By Johnny Yong & Jenny Chua

With the launch of the Malaysian Institute of Accountants’ (MIA) Digital Technology Blueprint in 2018, MIA has since been advocating firms, especially SMPs, to invest in technology as part of the strategic business transformation agenda of the profession. This is not purely a fad as IFAC has also been promoting investment in technology to global SMPs to move ahead, post-pandemic. Please refer to the IFAC’s Practice Transformation Action Plan – A Roadmap to the Future if you are interested to know more.

Can these Investments Really Make a Difference?

Based on a recent Harvard Business Review survey, many global chief executives highlighted the struggle to meaningfully differentiate their businesses from that of competitors in light of these digital investments, many of which were made to “keep up” with the rising table stakes of digital adoption. While 56% of executives responding to the PwC US Cloud Business Survey 2021 saw the cloud as a strategic platform for growth and innovation, 53% of companies in the same survey felt that they did not realise substantial value from their tech investments.

This may well be the case for Malaysian SMPs too and goes to explain why firms are reluctant or unwilling to invest in technology in a meaningful way.

In a benchmarking exercise amongst MIA member firms conducted in 2019, many high performing firms were embracing technology and change for the betterment of both firm and clients. However, amongst firms that have invested heavily in technology over the past few years (ranging from 4% to 8% of total revenue), some firms did not fully utilise tools that could drastically reduce the costs of compliance and improve client service. This lag is typically caused by a combination of factors within a firm, some of which can be summarised as the absence of appropriate reviews as to the suitability of existing processes to work in harmony with the new technology and users’ mindset towards the urgency for change at all levels within the firm.

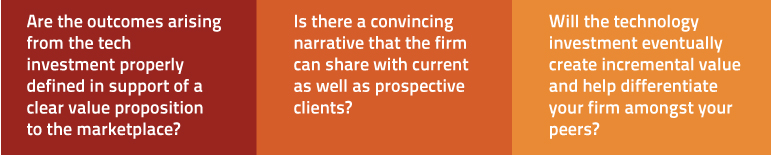

In addition, as pointed out by MIA Past President Mr. Huang Shze Jiun in a recent newspaper article, most SMPs are already being pushed to the edge, cashflow-wise, during the COVID-19 pandemic. Turning these concerns about investing in technology around, however, requires a paradigm change. For a start, practitioners should review every major technology investment in their firms and initiate critical questions such as:

The end goal is not to aim for a value realisation within half the time, although that would be impressive. However, an honest response to the questions above may help SMPs to start investing in technology whilst avoiding costly investments that require great adaptation to new ways of working yet do not assist firms to differentiate themselves in a meaningful way.

The dialogue that ensues after asking these questions would provide the momentum for the practitioners to take action outside of their comfort zone. The key here is to focus on the outcomes with technology as the enabler, although other non-tech related solutions are possible too. More importantly, the following questions have to be answered:

Unfortunately, in many instances, the answer to the above questions is No.

In the next part of this article, six essential factors for SMPs to consider when shaping their technology agenda will be further discussed. After thoroughly working through the six essential factors before engaging in any significant tech-related project, SMPs will be better prepared to tame the technology tiger by taking on the technology investments that focus on the outcomes that matter the most and raising the returns on those investments.

Johnny Yong is Head of Capital Market and Assurance of MIA’s Professional, Practices and Technical Division. Jenny Chua is Head of Small and Medium Practices of MIA’s Professional, Practices and Technical Division.