recognised and measured in accordance with MFRS 9 Financial Instruments.

However, if an issuer of financial guarantee contracts has previously asserted explicitly that it regards such contracts as insurance contracts and has used accounting that is applicable to insurance contracts, the issuer may elect to apply either MFRS 9 or MFRS 4 Insurance Contracts to such financial guarantee contracts. The issuer may make that election contract by contract, but the election for each contract is irrevocable [MFRS 9.2(i)(e)].

In either case, there should be clear and consistent application of the accounting policy, accompanied with the respective disclosure requirements covered by MFRS 7 Financial Instruments: Disclosures or MFRS 4 accordingly.

MFRS 9 APPROACH

In this article, we look at the measurement and disclosure requirements relating to FGCs that are accounted for in accordance with MFRS 9.

FGCs are recognised initially as a financial liability at fair value, net of transaction costs. After initial recognition, FGCs are subsequently measured at the ‘higher of’ [MFRS 9.4.2.1(c)]:

- the amount of the loss allowance according to the impairment requirements of Section 5.5 of MFRS 9; and

- the amount initially recognised [MFRS 9.5.1.1] less, when appropriate, the cumulative amount of income recognised under MFRS 15 Revenue from Contracts with Customers.

The above measurement requirements do not apply if the FGCs meet the requirements and are designated to be accounted for at fair value through profit or loss at inception or they arise from a transfer of a financial asset which does not qualify for derecognition or when the continuing involvement applies [MFRS 9.4.2.1(a) and (b)].

OBSERVATIONS

Below are the observations noted by the Financial Statements Review Committee (FSRC or the Committee) on common deficiencies relating to disclosure of FGCs arising from the review of financial statements of public-listed entities for the review period from July 2020 to June 2021. The financial statements under review are those with financial years ended ranging from December 2019 to December 2020.

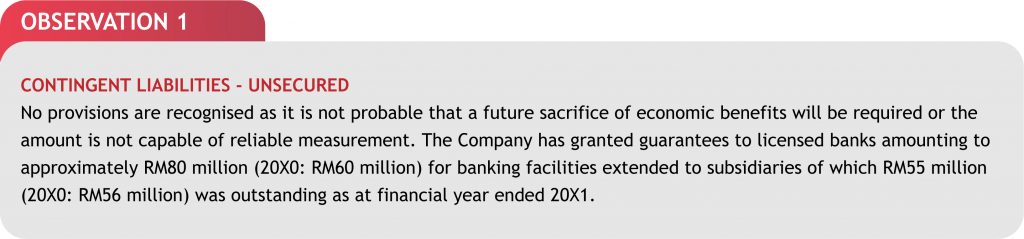

In Observation 1, FGC were disclosed as contingent liabilities. No other disclosures relating to FGC as required by MFRS 7 were noted.

The Committee wishes to highlight that FGCs are within the scope of MFRS 9 and are not contingent liabilities. As such, in relation to corporate guarantees, reference to disclosure on contingent liabilities should not be made.

Paragraph 31 of MFRS 7 states that an entity shall disclose information that enables users of its financial statements to evaluate the nature and extent of risks arising from financial instruments to which the entity is exposed at the end of the reporting period.

The disclosures required by paragraphs 33-42 focus on the risks that arise from financial instruments and how they have been managed. These risks typically include, but are not limited to, credit risk, liquidity risk and market risk.

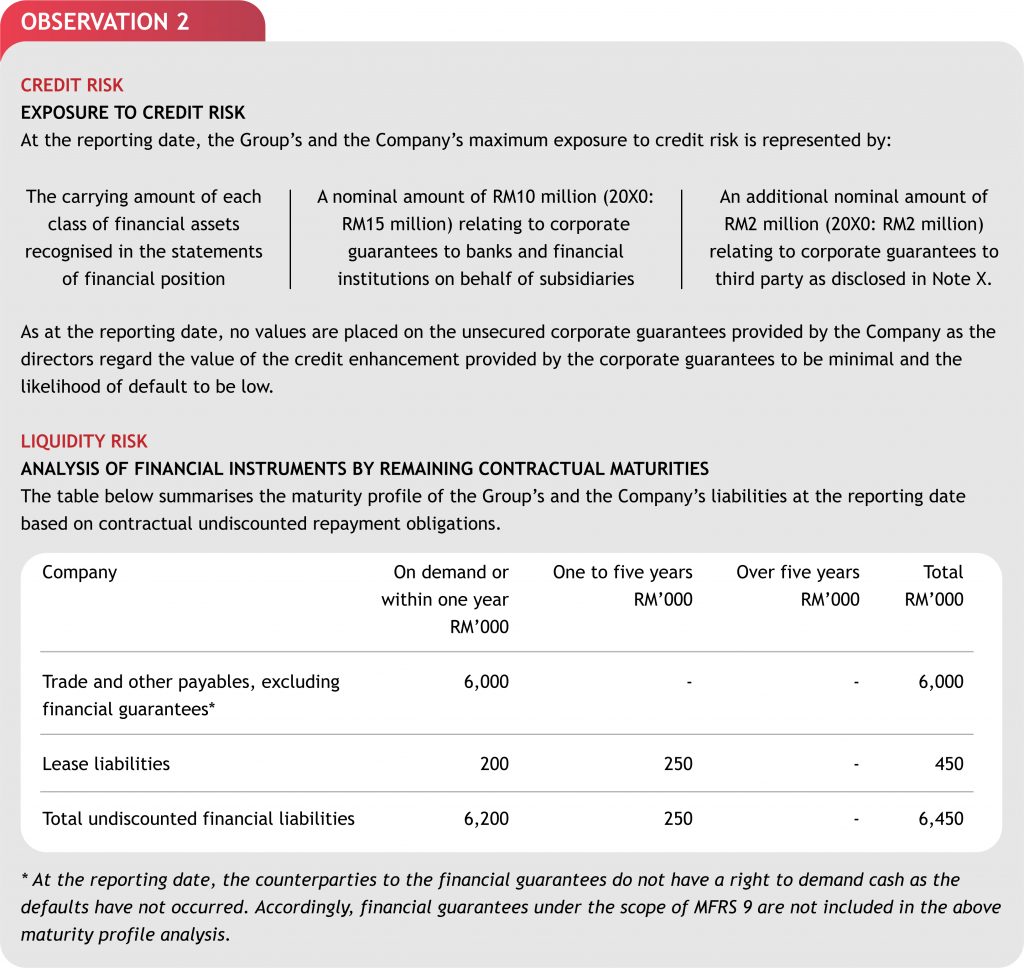

In Observation 2, the maximum exposure of FGC under credit risk was disclosed. However, under liquidity risk, maturity analysis of FGC was not disclosed because no default has occurred as at the reporting date.

The Committee wishes to highlight that the entity is exposed to liquidity risk, notwithstanding the low or no risk of default.

Paragraph 39(a) of MFRS 7 Financial Instruments: Disclosures requires an entity to disclose a maturity analysis for non-derivative financial liabilities (including issued financial guarantee contracts) that shows the remaining contractual maturities. BC58C states that contractual maturities are essential for an understanding of the timing of cash flows associated with the liabilities. Therefore, this information is useful to users of financial statements.

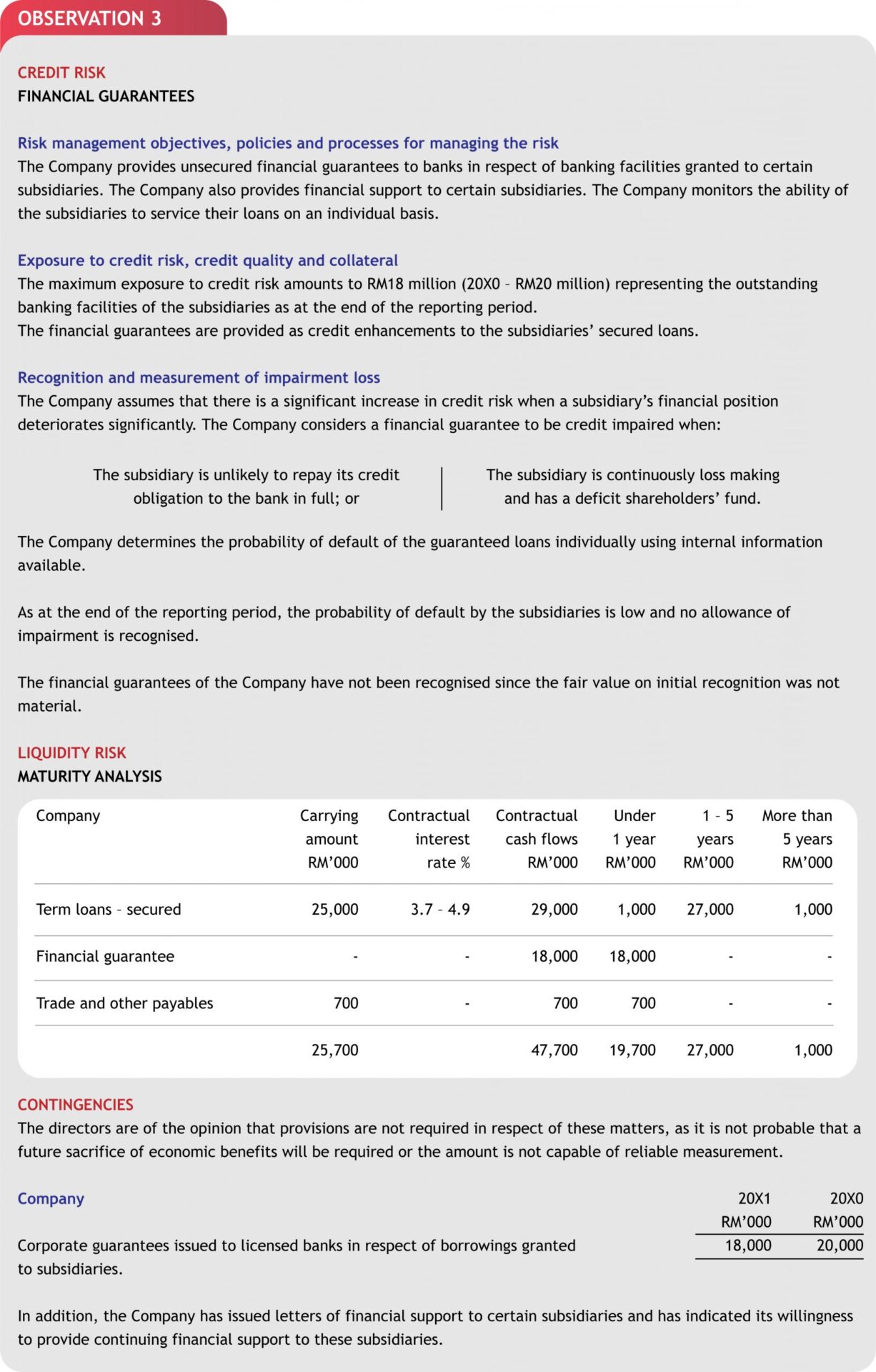

In Observation 3, FGC has been disclosed pursuant to MFRS 7 and as contingent liabilities pursuant to MFRS 137 at the same time.

The Committee wishes to highlight that paragraph 2 of MFRS 137 clarifies that MFRS 137 does not apply to financial instruments (including guarantees) that are within the scope of MFRS 9. Hence, the disclosure of FGC as contingencies is not appropriate.

COMMON FINDINGS

Generally, most of the reviewed financial statements have classified FGCs as financial liabilities, although there are still some that disclosed FGCs as contingent liabilities. Where it had been assessed that an outflow of cash is not probable, these FGCs were disclosed as contingent liabilities. The Committee wishes to highlight that MFRS 137 Provisions, Contingent Liabilities and Contingent Assets does not apply to financial instruments (including guarantees) that are within the scope of MFRS 9 Financial Instruments [Paragraph 2 of MFRS 137].

In cases where FGCs have been classified as financial liabilities, the following weaknesses were noted:

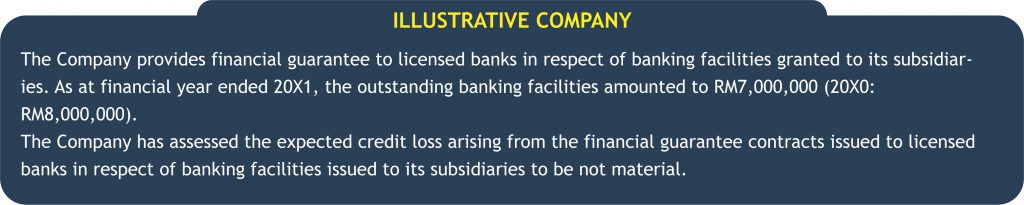

- No disclosures were noted in respect of FGCs that were not recognised in the Statement of Financial Position. As a good practice, in instances where FGCs have not been recognised due to the immateriality of their fair values, a disclosure reflecting this should be made in the financial statements. The disclosure on immateriality of FGC’s fair value can be made as part of the credit risk disclosure [MFRS7.33-34] [MFRS7.BC47A].

- Weak or non-existent disclosures on the nature and extent of risks arising from FGCs. Typical risks arising from FGCs include liquidity risk and credit risk [MFRS 7.31-42]. Entities fail to provide the necessary disclosures citing that the risk of default is low. The Committee wishes to highlight that the entity is exposed to these risks, notwithstanding the low risk of default. Specifically, in addressing liquidity risk disclosures, the maximum amount of the guarantee is allocated to the earliest period in which it could be called [MFRS7.B11(c)].

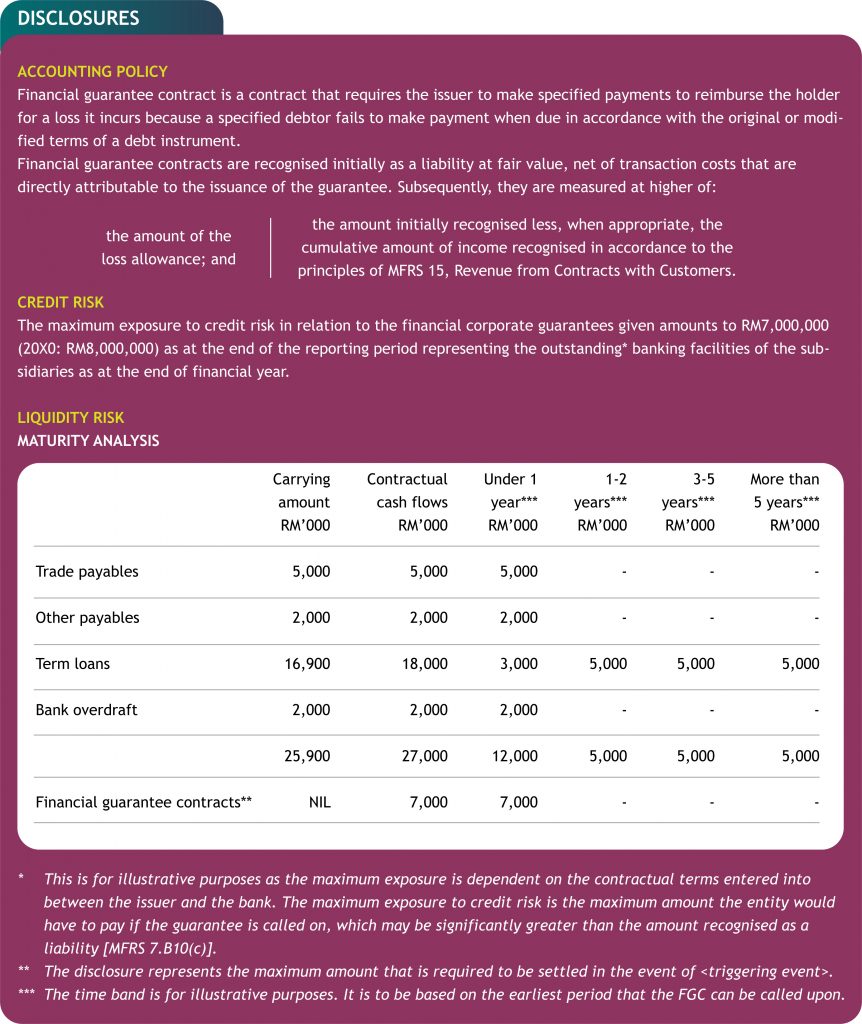

ILLUSTRATIVE DISCLOSURE

Illustrated below is an example of how the relevant disclosures should be made.

CONCLUSION

For risk management and financial reporting purposes, entities should ensure that they have processes in place to monitor their loans and borrowings for which financial guarantees have been provided. This is essential in ensuring a regular monitoring of the FGCs that may be accounted for under MFRS 9 Financial Instruments or MFRS 4 Insurance Contracts. For FGCs accounted for under MFRS 9, entities need to ensure that they comply with disclosure requirements of MFRS 7 Financial Instruments: Disclosures.