By Azleen Ilias, Erlane K Ghani, & Zubir Azhar

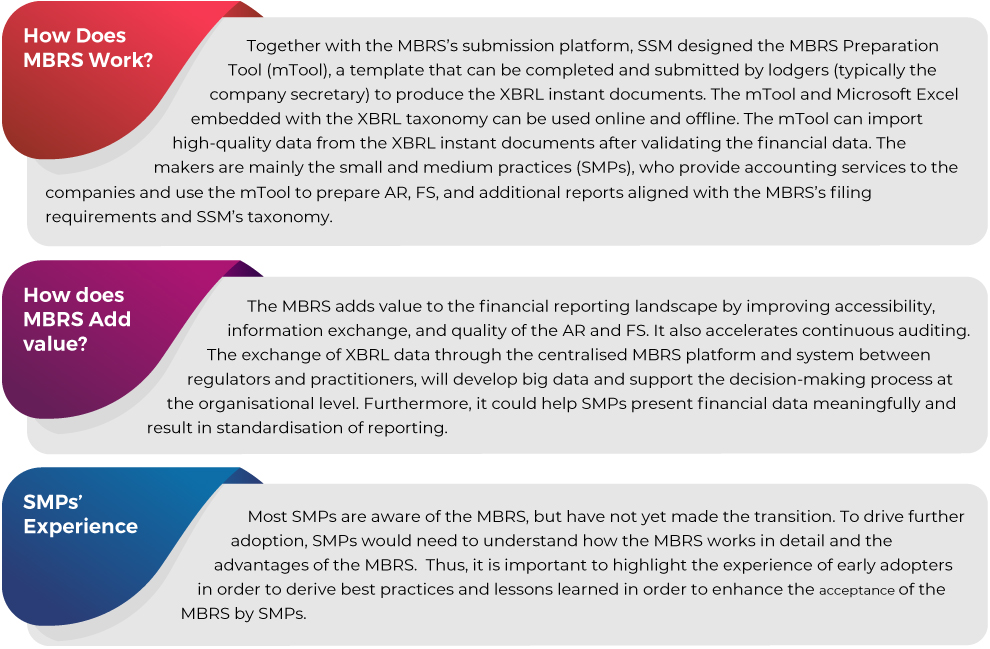

Following the adoption of the eXtensible Business Reporting Language (XBRL) throughout the world, the Companies Commission of Malaysia (SSM) has taken the initiative to develop the Malaysian Business Reporting System (MBRS). The MBRS is a reporting and submission system that is aligned with the XBRL’s requirements and format. It incorporates the XBRL concept to assist companies preparing annual returns (AR) and financial statements (FS). The aim of the MBRS is to eliminate all manual registration and handling, and transition to an automated online process.

Key issues faced by early adopters among SMPs:

Limited Accounting Tools and Software

In Malaysia, as the adoption of the XBRL through MBRS has been only for two years, SMPs have limited tools and software. Many of them use the corporate secretarial software. It is still uncertain how the XBRL taxonomy can be embedded into the software to ensure the smooth preparation of the XBRL instant document.

Solution: SMPs need a software that can integrate with the MBRS and generate information to produce the XBRL instant documents.

Limited Resource Capability

There is a lack of local expertise in the XBRL. Despite their involvement in the mTool and MBRS development, SMPs have concerns regarding their limited know-how, knowledge, and expertise in the preparation of the AR and FS using the mTool. They are also concerned about whether corporate secretaries and owners have sufficient knowledge and know-how to prepare the FS submission. Another concern is the time needed to prepare the XBRL instant document using the mTool.

Solution: SMPs need to build up resource capability, e.g. staff who are able to use the mTool to enter data and generate the XBRL instant documents in order to adopt the MBRS.

Readiness of SMPs

SMPs need to be ready with the relevant skills, knowledge, and accounting tools and software in preparing the XBRL submission via the MBRS when they decide to adopt the MBRS. In ensuring the readiness, SMPs must encourage the corporate secretaries, as lodgers and makers of the AR and FS, to use the MBRS.

Solution: Incentives could be given to encourage adoption and full compliance with the MBRS.

XBRL Data Quality Assurance

SMPs are also concerned about how the XBRL taxonomy embedded in the mTool can guarantee data quality due to limited expertise in the XBRL data quality assurance. However, the XBRL taxonomy can reduce the risk of – incorrect data being keyed into the mTool.

Solution: Data quality is assured through an XBRL taxonomy’s validation process, which could lower the workload of SMPs in the preparation of the AR, FS, and other reports.

Based on the issues gathered from the SMPs’ experiences, we have come up with four recommendations that we believe would improve the MBRS adoption.

Integrating Accounting Software with XBRL Taxonomy

At the early stage of adopting the MBRS, it was uncertain that SMPs would have the relevant tools and software. Therefore, there is a need to ensure that the XBRL taxonomy could be embedded within the accounting software. This software can facilitate the FS preparation and conversion of the report into XBRL Instant Document before submission to the SSM. However, SMPs need to ensure that the accounting software is aligned with the SSM’s XBRL taxonomy, in order to assist the maker and lodger of the FS.

Incentive Provision

Providing incentives could motivate SMPs to perform the AR and FS submission via the MBRS. The incentives may include giving more time to prepare the FS in the XBRL format, making free data available for future use, and providing incentive for purchasing accounting software with the SSM taxonomy. With incentives, SMPs would be more willing to purchase accounting tools and software embedded with the SSM Taxonomy voluntarily.

Inclusive Training

The SSM and MIA have provided training to the lodgers (i.e. the corporate secretaries) on preparing the AR and FS using the mTool. But, training is still required for the makers (i.e. SMPs).

XBRL Data Quality Assurance

The SSM has foreseen that the adoption of the MBRS could further improve business reporting submission among companies as it promotes centralised submission on an integrated data platform. In future, there is a need to focus on the audit and assurance of the XBRL data to ensure that the FS and any other reports published in the XBRL are true and fair and increase confidence on the information submitted through the MBRS. Therefore, there is a need to enhance the knowledge and skills of the Malaysian auditors in validating the XBRL data with a focus on data quality assurance.

This article proposes a way forward for the XBRL adoption among SMPs in Malaysia. We put forward four recommendations which are (a) integrating accounting software with the XBRL taxonomy; (b) incentive provision; (c) inclusive training; and (d) XBRL data quality assurance. The issues and recommendations discussed in this article are purely to provide ideas to SMPs and regulators to enhance the implementation of the MBRS.

This article is written by Azleen Ilias from the College of Business and Administration, Universiti Tenaga Nasional, Pahang, Malaysia, Erlane K Ghani from the Faculty of Accountancy, Universiti Teknologi MARA Selangor, Malaysia and Zubir Azhar from the School of Management, Universiti Sains Malaysia, Penang, Malaysia